Concept explainers

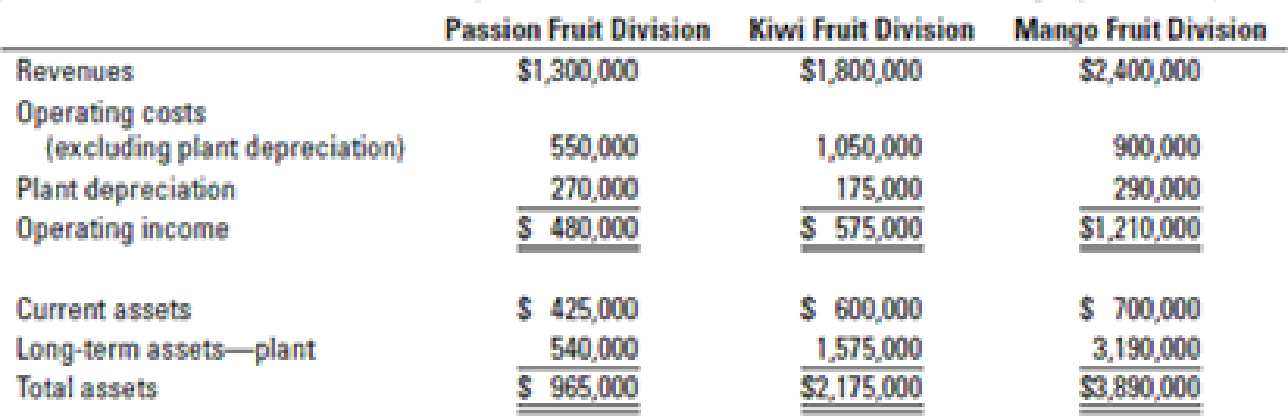

ROI performance measures based on historical cost and current cost. Nature’s Juice Corporation operates three divisions that process and bottle natural fruit juices. The historical-cost accounting system reports the following information for 2017:

Nature’s Juice estimates the useful life of each plant to be 12 years, with no terminal disposal value. The

| 2007 | 2014 | 2016 | 2017 |

| 100 | 120 | 185 | 200 |

Given the high turnover of current assets, management believes that the historical-cost and current-cost measures of current assets are approximately the same.

- 1. Compute the ROI ratio (operating income to total assets) of each division using historical-cost measures. Comment on the results.

Required

- 2. Use the approach in Figure 23-2 (page 902) to compute the ROI of each division, incorporating current-cost estimates as of 2017 for depreciation expense and long-term assets. Comment on the results.

- 3. What advantages might arise from using current-cost asset measures as compared with historical-cost measures for evaluating the performance of the managers of the three divisions?

Want to see the full answer?

Check out a sample textbook solution

Chapter 23 Solutions

COST ACCT

- Easy Removals offers a complete interstate, door-to-door solution for residential and commercial removals. As the market for removal services is very competitive, Easy Removals aims to deliver services at a low cost. Its management accountant prepared the following information - the growth, price-recovery, and productivity components that explain the change in operating income from 2020 to 2021. Growth Component Price-recovery Component Productivity Component Revenue effect $ 310,000 F $ 98,000 U - Cost effect $ 210,000 U $ 32,000 U $ 128,000 F Suppose that during 2021, the market growth rate in the industry was 10%. The number of jobs billed was 400 and 500 in 2020 and 2021, respectively. Any increase in market share more than 10%, and any change in selling price, are the result of Easy Removals’ strategic actions. Required: Compute how much of the change in operating income from 2020 to 2021 is due to the: (a) industry-market-size factor; (b)…arrow_forwardBenoit Manufacturing Company manufactures and sells parts for various musical gadgets. The following information to a single part which is used in the production of a wind instrument. The business earned Operating Income of $220,000 in 2019, when production was 3,000 units and the president of Darius is under pressure from shareholders to increase operating income in 2020 and is therefore considering theimplementation of strategies mainly geared at increasing revenues and or decreasing variable costs. Data for variable cost per unit and total fixed costs were as follows:Variable expenses per unit: Direct Material $58Direct Labour $74Variable Manufacturing Overhead $48Fixed expenses: Fixed Manufacturing Overhead $215,000Fixed Selling Costs $65,000Fixed Administrative Costs $160,000 e) The President of Benoit is under pressure from shareholders to increase operating income by 50% in 2020. Management expects per…arrow_forwardBenoit Manufacturing Company manufactures and sells parts for various musical gadgets. The following information to a single part which is used in the production of a wind instrument. The business earned Operating Income of $220,000 in 2019, when production was 3,000 units and the president of Darius is under pressure from shareholders to increase operating income in 2020 and is therefore considering theimplementation of strategies mainly geared at increasing revenues and or decreasing variable costs. Data for variable cost per unit and total fixed costs were as follows:Variable expenses per unit: Direct Material $58Direct Labour $74Variable Manufacturing Overhead $48Fixed expenses: Fixed Manufacturing Overhead $215,000Fixed Selling Costs $65,000Fixed Administrative Costs $160,000 Required:a) Compute the selling price per unit in 2019, using the equation method. b) Given the sales of 3,000 units and the…arrow_forward

- B' Manufacturing Company manufactures and sells parts for various musical gadgets. The followinginformation to a single part which is used in the production of a wind instrument. The business earned operating Income of $220,000 in 2019, when production was 3,000 units and the president of Darius is underpressure from shareholders to increase operating income in 2020 and is therefore considering the implementation of strategies mainly geared at increasing revenues and or decreasing variable costs. Data forvariable cost per unit and total fixed costs were as follows:Variable expenses per unit: Direct Material --$58Direct Labour-- $74Variable Manufacturing Overhead --$48Fixed expenses: Fixed Manufacturing Overhead --$215,000Fixed Selling Costs-- $65,000Fixed Administrative Costs -- $160,000Required:1) Compute the selling price per unit in 2019, using the equation method. 2) Given the sales of 3,000 units and the selling price calculated in (a), prepare a contribution margin income…arrow_forwardBenoit Manufacturing Company manufactures and sells parts for various musical gadgets. The following information to a single part which is used in the production of a wind instrument. The business earned Operating Income of $220,000 in 2019, when production was 3,000 units and the president of Darius is under pressure from shareholders to increase operating income in 2020 and is therefore considering the implementation of strategies mainly geared at increasing revenues and or decreasing variable costs. Data forvariable cost per unit and total fixed costs were as follows:Variable expenses per unit: Direct Material $58Direct Labour $74Variable Manufacturing Overhead $48Fixed expenses: Fixed Manufacturing Overhead $215,000Fixed Selling Costs $65,000Fixed Administrative Costs $160,000Required:d) Calculate the margin of safety in units and in sales dollars. e) The President of Benoit is under pressure from shareholders to increase operating income by 50% in 2020. Management expects per unit…arrow_forwardBenoit Manufacturing Company manufactures and sells parts for various musical gadgets. The following information to a single part which is used in the production of a wind instrument. The business earned Operating Income of $220,000 in 2019, when production was 3,000 units and the president of Darius is under pressure from shareholders to increase operating income in 2020 and is therefore considering the implementation of strategies mainly geared at increasing revenues and or decreasing variable costs. Data forvariable cost per unit and total fixed costs were as follows: Variable expenses per unit: Direct Material $58Direct Labour $74Variable Manufacturing Overhead $48Fixed expenses: Fixed Manufacturing Overhead $215,000Fixed Selling Costs $65,000Fixed Administrative Costs $160,000 Required:a) Compute the selling price per unit in 2019, using the equation method. b) Given the sales of 3,000 units and the selling price calculated in (a), prepare a contribution margin income statement…arrow_forward

- Benoit Manufacturing Company manufactures and sells parts for various musical gadgets. The following information to a single part which is used in the production of a wind instrument. The business earned Operating Income of $220,000 in 2019, when production was 3,000 units and the president of Darius is under pressure from shareholders to increase operating income in 2020 and is therefore considering the implementation of strategies mainly geared at increasing revenues and or decreasing variable costs. Data forvariable cost per unit and total fixed costs were as follows:Variable expenses per unit: Direct Material $58Direct Labour $74Variable Manufacturing Overhead $48Fixed expenses: Fixed Manufacturing Overhead $215,000Fixed Selling Costs $65,000Fixed Administrative Costs $160,000Required: g) Briefly explain the impact of each of the following scenarios on the break-even point and the margin ofsafety:(i) Increase in sales volume(ii) Increase in total fixed costs(iii) Increase in…arrow_forwardThe following data refer to Clear Panes, a division of Global Corporation. Clear Panes makes and sells residential windows that sell for $150 each. Clear Panes expects sales of 150,000 units in 2017. Clear Panes’ annual fixed costs are $2,750,000 and their variable cost is $90 per window. Global evaluates Clear Panes based on residual income. The total investment attributed to Clear Panes is $12 million and the required rate of return on investment is 16%. Ignore taxes and depreciation expense. Answer each of the following parts independently, unless otherwise stated. Q. One of Clear Panes’s regular customers asks for a special window with stained glass inserts. The customer requires 2,500 of these windows. Clear Panes estimates its variable cost for these special units at $105 each. Clear Panes will also have to undertake new investment of $300,000 to produce these windows. What is the minimum selling price that will make the deal acceptable to Clear Panes? Also suppose that the…arrow_forwardThe following data refer to Clear Panes, a division of Global Corporation. Clear Panes makes and sells residential windows that sell for $150 each. Clear Panes expects sales of 150,000 units in 2017. Clear Panes’ annual fixed costs are $2,750,000 and their variable cost is $90 per window. Global evaluates Clear Panes based on residual income. The total investment attributed to Clear Panes is $12 million and the required rate of return on investment is 16%. Ignore taxes and depreciation expense. Answer each of the following parts independently, unless otherwise stated. Q. What is the expected residual income in 2017?arrow_forward

- The following data refer to Clear Panes, a division of Global Corporation. Clear Panes makes and sells residential windows that sell for $150 each. Clear Panes expects sales of 150,000 units in 2017. Clear Panes’ annual fixed costs are $2,750,000 and their variable cost is $90 per window. Global evaluates Clear Panes based on residual income. The total investment attributed to Clear Panes is $12 million and the required rate of return on investment is 16%. Ignore taxes and depreciation expense. Answer each of the following parts independently, unless otherwise stated. Q. Clear Panes receives an external special order for 10,000 units at $120 each. If the order is accepted, Clear Panes will have to incur incremental fixed costs of $250,000 and invest an additional $450,000 in various assets. What is the effect on Clear Panes’s residual income of accepting the order?arrow_forwardThe following data refer to Clear Panes, a division of Global Corporation. Clear Panes makes and sells residential windows that sell for $150 each. Clear Panes expects sales of 150,000 units in 2017. Clear Panes’ annual fixed costs are $2,750,000 and their variable cost is $90 per window. Global evaluates Clear Panes based on residual income. The total investment attributed to Clear Panes is $12 million and the required rate of return on investment is 16%. Ignore taxes and depreciation expense. Answer each of the following parts independently, unless otherwise stated. Q. One of Clear Panes’s regular customers asks for a special window with stained glass inserts. The customer requires 2,500 of these windows. Clear Panes estimates its variable cost for these special units at $105 each. Clear Panes will also have to undertake new investment of $300,000 to produce these windows. What is the minimum selling price that will make the deal acceptable to Clear Panes? Also suppose that the…arrow_forwardThe following data refer to Clear Panes, a division of Global Corporation. Clear Panes makes and sells residential windows that sell for $150 each. Clear Panes expects sales of 150,000 units in 2017. Clear Panes’ annual fixed costs are $2,750,000 and their variable cost is $90 per window. Global evaluates Clear Panes based on residual income. The total investment attributed to Clear Panes is $12 million and the required rate of return on investment is 16%. Ignore taxes and depreciation expense. Answer each of the following parts independently, unless otherwise stated. Q. One of Clear Panes’s regular customers asks for a special window with stained glass inserts. The customer requires 2,500 of these windows. Clear Panes estimates its variable cost for these special units at $105 each. Clear Panes will also have to undertake new investment of $300,000 to produce these windows. What is the minimum selling price that will make the deal acceptable to Clear Panes?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education