Determining Financial Statement Effects of Various Transactions

Adamson Incorporated is a small manufacturing company that makes model trains to sell to toy stores. It has a small service department that repairs customers’ trains for a fee. The company has been in business for Five years. At the end of the company’s prior fiscal year ending on December 31, the accounting records reflected total assets of $500,000 (cash, $120,000; equipment, $70,000: buildings, $310,000), total liabilities of $200,000 (short-term notes payable, $140,000; long-term notes payable, $60,000), and total stockholders’ equity of $300,000 (common stock [par value $1.00 per share], $20,000; additional paid-in capital. $200,000;

- a. Borrowed $110,000 cash from the bank and signed a 10-year note.

- b. Purchased equipment for $30,000, paying $3,000 in cash and signing a note due in six months for the balance.

- c. Issued an additional 10,000 shares of capital stock for $100,000 cash.

- d. Purchased a delivery truck (equipment) for $10,000; paid $5,000 cash and signed a short-term note payable for the remainder.

- e. Lent $2,000 cash to the company president, Clark Adamson, who signed a note with terms showing the principal plus interest due in one year.

- f. Built an addition on the factory for $200,000 and paid cash to the contractor.

- g. Purchased $85,000 in long-term investments.

- h. Returned a $3,000 piece of equipment purchased in (b) because it proved to be defective; received a reduction of its short-term note payable.

- i. A stockholder sold $5,000 of his capital stock in Adamson Incorporated to his neighbor.

Required:

1. Was Adamson Incorporated organized as a sole proprietorship, a

2. During the current year, the records of the company were inadequate. You were asked to prepare the summary of transactions shown above. To develop a quick assessment of their economic effects on Adamson Incorporated, you have decided to complete the tabulation that follows and to use plus (+) for increases and minus (−) for decreases for each account. The first transaction is used as an example.

| ASSETS | = | LIABILITIES | + | STOCKHOLDERS’ EQUITY | |||||||||||||

| Cash | Notes Long-Term Receivable | Long-Term Investments | Equipment | Buildings | Short-Term Notes Payable | Long-Term Notes Payable | Common Stock | Additional Paid-in Capital | Retained Earnings | ||||||||

| Beg. (a) | 120,000+110000 | 70,000 | 310,000 | =_ | 140000 | 60,000 +110,000 | 20,000 | 200,000 | 80,000 | ||||||||

3. Did you include event (i) in the tabulation? Why?

4. Based on beginning balances plus the completed tabulation, provide the following amounts (show computations):

- a. Total assets at the end of the year.

- b. Total liabilities at the end of the year.

- c. Total stockholders’ equity at the end of the year.

- d. Cash balance at the end of the year.

- e. Total current assets at the end of the year.

5. Compute the

1.

Ascertain whether Company A is a corporation, a partnership or a sole proprietorship.

Explanation of Solution

Corporation:

A business concern where there is a separate legal entity and are owned by stockholders are classified as corporation. Transfer of ownership and raising funds are easy in this form of organization. No personal legal liability exists among the stockholders.

Company A is a corporation, because it issued common stock to investors for raising fund.

2.

Ascertain the effect of accounting equation, and calculate the ending balance of each account.

Explanation of Solution

Accounting equation:

Accounting equation is an accounting tool expressed in the form of equation, by creating a relationship between the resources or assets of a company, and claims on the resources by the creditors and the owners. Accounting equation is expressed as shown below:

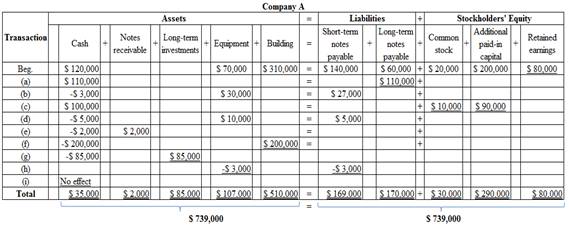

The effect of accounting equation is as follows:

Figure (1)

3.

Discuss whether the transaction between the two stockholders (event- i) is included in the spreadsheet or not and also explains the reason.

Explanation of Solution

Separate entity assumption:

Business is considered as an individual entity, as per the separate entity assumption, hence it indicates the business and personal record keeping should be maintained separately.

The transaction between the two stockholders is not included in the table, because it is not a business transaction under separate entity assumption.

4.

Calculate the amount of given items based on the completed table.

Answer to Problem 2.2AP

(a) Total assets at the end of the month = $739,000 (1)

(b) Total liabilities = $339,000 (2)

(c) Total stockholder’s equity = $400,000 (3)

(d) Cash balance at the end of the year = $35,000

(e) Total current assets = $37,000

Explanation of Solution

Total assets:

The sum of all current and non-current assets that are owned in a company is called as total assets. The total assets are reported in the balance sheet.

Liabilities:

Liabilities are an obligation of the business to pay to the creditors in future for the goods and services purchased on account or any for other financial benefit received.

Stockholders’ equity

Stockholders’ equity refers to the rights of the stockholders on the assets of the company. It is increased by issuance of stock and retained earnings of the company and decreased by the payment of dividends and repurchase of treasury stock.

Working note:

Calculate the total assets value

Calculate the total liabilities:

Calculate the total stockholders’ equity:

5.

Calculate the current ratio of Company A and evaluate the ratio.

Explanation of Solution

Current Ratio:

A part of liquidity ratios, current ratio reflects the ability to oblige the short term debts of a company. It is calculated based on the current assets and current liabilities; a company has in an accounting period. A current ratio is a useful tool for analysis of financials of a company.

Calculate the current ratio of Company A as follows:

Here,

Current assets = $37,000 (4)

Current liabilities= $169,000 (short-term notes payable)

Therefore, the current ration of Company A is 0.22

In this case, Company A has more current assets than current liabilities. Therefore, Company A has better position to repay the current liabilities.

Working note:

Calculate the value of current assets

Want to see more full solutions like this?

Chapter 2 Solutions

VALUE - FINANCIAL ACCOUNTING LL+ACCESS

- Comparing Two Companies in the Same Industry: Chipotle and Panera Bread Refer to the financial information for Chipotle and Panera Bread reproduced at the end of this book and answer the following questions: Required What is the dollar amount of inventories that each company reports on its balance sheet at the end of the most recent year? What percentage of total assets do inventories represent for each company? What does this tell you about the nature of their business? Refer to Note 1 in Chipotles annual report. What inventory valuation method does the company use? Refer to Note 2 in Panera Breads annual report. What inventory valuation method does the company use? How do both companies deal with situations in which the market value of inventory is less than its cost? Given the nature of their businesses, which inventory system, periodic or perpetual, would you expect both Chipotle and Panera Bread to use? Explain your answer.arrow_forwardJournal Entries Castle Consulting Agency began business in February. The transactions entered into by Castle during its first month of operations are as follows: Acquired articles of incorporation from the state and issued 10,000 shares of capital stock in exchange for $150,000 in cash. Paid monthly rent of $400. Signed a five-year promissory note for $100,000 at the bank. Purchased software to be used on future jobs. The software costs $950 and is expected to be used on five to eight jobs over the next two years. Billed customers $12,500 for work performed during the month. Paid office personnel $3,000 for the month of February. Received a utility bill of $100. The total amount is due in 30 days. Required Prepare in journal form, the entry to record each transaction.arrow_forwardBrief Exercise 1-26 Income Statement An analysis of the transactions of Rutherford Company for the year ended December 31, yields the following information: sales revenue, $65,000; insurance expense, $4,300; interest income, $3,900; cost of goods sold, $28,800; and loss on disposal of property, plant, and equipment, $1,200. Required: Prepare a single income statement.arrow_forward

- Income Statement and Balance Sheet Fort Worth Corporation began business in January 2016 as a commercial carpet-cleaning and drying service. Shares of stock were issued to the owners in exchange for cash. Equipment was purchased by making a down payment in cash and signing a note payable for the balance. Services are performed for local restaurants and office buildings on open account, and customers are given 15 days to pay their accounts. Rent for office and storage facilities is paid at the beginning of each month. Salaries and wages are paid at the end of the month. The following amounts are from the records of Fort Worth Corporation at the end of its first month of operations: Required Prepare an income statement for the month ended January 31, 2016. Prepare a balance sheet at January 31, 2016. What information would you need about Notes Payable to fully assess Fort Worths longterm viability? Explain your answer.arrow_forwardComparing Two Companies in the Same Industry: Chipotle and Panera Bread Refer to the financial information for Chipotle and Panera Bread reproduced at the back of the book and answer the following questions. What was the total revenue for each company for the most recent year? By what percentage did each companys revenue increase or decrease from its total amount in the prior year? What was each companys net income for the most recent year? By what percentage did each companys net income increase or decrease from its net income for the prior year? What was the total asset balance for each company at the end of its most recent year? Among its assets, what was the largest asset each company reported on its year-end balance sheet? Did either company pay its stockholders any dividends during the most recent year? Explain how you can tell.arrow_forwardFinancial statements The assets and liabilities of Global Travel Agency on December 31, 20Y5, and its revenue and expenses for the year are as follows: Common stock was 525,000 and retained earnings was 1,250,000 as of January 1, 20Y5. During the year, additional common stock of 50,000 was issued for cash, and dividends of 90,000 were paid. Instructions 1. Prepare an income statement for the year ended December 31, 20Y5. 2. Prepare a statement of stockholders equity for the year ended December 31, 20Y5. 3. Prepare a balance sheet as of December 31, 20Y5. 4. What items appears on both the statement of stockholders equity and the balance sheet?arrow_forward

- Journal Entries and a Balance Sheet Krittersbegone Inc. was organized on July 1 by a group of technicians to provide termite inspections and treatment to homeowners and small businesses. The following transactions occurred during the first month of business: July 2: Received contributions of $3,000 from each of the six owners in exchange for shares of stock. July 3: Paid $1,000 rent for the month of July. July 5: Purchased flashlights, tools, spray equipment, and ladders for $18,000, with a down payment of $5,000 and the balance due in 30 days. July 17: Paid a $200 bill for the distribution of door-to-door advertising. July 28: Paid August rent and July utilities to the landlord in the amounts of $1,000 and $450, respectively. July 30: Received $8,000 in cash from homeowners for services performed during the month. In addition, billed $7,500 to other customers for services performed during the month. Billings are due in 30 days. July 30: Paid commissions of $9,500 to the technicians for July. Required Prepare journal entries on the books of Krittersbegone to record the transactions entered into during the month. Ignore depreciation expense. Prepare a classified balance sheet dated July 31. From the balance sheet, what cash inflow and what cash outflow can you predict in the month of August? Who would be interested in the cash flow information? Why?arrow_forwardTransaction Analysis and Journal Entries Recorded Directly in T Accounts Four brothers organized Beverly Entertainment Enterprises on October 1. The following transactions occurred during the first month of operations: October 1: Received contributions of $10,000 from each of the four principal owners of the new business in exchange for shares of stock. October 2: Purchased the Ace Theater for $125,000. The seller agreed to accept a down payment of $12,500 and a seven-year promissory note for the balance. The Ace property consists of land valued at $35,000, and a building valued at $90,000. October 3: Purchased new seats for the theater at a cost of $5,000, paying $2,500 down and agreeing to pay the remainder in 60 days. October 12: Purchased candy, popcorn, cups, and napkins for $3,700 on an open account. The company has 30 days to pay for the concession supplies. October 13: Sold tickets for the opening-night movie for cash of $1,800 and took in $2,400 at the concession stand. October 17: Rented out the theater to a local community group for $1,500. The community group is to pay one-half of the bill within five working days and has 30 days to pay the remainder. October 23: Received 50% of the amount billed to the community group. October 24: Sold movie tickets for cash of $2,000 and took in $2,800 at the concession stand. October 26: The four brothers, acting on behalf of Beverly Entertainment, paid a dividend of $750 on the shares of stock owned by each of them, or $3,000 in total. October 27: Paid $500 for utilities. October 30: Paid wages and salaries of $2,400 total to the ushers, projectionist, concession stand workers, and maintenance crew. October 31: Sold movie tickets for cash of $1,800 and took in $2,500 at the concession stand. Required Prepare a table to summarize the preceding transactions as they affect the accounting equation. Use the format in Exhibit 3-1. Identify each transaction with a date. Record each transaction directly in T accounts using the dates preceding the transactions to identify them in the accounts. Each account involved in the problem needs a separate T account.arrow_forwardTransaction Analysis and Financial Statements Expert Consulting Services Inc. was organized on March 1 by two former college roommates. The corporation provides computer consulting services to small businesses. The following transactions occurred during the first month of operations: March 2: Received contributions of $20,000 from each of the two principal owners of the new business in exchange for shares of stock. March 7: Signed a two-year promissory note at the bank and received cash of $15,000. Interest, along with the $15,000, will be repaid at the end of the two years. March 12: Purchased $700 in miscellaneous supplies on account. The company has 30 days to pay for the supplies. March 19: Billed a client $4,000 for services rendered by Expert in helping to install a new computer system. The client is to pay 25% of the bill upon its receipt and the remaining balance within 30 days. March 20: Paid $1,300 bill from the local newspaper for advertising for the month of March. March 22: Received 25% of the amount billed to the client on March 19. March 26: Received cash of $2,800 for services provided in assisting a client in selecting software for its computer. March 29: Purchased a computer system for $8,000 in cash. March 30: Paid $3,300 of salaries and wages for March. March 31: Received and paid $1,400 in gas, electric, and water bills. Required Prepare a table to summarize the preceding transactions as they affect the accounting equation. Use the format in Exhibit 3-1. Identify each transaction with the date. Prepare an income statement for the month of March. Prepare a classified balance sheet at March 31. From reading the balance sheet you prepared in part (3), what events would you expect to take place in April? Explain your answer.arrow_forward

- Journal Entries Atkins Advertising Agency began business on January 2. The transactions entered into by Atkins during its first month of operations are as follows: Acquired its articles of incorporation from the state and issued 100,000 shares of capital stock in exchange for $200,000 in cash. Purchased an office building for $150,000 in cash. The building is valued at $110,000, and the remainder of the value is assigned to the land. Signed a three-year promissory note at the bank for $125,000. Purchased office equipment at a cost of $50,000, paying $10,000 down and agreeing to pay the remainder in ten days. Paid wages and salaries of $13,000 for the first half of the month. Office employees are paid twice a month. Paid the balance due on the office equipment. Sold $24,000 of advertising during the first month. Customers have until the 15th of the following month to pay their bills. Paid wages and salaries of $15,000 for the second half of the month. Recorded $3,500 in commissions earned by the salespeople during the month. They will be paid on the fifth of the following month. Required Prepare in journal form the entry to record each transaction.arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company’s financial statements, including comparing Lydex’s performance to its major competitors. The company’s financial statements for the last two years are as follows: Lydex CompanyComparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 860,000 $ 1,100,000 Marketable securities 0 300,000 Accounts receivable, net 2,300,000 1,400,000 Inventory 3,500,000 2,000,000 Prepaid expenses 240,000 180,000 Total current assets 6,900,000 4,980,000 Plant and equipment, net 9,320,000 8,950,000 Total assets $ 16,220,000 $ 13,930,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 3,910,000 $…arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] Wang Company began operations on January 1, year 1, by issuing common stock for $70,000 cash. During year 1, Wang received $88,000 cash from revenue and incurred costs that required $65,000 of cash payments. Required Prepare a GAAP-based income statement and balance sheet for Wang Company for year 1, for the below scenario: Wang is a manufacturing company. The $65,000 was paid to purchase the following items: (1) Paid $10,000 cash to purchase materials that were used to make products during the year. (2) Paid $20,000 cash for wages of factory workers who made products during the year. (3) Paid $5,000 cash for salaries of sales and administrative employees. (4) Paid $30,000 cash to purchase manufacturing equipment. The equipment was used solely to make products. It had a three-year life and a $6,000 salvage value. The company uses straight-line depreciation.…arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning