To determine: What AIG assumed about the probabilities of defaults by different home-owners in the U.S market and if they were wrong and right.

Concept introduction

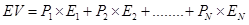

Expected Value: It is defined as the weighted average of probable events where the weights of each probable value corresponds to the chances of that value occurring. The formula to calculate the expected value is:

Where,

is expected value.

is expected value.  is probability of event 1.

is probability of event 1.  is probability of event 2.

is probability of event 2.  is probability of event N.

is probability of event N. is event 1.

is event 1.  is event 2.

is event 2.  is event N.

is event N.

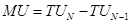

Expected Utility: It is defined as the value of a person’s total utility, so that there is no certainty for future results.

or

or

Where,

is marginal utility.

is marginal utility.  is total utility.

is total utility. - X is any quantity of goods.

is the number of goods.

is the number of goods.

Risk Averse: When a person does not like risk then he is referred to as risk averse. In case of risk averse, the marginal utility is diminishing in nature which means that for every additional unit of good, marginal utility declines.

Want to see the full answer?

Check out a sample textbook solution

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education