EBK FINANCIAL & MANAGERIAL ACCOUNTING

13th Edition

ISBN: 9780100545052

Author: WARREN

Publisher: YUZU

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 20, Problem 20.4APR

Salespersons' report and analysis

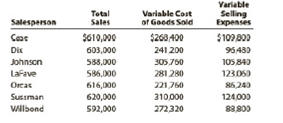

Walthman Industries Inc. employs seven salespersons to sell and distribute- its product throughout the state. Data taken from reports received from the .salespersons during the year ended December 31 are as follows:

Instructions

- 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. (Round whole percent to one digit after decimal point.)

- 2. Which salesperson generated the highest contribution margin ratio for the year and why?

- 3. Briefly list factors other than contribution margin that should be considered in evaluating the performance of salespersons.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows:

Salesperson

TotalSales

Variable Costof Goods Sold

VariableSellingExpenses

Case

$610,000

$268,400

$109,800

Dix

603,000

241,200

96,480

Johnson

588,000

305,760

105,840

LaFave

586,000

281,280

123,060

Orcas

616,000

221,760

86,240

Sussman

620,000

310,000

124,000

Willbond

592,000

272,320

88,800

Required:

1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. Round percents to the nearest whole number. Enter all amounts as positive numbers.

Walthman Industries Inc.

Salespersons' Analysis

For the Year Ended December 31

Salesperson

Contribution Margin

Variable Cost of…

Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout

the state. Data taken from reports received from the salespersons during the year ended December

31 are as follows:

Total

Sales

Variable Cost

of Goods Sold

Variable

Selling

Expenses

Salesperson

Case

$610,000

$268,400

$109,800

Dix

603,000

241,200

96,480

Johnson

588,000

305,760

105,840

LaFave

586,000

281,280

123,060

Orcas

616,000

221,760

86,240

Sussman

620,000

310,000

124,000

Willbond

592,000

272,320

88,800

Instructions

1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales,

variable selling expenses as a percent of sales, and contribution margin ratio by salesperson.

Round whole percent.

2.

- Which salesperson generated the highest contribution margin ratio for the year and why?

3.

Briefly list factors other than contribution margin that should be considered in

evaluating the performance of salespersons.

Salespersons' Report and Analysis

Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows:

Salesperson

Total Sales

Variable Cost of Goods Sold

Variable Selling Expenses

Case

$349,000

$115,170

$69,800

Dix

346,000

138,400

55,360

Johnson

588,000

217,560

76,440

LaFave

533,000

202,540

90,610

Orcas

557,000

245,080

72,410

Sussman

344,000

196,080

72,240

Willbond

408,000

159,120

61,200

Required:

1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. Round percents to the nearest whole number. Enter all amounts as positive numbers.

Waltham Industries Inc.

Salespersons' Analysis

For the Year Ended…

Chapter 20 Solutions

EBK FINANCIAL & MANAGERIAL ACCOUNTING

Ch. 20 - What types of costs are customarily included in...Ch. 20 - Which type of manufacturing cost (direct...Ch. 20 - Which of the following costs would be included in...Ch. 20 - In the variable costing income statement, how are...Ch. 20 - Since all costs of operating a business are...Ch. 20 - Discuss how financial data prepared on the basis...Ch. 20 - Why might management analyze product...Ch. 20 - Explain why rewarding sales personnel on the basis...Ch. 20 - Discuss the two factors affecting both sales and...Ch. 20 - How is the quantity factor for an increase or a...

Ch. 20 - Explain why service companies use different...Ch. 20 - Prob. 20.1APECh. 20 - Variable costing Marley Company has the following...Ch. 20 - Variable costingproduction exceeds sales Fixed...Ch. 20 - Variable costingproduction exceeds sales Fixed...Ch. 20 - Variable costingsales exceed production The...Ch. 20 - Variable costing sales exceed production The...Ch. 20 - Analyzing income under absorption and variable...Ch. 20 - Analyzing income under absorption and variable...Ch. 20 - Contribution margin by segment The following...Ch. 20 - Contribution margin by segment The following...Ch. 20 - Contribution margin analysis The actual price for...Ch. 20 - Contribution margin analysis The actual variable...Ch. 20 - Inventory valuation under absorption costing and...Ch. 20 - Income statements under absorption costing and...Ch. 20 - Income statements under absorption costing and...Ch. 20 - Cost of goods manufactured, using variable costing...Ch. 20 - Variable costing income statement On June 50, the...Ch. 20 - Absorption costing income statement On July 31,...Ch. 20 - Variable costing income statement The following...Ch. 20 - Estimated income statements, using absorption and...Ch. 20 - Variable and absorption costing Ansara Company had...Ch. 20 - Variable and absorption costingthree products...Ch. 20 - Prob. 20.11EXCh. 20 - Product profitability analysis Power Train Sports...Ch. 20 - Territory and product profitability analysis Coast...Ch. 20 - Prob. 20.14EXCh. 20 - Segment profitability analysis The marketing...Ch. 20 - Prob. 20.16EXCh. 20 - Prob. 20.17EXCh. 20 - Prob. 20.18EXCh. 20 - Contribution margin analysis variable costs Based...Ch. 20 - Variable costing income statement for a service...Ch. 20 - Contribution margin reporting and analysis for a...Ch. 20 - Variable costing income statement and contribution...Ch. 20 - Prob. 20.1APRCh. 20 - Income statements under absorption costing and...Ch. 20 - Absorption and variable costing income statements...Ch. 20 - Salespersons' report and analysis Walthman...Ch. 20 - Prob. 20.5APRCh. 20 - Contribution margin analysis Dozier Industries...Ch. 20 - Absorption and variable costing income statements...Ch. 20 - Income statements under absorption costing and...Ch. 20 - Absorption and variable costing income statements...Ch. 20 - Salespersons' report and analysis Pachec Inc....Ch. 20 - Prob. 20.5BPRCh. 20 - Contribution margin analysis Mathews Company...Ch. 20 - Prob. 20.1CPCh. 20 - Prob. 20.3CPCh. 20 - Prob. 20.4CPCh. 20 - Prob. 20.5CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Salespersons report and analysis Pachec Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended June 30 are as follows: Instructions 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. 2. Which salesperson generated the highest contribution margin ratio for the year and why? 3. Briefly list factors other than contribution margin that should be considered in evaluating the performance of salespersons.arrow_forwardUse the following information for Exercises 2-47 through 2-49. Jasper Company provided the following information for last year: Last year, beginning and ending inventories of work in process and finished goods equaled zero. Exercise 2-49 Income Statement Refer to the information for Jasper Company on the previous page. Required: 1. Prepare an income statement for Jasper for last year. Calculate the percentage of sales for each line item on the income statement. (Note: Round percentages to the nearest tenth of a percent.) 2. CONCEPTUAL CONNECTION Briefly explain how a manager could use the income statement created for Requirement 1 to better control costs.arrow_forwardUsing the information in the previous exercises about Marleys Manufacturing, determine the operating income for department B, assuming department A sold department B 1,000 units during the month and department A reduces the selling price to the market price.arrow_forward

- Salespersons' Report and Analysis Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows: Salesperson Total Sales Variable Cost of Goods Sold Variable Selling Expenses Case $429,000 $184,470 $90,090 Dix 417,000 212,670 58,380 Johnson 465,000 195,300 102,300 LaFave 585,000 204,750 87,750 Orcas 418,000 229,900 66,880 Sussman 407,000 215,710 85,470 Willbond 580,000 191,400 127,600 Required: 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. Round percents to the nearest whole number. Enter all amounts as positive numbers. Waltham Industries Inc. Salespersons' Analysis For the Year Ended…arrow_forwardSalespersons' Report and Analysis Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows: Salesperson Total Sales Variable Cost of Goods Sold Variable Selling Expenses $115,940 135,000 279,790 236,340 283,040 282,150 264,150 Case Dix Johnson LaFave Orcas Sussman Willbond Required: 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. Round percents to the nearest whole number. Enter all amounts as positive numbers. Salesperson Contribution Margin Case Dix Johnson LaFave Orcas $341,000 375,000 571,000 606,000 488,000 627,000 587,000 Sussman Willbond $ $51,150 75,000 108,490 84,840 78,080 112,860 105,660 Waltham Industries Inc. Salespersons' Analysis For the Year Ended December 31 Variable…arrow_forwardSalespersons' Report and Analysis Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows: Salesperson Total Sales Variable Cost of Goods Sold Variable Selling Expenses Case $372,000 $197,160 $70,680 Dix 566,000 277,340 113,200 Johnson 594,000 308,880 118,800 LaFave 344,000 172,000 51,600 Orcas 346,000 110,720 58,820 Sussman 559,000 318,630 72,670 Willbond 395,000 134,300 75,050 Required: 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. Round percents to the nearest whole number. Enter all amounts as positive numbers. Waltham Industries Inc.Salespersons' AnalysisFor the Year Ended December 31…arrow_forward

- Salespersons' Report and Analysis Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows: Salesperson Total Sales Variable Cost of Goods Sold Variable Selling Expenses Case $581,000 $284,690 $122,010 Dix 576,000 247,680 92,160 Johnson 587,000 246,540 129,140 LaFave 461,000 207,450 96,810 Orcas 525,000 194,250 84,000 Sussman 492,000 241,080 78,720 Willbond 426,000 187,440 55,380 Required: 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. Round percents to the nearest whole number. Enter all amounts as positive numbers. Waltham Industries Inc. Salespersons' Analysis For the Year Ended December 31 Variable Cost of Goods Variable Selling Expenses Contribution Margin Salesperson Contribution…arrow_forwardSalespersons' Report and Analysis Pachec Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended June 30 are as follows: Variable Total Variable Cost Selling Salesperson Sales of Goods Sold Expenses Asarenka $437,500 $196,875 $83,125 Crowell 570,000 228,000 91,200 Dempster 141,750 675,000 310,500 MacLean 587,500 246,750 123,375 Ortiz 525,000 215,250 126,000 Sullivan 587,500 246,750 99,875 Williams 575,000 253,000 115,000 Required: 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. Round percents to the nearest whole number. Enter all amounts as positive numbers.arrow_forwardReview the contribution margin income statements for Cover-to-Cover Company and Biblio Files Company on their respective Income Statements panels. Complete the following table from the data provided in the income statements. Each company sold 84,800 units during the year. Cover-to-Cover Company Biblio Files Company Contribution margin ratio (percent) Unit contribution margin Break-even sales (units) Break-even sales (dollars) Cover-to-Cover Company Contribution Margin Income Statement For the Year Ended December 31, 20Y7 1 Sales $424,000.00 2 Variable costs: 3 Manufacturing expense $254,400.00 4 Selling expense 21,200.00 5 Administrative expense 63,600.00 339,200.00 6 Contribution margin $84,800.00 7 Fixed costs: 8 Manufacturing expense $5,000.00 9 Selling expense…arrow_forward

- Salespersons' Report and Analysis Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows: Salesperson Total Sales Variable Cost of Goods Sold Variable Selling Expenses Case $514,000 $246,720 $92,520 Dix 380,000 148,200 68,400 Johnson 455,000 209,300 86,450 LaFave 531,000 297,360 106,200 226,800 88,200 Orcas 630,000 219,520 89,600 Sussman 448,000 355,000 198,800 006 Willbond Required:arrow_forwardWalthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows: Salesperson Total Sales Variable Cost of Goods Sold Variable Selling Expenses Case $349,000 $115,170 $69,800 Dix 346,000 138,400 55,360 Johnson 588,000 217,560 76,440 LaFave 533,000 202,540 90,610 Orcas 557,000 245,080 72,410 Sussman 344,000 196,080 72,240 Willbond 408,000 159,120 61,200 Required: 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. Round percents to the nearest whole number. Enter all amounts as positive numbers. Waltham Industries Inc. Salespersons' Analysis For the Year Ended December 31 Salesperson…arrow_forwardSalespersons' Report and Analysis Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows: Salesperson Total Sales Variable Cost of Goods Sold Variable Selling Expenses Case $424,000 $233,200 $80,560 Dix 371,000 178,080 63,070 Johnson 469,000 262,640 75,040 LaFave 586,000 334,020 111,340 Orcas 538,000 199,060 91,460 Sussman 529,000 185,150 116,380 Willbond 569,000 216,220 91,040 Required: 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. Round percents to the nearest whole number. Enter all amounts as positive numbers. Waltham Industries Inc.Salespersons' AnalysisFor the Year Ended December 31…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License