CORPORATE FINANCE-ACCESS >CUSTOM<

11th Edition

ISBN: 9781260170016

Author: Ross

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 10CQ

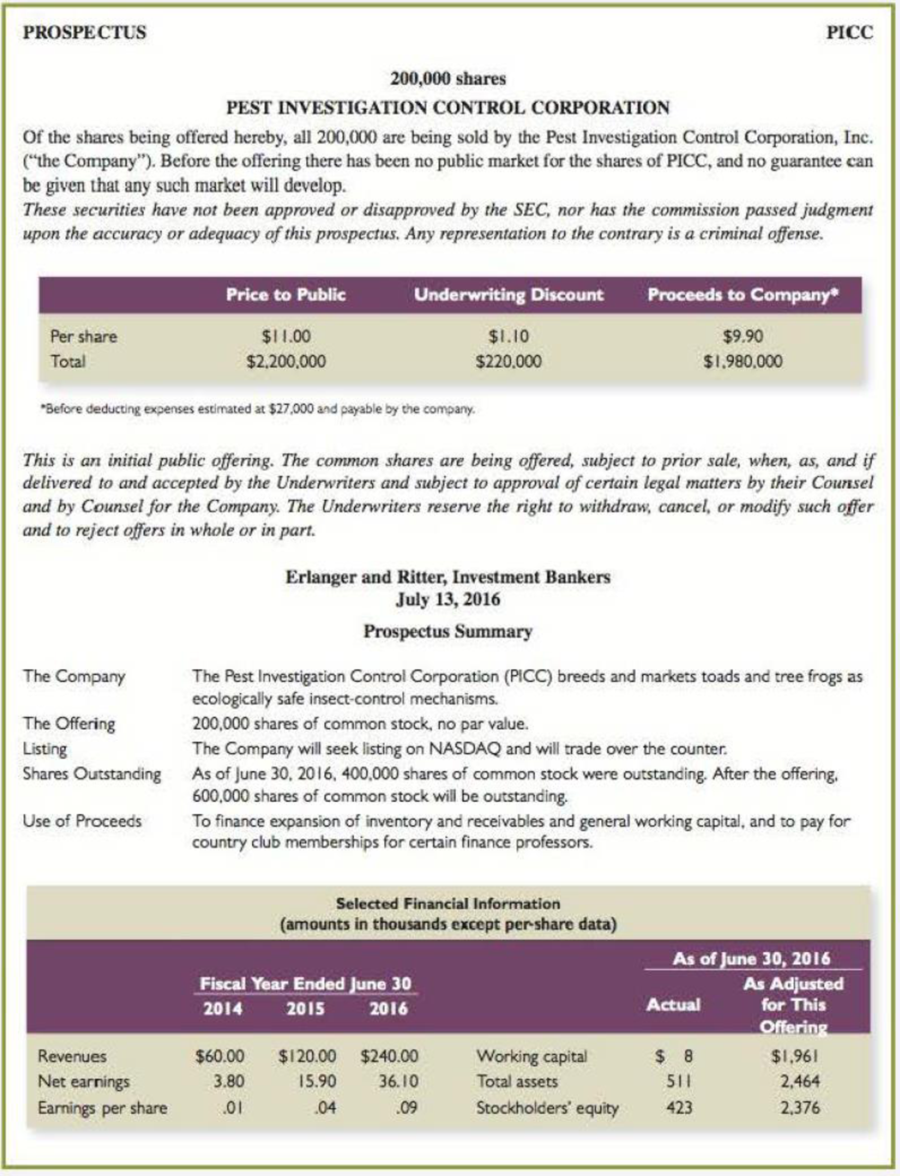

IPO Pricing The following material represents the cover page and summary of the prospectus for the initial public offering of the Pest Investigation Control Corporation (PICC), which is going public tomorrow with a firm commitment initial public offering managed by the investment banking firm of Erlanger and Ritter.

Answer the following questions:

- a. Assume that you know nothing about PICC other than the information contained in the prospectus. Based on your knowledge of finance, what is your prediction for the price of PICC tomorrow? Provide a short explanation of why you think this will occur.

- b. Assume that you have several thousand dollars to invest. When you get home from class tonight, you find that your stockbroker, whom you have not talked to for weeks, has called. She has left a message that PICC is going public tomorrow and that she can get you several hundred shares at the offering price if you call her back first thing in the morning. Discuss the merits of this opportunity.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Free cash flow valuation

Nabor Industries is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their own estimate of the firm's common stock value. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model.

The firm's weighted average cost of capital is 12 %, and it has $3,060,000 of debt at market value and $610,000 of preferred stock in terms of market value. The estimated free cash flows over the next 5 years, 2020 through 2024, are given in the table. Beyond 2024 to infinity, the firm expects its free cash flow to grow by 6 % annually.

Year (t)

Free Cash Flow (FCF)

2020

$260,000

2021

$330,000

2022

$380,000

2023

$430,000

2024

$480,000

a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model.

b.…

You have the following initial information on Financeur Co. on which to base your calculations and discussion for question 2):

• Current long-term and target debt-equity ratio (D:E) = 1:3

• Corporate tax rate (TC) = 30%

• Expected Inflation = 1.55%

• Equity beta (E) = 1.6325

• Debt beta (D) = 0.203

• Expected market premium (rM – rF) = 6.00%

• Risk-free rate (rF) =2.05%

2) Assume now a firm that is an existing customer of Financeur Co. is considering a buyout of Financeur Co. to allow them to integrate production activities. The potential acquiring firm’s management has approached an investment bank for advice. The bank believes that the firm can gear Financeur Co. to a higher level, given that its existing management has been highly conservative in its use of debt. It also notes that the customer’s firm has the same cost of debt as that of Financeur Co. Thus, it has suggested use of a target debtequity ratio of 2:3 when undertaking valuation calculations.

a) What would the required…

Free cash flow valuation

Nabor Industries is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their own estimate of the firm's common stock value. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model.

The firm's weighted average cost of capital is 15 %, and it has $ 1,670,000 of debt at market value and $ 330,000 of preferred stock in terms of market value. The estimated free cash flows over the next 5 years, 2020 through 2024, are given in the table,

Year (t)

Free cash flow (FCF)

2020

$230,000

2021

$260,000

2022

$330,000

2023

$370,000

2024

$440,000

Beyond 2024 to infinity, the firm expects its free cash flow to grow by 5% annually.

a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model.

b. Use your finding in part a,…

Chapter 20 Solutions

CORPORATE FINANCE-ACCESS >CUSTOM<

Ch. 20 - Prob. 1CQCh. 20 - Debt versus Equity Flotation Costs Why arc the...Ch. 20 - Prob. 3CQCh. 20 - Prob. 4CQCh. 20 - Prob. 5CQCh. 20 - Prob. 6CQCh. 20 - Prob. 7CQCh. 20 - Prob. 8CQCh. 20 - Prob. 9CQCh. 20 - IPO Pricing The following material represents the...

Ch. 20 - Competitive and Negotiated Offers What are the...Ch. 20 - Seasoned Equity Offers What are the possible...Ch. 20 - Prob. 13CQCh. 20 - Prob. 14CQCh. 20 - Prob. 15CQCh. 20 - Rights Offerings Chanelle, Inc., is proposing a...Ch. 20 - Prob. 2QPCh. 20 - Prob. 3QPCh. 20 - Prob. 4QPCh. 20 - Calculating Flotation Costs The St. Anger...Ch. 20 - Prob. 6QPCh. 20 - Calculating Flotation Costs The Green Hills Co....Ch. 20 - Prob. 8QPCh. 20 - Stock Offerings The Newton Company has 50,000...Ch. 20 - Dilution Teardrop, Inc., wishes to expand its...Ch. 20 - Dilution The all-equity firm Metallica Heavy Metal...Ch. 20 - Prob. 12QPCh. 20 - Prob. 13QPCh. 20 - Prob. 14QPCh. 20 - Prob. 15QPCh. 20 - Prob. 16QPCh. 20 - Prob. 17QPCh. 20 - Prob. 18QPCh. 20 - Prob. 1MCCh. 20 - Prob. 2MCCh. 20 - Prob. 3MCCh. 20 - Prob. 4MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Using Past Information to Estimate Required Returns Use online resources to work on this chapter's questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions. Chapter 8 discussed the basic trade-off between risk and return. In the capital asset pricing model (CAPM) discussion, beta was identified as the correct measure of risk for diversified shareholders. Recall that beta measures the extent to which the returns of a given stock move with the stock market. When using the CAPM to estimate required returns, we would like to know how the stock will move with the market in the future, but because we dont have a crystal ball, we generally use historical data to estimate this relationship with beta. As mentioned in Web Appendix 8A, beta can be estimated by regressing the individual stock's returns against the returns of the overall market. As an alternative to running our own regressions, we can rely on reported betas from a variety of sources. These published sources make it easy for us to readily obtain beta estimates for most large publicly traded corporations. However, a word of caution is in order. Beta estimates can often be quite sensitive to the time period in which the data are estimated, the market index used, and the frequency of the data used. Therefore, it is not uncommon to find a wide range of beta estimates among the various Internet websites. 4. Select one of the four stocks listed in question 3 by entering the company's ticker symbol on the financial website you have chosen. On the screen you should see the interactive chart. Select the six-month time period and compare the stock's performance to the SP 500's performance on the graph by adding the SP 500 to the interactive chart. Has the stock outperformed or underperformed the overall market during this time period?arrow_forwardIn a firm-commitment IPO, the initial suggested offer range was quoted as $18 to $20 per share. The final offer price on the issue is $25 per share. At what price do you expect the issue to close on its first day of trading? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardHow is AIC currently valued in the stock market? (under, over, fairly) Your firm's client makes her investment decisions based on research report and requires 30% margin safety. What would be her investment decision if AIC price falls to $40?arrow_forward

- Free cash flow valuation Nabor Industries is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their own estimate of the firm's common stock value. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model. The firm's weighted average cost of capital is 13%, and it has $1,720,000 of debt at market value and $340,000 of preferred stock in terms of market value. The estimated free cash flows over the next 5 years, 1 through 5, 1 230,0002 270,0003 330,0004 360,0005 420,000After year 5, the firm expects its free cash flow to grow by 3% annually. a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model. b. Use your finding in part a, along with the data provided above, to find Nabor Industries' common stock value. c. If…arrow_forwardYou are evaluating the potential purchase of a small business with no debt or preferred stock that is currently generating $41,200 of free cash flow (FCF0= $41,200). On the basis of a review of similar-risk investment opportunites, you must earn a(n)19% rate of return on the proposed purchase. Because you are relatively uncertain about future cash flows, you decide to estimate the firm's value using several possible assumptions about the growth rate of cash flows. a. What is the firm's value if cash flows are expected to grow at an annual rate of 0% from now to infinity? b. What is the firm's value if cash flows are expected to grow at a constant annual rate of 6% from now to infinity? c. What is the firm's value if cash flows are expected to grow at an annual rate of13% for the first 2 years, followed by a constant annual rate of 6% from year 3 to infinity?arrow_forwardYou are evaluating the potential purchase of a small business with no debt or preferred stock that is currently generating $41,300 of free cash flow (FCF0= $41,300). On the basis of a review of similar-risk investment opportunites, you must earn a(n) 20% rate of return on the proposed purchase. Because you are relatively uncertain about future cash flows, you decide to estimate the firm's value using several possible assumptions about the growth rate of cash flows. a. What is the firm's value if cash flows are expected to grow at an annual rate of 0% from now to infinity? b. What is the firm's value if cash flows are expected to grow at a constant annual rate of 8% from now to infinity? c. What is the firm's value if cash flows are expected to grow at an annual rate of 12% for the first 2 years, followed by a constant annual rate of 8%from year 3 to infinity?arrow_forward

- You have the following initial information on Financeur Co. on which to base your calculationsand discussion for questions 2):• Current long-term and target debt-equity ratio (D:E) = 1:3• Corporate tax rate (TC) = 30%• Expected Inflation = 1.55%• Equity beta (E) = 1.6325• Debt beta (D) = 0.203• Expected market premium (rM – rF) = 6.00%• Risk-free rate (rF) =2.05%2) Assume now a firm that is an existing customer of Financeur Co. is considering a buyoutof Financeur Co. to allow them to integrate production activities. The potential acquiringfirm’s management has approached an investment bank for advice. The bank believesthat the firm can gear Financeur Co. to a higher level, given that its existing managementhas been highly conservative in its use of debt. It also notes that the customer’s firm hasthe same cost of debt as that of Financeur Co. Thus, it has suggested use of a target debtequity ratio of 2:3 when undertaking valuation calculations.a) What would the required rate of return…arrow_forwardYou are evaluating the potential purchase of a small business with no debt or preferred stock that is currently generating$42,200of free cash flow(FCF 0 =$42, 200).On the basis of a review of similar-risk investment opportunites, you must earn a(n)18%rate of return on the proposed purchase. Because you are relatively uncertain about future cash flows, you decide to estimate the firm's value using several possible assumptions about the growth rate of cash flows. a. What is the firm's value if cash flows are expected to grow at an annual rate of 0% from now to infinity? b. What is the firm's value if cash flows are expected to grow at a constant annual rate of7%from now to infinity? c. What is the firm's value if cash flows are expected to grow at an annual rate of12%for the first 2 years, followed by a constant annual rate of 7%from year 3 to infinity?arrow_forwardExplain how a financial market operates? Which of the investment constraints is expected to have the most impact on your decision process? You plan to buy common stock and hold it for one year. You expect to receive both ₱150 and ₱260 from the sale of the stock at the end of the year. How much will you pay for the stock, if you want to a. Have a return of 8% b. A return of 20% c. A return of 15%arrow_forward

- Provide an analysis of how the following investment patterns can be explained using theories of behavioral finance. Once a firm's current earnings become known, the information content should be quickly digested by investors and incorporated into the efficient market price. However, if the security’s price is close to its 52-week high, investors are reluctant to bid prices up even if the company has an extremely positive earnings surprise.arrow_forwardAs the general manager of a firm, you are presented with an investment proposal from one of your divisions. Its net present value, if discounted at the cost of capital for your firm (which is 15 percent), is $ 1 00,000, and its internal rate of return is 20 percent. (a) What are the economic interpretations of the net present value and internal rate of return figures? In other words, what do they mean? (b) What, if any, additional information would you like to have before approving the project?arrow_forwardThe analysis that we have to provide is as follows: Review the specifics of the IPO, including underwriting spread and other expenses. Consider the concept of underpricing and a higher than normal first day spike in stock price. What does this mean for the issuing company? What does this mean for the underwriter? The Mini Case we have to go off of is: Mutt.Com was founded in 2015 by two graduates of the University of Wisconsin with help from Georgina Sloberg, who had built up an enviable reputation for backing new start-up businesses. Mutt.Com's user-friendly system was designed to find buyers for unwanted pets. Within 3 years, the company was generating revenues of $3.4 million a year and, despite racking up sizable losses, was regarded by investors as one of the hottest new e-commerce businesses. Therefore, the news that the company was preparing to go public generated considerable excitement. The company's entire equity capital of 1.5 million shares was owned by the two founders…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Financial instruments products; Author: fi-compass;https://www.youtube.com/watch?v=gvxozM3TUIg;License: Standard Youtube License