Identifying the Investing and Financing Activities Affecting Cash Flows

Starwood Hotels & Resorts Worldwide. Inc., is one of the world's largest hotel and leisure companies. with more than 1,200 properties in 100 countries. Starwood owns, operates, and franchises hotels, resorts, and residences with the following brands: St. Regis®, The Luxury Collection®, W®, Westin®, Le Méridien®, Sheraton®, Four Points® by Sheraton, Aloft® , and Element®. Information adapted from the company's recent annual statement of cash flows indicates the following investing and financing activities during that year (simplified, in millions of dollars):

| a. | Additional borrowing from banks | $1,290 |

| b. | Purchase of investments | 1 |

| c. | Sale of assets and investments (assume sold at cost) | 806 |

| d. | issuance of stock | 70 |

| e. | Purchases of property, plant, and equipment | 327 |

| f | Payment of debt principal | 108 |

| g- | Dividends paid | 735 |

| h. | Receipt of principal payment on a note receivable | 5 |

Required:

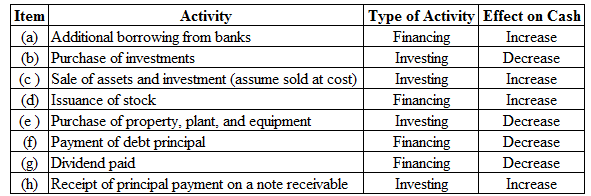

For activities (a) through (h), indicate whether the activity is investing (I) or financing (F) and the direction of the effects on cash flows (+ for increases cash; − for decreases cash).

Identify the activities (a) through (h) indicate whether the activity is investing or financing and the direction of the effects on cash flows whether ‘+’ increase in cash or‘‒’decrease in cash.

Answer to Problem 2.21E

Figure (1)

Explanation of Solution

Investing activities:

Investing activities refer to the activities carried out by a company for acquisition of long term assets. The examples for investing activities are purchase of equipment, long term investment, sale of land, and others.

Financing activities:

Financing activities refer to the activities carried out by a company to mobilize funds to carry out the business activities. The examples for financing activities are purchase of bonds, issuance of common shares, and others.

- (a) Additional borrowing from banks comes under financing activity, and it increases the cash by $1,290 million.

- (b) Purchase of investments comes under investing activity, and it decreases the cash by $1 million.

- (c) Sales of assets and investment (assume sold at cost) comes under investing activity, and it increases the cash by $806 million.

- (d) Issuance of common stock comes under financing activity, and increases the cash by $70 million.

- (e) Purchase of plant, property, and equipment comes under investing activity, and decreases the cash by $327 million.

- (f) Payment of debt principal comes under financing activity, and decreases the cash by $108 million.

- (g) Dividend paid comes under financing activity, and decreases the cash by $735 million.

- (h) Receipt of principal payment on a note receivable comes under investing activity, and increases the cash by $5 million.

Want to see more full solutions like this?

Chapter 2 Solutions

VALUE - FINANCIAL ACCOUNTING LL+ACCESS

- Extracting Performance Trends from the Statement of Cash Flows. The Apollo Group is one of the largest providers of private education, and runs numerous programs and services, including the University of Phoenix. Exhibit 3.25 provides the statement of cash flows for 2012. REQUIRED Discuss the relations between net income and cash flow from operations and among cash flows from operating, investing, and financing activities for the firm, especially for 2012. Identify signals that might raise concerns for an analyst.arrow_forwardQuestion 6 You are the finance manager of Adventure Tourist Ltd. The following data is available for the company as of 31 June 2021: Current assets of $253,950 Current liabilities $178,700 Total assets $795,500 Equity $405,890 Required: The company’s Management Board required you to evaluate the efficiency of daily cash flows in and out of business operating activities. What job are you doing to complete the task? (referring to one out of 3 important questions of corporate finance for your answer) Calculate non-current assets, non-current liabilities and build a balance sheet for the company? Calculate the return on assets (ROA) of the company given that return on equity (ROE) is 35%? Adventure Tourist Ltd. has net credit sales of $1,476,000. Calculate the accounts receivable turnover of the company, given average accounts receivable is $128,500?arrow_forwardSegment analysis for a service company Charles Schwab Corporation (SCHW) is one of the more innovative brokerage and financial service companies in the United States. The company recently provided information about its major business segments as follows (in millions): InvestorServices AdvisorServices Revenues $5,411 $2,067 Operating income 2,031 962 Depreciation 180 54 a. The Investor Services segment serves the retail customer, you and me. These are the brokerage, Internet, and mutual fund services used by individual Investors. The Advisor Services segment includes the same services provided for financial institutions, such as banks, mutual fund managers, insurance companies, and pension plan administrators. b. Indicate whether the following costs are a “Variable Cost” or a “Fixed Cost” in the “Investor Services” segment. 1. Commissions to brokers Variable Cost 2. Fees paid to exchanges for executing trades Variable Cost 3. Depreciation on brokerage…arrow_forward

- Cyberdyne Systems and Virtucon are competitors focusing on the latest technologies. Selected financial data is provided below.($ in millions) Cyberdyne VirtuconNet sales $37,905 $ 4,984Net income 9,737 1,049Operating cash flows 14,565 1,324Total assets, beginning 57,851 14,928Total assets, ending 72,574 14,783Required:1. Calculate the return on assets for both companies.2. Calculate the cash return on assets for both companies.3. Calculate the cash flow to sales ratio and the asset turnover ratio for both companies.4. Which company has the more favorable ratios?arrow_forwardYou become an investment advisor in one of the prominent financial institutions; a client wants to know if he should invest in Qualcomm or AMD, which operate in the same industry. He presents you with the Form 10-Q of both companies. Using ONLY the Consolidated Statements of Cash Flows to decide, what will you tell your client? UALCOMM Incorporated CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) (Unaudited) Nine Months Ended June 26,2022 June 27,2021 Operating Activities: Net income $ 10,063 $ 6,245 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization expense 1,272 1,157 Income tax provision less than income tax payments (234) (358) Share-based compensation expense 1,510 1,238 Net losses (gains) on marketable securities and other investments 374 (487) Other items, net — (49)…arrow_forwardUpon reviewing Myert Company's statement of cash flows, the following was noted: Cash flows from operating activities $60,000 Cash flows from investing activities (125,000) Cash flows from financing activities 115,000 From this information, the most likely explanation is that this company is a using cash from operations and borrowing to purchase long-term assets. b using cash from operations and selling long-term assets to pay back debt. c using its profits to expand growth. d using cash from investors to provide for operations.arrow_forward

- “Cash Is King” for all businesses You can determine a company’s cash situation by analyzing the cash flow statement. The cash flow statement also helps determine whether the company (1) is generating enough cash from its operations to make new investments and pay dividends or (2) will need to generate cash by issuing new debt or selling its assets. Which of the following is true for the statement of cash flows? It reflects cash generated and used during the reporting period. It reflects revenues when earned. Three categories of activities (operating, investing, and financing) generate or use the cash flow in a company. In the following table, identify which type of activity is described by each statement. Operating Activity Investing Activity Financing Activity Yum Co. uses cash to repurchase 10% of its common stock. A pharmaceutical company buys marketing rights to sell a drug exclusively in East Asian markets.…arrow_forward“Cash Is King” for all businesses You can determine a company’s cash situation by analyzing the cash flow statement. The cash flow statement also helps determine whether the company (1) is generating enough cash from its operations to make new investments and pay dividends or (2) will need to generate cash by issuing new debt or selling its assets. Which of the following is true for the statement of cash flows? It reflects revenues when earned. It reflects cash generated and used during the reporting period. A. Three categories of activities (operating, investing, and financing) generate or use the cash flow in a company. In the following table, identify which type of activity is described by each statement. Operating Activity Investing Activity Financing Activity A company records a loss of $70,000 on the sale of its outdated inventory. D and W Co. sells its last season’s inventory to a discount store. Yum…arrow_forward(AACSB) AnalysisYou review a company’s statement of cash flows and find that cash inflows from operations are $150,000,net outflows from investing are $80,000, and net inflows from financing are $60,000. Did the company’scash balance increase or decrease for the year? By what amount? What types of activities would you findunder the category investing activities? Under financing activities? If you had access to the company’sincome statement and balance sheet, why would you be interested in reviewing its statement of cash flows?What additional information can you gather from the statement of cash flows?arrow_forward

- according to information: Question Liabilities OMR Assets OMR Equity share capital 27,800 Furniture 4,000 Accounts Payable 1,550 Cash in hand 4,500 Reserves and surplus 2,550 Bills receivables 3,750 Bills payable 950 Land 9,000 Long term borrowings 6,520 Marketable securities 850 Outstanding Salaries 850 Cash in bank 5,250 Loan from Bank 3,450 Building 6,600 Preference share capital 5,265 Prepaid expenses 850 Bank overdraft 825 Cars & Trucks 3,350 Tax outstanding 590 Account Receivables 1,150 Inventory 2,150 Income earned but not received 430 Machinery 6,250 Equipment 2,220 Total 50,350 Total 50,350 Other information Particulars OMR Sales 330,000 Cost of goods sold 155,000 Administration expenses 33,000 Selling & Distribution exp. 44,000 Interest received…arrow_forwardThe text book I am using is Hospitality Industry Financial Accounting (4th edition). I am in chapter 17 -- Statement of Cash Flows now. Problem 3 asks me to prepare a schedule of cash flows from operating activities for 20x4. The scenario is : The Westland Inn had net earnings of $65,000 during 20X5. Included on its income statement for 20X5 were depreciation and amortization expenses of $150,000 and $5,000, respectively. Its current accounts on its comparative balance sheet showed the following: December 31 . 20x4 20x5 Cash $10,000 $12,000 Marketable Securities $25,000 $27,000 Accounts Receivable $45,000 $40,000 Inventory…arrow_forwardsources and Uses of Cash. How would each ofthe following events would affect the firm's balancesheet. State whether each change is a source or useof cash. (LO3)d.The firm repurchases its own common stock.e.The firm pays its quarterly dividend.f. The firm issues $1 million of long-term debt anduses the proceeds to repay a short-term bank loan.arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning