(a)

Consumption and saving.

(a)

Explanation of Solution

According to the life-cycle model of consumption, the consumption of an individual depends on the income earned in the entire life time of an individual.

The total life time income of the individuals can be calculated as the sum of income they earn in different periods using Equation (1) as follows:

Given that A enjoys $100,000 in three periods and F enjoys $40,000 in period1, $100,000 in period2, and $160,000 in period3, both individuals consume for 5 periods in life.

The life-time income of A can be calculated by substituting the respective values in Equation (1) as follows:

Thus, the life-time income of A is $300,000.

The life-time income of F can be calculated by substituting the respective values in Equation (1) as follows:

Thus, the life-time income of F is $300,000.

The life-time consumption of individuals can be calculated using Equation (2) as follows:

The life-time consumption of A can be calculated by substituting the respective values in Equation (2) as follows:

The life-time consumption of A is $60,000.

The life-time consumption of F can be calculated by substituting the respective values in Equation (2) as follows:

The life-time consumption of F is $60,000.

The savings can be calculated as the part of income, which is not consumed. The savings can be calculated using Equation (3) as follows:

The saving in period 1 for A can be calculated by substituting the respective value in Equation (3) as follows:

Thus, A’ savings for period 1 is $40,000.

Table 1 shows the values of savings for A and F in different periods calculated using Equations 1, 2, and 3.

Table 1

| A | F | |

| S1 | 40,000 | -20,000 |

| S2 | 40,000 | 40,000 |

| S3 | 40,000 | 100,000 |

| S4 | -60,000 | -60,000 |

| S5 | -60,000 | -60,000 |

Life-cycle theory: Life-cycle theory developed by Franco Modigliani and Richard Brumberg relates the spending and saving habits of an individual to the course of their life time.

Savings: Savings is defined as that part of income that is not consumed in the current period and is to be used for future consumption.

(b)

The wealth of individuals.

(b)

Explanation of Solution

The wealth of an individual is calculated as the accumulated saving in each period.

The wealth can be calculated using Equation (4) as follows:

The wealth of individual A in the beginning of period 2 is calculated by substituting the respective values in Equation (4) as follows:

Thus, the wealth of A in the beginning of period 2 is $40,000.

Table 2 shows the values of wealth for A and F in different periods, which are calculated using Equation 4.

Table 1

| A | F | |

| W1 | 0 | 0 |

| W2 | 40,000 | -20,000 |

| W3 | 80,000 | 20,000 |

| W4 | 120,000 | 120,000 |

| W5 | 60,000 | 60,000 |

| W6 | 0 | 0 |

It is evident from the table values that there is no wealth in period1 and period 6.

(c)

The graphical representation of consumption, income, and wealth of the individuals.

(c)

Explanation of Solution

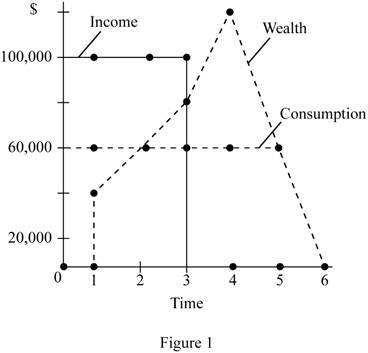

Figure 1 given below shows the consumption, income, and wealth of A.

The horizontal axis of Figure 1 measures the time period, and the vertical axis measures the consumption, income, and wealth. A enjoys a fixed income over the first 3 periods, and hence he also has a constant pattern of consumption as clearly depicted in Figure 1. A saves a part of his income and thus gradually increases his wealth during his earning years and gradually dissaves when he leads his retirement life. His pattern of consumption, income, and wealth is according to the prediction of the life-cycle model.

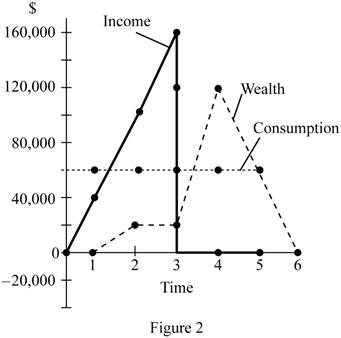

Figure 2 given below shows the consumption, income, and wealth of F.

The horizontal axis of Figure 1 measures the time period, and the vertical axis measures the consumption, income, and wealth. F increases his income gradually, and this would force him to borrow initially to enjoy a smooth consumption. When his income increases, he would accumulate wealth and then use it for his consumption in the retirement life.

Savings: Savings is defined as that part of income that is not consumed in the current period and is to be used for future consumption.

Dissaving: The act of spending more than earned in the current period or spending the past savings is known as dissaving.

(d)

The impact of borrowing.

(d)

Explanation of Solution

A has fixed income from the initial years of earning, and hence there is no need for him to borrow. Thus, A’s consumption or income will not be affected when there is a borrowing constraint. However, F depends on borrowing for his initial period. When there is a borrowing constraint, F has to spend his entire income of $40,000 in the initial period. For the later periods, he smooths his consumption by dividing the lifetime income across the remaining periods.

The life-time income of F can be calculated by substituting the respective values in Equation (1) as follows:

Thus, the life-time income of F is $260,000.

The life-time consumption of F can be calculated by substituting the respective values in Equation (2) as follows:

The life-time consumption of F is $65,000.

The saving in period 2 for F can be calculated by substituting the respective values in Equation (3) as follows:

Thus, F’s savings for period 2 is $35,000.

The wealth of individual F in the beginning of period 2 is calculated by substituting the respective values in Equation (4) as follows:

Thus, the wealth of A in the beginning of period 2 is $40,000.

Table 2 shows the values of savings and wealth F in different periods, which are calculated using Equations 3 and 4.

Table 1

| Period | F's Consumption | F's Savings | F's Wealth |

| 0 | 0 | 0 | 0 |

| 1 | 40,000 | 0 | 0 |

| 2 | 65,000 | 35,000 | 35,000 |

| 3 | 65,000 | 95,000 | 130,000 |

| 4 | 65,000 | -65,000 | 65,000 |

| 5 | 65,000 | -65,000 | 0 |

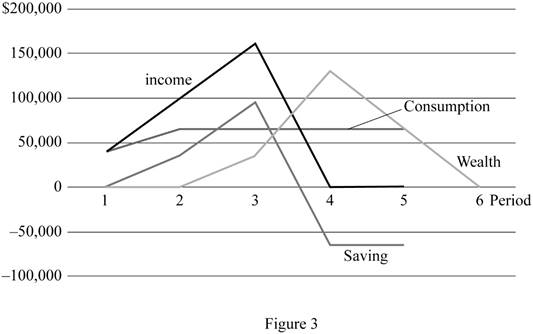

Figure 3 given below shows the consumption, income, and wealth of F.

The horizontal axis of Figure 1 measures the time period, and the vertical axis measures the consumption, income, and wealth. F increases his income gradually. However, he faces borrowing constraints, and hence he can only use his initial income for consumption. When his income increases, he would accumulate wealth, and then use it for his consumption in the retirement life.

Savings: Savings is defined as that part of income that is not consumed in the current period and is to be used for future consumption.

Dissaving: The act of spending more than earned in the current period or spending the past savings is known as dissaving.

Want to see more full solutions like this?

Chapter 19 Solutions

MACROECONOMICS+SAPLING+6 M REEF HC>IC<

- In the Neoclassical model of determination of income in the long run we assumed that aggregate consumption was an increasing function of disposable income, , and nothing else. Suppose that instead we assume that consumption is an increasing function of disposable income, , and a decreasing function of the real interest rate, . Provide an economic rationale for making consumption a function of the real interest rate. How does this assumption change the national saving function relative to the benchmark model Using the model developed in (1), use a diagram for the market for loanable funds to describe what happens to national saving, national investment, and the real interest rate when government expenditure increases. Make sure to also explain in your own words the economic intuition of your results.arrow_forwardJack and Jill both obey the two-period Fisher model of consumption. Jack earns $100 in the first period and $100 in the second period. Jill earns nothing in the first period and $210 in the second period. Both can borrow or lend at the interest rate r. a. You observe both Jack and Jill consuming $100 in the first period and $100 in the second period. What is the interest rate r? b. Suppose the interest rate increases. What will happen to Jack’s consumption in the first period? Is Jack better off or worse off than before the interest rate rose?arrow_forwardPlease write down whether the following statements are true or false, and explain your answer very briefly A)If actual investment is greater than planned investment, inventories increase more than planned. B)The marginal propensity to consume is the change in consumption expenditure divided by the percentage change in income. C)Gross domestic product (GDP) is the value of all goods and services produced in an economy over a particular time period. D)Monetary policy refers to taxation and spending policies implemented by government. E)In a simple Keynesian model (with lump-sum taxes and a MPC of 0.8), a tax cut of 20 billion TL will have less of an impact on GDP than an increase in government spending of 10 billion TL. D)When you take 1000 TL from your savings account and deposit it in your checking account, M2 decreases. F)An open market purchase of government securities (such as Treasury Bills) by the Central Bank will decrease the money supply and raise the interest rate.…arrow_forward

- Which one of the following statements relating to marginal propensity to consume is INCORRECT? (a) Marginal propensity to consume for a given consumption function is usually less than 1; (b) If the people in a country save 30c out of every rand they earn, the marginal propensity to consume in this country is said to be 0.7; (c) If the marginal propensity to consume is given as 0.622, then the value of the simple multiplier will be 2.5; (d) The larger the value of the marginal propensity to consume, the steeper the consumption function will be.arrow_forwardCarefully explain the major differences between the Keynes and Fisher models of consumptionarrow_forwardWhat is a random walk? How is Hall’s random-walk model of consumption related to the life-cycle and permanent-income hypotheses?arrow_forward

- In consumption theory, what is meant by the expression “consumption smoothing”? Why is consumption smoothing a key element of the life-cycle hypothesis and permanent income hypothesis? (100 words max)arrow_forwardJack and Jill both obey the two-period Fisher model of consumption. Jack earns $200 in the first period and $200 in the second period. Jill earns nothing in the first period and $410 in the second period. Both of them can borrow or lend at the interest rate r. a. You observe both Jack and Jill consuming $200 in the first period and $200 in the second period. What is the interest rate r? b. Suppose the interest rate increases. What will happen to Jack’s consumption in the first period? Is Jack better off or worse off than before the interest rate rise? c. What will happen to Jill’s consumption in the first period when the interest rate increases? Is Jill better off or worse off than before the interest rate increase?arrow_forwardIn the Neoclassical model of determination of income in the long run we assumed that aggregate consumption was an increasing function of disposable income, , and nothing else. Suppose that instead we assume that consumption is an increasing function of disposable income, , and a decreasing function of the real interest rate, . Provide an economic rationale for making consumption a function of the real interest rate. How does this assumption change the national saving function relative to the benchmark model?arrow_forward

- Consider the following functions for consumption and investment: C = 1,000 + (2/3)*(Y – T) and I = 1,200 – 100*r. Furthermore, Y = 8,000, G = 2500, T = 2,000. Compute private, public, and national savings for this economy, and find the equilibrium real interest rate (r). Assume that G declines by 500 units. How will it change your answers in part (a)? What happens to the national savings, given everything else, if the public decides to consume less out of their disposable income (assume that the propensity of consume falls by 10 percent)? Given your answer in part (c), what happens to investment and real interest rate? Answer all four.arrow_forwardConsumption and the real interest rate: According to the life-cycle / permanent-income hypothesis, consumption depends on the present discounted value of income. An increase in the real interest rate will make future income worth less, thereby reducing the present discounted value and reducing consumption. To incorporate this channel into the model, suppose the consumption equation is given by Assume the remainder of the model is unchanged from the original setup, as in Table 11.1. (a) Derive the IS curve for this new specification. (b) How and why does it differ from the original IS curve?arrow_forwardThe Wilson family has a disposable income of $70,000 annually. Currently, the Wilson family spends 80% of new disposable income on consumption. Assume that their marginal propensity to consume is 0.8 and that their autonomous consumption spending is equal to $10,000. What is the amount of the Wilson family's annual consumer spending?arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education