Concept explainers

Statement of

• LO21–3, LO21–8

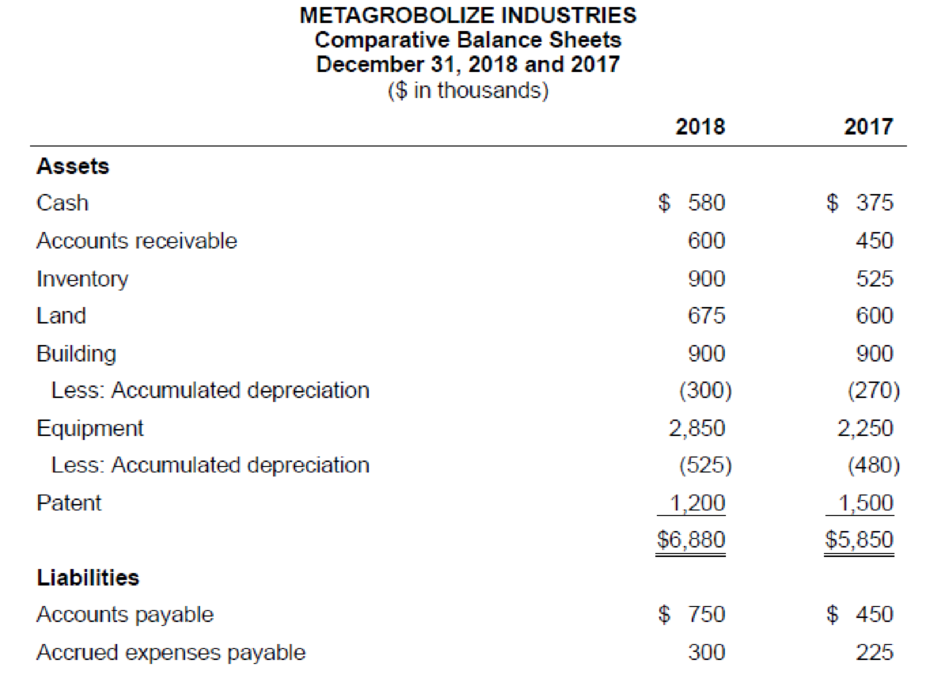

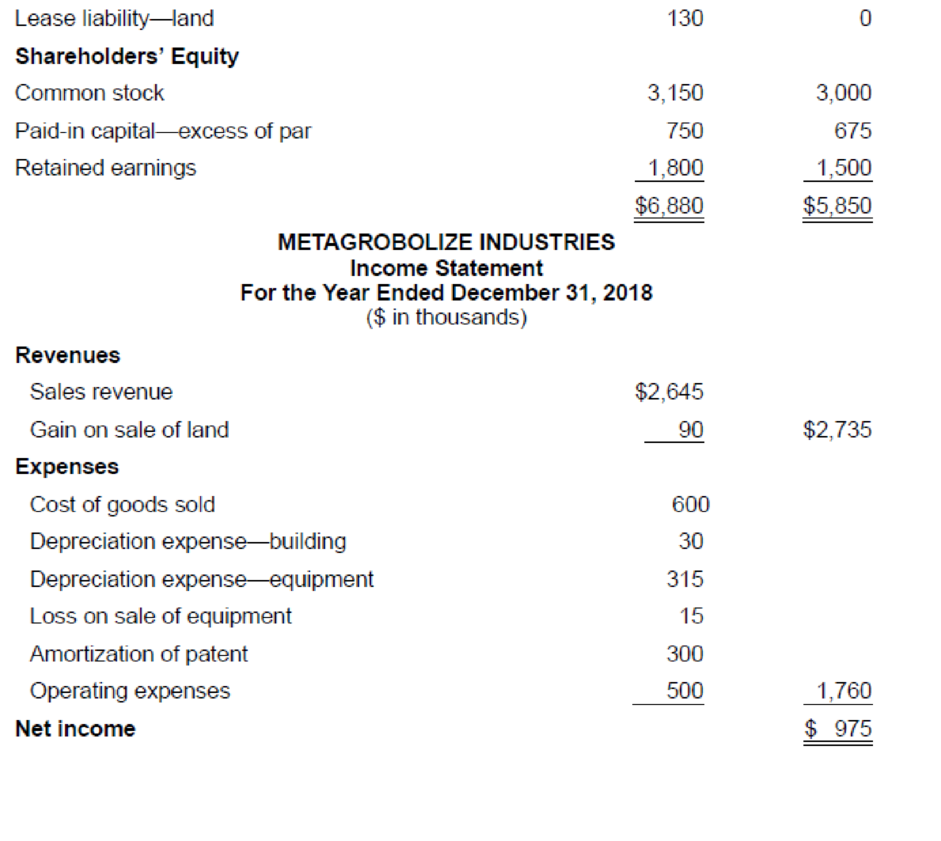

Comparative balance sheets for 2018 and 2017 and a statement of income for 2018 are given below for Metagrobolize Industries. Additional information from the accounting records of Metagrobolize also is provided.

Additional information from the accounting records:

a. Annual payments of $20,000 on the finance lease liability are paid each January 1, beginning in 2018.

b. During 2018, equipment with a cost of $300,000 (90%

c. The statement of shareholders’ equity reveals reductions of $225,000 and $450,000 for stock dividends and cash dividends, respectively.

Required:

Prepare the statement of cash flows of Metagrobolize for the year ended December 31, 2018. Present cash flows from operating activities by the direct method. (You may omit the schedule to reconcile net income to cash flows from operating activities.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 21 Solutions

INTERMEDIATE ACCOUNTING(LL)-W/2 ACCESS

- Ratio Analysis Consider the following information taken from Chicago Water Slides (CWSs) financial statements: Also, CWSs operating cash flows were $25,658 and $29,748 in 2019 and 2018, respectively. Note: Round all answers to two decimal places. Required: 1. Calculate the current ratios for 2019 and 2018. 2. Calculate the quick ratios for 2019 and 2018. 3. Calculate the cash ratios for 2019 and 2018. 4. Calculate the operating cash flow ratios for 2019 and 2018. 5. CONCEPTUAL CONNECTION Provide some reasons why CWSs liquidity may be considered to be improving and some reasons why it may be worsening.arrow_forwardProblem 21-4 (Static) Statement of cash flows; direct method [LO21-3, 21-8] The comparative balance sheets for 2024 and 2023 and the statement of income for 2024 are given below for Dux Company. Additional information from Dux's accounting records is provided also.arrow_forwardProblem 21-16 (Algo) Statement of cash flows; indirect method [LO21-4, 21-8] The comparative balance sheets for 2021 and 2020 and the statement of income for 2021 are given below for Dux Company. Additional information from Dux’s accounting records is provided also. DUX COMPANYComparative Balance SheetsDecember 31, 2021 and 2020($ in thousands) 2021 2020 Assets Cash $ 117.0 $ 34.0 Accounts receivable 62.0 64.0 Less: Allowance for uncollectible accounts (3.0 ) (2.0 ) Dividends receivable 17.0 16.0 Inventory 69.0 64.0 Long-term investment 29.0 24.0 Land 84.0 40.0 Buildings and equipment 169.0 264.0 Less: Accumulated depreciation (7.0 ) (120.0 ) $ 537.0 $ 384.0 Liabilities Accounts payable $ 27.0 $ 34.0 Salaries payable 16.0 19.0 Interest payable 18.0 16.0 Income tax payable…arrow_forward

- REQUIREDUse the information provided below to prepare the Cash Flow Statement for the year ended 30 June 2020.INFORMATIONThe information given below was extracted from the books of Siyakha Limited for the financial year ended30 June 2020.1. STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE:2020R2019RASSETSProperty, plant and equipment (See note to the financial statements below.) 14 826 000 13 998 000Inventory 1 539 000 1 638 000Accounts receivable 6 243 000 4 572 000Bank 861 000 480 00023 469 000 20 688 000EQUITY AND LIABILITIESOrdinary Share Capital 9 300 000 8 220 000Retained Income 2 031 000 1 701 000Loan: OVS Bank 8 100 000 5 940 000Accounts payable 3 795 000 3 549 000Company tax payable 150 000 564 000Dividends payable 93 000 714 00023 469 000 20 688 0002. STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 JUNE 2020RDepreciation on Vehicles 1 233 000Depreciation on Equipment 1 083 000Operating profit 3 801 000Interest on Loan 1 404 000Profit before tax 2 397 000Profit after tax…arrow_forward6zOshLaGsSzvcHy9vKm0jUnAg/formResponse?pli=1 * Required Consider the following selected financial information for Aishti company. Aishti Company Income Statement For the Year Ended December 31, 2020 Aishti Company Balance Sheet For the Year Ended December 31, 2019 & 2020 2020 2019 Assets Cash Accounts Receivable Inventories $2,415 $5,040 Revenues $94.300 $5,355 $6,195 $10,290 $10,080 Less: Depreciation expense $6.825 Plant & Equipment Less: Acc. Depreciation Total Assets $22,575 ($15,960) ($9,135) S35,070 $32,970 Less: Other operating expenses 74,560 $34,755 Less: Interest Expense 3,990 Liabilities & O/E Accounts Payable Income Tax Payable Long-Term Debt Common Stock Retained Earmings Total Liabilities and 0/E $3,885 $1,260 $9,555 $11,550 $8.820 $35,070 S5,775 $2,940 $8,715 $14,175 $3,150 $34,755 Income before income taxes $9,135 Income tax expense $3.197 Net income $5,938 1. Using the indirect method of cash flow statement, what is the net dasharrow_forwardProblem 21-4 (Algo) Statement of cash flows; direct method [LO21-3, 21-8] The comparative balance sheets for 2021 and 2020 and the statement of income for 2021 are given below for Dux Company. Additional information from Dux's accounting records is provided also. DUX COMPANYComparative Balance SheetsDecember 31, 2021 and 2020($ in thousands) 2021 2020 Assets Cash $ 72 $ 27 Accounts receivable 41 56 Less: Allowance for uncollectible accounts (3 ) (2 ) Dividends receivable 6 5 Inventory 95 90 Long-term investment 27 24 Land 95 75 Buildings and equipment 194 220 Less: Accumulated depreciation (34 ) (60 ) $ 493 $ 435 Liabilities Accounts payable $ 76 $ 83 Salaries payable 7 10 Interest payable 10 5 Income tax payable 5 7 Notes payable 20 0 Bonds…arrow_forward

- How much net cash did the entity receive (give) with regards to the premium transactions for the yeargiven below? (if net cash outflow, put a negative (-) sign before the numerical figure.A. December 31, 2020B. December 31, 2021arrow_forwardREQUIRED Study the statement of cash flows of Mantis Limited for the year ended 31 December 2021 and answer the following questions: Comment on the following: 1.3.1 Cash flows from operating activities (R181 800) 1.3.2. Increase in inventory (R808 000) 1.3.3 Increase in receivables (R606 000) 1.3.4 Interest paid (R80 800) 1.3.5 Cash flows from investing activities (R2 343 200) INFORMATION MANTIS LIMITED STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31 DECEMBER 2021 R Cash flows from operating activities (181 800) Operating profit 979 700 Depreciation ? Profit before working capital changes ? Working capital changes (808 000) Increase in inventory (808 000) Increase in receivables (606 000) Increase in payables 606 000 Cash generated from operations 494 900 Interest paid (80 800) Dividends paid ? Income tax paid (272 700) Cash flows from investing activities (2…arrow_forwardCalculator Cash paid to purchase long-term investments would be reported in the statement of cash flows in a. the cash flows from operating activities section. b. the cash flows from financing activities section. C. the cash flows from investing activities section. d. a separate schedule. 4:09 PM 12/20/2019arrow_forward

- REQUIRED Use the information provided below to prepare the Cash Flow Statement for the year ended 30 June 2020. INFORMATION The information given below was extracted from the books of Siyakha Limited for the financial year ended 30 June 2020. STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE: 2020 R 2019 R ASSETS Property, plant and equipment (See note to the financial statements below.) 14 826 000 13 998 000 Inventory 1 539 000 1 638 000 Accounts receivable 6 243 000 4 572 000 Bank 861 000 480 000 23 469 000 20 688 000 EQUITY AND LIABILITIES Ordinary Share Capital 9 300 000 8 220 000 Retained Income 2 031 000 1 701 000 Loan: OVS Bank 8 100 000 5 940 000 Accounts payable 3 795 000 3 549 000 Company tax payable 150 000 564 000 Dividends payable 93 000 714 000 23 469 000 20 688 000 STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR…arrow_forwardHow would you prepare a statement of Cash Flows using the following information? Maple Group Ltd Comparative Balance Sheet December 31, 2020 and 2019 2020 2019 Increase/Decrease Assets Cash and cash Equivalent $ 51,500.00 $ 45,400.00 $ 6,100.00 Accounts Receivable $ 51,100.00 $ 61,400.00 $ 10,000.00 Inventories $ 61,400.00 $ 51,900.00 $ 9,500.00 Fixed Assets, net $ 160,000.00 $ 110,000.00 $ 50,000.00 Total Assets $ 324,000.00 $ 268,700.00 $ 55,600.00 Liabilities Accounts Payable $ 35,450.00 $ 27,800.00 $ 7,650.00 Accrued liabilities $ 31,000.00 $ 37,550.00 -$ 6,550.00 Long-term notes payable $ 60,000.00 $ 78,540.00 -$ 18,540.00 Stockholders Equity: Common Stock $ 143,050.00 $ 105,110.00 $ 37,940.00 Retained Earnings $ 54,800.00 $ 19,700.00 $…arrow_forwardQUESTION 1 Given the following information Please calculate the Free Cash Flow to Equity EBIT Net Income Tax rate Depreciation Capital expenditure 2207.9 1513.5 21.80% 1807.1 954.6 Change in non-cash Working Capital -2176.3 Change in long term debt Interest Expense Liabilities Total Long Term debt Total Assets 4755 5470 3902 5628 927.6 395.3 24511.8 13220.6 26168.2arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning