a

To compute:The Value of a stock-plus-put position as on the ending date of the option.

Introduction:

Put-Call parity relationship: It is a relationship defined among the amounts of European put options and European call options of the given same class. The condition implied here is that the underlying asset, strike price, and expiration dates are the same in both the options. The Put-Call

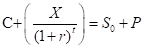

Parity equation is as follows:

Where C= Call premium

P=Put premium

X=Strike Price of Call and Put

r=Annual interest rate

t= Time in years

S0= Initial price of underlying

b

To compute: The value of the portfolio as on the ending date of the option when portfolio includes a call option and zero-coupon bond with face value (X+D) and make sure its value equals the stock plus-put portfolio.

Introduction:

Value of the portfolio:It is also called as the portfolio value. The

c.

To compute: The cost of establishing above said portfolios and derives the put-call parity relationship.

Introduction:

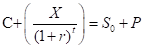

Put-Call parity relationship: It is a relationship defined among the amounts of European put options and European call options of the given same class. The condition implied here is that the underlying asset, strike price, and expiration dates are the same in both the options. The Put-Call Parity equation is as follows:

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

INVESTEMENTS (LL) W/CONNECT <CUSTOM>

- Show how you would make a portfolio delta-neutral and also self-financing by including bonds and call options to a stock that is currently traded at sh. 100, given that the delta for the call = 0.2499 and the call price = sh5.55.arrow_forwardConsider an european call option on a stock that is not paying dividends with the following characteristics. (i) The stock price at t = 0 is S = $30. (ii) The stricke price is $31. (iii) The volatility of the stock is 20%. (iv) The free risk interest rate is 7%. Construct a 2 period recombining Binomial tree diagram and specty tne varue or the can optron at eacn node of the tree diagram.arrow_forwardConsider two put options on different stocks. The table below reports the relevant information for both options: Put optionTime to maturityCurrent price of underlying stockStrike priceVolatility ( )X1 year$27$1830%Y1 year$25$2030%All else equal, which put option has a lower premium? A.Put option Y B.Put option Xarrow_forward

- Consider a European call option and a European put option that have the same underlying stock, the same strike price K = 40, and the same expiration date 6 months from now. The current stock price is $45. a) Suppose the annualized risk-free rate r = 2%, what is the difference between the call premium and the put premium implied by no-arbitrage? b) Suppose the annualized risk-free borrowing rate = 4%, and the annualized risk-free lending rate = 2%. Find the maximum and minimum difference between the call premium and the put premium, i.e., C − P such that there is no arbitrage opportunities.arrow_forwardConsider the 1-period binomial model with a bond with A(0) = 60 and A(1) = 70 and a stock with S(0) = 4X and S^u(1) 6Y and S^d(1) = 3Z. = 1. What is the price (payoff) C(1) of a call option with strike price 28? 2. same... with strike price 45? 3. same... with strike price 72? 4. Set up a system of linear equations to determine a replicating portfolio for the call option from part 2 (strike price 45). 5. Solve it and determine the price C(O). 6. Compute, tabulate, and plot the price C(O) as you vary the strike price of the option from 28, 29, ..., 71, 72.arrow_forwardConsider two European call options with strike K and the same underlying non- dividend paying stock. The stock price is currently at So. Option 1 has price C₁ maturity T₁ and Option 2 has price C₂ and maturity T2, where T₂ > T₁. The risk-free interest rate is r. Use a no-arbitrage argument to prove that C₂ > C₁-arrow_forward

- Reconsider the determination of the hedge ratio in the two-state model, where we showed that one-third share of stock would hedge one option. What would be the hedge ratio for the following exercise prices: (a) 120, (b) 110, (c) 100, (d) 90? (e) What do you conclude about the hedge ratio as the option becomes progressively more in the money?arrow_forwardForward prices of the form Fo = S,e"" are sometimes referred to as “risk-adjusted expected future spot prices". If a stock's expected annualized log return is a (i.e. E[Sr] Soear, or – In ("5") = a), show that the expected annualized log return over the period So t = 0 → T (i.e. the rate of appreciation in F) on a forward contract with maturity T years written on that stock must be equal to the risk premium a – r, where r is the annualized risk-free rate. Explain the surprising result that an asset that requires zero initialarrow_forwardUsing the binomial call option model to find the current value of a call option with a $25 exercise price on a stock currently priced at $26. Assume the option expires at the end of two periods, the riskless interest rate is ½ percent per period. What are the hedge ratios?arrow_forward

- You are evaluating a put option based on the following information: P = Ke-H•N(-d,) – S-N(-d,) Stock price, So Exercise price, k = RM 11 = RM 10 = 0.10 Maturity, T= 90 days = 0.25 Standard deviation, o = 0.5 Interest rate, r Calculate the fair value of the put based on Black-Scholes pricing model. Cumulative normal distribution table is provided at the back.arrow_forwardConsider a portfolio consisting of one share and several European call options with the same expiry, but different strike prices. The payoff diagram of the portfolio is given by the following figure. Find the strike prices and the positions of each call option. Portfolio payoff 25 20 15 10 15 20 25 30 Stock price Payoffarrow_forwardA portfolio of derivatives on a stock has a delta of 2400 and a gamma of –10. An option on the stock with a delta of 0.5 and a gamma of 0.04 can be traded. What position in the option is necessary to make the portfolio gamma neutral? Long/Short and how many options and why?arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education