Concept explainers

Change in principle; change in inventory cost method

• LO20–2

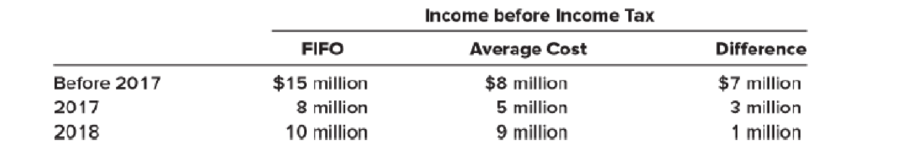

Millington Materials is a leading supplier of building equipment, building products, materials and timber for sale, with over 200 branches across the Mid-South. On January 1, 2018, management decided to change from the average inventory costing method to the FIFO inventory costing method at each of its outlets. The following table presents information concerning the change. The income tax rate for all years is 40%.

Required:

1. Prepare the

2. Determine the net income to be reported in the 2018–2017 comparative income statements.

3. Which other 2017 amounts would be reported differently in the 2018–2017 comparative income statements and 2018–2017 comparative

4. How would the change be reflected in the 2018–2017 comparative statements of shareholders’ equity? Cash dividends were $1 million each year. Assume no dividends were paid prior to 2017.

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

INTERMEDIATE ACCOUNTING(LL)-W/CONNECT

- Exercise 20-2 (Algo) Change in principle; change in inventory methods [LO20-2] Aquatic Equipment Corporation decided to switch from the LIFO method of costing inventories to the FIFO method at the beginning o 2021. The inventory as reported at the end of 2020 using LIFO would have been $55,000 higher using FIFO. Retained earnings at the end of 2020 was reported as $730,000 (reflecting the LIFO method). The tax rate is 40%. Required: 1. Calculate the balance in retained earnings at the time of the change (beginning of 2021) as it would have been reported if FIFO had been used in prior years. 2. Prepare the journal entry at the beginning of 2021 to record the change in accounting principle. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the balance in retained earnings at the time of the change (beginning of 2021) as it would have been reported if FIFO had been used in prior years. Balance in retained earningsarrow_forwardd t nces SLR Corporation has 500 units of each of its two products in its year-end inventory. Per unit data for each of the products are as follows: Cost Replacement cost Selling price Selling costs Normal profit Product 1 $ 53 51 73 Required 1 Determine the carrying value of SLR's inventory assuming that the lower of cost or market (LCM) rule is applied to individual products. What is the before-tax income effect of the LCM adjustment? Complete this question by entering your answers in the tabs below. Product Cost 9 13 Required 2 Product 2 $ 37 29 39 7 11 Determine the carrying value of SLR's inventory assuming that the lower of cost or market (LCM) rule is applied to individual products. Market Per Unit Inventory Value Unit Cost Lower of Cost or Marketarrow_forward64 The portion of the functional income statements of Brief Company for 2021 and 2020 are presented below: 2021 2020 Sales P890,000 P800,000 Cost of goods sold 530,000 450,000 Gross margin 360,000 350,000 Assuming that effective January of 2021 the unit cost is higher by 6 percent, calculate the change in sales due to change in volume rounded to nearest thousands. Group of answer choices P85,000 Favorable P88,000 Favorable P85,000 Unfavorable P88,000 Unfavorablearrow_forward

- Question 5 In 2019, SixthZ had 75 treehouses in its ending inventory. Variable product costs per treehouse were $450, and fixed manufacturing overhead costs were applied at $75 per treehouse (which was the same as last year). The company's net operating income was $1.250 higher under absorption costing than it was under variable costing. What was the number of units of product in beginning inventory? 72 treehouses O92 treehouses O 58 treehouses 00 treehousesarrow_forwardQUESTION 1 a. Kpogo Ltd has the following products in inventory at the end of 2019: Units Cost per unit GH¢ XYZ (completed) 540 22 ABC (part complete) 280 26 Each product normally sells at GH¢34 per unit. Due to the difficult trading conditions, Kpogo Ltd intends to offer a discount of 15% per unit and expects to incur GH¢4 per unit in selling costs. GH¢10 per unit is expected to be incurred to complete each unit of ABC. Required: In accordance with IAS 2 Inventories, at what amount should inventory be stated in the financial statements of Kpogo Ltd as at 31 December 2019? b. According to IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors, an entity must select and apply its accounting policies consistently from one period to the next and among various items in the financial statements. However, an entity may change its accounting policies under certain conditions. Required: Identify the circumstances under which it may be appropriate to change accounting policy in…arrow_forward1. What is the company’s gross profit rate beginning January 1, 2021?* 17% 20% 21% 24% None of the choices 2. How much is the inventory fire loss?* 146,920 183,640 189,400 254,000 None of the choicesarrow_forward

- A EXAMPLE 20.18 The following information relating to the third and last quarter of 2019-20 is furnished by a compan which manufactures and sells a single product: Third Quarter Last Quarter (Actual) 76,24,000 (Estimate) 76,60,000 Sales Inventory of raw material and finished goods: Орening Balance Closing Balance Closing Balance Raw material A (kg) Raw materialB (kg) Finished goods (units) 25,000 23,500 25,000 15,000 12,650 13,400 670 700 1,000 Unit cost data: Raw material A: 10 kg @ 33 = 730 5 kg @ 2 = 10 %3D Raw material B: %3D Direct labour (Machine time 5 hrs @ 4): Machine shop = 20 Assembly 2 hrs. @ 75 (labour time) = 710 Production overheads: %3D Machine shop @ 12 per machine hr. Assembly @10 per labour hr. Selling and Administration O.H. : 20% of production cost Profit margin : 10% on selling price Production and sales occur evenly during the budget period. You are required to prepare for the las quarter of the year. (a) Production budget (in units) (b) Purchase budget (quantity…arrow_forwardMeasuring profitability based on different inventory and amortization methods 1. Net income: Zastre Associates, $116,000 12000 27000 DP10-1 Suppose you are considering investing in two businesses, Zastre Associates and Chen Co. The two companies are virtually identical, and both began operations at the beginning of 2020. During the year, each company purchased inventory as follows: Jan. 10 Mar. 11 Jul. 9 Oct. 12 Totals 12,000 units at $7 = $ 84,000 5,000 units at $9 45,000 10,000 units at $10 100,000 12,000 units at $11 132,000 $361,000 39,000 = - During 2020, both companies sold 30,000 units of inventory. In early January 2020, both companies purchased equipment costing $400,000 that had a five-year estimated useful life and a $40,000 residual value. Zastre Associates uses the first- in, first-out (FIFO) method for its inventory and straight-line amortization for its equipment. Chen Co. uses the weighted-average method for inventory and DDB amortization. Both companies' trial balances…arrow_forwardA21-20 Retrospective Policy Change (LO 21-3, 21-4, 21-6) Armstrong Ltd. has used the average cost (AC) method to determine inventory values since the company was first formed in 20X3. In 20X7, the company decided to switch to the FIFO method, to conform to industry practice. Armstrong will still use average cost for tax purposes. The tax rate is 40%. The following data have been assembled: Net income, as reported, after tax Closing inventory, AC 20x3 $82,000* 20X4 $98,800* 20X5 51,600 68,400 Closing inventory, FIFO Dividends 60,200 7,600 86,600 10,600 $327,600* 84,800 78,200 10,600 20X6 $385,600* 137,800 127,200 14,600 20X7 $182,800** 169,200 189,800 20,600 *Using the old policy, average cost **Using the new policy, FIFO. *Using the old policy, average cost **Using the new policy, FIFO. Required: Prepare the comparative retained earnings section of the statement of changes in shareholders' equity for 20X7, reflecting the change in accounting policy. ARMSTRONG LIMITED Comparative…arrow_forward

- QUESTION 13 ABC Corporation sells just one product. At the end of fiscal year 2017, ABC applies the lower-of-cost-or market (LCM) rule and writes down the value of inventory from historical cost of $10,000 to current market value of $9,700. Which of the following will result from this write-down? O a. ABC's owners' equity decreases by $300. O b. ABC's total assets decrease by $300. O C. ABC's gross profit remains the same. O d. Both a and b are true.arrow_forwardA D F G H Problem #3 Robin Rotelle Corp. began operations late in 2020 and adopted the conventional retail method. Because there was no beginning inventory for 2020 and no markdowns during 2020, the ending inventory as of Dec. 31, 2020 was $525,000 using either the conventional retail or LIFO retail methods. At the end of 2021 Robin wants to compare the results of applying the conventional and LIFO retail methods. The following data is available for computations: Cost Retail Inventory Dec. 31, 2020 525,000 1,312,500 2021 Purchases 1,917,825 4,100,000 2021 Net markups 16,000 2021 Net markdowns 202,071 2021 Net Sales 3,690,000 2021 Price Index 108 Required: Compute the cost of the 2021 ending inventory under the a conventional retail method b LIFO retail method Dollar-value Lifo Retail Method (2020 is "Base-year") 11 02 D3arrow_forwardKnowledge Check 01 Saunderstown Company reported the following pretax data for its first year of operations. Net sales Cost of goods available for sale Operating expenses Effective tax rate Ending inventories: If LIFO is elected If FIFO is elected Gross profit ratio $ 2,950 $ 2,480 $700 % 30% What is Saunderstown's gross profit ratio if it elects LIFO? Note: Round your answer to the nearest whole percentage. $ 990 $ 1,250arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning