Concept explainers

CHALLENGE PROBLEM

In this chapter, you learned about three important financial statements: the income statement, statement of owner’s equity, and balance sheet. As mentioned in the margin note on page 34, most firms also prepare a statement of

REQUIRED

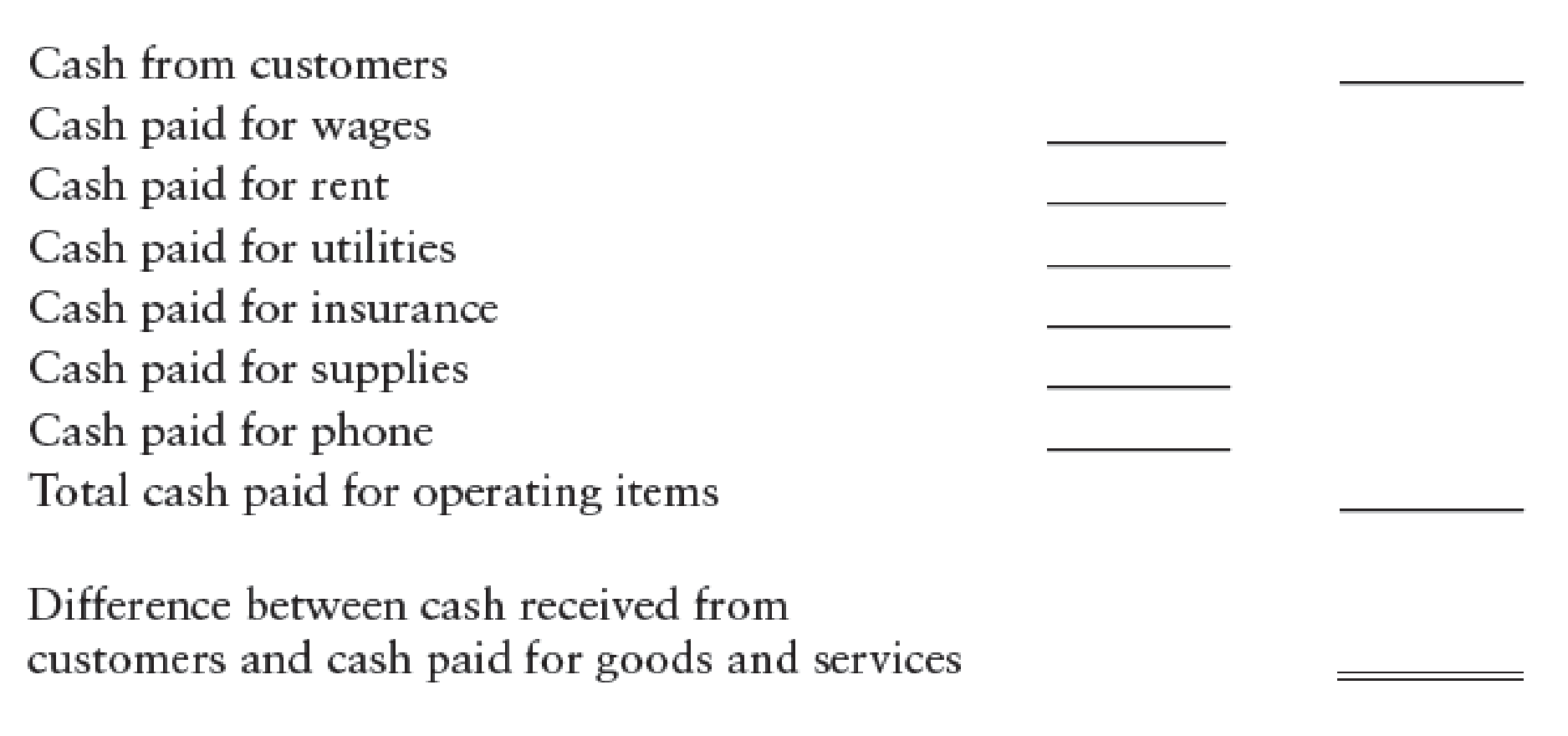

Take another look at the Demonstration Problem for Kenny Young’s “Home and Away Inspections.” Note that when revenues are measured based on the amount earned, and expenses are measured based on the amount incurred, net income for the period was $4,165. Now, compute the difference between cash received from customers and cash paid to suppliers of goods and services by completing the form provided below. Are these measures different? Which provides a better measure of profitability?

Trending nowThis is a popular solution!

Chapter 2 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

- Codification Situation You are conducting an accounting research project for your boss. Your boss has asked you to determine the appropriate U.S. GAAP that specifies how your company should recognize revenues from the sales of products in a retail store. Your boss is confused because most customers pay cash, but some customers purchase on credit terms, and pay in cash 30 days later. Your manager also wants you to determine the GAAP guidance for how revenue should be recognized in income. Your manager has a lot of knowledge and experience in accounting and has heard about, but has never used, the FASB Accounting Standards Codification system. Directions Use the FASB Accounting Standards Codification system to conduct the research your manager has assigned to you. Use the Codification to determine how to recognize revenue from retail sales, including the right to return. Be prepared to show your manager the specific FASB ASC references that provide the appropriate guidance. Also prepare a brief memo explaining to your manager the different levels of the Codification and how to use the Codification system.arrow_forwardTo demonstrate the difference between cash account activity and accrual basis profits (net income), note the amount each transaction affects cash and the amount each transaction affects net income. A. paid balance due for accounts payable $6,900 B. charged clients for legal services provided $5,200 C. purchased supplies on account $1,750 D. collected legal service fees from clients for current month $3,700 E. issued stock in exchange for a note payable $10,000arrow_forwardTRANSACTION ANALYSIS Linda Kipp starred a business on May 1, 20--. Analyze the following transactions for the first month of business using T accounts. Label each T account with the title of the account affected and then place the transaction letter and the dollar amount on the debit or credit side. (a) Invested cash in the business, 5,000. (b) Bought equipment for cash, 700. (c) Bought equipment on account, 600. (d) Paid cash on account for equipment purchased in transaction (c), 400. (e) Withdrew cash for personal use, 900. FOOT AND BALANCE T ACCOUNTS Foot and balance the T accounts prepared Exercise 3-5A if necessary.arrow_forward

- TRANSACTION ANALYSIS Linda Kipp started a business on May 1, 20--. Analyze the following transactions for the first month of business using T accounts. Label each T account with the title of the account affected and then place the transaction letter and the dollar amount on the debit or credit side. (a) Invested cash in the business, 5,000. (b) Bought equipment for cash, 700. (c) Bought equipment on account, 600. (d) Paid cash on account for equipment purchased in transaction (c), 400. (e) Withdrew cash for personal use, 900.arrow_forwardCASH, MODIFIED CASH, AND ACCRUAL BASES OF ACCOUNTING For each journal entry shown below, indicate the accounting method(s) for which the entry would be appropriate. If the journal entry is not appropriate for a particular accounting method, explain the proper accounting treatment for that method. 1. Office Equipment Cash Purchased equipment for cash 2. Office Equipment Accounts Payable Purchased equipment on account 3. Cash Revenue Cash receipts for week 4. Accounts Receivable Revenue Services performed on account 5. Prepaid Insurance Cash Purchased prepaid asset 6. Supplies Accounts Payable Purchased prepaid asset 7. Phone Expense Cash Paid phone bill 8. Wages Expense Cash Paid wages for month 9. Accounts Payable Cash Made payment on account Adjusting Entries: 10. Supplies Expense Supplies 11. Wages Expense Wages Payable 12. Depreciation ExpenseOffice Equipment Accumulated DepreciationOffice Equipmentarrow_forwardAnalyzing the Accounts The controller for Summit Sales Inc. provides the following information on transactions that occurred during the year: a. Purchased supplies on credit, $18,600 b. Paid $14,800 cash toward the purchase in Transaction a c. Provided services to customers on credit1 $46,925 d. Collected $39,650 cash from accounts receivable e. Recorded depreciation expense, $8,175 f. Employee salaries accrued, $15,650 g. Paid $15,650 cash to employees for salaries earned h. Accrued interest expense on long-term debt, $1,950 i. Paid a total of $25,000 on long-term debt, which includes $1.950 interest from Transaction h j. Paid $2,220 cash for l years insurance coverage in advance k. Recognized insurance expense, $1,340, that was paid in a previous period l. Sold equipment with a book value of $7,500 for $7,500 cash m. Declared cash dividend, $12,000 n. Paid cash dividend declared in Transaction m o. Purchased new equipment for $28,300 cash. p. Issued common stock for $60,000 cash q. Used $10,700 of supplies to produce revenues Summit Sales uses the indirect method to prepare its statement of cash flows. Required: 1. Construct a table similar to the one shown at the top of the next page. Analyze each transaction and indicate its effect on the fundamental accounting equation. If the transaction increases a financial statement element, write the amount of the increase preceded by a plus sign (+) in the appropriate column. If the transaction decreases a financial statement element, write the amount of the decrease preceded by a minus sign (-) in the appropriate column. 2. Indicate whether each transaction results in a cash inflow or a cash outflow in the Effect on Cash Flows column. If the transaction has no effect on cash flow, then indicate this by placing none in the Effect on Cash Flows column. 3. For each transaction that affected cash flows, indicate whether the cash flow would be classified as a cash flow from operating activities, cash flow from investing activities, or cash flow from financing activities. If there is no effect on cash flows, indicate this as a non-cash activity.arrow_forward

- ANALYSIS OF T ACCOUNTS Roberto Alvarez began a business called Robertos Fix-It Shop. 1. Create T accounts for Cash; Supplies; Roberto Alvarez, Capital; and Utilities Expense. Identify the following transactions by letter and place them on the proper side of the T accounts: (a) Invested cash in the business, 6,000. (b) Purchased supplies for cash, 51,200. (c) Paid utility bill, 900. 2. Foot the T account for cash and enter the ending balance.arrow_forwardTRANSACTION ANALYSIS George Atlas started a business on June 1,20--. Analyze the following transactions for the first month of business using T accounts. Label each T account with the title of the account affected and then place the transaction letter and the dollar amount on the debit or credit side. (a) Invested cash in the business, 7,000. (b) Purchased equipment for cash, 900. (c) Purchased equipment on account, 1,500. (d) Paid cash on account for equipment purchased in transaction (c), 800. (e) Withdrew cash for personal use, 1,100.arrow_forwardThis problem challenges you to apply your cumulative accounting knowledge to move a step beyond the material in the chapter. Days cash is outstanding for merchandise: 54.04 days Combining the information provided by various ratios can enhance your understanding of the financial condition of a business. Review the information provided for Na Pali Coast Company in the Mastery Problem. Using this information, respond to the following questions: REQUIRED 1. Compute the average number of days required to sell inventory and collect cash from customers buying on account. 2. Note that Na Pali Coast Company also buys inventory on account. On average, how many days pass before Na Pali pays its creditors? 3. Using the information from your answers to parts (1) and (2), compute the number of days from the time Na Pali Coast pays for inventory until it receives cash from customers on account.arrow_forward

- Identifying journals, assuming the use of a two-column (all-purpose) general journal, a revenue journal, and a cash receipts journal as illustrated in this chapter, indicate the journal in which each of the following transactions should be recorded:a. Receipt of cash refund from overpayment of taxes.b. Adjustment to record accrued salaries at the end of the year.c. Providing services on account.d. Investment of additional cash in the business by the owner.e. Receipt of cash on account from a customer.f. Receipt of cash for rent.g. Receipt of cash from sale of office equipment.h. Sale of used office equipment on account, at cost, to a neighboring business.i. Closing of drawing account at the end of the year.j. Providing services for cash.arrow_forwardA statement of cash flows classifies cash receipts and cash payments into what 3 categories of activity? For each category of activity, share 2 specific examples of both cash receipts and cash payments based on 2 different business scenarios of your choosing. The business scenarios you choose can be based on real or fictional companies. For example, if you chose Uber and the fictional MarksABunch Art Supplies company, you would share 6 examples of cash receipts and cash payments per company, each broken out into one of the 3 different categories of activity presented in a statement of cash flows.arrow_forward“Cash Is King” for all businesses You can determine a company’s cash situation by analyzing the cash flow statement. The cash flow statement also helps determine whether the company (1) is generating enough cash from its operations to make new investments and pay dividends or (2) will need to generate cash by issuing new debt or selling its assets. Which of the following is true for the statement of cash flows? It reflects revenues when earned. It reflects cash generated and used during the reporting period. A. Three categories of activities (operating, investing, and financing) generate or use the cash flow in a company. In the following table, identify which type of activity is described by each statement. Operating Activity Investing Activity Financing Activity A company records a loss of $70,000 on the sale of its outdated inventory. D and W Co. sells its last season’s inventory to a discount store. Yum…arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College