Concept explainers

Change in inventory methods

• LO20–2

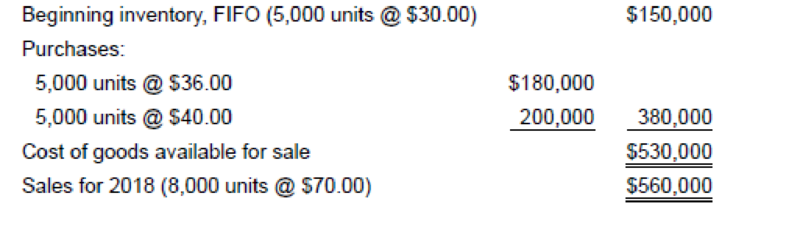

The Rockwell Corporation uses a periodic inventory system and has used the FIFO cost method since inception of the company in 1979. In 2018, the company decided to change to the average cost method. Data for 2018 are as follows:

Additional Information:

1. The company’s effective income tax rate is 40% for all years.

2. If the company had used the average cost method prior to 2018, ending inventory for 2017 would have been $130,000.

3. 7,000 units remained in inventory at the end of 2018.

Required:

1. Prepare the

2. In the 2018–2016 comparative financial statements, what will be the amounts of cost of goods sold and inventory reported for 2018?

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

INTERMEDIATE ACCOUNTING(LL)-W/CONNECT

- QUESTION 13 ABC Corporation sells just one product. At the end of fiscal year 2017, ABC applies the lower-of-cost-or market (LCM) rule and writes down the value of inventory from historical cost of $10,000 to current market value of $9,700. Which of the following will result from this write-down? O a. ABC's owners' equity decreases by $300. O b. ABC's total assets decrease by $300. O C. ABC's gross profit remains the same. O d. Both a and b are true.arrow_forwardChapter 8 Perform (ASAC LO 5 and BSAC LO 2) Kingbird Company began operations late in 2024 and adopted the conventional retail inventory method. Because there was no beginning inventory for 2024 and no markdowns during 2024, the ending inventory for 2024 was $13,708 under both the conventional retail method and the LIFO retail method. At the end of 2025, management wants to compare the results of applying the conventional and LIFO retail methods. There was no change in the price level during 2025. The following data are available for computations. Cost Inventory, January 1, 2025 Sales revenue Net markups mu Net markdowns mo Purchases Freight-in Estimated theft (b) The LIFO retail method. Ending inventory at cost Ending inventory at retail Cost $ $13,708 $ 63,900 5,888 Retail Compute the cost of the 2025 ending inventory under both: (a) The conventional retail method. $20,200 77,000 mu 9,900 mD 1,800 ex Beg Ending inventory using the conventional retail method $ 87,500 2,200 27336 40800…arrow_forward#25Gelai company had used the FIFO method of inventory valuation since it began operations in 2017. Gelai to change to theweighted average method for determining inventory costs at the beginning of 2017. The following schedule shows year endinventory balances under the FIFO and weighted average method:Year FIFO Weighted Average2017 5,400,000 6,480,0002018 9,360,000 8,520,0002019 9,960,000 9,360,000What amount, before income tax, should be reported in the 2020 statement of retained earnings as the cumulative effect of thechange in accounting policy? PLS provide solution and explanation for the answer above Philippines Accounting standardarrow_forward

- 8 Goldmeyer Company has used the FIFO method of inventory valuation since it began operations in 2021. Goldmeyer decided to change to the average cost method for determining inventory costs at the beginning of 2024. The following schedule shows year-end inventory balances under the FIFO and average cost methods: eBook 101 Hint D Print References Year 2021 2022 2023 FIFO $46,200 81,600 87,800 Required: 1. Ignoring income taxes, prepare the 2024 journal entry to adjust the accounts to reflect the average cost method. 2. How much higher or lower would cost of goods sold be in the 2023 revised income statement? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Ignoring income taxes, prepare the 2024 journal entry to adjust the accounts to reflect the average cost method. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Average Cost $ 56,400 72,200 81,600arrow_forwardA D F G H Problem #3 Robin Rotelle Corp. began operations late in 2020 and adopted the conventional retail method. Because there was no beginning inventory for 2020 and no markdowns during 2020, the ending inventory as of Dec. 31, 2020 was $525,000 using either the conventional retail or LIFO retail methods. At the end of 2021 Robin wants to compare the results of applying the conventional and LIFO retail methods. The following data is available for computations: Cost Retail Inventory Dec. 31, 2020 525,000 1,312,500 2021 Purchases 1,917,825 4,100,000 2021 Net markups 16,000 2021 Net markdowns 202,071 2021 Net Sales 3,690,000 2021 Price Index 108 Required: Compute the cost of the 2021 ending inventory under the a conventional retail method b LIFO retail method Dollar-value Lifo Retail Method (2020 is "Base-year") 11 02 D3arrow_forwardMultiple Choice Question 100 Coronado Industries had the following inventory transactions occur during 2014: Units Cost/unit 2/1/16 Purchase 55 $45 06 68 3/14/16 Purchase $45 5/1/16 Purchase $47 The company sold 150 units at $60 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars) $2114 $2240 $1404 $1568arrow_forward

- Problem 8-13 (Algo) Dollar-value LIFO [LO8-8] On January 1, 2024, a company adopted the dollar-value LIFO method. The inventory value for its one inventory pool on this date was $390,000. Inventory data for 2024 through 2026 are as follows: Date 12/31/2024 12/31/2025 12/31/2026 Date Required: Calculate the company's ending inventory for 2024, 2025, and 2026, 01/01/2024 12/31/2024 12/31/2025 Ending Inventory at Year-End Costs $ 430,500 484,500 510,450 12/31/2026 Cost Index 1.05 1.14 1.23 Inventory Layers Converted to Base Year Cost Inventory Layers at Base Year Cost Inventory at Year-End Cost Year-End Cost Index M T a W Base Base 2024 Base 2024 2025 Base 2024 2025 2026 Inventory Layers Converted to Cost Year-End Cost Index Inventory Layers at Base Year Cost - M " . Inventory Layers Converted to Cost Inventory DVL Cost $ $ $ $ 0 0 0 0arrow_forwardQuestion 54 On December 31, 2021 Dean Company changed its method of accounting for inventory from weighted average cost method to the FIFO method. This change caused the 2021 beginning inventory to increase by $960,000. The cumulative effect of this accounting change to be reported for the year ended 12/31/21, assuming a 20% tax rate, is $192,000. $960,000. $0. $768,000.arrow_forwardPROBLEM 10 The inventory of Juan Company on December 31, 2020, consists of the following items: Inventory No. Quantity Cost per Unit NRV A1001* 1,000 4,100 P56 P6 A1005 61 59 A1010 500 98 85 A1014 1,200 15 16 A1021 37 3,250 750 35 A1022 20 26 A1030 1,350 39 35 *Inventory A1001 is slow-moving and was acquired four years ago. It will be sold as scrap with a realizable value of P6.00 Requirement: 1. Determine the valuation of the inventory as of December 31, 2020.arrow_forward

- Exercise 8-27 (Static) Dollar-value LIFO [LO8-8] Mercury Company has only one inventory pool. On December 31, 2024, Mercury adopted the dollar-value LIFO inventory method. The inventory on that date using the dollar-value LIFO method was $200,000. Inventory data are as follows: Year 2025 2026 2027 Ending Inventory at Year- Ending Inventory at Base End Costs Date 12/31/2024 12/31/2025 Required: Compute the inventory at December 31, 2025, 2026, and 2027, using the dollar-value LIFO method. Note: Round "Year end cost index" to 2 decimal places. 12/31/2026 $ 231,000 299,000 300,000 12/31/2027 Year Costs Inventory at Year- End Cost $ 220,000 260,000 250,000 Inventory Layers Converted to Base Year Cost Year-End Cost Index = = Ending Inventory at Base Year Cost Base Base 2025 Base 2025 2026 Base 2025 2026 2027 Inventory Layers Converted to Cost Ending Inventory at Base Year Cost Year-End Cost Index Inventory Layers Converted to Cost Inventory DVL Cost $ $ $ S 0 0 0 0arrow_forwardExercise 8-26 (Algo) Dollar-value LIFO [LO8-8] On January 1, 2024, a Company adopted the dollar-value LIFO method for its one inventory pool. The pool's value on this date was $670,000. The 2024 and 2025 ending inventory valued at year-end costs were $714,000 and $795,000, respectively. The appropriate cost indexes are 1.05 for 2024 and 1.06 for 2025. Required: Complete the below table to calculate the inventory value at the end of 2024 and 2025 using the dollar-value LIFO method. Note: Round "Year end cost index" to 2 decimal places. Round other final answer values to the nearest whole dollars. Date 01/01/2024 12/31/2024 12/31/2025 Inventory Layers Converted to Base Year Cost Inventory at Year-End Cost Year-End Cost Index = = = Inventory Layers at Base Year Cost Base Base 2024 Base 2024 2025 Inventory Layers Converted to Cost Inventory Layers at Base Year Cost Year-End Cost Index = = = = = Inventory Layers Converted to Cost Inventory DVL Cost S S S 0 0 0arrow_forwardLIFO Liquidation Profit Hammond Company adopted LIFO when it was formed on January 1, 2017. Since then, the company has had the following purchases and sales of its single inventory item: In December 2020, the controller realized that because of an unexpected increase in demand, the company had sold 22,000 units but had purchased only 19,000 units during the year. In 2020, each unit had been sold for 19, and each unit purchased had cost 10. The income tax rate is 21%. Required: 1. Next Level If Hammond makes no additional purchases in 2020, how much LIFO liquidation profit will it report? 2. Prepare the appropriate annual report disclosures for 2020. 3. Next Level if Hammond purchases an additional 7,000 units in December 2020, how much income tax will the company save? 4. Next Level If Hammond purchases the additional 7,000 units, how much income tax has the company saved over the 4-year period by using LIFO instead of the FIFO cost flow assumption?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning