Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

4th Edition

ISBN: 9780134083278

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 3P

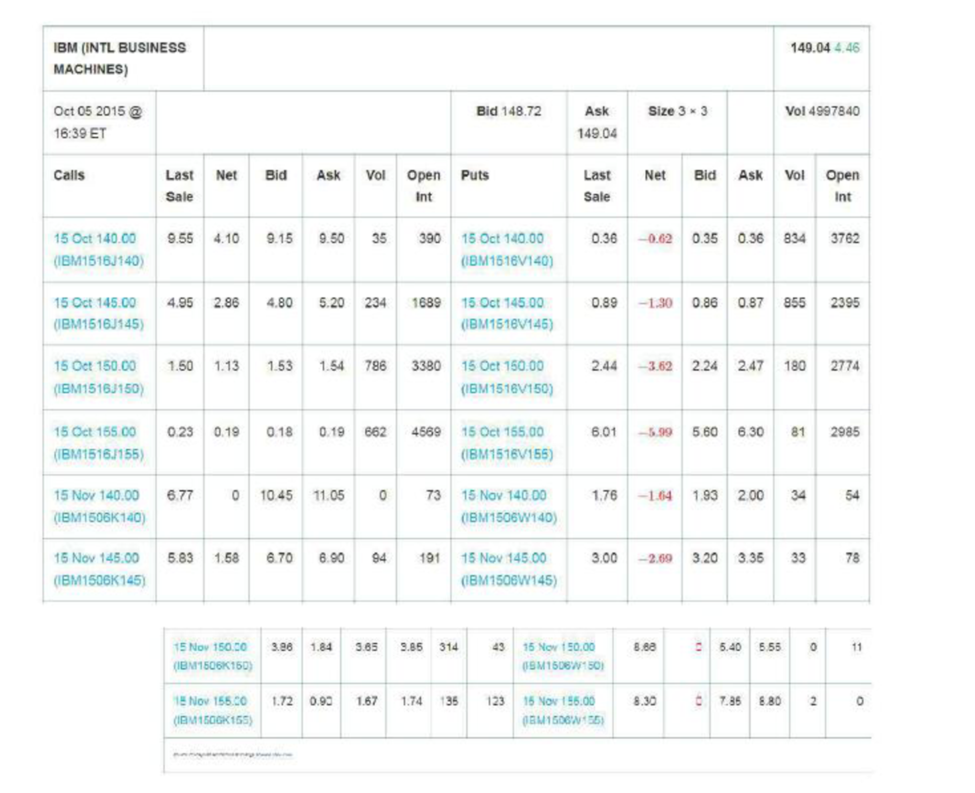

Below is an option quote on IBM from the CBOE Web site showing options expiring in October and November 2015.

- a. Which option contract had the most trades on that day?

- b. Which option contract is being held the most overall?

- c. Suppose you purchase one option with symbol IBM 1516J150. How much will you need to pay your broker for the option (ignoring commissions)?

- d. Explain why the last sale price is not always between the bid and ask prices.

- e. Suppose you sell one option with symbol IBM1516V 150. How much will you receive for the option (ignoring commissions)?

- f. The calls with which strike prices are currently in-the-money? Which puts are in-the money?

- g. What is the difference between the option with symboiiBM1 516J140 and the option with symbol IBM1506K140?

- h. On what date does the option with symbol IBM1516V140 expire? In what range must IBM’s stock price be at expiration for this option to be valuable?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The database is mentioned in the attachment:Ques) Draw a profit diagram for an investor in a call option with an exercise price of 64 that expires in March and explain the diagram. Undertake the same analysis for the writer of the call. Comment on the contention that options are a zero sum game for the writer and investor in options.

The following table shows the options quotation in U.S. dollars for Big Walnut Nut Company for June 30 of this year.

Option

Closing Price

Strike Price

Calls–Last Quote September

Puts–Last Quote September

1

$43.00

$47.00

$2.00

$2.20

2

$43.00

$41.00

$3.00

$1.20

3

$43.00

$49.00

$1.60

$2.60

If you could exercise the options listed only on the expiration date (the third Friday of September), then these options would be ____ options.

Assuming that the options listed are American options, on June 30, which of the call options for Big Walnut Nut Company listed in the table is in-the-money?

Option 2

Option 1

Option 3

A trader buys a six-month European call option and sells a six-month European put option. The options have the same underlying asset and the same strike price K. Can you identify a forward contract that has the same payoff as the trader’s combined options position? Under what circumstances does the price of the call equal the price of the put? (HINT: In answering these questions you may find it helpful to draw charts of the payoffs or profits of the two positions.)

Chapter 20 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Ch. 20.1 - What is the difference between an American option...Ch. 20.1 - Does the holder of an option have to exercise it?Ch. 20.1 - Prob. 3CCCh. 20.2 - What is a straddle?Ch. 20.2 - Explain how you can use put options to create...Ch. 20.3 - Explain put-call parity.Ch. 20.3 - If a put option trades at a higher price from the...Ch. 20.4 - What is the intrinsic value of an option?Ch. 20.4 - Can a European option with a later exercise date...Ch. 20.4 - How does the volatility of a stock affect the...

Ch. 20.5 - Is it ever optimal to exercise an American call on...Ch. 20.5 - When might it be optimal to exercise an American...Ch. 20.5 - Prob. 3CCCh. 20.6 - Explain how equity can be viewed as a call option...Ch. 20.6 - Explain how debt can be viewed as an option...Ch. 20 - Explain the meanings of the following financial...Ch. 20 - What is the difference between a European option...Ch. 20 - Below is an option quote on IBM from the CBOE Web...Ch. 20 - Prob. 4PCh. 20 - Prob. 5PCh. 20 - You own a call option on Intuit stock with a...Ch. 20 - Assume that you have shorted the call option in...Ch. 20 - You own a put option on Ford stock with a strike...Ch. 20 - Assume that you have shorted the put option in...Ch. 20 - What position has more downside exposure: a short...Ch. 20 - Consider the October 2015 IBM call and put options...Ch. 20 - You are long both a call and a put on the same...Ch. 20 - You are long two calls on the same share of stock...Ch. 20 - A forward contract is a contract to purchase an...Ch. 20 - You own a share of Costco stock. You are worried...Ch. 20 - Dynamic Energy Systems stock is currently trading...Ch. 20 - You happen to be checking the newspaper and notice...Ch. 20 - In mid-February 2016, European-style options on...Ch. 20 - Suppose Amazon stock is trading for 500 per share,...Ch. 20 - Consider the data for IBM options in Problem 3....Ch. 20 - You are watching the option quotes for your...Ch. 20 - Explain why an American call option on a...Ch. 20 - Consider an American put option on XAL stock with...Ch. 20 - The stock of Harford Inc. is about to pay a 0.30...Ch. 20 - Suppose the SP 500 is at 900, and a one-year...Ch. 20 - Suppose the SP 500 is at 900, and it will pay a...Ch. 20 - Prob. 29PCh. 20 - Suppose that in July 2009, Google were to issue 96...

Additional Business Textbook Solutions

Find more solutions based on key concepts

The cost of capital. Introduction: The cost of capital is the opportunity cost involved in making a specific in...

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

(Future value) Giancarlo Stanton hit 59 home runs in 2017. If his home-run output grew at a rate of 12 percent ...

Foundations Of Finance

Define investors’ expected rate of return.

Foundations of Finance (9th Edition) (Pearson Series in Finance)

The risk-neutral probabilities and price of the option. Introduction: A binomial model portrays the development...

Corporate Finance

Real options and its types. Introduction: The net present value is the variation between present cash inflows v...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

An annuity provides for 10 consecutive end-of-year payments of 72,000. The average general inflation rate is es...

Contemporary Engineering Economics (6th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Basic Option Strategies Profit Computation Assume the below prices for calls and puts: Call Call Call Put Put Put Strike Jul Aug Oct Jul Aug Oct 165 2.7 5.25 8.1 2.4 4.75 6.75 170 0.8 3.25 6 5.75 7.5 9 Buy one August 170 put contract. Hold it until expiration. Identify the breakeven stock price at expiration. What is the profit/loss if ST=190? Buy one October 165 call contract. Hold it until the options expire. Identify the breakeven stock price at expiration. What is the Maximum possible loss from the transaction? What is the profit/loss if ST=185 Buy 100 shares of stocks and buy one August 165 put contract. Hold the position until expiration. Determine the breakeven stock price at expiration, the maximum profit and the maximum loss. What is the profit/loss if ST=150. Buy 100 shares of stock and write one October 170 call contract. Hold the position until expiration. Determine the breakeven stock price at expiration, the…arrow_forwardState whether the following statements are true or false. In each case, provide a brief explanation. a. By observing the prices of call and put options on a stock, one can recover an estimate of the expected stock return. b. An investor would like to purchase a European call option on an underlying stock index with a strike price of 210 and a time to maturity of 3 months, but this option is not actively traded. However, two otherwise identical call options are traded with strike prices of 200 and 220 respectively, hence the investor can replicate a call with a strike price of 210 by holding a static position in the two traded calls. c. In a binomial world, if a stock is more likely to go up in price than to go down, an increase in volatility would increase the price of a call option and reduce the price of a put option. Note that a static position is a position that is chosen initially and not rebalanced through time.arrow_forwardBasic Option Strategies Profit Computation Assume the below prices for calls and puts: Call Put Strike Jul Aug Oct Jul Aug Oct 165 2.7 5.25 8.1 2.4 4.75 6.75 170 0.8 3.25 6 5.75 7.5 9 Buy one August 170 call contract. Hold it until expiration. Identify the breakeven stock price at expiration. What is the profit/loss if ST=190? What is the maximum profit? Buy one October 165 put contract. Hold it until the options expire. Identify the breakeven stock price at expiration. What is the Maximum possible loss from the transaction? What is the profit/loss if ST=185arrow_forward

- Basic Option Strategies Profit Computation Assume the below prices for calls and puts: Call Put Strike Jul Aug Oct Jul Aug Oct 165 2.7 5.25 8.1 2.4 4.75 6.75 170 0.8 3.25 6 5.75 7.5 9 Buy one August 170 put contract. Hold it until expiration. Identify the breakeven stock price at expiration. What is the profit/loss if ST=190? Buy one October 165 call contract. Hold it until the options expire. Identify the breakeven stock price at expiration. What is the Maximum possible loss from the transaction? What is the profit/loss if ST=185 Buy 100 shares of stocks and buy one August 165 put contract. Hold the position until expiration. Determine the breakeven stock price at expiration, the maximum profit and the maximum loss. What is the profit/loss if ST=150. Buy 100 shares of stock and write one October 170 call contract. Hold the position until expiration. Determine the breakeven stock price at expiration, the maximum profit…arrow_forwardBasic Option Strategies Profit Computation Assume the below prices for calls and puts: Call Put Strike Jul Aug Oct Jul Aug Oct 165 2.7 5.25 8.1 2.4 4.75 6.75 170 0.8 3.25 6 5.75 7.5 9 Buy one August 170 put contract. Hold it until expiration. Identify the breakeven stock price at expiration. What is the profit/loss if ST=190? Buy one October 165 call contract. Hold it until the options expire. Identify the breakeven stock price at expiration. What is the Maximum possible loss from the transaction? What is the profit/loss if ST=185 Buy 100 shares of stocks and buy one August 165 put contract. Hold the position until expiration. Determine the breakeven stock price at expiration, the maximum profit and the maximum loss. What is the profit/loss if ST=150. Buy 100 shares of stock and write one October 170 call contract. Hold the position until expiration. Determine the breakeven stock price at expiration, the maximum profit…arrow_forwardUse the option quote information shown here to answer the questions that follow. The stock is currently selling for $80. Option Expiration Strike Price Calls Puts Volume Last Volume Last RWJ March 72 250 5.20 180 5.30 April 72 190 11.05 147 10.05 July 72 159 11.90 63 13.85 October 72 80 12.80 31 12.45 a-1. Are the call options in or out of the money? multiple choice 1 In the money Out of the money a-2. What is the intrinsic value of an RWJ Corporation call option? b-1. Are the put options in or out of the money? multiple choice 2 In the money Out of the money b-2. What is the intrinsic value of an RWJ Corporation put option? c-1. Two of the options are clearly mispriced. Which ones? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to…arrow_forward

- You buy a put option on IBM common stock. The option has an exercise price of $136 and IBM’s stock currently trades at $140. The option premium is $5 per contract.a. What is your net profit on the option if IBM’s stock price increases to $150 at expiration of the option and you exercise the option? b. How much of the option premium is due to intrinsic value versus time value?c. What is your net profit if IBM’s stock price decreases to $130?d. Draw the payout diagram at maturity on a short put option position, option premium = $2, and the same exercise price... (Please give the full solution I will upvote)arrow_forwardAssume the below prices for calls and puts: Call Put Strike Jul Aug Oct Jul Aug Oct 165 2.7 5.25 8.1 2.4 4.75 6.75 170 0.8 3.25 6 5.75 7.5 9 Buy one August 170 put contract. Hold it until expiration. Identify the breakeven stock price at expiration. What is the profit/loss if ST=190? Buy one October 165 call contract. Hold it until the options expire. Identify the breakeven stock price at expiration. What is the Maximum possible loss from the transaction? What is the profit/loss if ST=185 Buy 100 shares of stocks and buy one August 165 put contract. Hold the position until expiration. Determine the breakeven stock price at expiration, the maximum profit and the maximum loss. What is the profit/loss if ST=150. Buy 100 shares of stock and write one October 170 call contract. Hold the position until expiration. Determine the breakeven stock price at expiration, the maximum profit and the maximum loss. What is the profit/loss…arrow_forwardHere is some price information on Fincorp stock. Suppose that Fincorp trades in a dealer market. Bid Ask 46.54 46.89 a. Suppose you have submitted an order to your broker to buy at market. At what price will your trade be executed? (Round your answer to 2 decimal places.) b. Suppose you have submitted an order to sell at market. At what price will your trade be executed? (Round your answer to 2 decimal places.) c. Suppose you have submitted a limit order to sell at $47.15. What will happen? The trade will not be executed The trade will be executed d. Suppose you have submitted a limit order to buy at $46.76. What will happen? The trade will not be executed The trade will be executedarrow_forward

- You own a call option on Intuit stock with a strike price of $40. The option will expire in exactly three months’ time. If the stock is trading at $55 in three months, what will be the payoff of the call? Note: practice drawing the payoff diagram. Assume that you have shorted the call option in Question 2. If the stock is trading at $55 in three months, what will you owe? Note: practice drawing the payoff diagram. (ONLY ANSWER THIS QUESTION)arrow_forwardSuppose that you sell for 8 dollars a call option with a strike price of 45 dollars, and you sell for 13 dollars each two put options with a strike price of 55 dollars. What is the minimum stock price at the exercise date that will result in you breaking even? Don't use Excel and chatgptarrow_forwardYou have taken a long position in a call option on IBM common stock. The option has an exercise price of $176 and IBM’s stock currently trades at $180. The option premium is $5 per contract. How much of the option premium is due to intrinsic value versus time value?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Accounting for Derivatives Comprehensive Guide; Author: WallStreetMojo;https://www.youtube.com/watch?v=9D-0LoM4dy4;License: Standard YouTube License, CC-BY

Option Trading Basics-Simplest Explanation; Author: Sky View Trading;https://www.youtube.com/watch?v=joJ8mbwuYW8;License: Standard YouTube License, CC-BY