The distinctions between the effects of sterilized and unsterilized interventions on foreign exchange markets using graphs and T-accounts.

Explanation of Solution

| Sterilized intervention | Unsterilized intervention |

| This form of intervention has no impact on the short-term interest rate, it is, therefore, sterilized.

It is signified as independent of the |

This form of intervention has an impact on the short-term interest rate, it is, therefore, unsterilized.

It is characterized by influencing interest rates in the money market and also by signaling that an upward/downward trend may ensure which affects expectations of the future exchange rate. |

| Pure foreign-exchange-policy | A mix of monetary-policy and foreign-exchange-policy operation. |

| Central Bank takes active balance-sheet measures to sterilize the intervention | No follow-up required by Central Bank |

| Example − Central Bank purchasing domestic currency by selling foreign assets, which would affect the availability of foreign exchange. | Example − Central Bank deliberately changes the interest rate in the country as a part of its |

Explanation for Sterilized intervention: In this case, the sterilized intervention does not affect either the monetary base, and no effect on interest rates is seen, nor the demand and supply of foreign exchange. It is largely based on expectations and other influences on market. Thus, no graph is used.

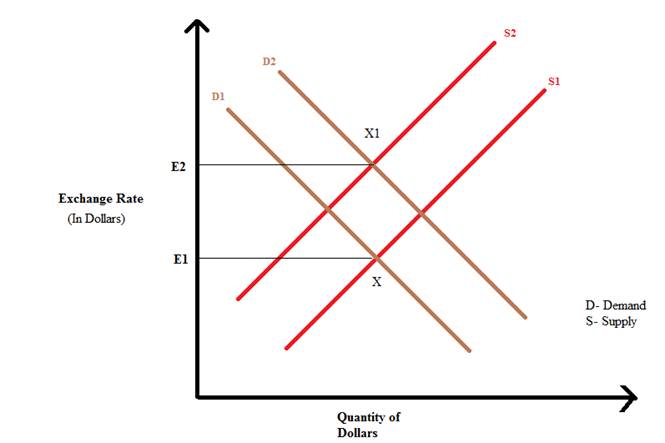

Explanation for Graph of Unsterilized intervention: In this case, the exchange rate X goes up to X1 as soon as the interest rates in the US market increases. We may also say that because of this higher interest rate, the supply of US dollars reduces (foreign investor who would not be willing to pay this level of interest will withdraw their investments, new investor will also not be attracted), which also brings about an increase in the price of the exchange rate of dollars.

Introduction:

A central bank holds large reserves of foreign currency. It has the capability of intervention by way of purchasing or selling of foreign exchange in the markets to influence the foreign currency prices. Both sterilized and unsterilized interventions have an effect on the foreign exchange market.

Want to see more full solutions like this?

Chapter 21 Solutions

Economics of Money, Banking and Financial Markets, Business School Edition - Revel

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education