You just started a summer internship with the successful management consulting firm of Kirk, Spock, and McCoy. Your first day on the job was a busy one, as the following problems were presented to you.

Required: Supply the requested comments in each of the following independent situations.

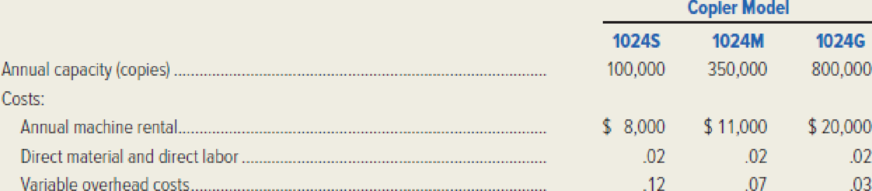

- 1. FastQ Company, a specialist in printing, has established 500 convenience copying centers throughout the country. In order to upgrade its services, the company is considering three new models of laser copying machines for use in producing high-quality copies. These high-quality copies would be added to the growing list of products offered in the FastQ shops. The selling price to the customer for each laser copy would be the same, no matter which machine is installed in the shop. The three models of laser copying machines under consideration are 1024S, a small-volume model; 1024M, a medium-volume model; and 1024G, a large-volume model. The annual rental costs and the operating costs vary with the size of each machine. The machine capacities and costs are as follows:

- a. Calculate the volume level in copies where FastQ Company would be indifferent to acquiring either the small-volume model laser copier, 1024S, or the medium-volume model laser copier, 1024M.

- b. The management of FastQ Company is able to estimate the number of copies to be sold at each establishment. Present a decision rule that would enable FastQ Company to select the most profitable machine without having to make a separate cost calculation for each establishment. (Hint: To specify a decision rule, determine the volume at which FastQ would be indifferent between the small and medium copiers. Then determine the volume at which FastQ would be indifferent between the medium and large copiers.)

- 2. Alderon Enterprises is evaluating a special order it has received for a ceramic fixture to be used in aircraft engines. Alderon has recently been operating at less than full capacity, so the firm’s management will accept the order if the price offered exceeds the costs that will be incurred in producing it. You have been asked for advice on how to determine the cost of two raw materials that would be required to produce the order.

- a. The special order will require 800 gallons of endor, a highly perishable material that is purchased as needed. Alderon currently has 1,200 gallons of endor on hand, since the material is used in virtually all of the company’s products. The last time endor was purchased, Alderon paid $5.00 per gallon. However, the average price paid for the endor in stock was only $4.75. The market price for endor is quite volatile, with the current price at $5.50. If the special order is accepted, Alderon will have to place a new order next week to replace the 800 gallons of endor used. By then the price is expected to reach $5.75 per gallon.

Using the cost terminology introduced in this chapter, comment on each of the cost figures mentioned in the preceding discussion. What is the real cost of endor if the special order is produced?

- b. The special order also would require 1,500 kilograms of tatooine, a material not normally required in any of Alderon’s regular products. The company does happen to have 2,000 kilograms of tatooine on hand, since it formerly manufactured a ceramic product that used the material. Alderon recently received an offer of $14,000 from Solo Industries for its entire supply of tatooine. However, Solo Industries is not interested in buying any quantity less than Alderon’s entire 2,000-kilogram stock. Alderon’s management is unenthusiastic about Solo’s offer, since Alderon paid $20,000 for the tatooine. Moreover, if the tatooine were purchased at today’s market price, it would cost $11.00 per kilogram. Due to the volatility of the tatooine, Alderon will need to get rid of its entire supply one way or another. If the material is not used in production or sold, Alderon will have to pay $1,000 for each 500 kilograms that is transported away and disposed of in a hazardous waste disposal site.

Using the cost terminology introduced in this chapter, comment on each of the cost figures mentioned in the preceding discussion. What is the real cost of tatooine to be used in the special order?

- 3. A local PBS station has decided to produce a TV series on state-of-the-art manufacturing. The director of the TV series, Justin Tyme, is currently attempting to analyze some of the projected costs for the series. Tyme intends to take a TV production crew on location to shoot various manufacturing scenes as they occur. If the four-week series is shown in the 8:00–9:00 P.M. prime-time slot, the station will have to cancel a wildlife show that is currently scheduled. Management projects a 10 percent viewing audience for the wildlife show, and each 1 percent is expected to bring in donations of $10,000. In contrast, the manufacturing show is expected to be watched by 15 percent of the viewing audience. However, each 1 percent of the viewership will likely generate only $5,000 in donations. If the wildlife show is canceled, it can be sold to network television for $25,000.

Using the cost terminology introduced in this chapter, comment on each of the financial amounts mentioned in the scenario above. What are the relative merits of the two shows regarding the projected revenue to the station?

1 a.

Calculate the volume level in copies for F Company, if the company indifferent among the 1024S copier model and 1024M copier.

Explanation of Solution

F Company is confused to acquire the 1024S copier or 1024M copier, at this point the cost of 1024S and 1024M are same. The value X is considered being the volume level for the 1024S copier and 1024M.

Working notes:

Calculate the total variable cost of the 1024S copier.

Calculate the variable cost of the 1024M copier.

Therefore, the F Company will be indifferent to acquire the 1024S or 1024M machine at an annual volume of 60,000 copies.

1 b.

Calculate the volume level in copies for F Company, if the company indifferent among the 1024S copier model, 1024M copier and 1024G copier models.

Explanation of Solution

Select the most profitable copier, when the volume is estimated and establish the points where F Company is indifferent to each machine. The value X is considered being the volume level for the 1024S copier and 1024M.

For the 1024M machine compared to 1024G machine.

Working notes:

Calculate the variable cost of the 1024M copier.

Calculate the total variable cost of the 1024M copier.

Select the alternatives as show in the following table.

| Anticipated Annual Volume | Optimal Model Choice |

| 0−60,000 | 1024S |

| 60,000−225,000 | 1024M |

| 225,000 and higher | 1024G |

Table (1)

2 a.

Find the real cost of endor, if the special order is produced.

Explanation of Solution

The price of the endor in hand is $5 per gallon, and the average cost of the endor inventory is $4.75 per gallon, are sunk cost. These costs were incurred in the past and will have no impact on future costs. They cannot change any future action and are irrelevant to future decision. The current price of $5 per gallon is not relevant to the current special order. If the special order is accepted by A enterprises then they replace the 800 gallons by purchasing endor at the rate of $5.75 per gallon. Therefore, the real cost of endor will be $4,600

2 b.

Find the real cost of tatooine used for the special order.

Explanation of Solution

The value of the tatooine in hand $20,000 is a sunk cost because it is incurred in the past and irrelevant for the future decision. From now onwards A enterprises decided to no more purchase of the tatooine and the current price of tatooine $11 per kilogram is irrelevant. If A enterprises accept the special order, they use 1,500 kilogram of tatooine from their stock and lose their opportunity of selling the entire 2,000 kilogram of stock for $14,000. Thus, $14,000 is an opportunity cost of A enterprises for using the tatooine instead of selling to the S industries. If A enterprises uses 1,500 kilograms of tatooine in production, then they need to pay $1,000 for the remaining 500 tatooine and it will be disposed as hazardous waste. The disposal cost of $1,000 is an out of pocket cost.

Therefore, the real cost for tatoine used for the special order is $15,000.

3.

Explain the relative merits of the two shows related to the projected revenue to the station.

Explanation of Solution

PBS station projected the donations incurred from wildlife show by $100,000 (Ten percentages from the viewing audience and each one percentage of viewers are expected to bring $10,000). The projected donations from the manufacturing series by $75,000 (Fifteen percentages from the viewing audience and each one percentage of viewers are expected to bring $5,000). Therefore there will be the differential cost of $25,000 between the wildlife show and manufacturing show. If the PBS station aired the manufacturing show, they can sell the wildlife show to the network TV for $25,000. Therefore, PBS station will incur the opportunity cost of $25,000 due to airing the wildlife show.

Hence, as a conclusion, the management found the same merit of two shows, since each show generates the revenue of $100,000.

Supporting calculation:

Calculate the revenue generated for wildlife show.

Wildlife show generated revenue of $100,000

Calculate the revenue generated for manufacturing show.

Manufacturing show generated revenue of $75,000

Want to see more full solutions like this?

Chapter 2 Solutions

Loose-Leaf for Managerial Accounting: Creating Value in a Dynamic Business Environment

- You are a management accountant for Time Treasures Company, whose company has recently signed an outsourcing agreement with Spotless. Inc., a janitorial service company. Spotless will provide all of Time Treasures janitorial services, including sweeping floors, hauling trash, washing windows, stocking restrooms, and performing minor repairs. Time Treasures will be billed at an hourly rate based on the type of service performed. The work of common laborers (sweeping, hauling trash) is to be billed at $8 per hour. More skilled (repairs) and more dangerous work (washing outside windows on the 23rd floor) are to be billed at $18 per hour. Supervisory time is to be billed at $20 per hour. Spotless will submit monthly invoices, which will show the number and types of hours for which Time Treasures is being charged. The outsourcing contract is simple and straightforward. A. What are some of the internal control problems you foresee as a result of our sourcing the janitorial service with this contract? B. Explain recommendations to control risk that would you suggest after reviewing the contract.arrow_forwardRoald is the sales manager for a small regional manufacturing firm you own. You have asked him to put together a plan for expanding into nearby markets. You know that Roalds previous job had him working closely with many of your competitors in this new market, and you believe he will be able to facilitate the company expansion. He is to prepare a presentation to you and your partners outlining his strategy for taking the company into this expanded market. The day before the presentation, Roald comes to you and explains that he will not be making a presentation on market expansion but instead wants to discuss several ways he believes the company can reduce both fixed and variable costs. Why would Roald want to focus on reducing costs rather than on expanding into a new market?arrow_forwardElla Maksimov is CEO of her own marketing firm. The firm recently moved from a strip mall in the suburbs to an office space in a downtown building, in order to make the firms employees more accessible to clients. Two new clients are interested in using Ellas advertising services but both clients are in the same line of business, meaning that Ellas company can represent only one of the clients. Pampered Pooches wants to hire Ellas firm for a one-year contract for web, newspaper, radio, and direct mail advertising. Pampered will pay $126,000 for these services. Ella estimates the cost of the services requested by Pampered Pooches to be $83,000. Delightful Dogs is interested in hiring Ella to produce mass mailings and web ads. Delightful will pay Ella $94,000 for these services and Ella estimates the cost of these services to be $47,000. Identify any relevant costs, relevant revenues, sunk costs, and opportunity costs that Ella Graham has to consider in making the decision whether to represent Pampered Pooches or Delightful Dogs.arrow_forward

- Your firm designs training materials for computer training classes, and you have just received a request to bid on a contract to produce a complete set of training manuals for an 8-session class. From previous experience, you know that your firm follows a 90% learning rate. For this contract, it appears that the effort will be substantial, running 400 hours for the first session. Your firm has an average cost of labor of $60/hour and the overhead is expected to run a fixed $1000 per session. The customer will pay you a flat fixed rate per session (Per Session Price.) If your profit markup is 12%, what will be the Total Price, the Per Session Price, and at what session will you break even? Answer the following four questions: What is the Total Price? This is what you would charge the customer so that you can have your profit markup of 10% over all of your costs. To calculate this, first figure out your cost per each session, add them up, and then add your profit. What is the Per…arrow_forwardJerry is a personnel manager for a large retail department store. He justreceived a memo stating that the company will build three new stores inPhoenix over the next 5 years, with one store opening in 24 months, oneopening in 36 months, and one opening in 60 months. The memo thatJerry received relates to what type of business plan? If Jerry is directedto develop a personnel plan for Phoenix, what type of planning will Jerrybe doing?arrow_forwardDon Masters and two of his colleagues are considering opening a law office in a large metropolitan area that would make inexpensive legal services available to those who could not otherwise afford these services. The intent is to provide easy access for their clients by having the office open360 days per year, 16 hours each day from 7:00 a.m. to 11:00 p.m. The office would be staffed by a lawyer, paralegal, legal secretary, and clerk-receptionist for each of the two 8-hour shifts.In order to determine the feasibility of the project, Don hired a marketing consultant to assist with market projections. The results of this study show that if the firm spends $500,000 onadvertising the first year, the number of new clients expected each day would have the following probability distribution: Number of NewClients per Day Probability 20 0.10 30 0.30 55 0.40…arrow_forward

- As CEO of Riverside Marine, Rachel Moore knows it is important to control costs and to respond quickly to changes in the highly competitive boat-building industry. When Gerbig Consulting proposes that Riverside Marine invest in an ERP system, she forms a team to evaluate the proposal: the plant engineer, the plant foreman, the systems specialist, the human resources director, the marketing director, and the management accountant. A month later, the management accountant Miles Cobalt reports that the team and Gerbig estimate that if Riverside Marine implements the ERP system, it will incur the following costs: Costs of the Project a.$390,000 in software costs b. $85,000 to customize the ERP software and load Riverside Marine'sdata into the new ERP system c. $112,000 for employee training Benefits of the Project a. More efficient order processing should lead to savings of $185,000. b. Streamlining the manufacturing process so that it maps into the ERP…arrow_forwardJade Ltd is now considering how to obtain a computer software. The director of Jade Ltd has noticed that over the last 20 years, many companies have spent a great deal of money internally developing new intangible assets, such as software. You have been asked by the director to provide your advice on the accounting treatments of the two possibilities below: (i) Employ its own programmers to write software that the company will use (ii) Purchase computer software externally, including packages for payroll and general ledger. Required: In accordance with IAS 38 / AASB 138 Intangible Assets, discuss whether internally developed intangible assets should be recognised, and explain the differ in the accounting treatments for the two possible options.arrow_forwardDuring your first month as an employee at Greenfield Industries (a large drill-bit manufacturer), you are asked to evaluate alternatives for producing a newly designed drill bit on a turning machine. Your boss' memorandum to you has practically no information about what the alternatives are and what criteria should be used. The same task was posed to a previous employee who could not finish the analysis, but she has given you the following information: An old turning machine valued at $350,000 exists (in the warehouse) that can be modified for the new drill bit. The in-house technicians have given an estimate of $40,000 to modify this machi, and they assure you that they will have the machine ready before the projected start date (although they have never done any modifications of this type). It is hoped that the old turning machine will be able to meet production requirements at full capacity. An outside company, McDonald Inc., made the machine seven years ago and can easily do the…arrow_forward

- During your first month as an employee at Greenfield Industries (a large drill-bit manufacturer), you are asked to evaluate alternatives for producing a newly designed drill bit on a turning machine. Your boss' memorandum to you has practically no information about what the alternatives and what criteria should be used. The same task was posed to a previous employee who could not finish the analysis, but she has given you the following information: An old turning machine valued at $350,000 exists (in the warehouse) that can be modified for the new drill bit. The in-house technicians have given an estimate of $40,000 to modify this machine, and they assure you that they will have the machine ready before the projected start date (although they have never done any modifications of this type). It is hoped that the old turning machine will be able to meet production requirements at full capacity. An outside company, McDonald Inc., made the machine seven years ago and can…arrow_forwardJohn Milton and two of his colleagues are considering opening a law office in New York City that would make inexpensive legal services available to those who could not otherwise afford these services. The intent is to provide easy access for their clients by having the office open 360 days per year, 16 hours each day from 7:00 a.m. to 11:00 p.m. The office would be staffed by a lawyer, paralegal, legal secretary, and clerk-receptionist for each of the two 8-hour shifts. In order to determine the feasibility of the project, John hired a marketing consultant to assist with market projections. The results of this study show that if the firm spends $500,000 on advertising the first year, the number of new clients expected each day would have the following probability distribution: Number of New Clients per Day Probability 20 0.10 30 0.30 55 0.40 85 0.20 John and his associates believe these numbers are reasonable and are prepared to spend the $500,000 on advertising. Other pertinent…arrow_forwardMadison is the newly appointed manager of spark communication a small computer monitor manfacturing company based out of halifox nova Scottia. During her first few days on the jobs she collected the following data about the company. The company has the capacity to produce 750 monitors per month and is currently producing 525monitors every month and selling it to wholesaler The company is expenses are :rent $4000 per month, salaries of $12500 per month, insurance of $1500 per month , material is of $6 permonth, labour of $35 per month and sales commissions of $19 per month. Each month is sold for $105. a. What is the contribution margin and the contribution rate? b. What is the break even volume and break even revenue per month? c. How much net income per month we earned at the current level of presentation.?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning