Concept explainers

(a)

Concept Introduction: The value analysis is more of a systematic production review which includes the purchase process and the design of product to make sure the costs are reduced. This can be done using a set of activities including the product designs to make use of parts that have low-tolerance which are affordable, to switch to the components that cost low, including standardization of the parts to ensure the volume discounts are achieved.

To Prepare: The value analysis schedule and the determination and distribution of excess schedules.

(a)

Explanation of Solution

Given: Quail company purchases 80 of the common stock of Commo Company for $800000. At the time of purchase, Commo has framed its balance sheet.

Calculating fair value of total assets.

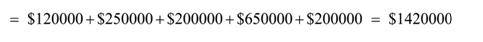

Fair value of total assets = Cash equivalents + Inventory + Land + Building + Equipment

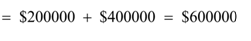

Calculating net liabilities,

Net liabilities = Current liabilities + Bonds payable

Now, calculate the fair value of net assets:

Fair value of net assets = Fair value of total assets - Liabilities payable = $1420000-$600000 = $820000

Value analysis schedule.

| Value analysis Schedule | Company-implied fair value | Parent Price (80%) | Non-controlling interest value (20%) |

| Company fair value | $1000000 | $800000 | $200000 |

| Fair value of net assets excluding | $820000 | $656000 | $164000 |

| Goodwill | $180000 | $1440000 | $36000 |

Along with total equity and excess of fair value over book value.

| Value analysis Schedule | Company-implied fair value | Parent Price (80%) | Non-controlling interest value (20%) |

| Fair value of subsidiary | $1000000 | $800000 | $200000 |

| Less: Book value of interest acquired Common stock Paid-in capital excess of par | $100000 $150000 $250000 | ||

| Total equity | $500000 | $500000 | $500000 |

| Interest acquired | 80% | 20% | |

| Book value (b) | $500000 | $400000 | $100000 |

| Excess of fair value over book value (a)-(b) | $500000 | $400000 | $100000 |

Inventory Adjustment = Fair value - book value

Land Adjustment = Fair value - book value

Building Adjustment = Fair value - book value

Equipment Adjustment = Fair value - book value

Adjustment of Identifiable Accounts

| Particulars | Adjustments | Worksheet key |

| Inventory | $1000000 | Debit D1 |

| Land | $100000 | Debit D2 |

| Building | $200000 | Debit D3 |

| Equipment | (30000) | Credit D4 |

| Goodwill | $180000 | Debit D5 |

| Total | $500000 |

(b)

Concept Introduction: The value analysis is more of a systematic production review which includes the purchase process and the design of product to make sure the costs are reduced. This can be done using a set of activities including the product designs to make use of parts that have low-tolerance which are affordable, to switch to the components that cost low, including standardization of the parts to ensure the volume discounts are achieved.

The value analysis schedule and the determination and distribution of excess schedules.

(b)

Explanation of Solution

Given: Quail company purchases 80% of the common stock of Commo Company for $800000. At the time of purchase, Commo has framed its balance sheet.

Market value of shares = Total number of shares x value per share

= 4000 shares x $45 per share = $980000

Goodwill under market value

| Value analysis Schedule | Company-implied fair value | Parent Price (80%) | Non-controlling interest value (20%) |

| Fair value of company | $980000 | $800000 | $180000 |

| Fair value of net assets excluding goodwill | $820000 | $656000 | $164000 |

| Goodwill | $160000 | $144000 | $16000 |

Value analysis schedule

| Value analysis Schedule | Company-implied fair value | Parent Price (80%) | Non-controlling interest value (20%) |

| Fair value of subsidiary (a) | $980000 | $800000 | $180000 |

| Less: Book value of interest acquired Common stock Paid-in capital excess of par retained earnings | $100000 $150000 $250000 | ||

| Total equity | $500000 | $500000 | $500000 |

| Interest acquired | 80% | 20% | |

| Book value (b) | $500000 | $400000 | $100000 |

| Excess of fair value over book value (a)-(b) | $500000 | $400000 | $100000 |

Adjustment of identifiable accounts

| Particulars | Adjustments | Worksheet Key |

| Inventory | $50000 | Debit D1 |

| Land | $100000 | Debit D2 |

| Building | $200000 | Debit D3 |

| equipment | ($30000) | Credit D4 |

| Goodwill | $160000 | Debit D6 |

| Total | $480000 |

c.

Concept Introduction: The value analysis is more of a systematic production review which includes the purchase process and the design of product to make sure the costs are reduced. This can be done using a set of activities including the product designs to make use of parts that have low-tolerance which are affordable, to switch to the components that cost low, including standardization of the parts to ensure the volume discounts are achieved.

The value analysis schedule and the determination and distribution of excess schedules.

c.

Explanation of Solution

Given: Quail company purchases 80 of the common stock of Commo Company for $800000. At the time of purchase, Commo has framed its balance sheet.

Value analysis schedule

| Value analysis Schedule | Company-implied fair value | Parent Price (80%) | Non-controlling interest value (20%) |

| Fair value of subsidiary (a) | $964000 | $800000 | $164000 |

| Less: Book value of interest acquired Common stock Paid-in capital excess of par retained earnings | $100000 $150000 $250000 | ||

| Total equity | $500000 | $500000 | $500000 |

| Interest acquired | 80% | 20% | |

| Book value (b) | $500000 | $400000 | $100000 |

| Excess of fair value over book value (a)-(b) | $464000 | $400000 | $64000 |

Adjustment of Identifiable Accounts

| Particulars | Adjustments | Worksheet Key |

| Inventory | $50000 | Debit D1 |

| Land | $100000 | Debit D2 |

| Building | $200000 | Debit D3 |

| equipment | ($30000) | Credit D4 |

| Goodwill | $144000 | Debit D6 |

| Total | $464000 |

Want to see more full solutions like this?

Chapter 2 Solutions

EBK ADVANCED ACCOUNTING

- BTS Corporation reports net assets of P300,000 at book value. These net assets have an estimated fair value of P350,000. TWICE Corporation buys 80% ownership of BTS for P300,000; there is a control premium of P10,000 included in the purchase price.Of the goodwill reported in the consolidated balance sheet (as of date of acquisition), how much is attributable to the non-controlling interest? 3,000 2,500 4,500 5,000arrow_forward5. ABC Company acquired all of XYZ Corporation’s assets and liabilities on June 30, 20X1. XYZ reported assets with a book value of P1,000,000 and liabilities of P550,000. ABC noted that XYZ included the amount P70,000 for an obsolete inventory at the acquisition date that did not appear to have any value. ABC also determined that an old machine previously used by XYZ had a fair value of P150,000 but had not been recorded by XYZ. Except for machinery and equipment, all the other assets and liabilities of XYZ approximated their fair values. In recording the transfer of assets and liabilities in its books, ABC recorded a gain of P150,000 and paid P340,000 to acquire XYZ’s net assets. If the book value of XYZ's machinery and equipment was P360,000, what was their fair value?arrow_forwardEaster Company’s 12/31/2021 statement of financial position reports assets of $5,000,000 and liabilities of $2,000,000. All of Easter’s assets’ book values approximate their fair value, except for land, which has a fair value that is $300,000 greater than its book value. On 12/31/2021, Wendell Corporation paid $5,100,000 to acquire Easter. Calculate the amount of goodwill Wendell should record as a result of this purchase.arrow_forward

- Hw.27. Entity A entered into a sale and repurchase agreement for its head office on 1 January 2022, selling the office to Bank B for $78,560,000. On the same date, the head office had a fair value of $97,800,000. Entity A will continue to use the head office for the next 2 years and has the option to buy back the property for $93,765,779, based on an effective interest rate of 9.25% per year over the next 2 years. Property prices are expected to increase over the next 2 years. REQUIRED: Measure the net amount to be shown in the Statement of Profit or Loss for the year ended 31 December 2022. 1. $7,938,979 Expense 2. $19,240,000 Expense 3. $0 4. $7,266,800 Expense 5. None of them.arrow_forwardSub Corporation reports net assets of P300,000 at book value. These net assets have an estimated fair value of P350,000. Parent Corporation buys 80% ownership of Sub for P300,000; there is a control premium of P10,000 included in the purchase price.Of the goodwill reported in the consolidated balance sheet (as of date of acquisition), how much is attributable to the non-controlling interest? A. 3,000 B. 5,000 C. 2,500 D. 4,500arrow_forward1. Nicole Company acquires 75% of Carl John Company (CJC) for P6,000,000. The carrying and fair values of CJC’s net assets at the time of acquisition are P4,500,000 and P4,900,000, respectively.Required:a. Determine the goodwill or gain on bargain purchase from the above acquisition if the non-controlling interest (NCI) is to be valued on a proportionate basis. b. Determine the goodwill or gain on bargain purchase from the above acquisition if the NCI is to be valued on a fair value basis.2. The Statement of Financial Position (SFP) of Arthur Corporation on June 30, 202X is presented below:Current Assets P195,000Land 1,320,000Building 660,000Equipment 525,000Total Assets P2,700,000Liabilities P525,000Ordinary Shares, P5 par 900,00Share Premium 825,000Retained Earnings 450,000Total Equities P2,700,000All the assets and liabilities of Arthur were assumed to approximate their fair values except for land and building. It is estimated that the land has a fair value of P2,100,000, and the…arrow_forward

- Choose the correct. Baratheon Company purchases all of Tyrell Company for $450,000 in cash. On that date, the subsidiary has net assets with a $454,000 fair value but a $310,000 book value and tax basis. The tax rate is 40 percent. Neither company has reported any deferred income tax assets or liabilities. What amount of goodwill should be recognized on the date of the acquisition?a. $53,600b. $123,600c. $23,600d. $39,600arrow_forwardPROBLEM 32Guillen Company acquired 30% of ABC Corporations share for P8,000,000 on July 1, 2020. ABC Corporation’s identifiable net assets on the date of acquisition are P20,000,000. Guillen believes that the investee has known goodwill and the fair value of the corporation's net assets is the same as itscarrying amount except for the following: a. Equipment is undervalued by P2,000,000.b. Inventory’s fair value is P2,000,000 greater than its carrying amount. The equipment has a remaining life of 4 years and depreciated using the straight-line method. At the end of 2020, all inventories at the acquisition date are entirely sold. On November 30, ABC Corporation pays a P2,000,000 dividend to its shareholders. During the year,ABC Corporation reported a net income of P5,000,000, 40% of these were earned in the first half ofthe year. The fair value of ABC Corporation's shares held by Guillen at the end of 2020 is P8,250,000. Requirements:1. Prepare the necessary journal entries to record…arrow_forwardIllustration 1. Measuring Goodwill/Gain on Bargain PurchaseOn January 1, 2021, Amahan Co. acquired all of the assets and assumed all of the liabilities of Anak, Inc. As of this date, the carrying amounts and fair values of the assets and liabilities of Anak acquired by Amahan are shown below: On the negotiation for the business combination, Amahan Co. incurred the followingtransaction costs: P25,000.00 for legal fees; P 75,000.00 for accounting fees and P 50,000.00 for consultancy fees. Case 1: Amahan Co. paid P1,000,000.00 cash and P 350,000.00 land with fair value ofP500,000.00 as consideration for the assets and liabilities of Anak, Inc.1. How much is the transaction costs incurred during the business combination?a. 50,000.00b. 75,000.00 c. 125,000.00d. 150,000.00 2. How much is the Consideration Transferred?a. 1,000,000.00b. 1,350,000.00c. 1,500,000.00d. 1,850,000.00 3. How Much is the Non-Controlling Interest in the acquiree?a. 0.00b. 150,000.00c. 310,000.00d. 500,000.000arrow_forward

- Illustration 1. Measuring Goodwill/Gain on Bargain PurchaseOn January 1, 2021, Amahan Co. acquired all of the assets and assumed all of the liabilities of Anak, Inc. As of this date, the carrying amounts and fair values of the assets and liabilities of Anak acquired by Amahan are shown below: On the negotiation for the business combination, Amahan Co. incurred the followingtransaction costs: P25,000.00 for legal fees; P 75,000.00 for accounting fees and P 50,000.00 for consultancy fees. 1. How much is the goodwill (gain on bargain purchase) on the businesscombination?a. (465,000.00)b. 185,000.00c. (190,000.00)d. 310,000.00arrow_forwardIllustration 1. Measuring Goodwill/Gain on Bargain PurchaseOn January 1, 2021, Amahan Co. acquired all of the assets and assumed all of the liabilities of Anak, Inc. As of this date, the carrying amounts and fair values of the assets and liabilities of Anak acquired by Amahan are shown below: On the negotiation for the business combination, Amahan Co. incurred the followingtransaction costs: P25,000.00 for legal fees; P 75,000.00 for accounting fees and P 50,000.00 for consultancy fees. 1. How much is the previously held equity interest in the acquiree?a. 0.00b. 150,000.00c. 310,000.00d. 500,000.00 2. How much is the fair value of the net identifiable assets acquired?a. 1,965,000.00b. 1,315,000.00c. 1,310,000.00d. 1,190,000.00 3. How much is the goodwill (gain on bargain purchase) on the businesscombination?a. (465,000.00)b. 185,000.00c. (190,000.00)d. 310,000.00arrow_forwardIllustration 1. Measuring Goodwill/Gain on Bargain PurchaseOn January 1, 2021, Amahan Co. acquired all of the assets and assumed all of the liabilities of Anak, Inc. As of this date, the carrying amounts and fair values of the assets and liabilities of Anak acquired by Amahan are shown below: On the negotiation for the business combination, Amahan Co. incurred the followingtransaction costs: P25,000.00 for legal fees; P 75,000.00 for accounting fees and P 50,000.00 for consultancy fees. Case 2: Amahan Co. paid P1,000,000.00 cash as consideration for the assets and liabilities of Anak, Inc. 1. How much is the previously held equity interest in the acquiree?a. 0.00b. 150,000.00c. 310,000.00d. 500,000.00 2. .How much is the fair value of the net identifiable assets acquired?a. 1,965,000.00b. 1,315,000.00c. 1,310,000.00d. 1,190,000.00 3.How much is the goodwill (gain on bargain purchase) on the business combination?a. (465,000.00)b. 185,000.00c. (190,000.00)d. 310,000.00arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT