a

To compute:The Value of a stock-plus-put position as on the ending date of the option.

Introduction:

Put-Call parity relationship: It is a relationship defined among the amounts of European put options and European call options of the given same class. The condition implied here is that the underlying asset, strike price, and expiration dates are the same in both the options. The Put-Call

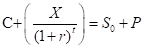

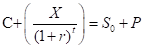

Parity equation is as follows:

Where C= Call premium

P=Put premium

X=Strike Price of Call and Put

r=Annual interest rate

t= Time in years

S0= Initial price of underlying

b

To compute: The value of the portfolio as on the ending date of the option when portfolio includes a call option and zero-coupon bond with face value (X+D) and make sure its value equals the stock plus-put portfolio.

Introduction:

Value of the portfolio:It is also called as the portfolio value. The present value on a specific date derived after calculating the cash availability for debt service at a certain discounted rate can be termed as value of the portfolio.

c.

To compute: The cost of establishing above said portfolios and derives the put-call parity relationship.

Introduction:

Put-Call parity relationship: It is a relationship defined among the amounts of European put options and European call options of the given same class. The condition implied here is that the underlying asset, strike price, and expiration dates are the same in both the options. The Put-Call Parity equation is as follows:

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

INVESTMENTS (LOOSELEAF) W/CONNECT

- 1. Suppose you have the following information concerning a particular options.Stock price, S = RM 21Exercise price, K = RM 20Interest rate, r = 0.08Maturity, T = 180 days = 0.5Standard deviation, � = 0.5 The Call option value is 3.7739. and put option value is 1.8101 Suppose a European put options has a price higher than that dictated by the putcall parity. a. Outline the appropriate arbitrage strategy and graphically prove that the arbitrage is riskless. Note: Use the call and put options prices above)b. Name the options/stock strategy used to proof the put-call parity. c. What would be the extent of your profit in (a) depend on?arrow_forwardIn a financial market a stock is traded with a current price of 50. Next period the priceof the stock can either go up with 30 per cent or go down with 25 per cent. Risk-freedebt is available with an interest rate of 8 per cent. Also traded are European optionson the stock with an exercise price of 45 and a time to maturity of 1, i.e. they maturenext period.a) Find prices of Arrow-Debreu securities.b) Calculate the price of a call option by constructing and pricing areplicating portfolio.arrow_forwardIn a financial market a stock is traded with a current price of 50. Next period the price of the stock can either go up with 30 per cent or go down with 25 per cent. Risk-free debt is available with an interest rate of 8 per cent. Also traded are European options on the stock with an exercise price of 45 and a time to maturity of 1, i.e. they mature next period. Does put-call parity hold? Explain.arrow_forward

- An investor buys a European call option at a price of 7.6 yuan. The stock price is 52 yuan and the strike price is 55 yuan. Under what circumstances will the investor make a profit ? Under what circumstances will the option be executed ? Draw a diagram of the relationship between investor profitability and stock price at maturity.arrow_forwardIn a financial market a stock is traded with a current price of 50. Next period the price of the stock can either go up with 30 per cent or go down with 25 per cent. Risk-free debt is available with an interest rate of 8 per cent. Also traded are European options on the stock with an exercise price of 45 and a time to maturity of 1, i.e. they mature next period. Calculate the price of a put option by RNVR.arrow_forwardConsider a European call on Procter and Gamble stock (PG) that expires in one period. The current stock price is $120, the strike price is $130, and the risk-free rate is 5%. Assume that PG stock will either go up to $150 (probability = .4), or go down to $90 (probability = .6). Construct a replicating portfolio based on shares of PG stock and a position in a risk-free asset, and compute the price of the call option.arrow_forward

- A three-step binomial tree with terminal stock prices being 1.103, 0.875, 0.695, and 0.552. At time 0, if you have the insider information that at the maturity the stock price will be 0.875. Then, will the option premium at time 0 still be same as if you don't have this information, please choose from the answers below? a) Option premium is irrelevant to the private information (about the underlying) that option holder possesses. b) As in that case, the risk neutral probability of the impossible sample paths become zero.arrow_forwardLet C be the price of a call option that enables its holder to buy one share of a stock at an exercise price K at time t; also, let P be the price of a European put option that enables its holder to sale one share or the stock for the amount K at time t. Let S be the price of the stock at time 0. Then, assuming that interest is continuously discounted at a nominal rate r, either S+P-C=Ke-rt or there is an arbitrage opportunity. Question: How do I verify that the strategy of selling one share of stock, selling one put option, and buying one call option always results in a positive win if S+P-C>Ke-rt ?arrow_forwardReconsider the determination of the hedge ratio in the two-state model where we showed that one-third share of stock would hedge one option. The possible end-of-year stock prices, uS0 = $135 (up state) and dS0 = $100 (down state). What would be the call option hedge ratio for each of the following exercise prices: $135, $122, $111, $100, given the possible end-of-year stock prices, uS0 = $135 (up state) and dS0 = $100 (down state)? Exercise Price Hedge Ratio $135 ? $122 ? $111 ? $100 ?arrow_forward

- State whether the following statements are true or false. In each case, provide a brief explanation. a. In a risk averse world, the binomial model states that, other things being equal, the greater the probability of an up movement in the stock price, the lower the value of a European put option. b. By observing the prices of call and put options on a stock, one can recover an estimate of the expected stock return. c. An investor would like to purchase a European call option on an underlying stock index with a strike price of 210 and a time to maturity of 3 months, but this option is not actively traded. However, two otherwise identical call options are traded with strike prices of 200 and 220 respectively, hence the investor can replicate a call with a strike price of 210 by holding a static position in the two traded calls. d. In a binomial world,if a stock is more likely to go up in price than to go down, an increase in volatility would increase the price of a call option and reduce…arrow_forwardWithout using the Black‐Scholes model, compute the price of a European put option on a non‐dividend‐paying stock with the strike price is $70 when the stock price is $73, the risk‐free interest rate is 10% pa, the volatility is 40% pa, and the time to maturity is 6 months?arrow_forwardConsider a European call option and a European put option that have the same underlying stock, the same strike price K = 40, and the same expiration date 6 months from now. The current stock price is $45. a) Suppose the annualized risk-free rate r = 2%, what is the difference between the call premium and the put premium implied by no-arbitrage? b) Suppose the annualized risk-free borrowing rate = 4%, and the annualized risk-free lending rate = 2%. Find the maximum and minimum difference between the call premium and the put premium, i.e., C − P such that there is no arbitrage opportunities.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education