COST ACCOUNTING TTU >IC<

17th Edition

ISBN: 9781323409046

Author: Horngren

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 23, Problem 23.35P

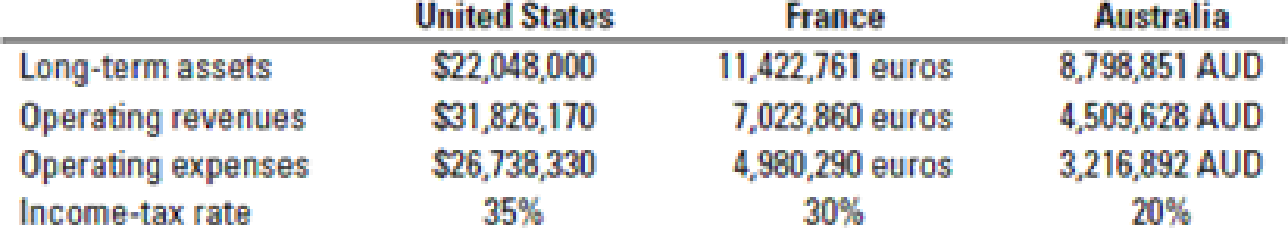

Multinational firms, differing risk, comparison of profit, ROI, and RI. Newmann, Inc. has divisions in the United States, France, and Australia. The U.S. division is the oldest and most established of the three and has a cost of capital of 6%. The French division was started four years ago when the exchange rate for the Euro was 1 Euro = $1.34 USD. The French division has a cost of capital of 8%. The division in Australia was started this year, when the exchange rate was 1 Australian Dollar (AUD) = $.087 USD. Its cost of capital is 11%. Average exchange rates for the current year are 1 euro = $1.07 and 1 AUD = $0.74 USD. Other information for the three divisions includes:

- 1. Translate the French and Australian information into dollars to make the divisions comparable. Find the after-tax operating income for each division and compare the profits.

Required

- 2. Calculate ROI using after-tax operating income. Compare among divisions.

- 3. Use after-tax operating income and the individual cost of capital of each division to calculate residual income and compare.

- 4. Redo requirement 2 using pretax operating income instead of net income. Why is there a big difference, and what does this mean for performance evaluation?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Multinational rms, differing risk, comparison of prot, ROI, and RI. Newmann, Inc. has divisions in the United States, France, and Australia. The U.S. division is the oldest and most established of the three and has a cost of capital of 6%. The French division was started four years ago when the exchange rate for the Euro was 1 Euro = $1.34 USD. The French division has a cost of capital of 8%. The division in Australia was started this year, when the exchange rate was 1 Australian Dollar (AUD) = $0.87 USD. Its cost of capital is 11%. Average exchange rates for the current year are 1 euro = $1.07 and 1 AUD = $0.74 USD. Other information for the three divisions includes:

Billabong Fashion is based in Melbourne, Australia. Billabong Fashion has a subsidiary in Shanghai that generates RMB85 million in annual sales. Any earnings generated by the subsidiary are reinvested to support its operations. Belle Fashion is the close competitor of Billabong Fashion. Belle Fashion is a local Australian company located in Japan with annual export sale to Malaysia of about MYR 45 million. Based on the information provided, which firm is subject to a higher degree of translation exposure? Justify your answer with thorough explanation on both companies.

Doman Industries Ltd., whose products are sold in 30 countries worldwide, is an integrated Canadian forest products company.

Doman sells the majority of its lumber products in the United States and a significant amount of its pulp products in asia.Demon also has loans from other countries. For example, on June 18, 2018, the company borrowed US$160 million at an annual interest rate of 12%.

Demon must repay this loan, and interest, in U.S.dollars

One of the challenges global companies face is to make themselves attractive to investors from other currencies. This is difficult to do when different accounting rules in different countries blur the real impact of earnings. For example, in 2018 Doman reported a loss of $2.3 million, using Canadian accounting rules.Had it reported under U.S. accounting rules, its loss would have been $12.1 million.

Many companies that want to be more easily compared with U.S and other global competitors have switched to U,S. accounting principles. Canadian…

Chapter 23 Solutions

COST ACCOUNTING TTU >IC<

Ch. 23 - Prob. 23.1QCh. 23 - Prob. 23.2QCh. 23 - What factors affecting ROI does the DuPont method...Ch. 23 - RI is not identical to ROI, although both measures...Ch. 23 - Describe EVA.Ch. 23 - Give three definitions of investment used in...Ch. 23 - Distinguish between measuring assets based on...Ch. 23 - Prob. 23.8QCh. 23 - Why is it important to distinguish between the...Ch. 23 - Prob. 23.10Q

Ch. 23 - Managers should be rewarded only on the basis of...Ch. 23 - Explain the role of benchmarking in evaluating...Ch. 23 - Explain the incentive problems that can arise when...Ch. 23 - Prob. 23.14QCh. 23 - Prob. 23.15QCh. 23 - During the current year, a strategic business unit...Ch. 23 - Assuming an increase in price levels over time,...Ch. 23 - If ROI Is used to evaluate a managers performance...Ch. 23 - The Long Haul Trucking Company is developing...Ch. 23 - ABC Inc. desires to maintain a capital structure...Ch. 23 - ROI, comparisons of three companies. (CMA,...Ch. 23 - Prob. 23.22ECh. 23 - ROI and RI. (D. Kleespie, adapted) The Sports...Ch. 23 - ROI and RI with manufacturing costs. Excellent...Ch. 23 - ROI, RI, EVA. Hamilton Corp. is a reinsurance and...Ch. 23 - Goal incongruence and ROI. Comfy Corporation...Ch. 23 - ROI, RI, EVA. Performance Auto Company operates a...Ch. 23 - Capital budgeting, RI. Ryan Alcoa, a new associate...Ch. 23 - Prob. 23.29ECh. 23 - ROI, RI, EVA, and performance evaluation. Cora...Ch. 23 - Prob. 23.31ECh. 23 - Prob. 23.32ECh. 23 - ROI performance measures based on historical cost...Ch. 23 - ROI, measurement alternatives for performance...Ch. 23 - Multinational firms, differing risk, comparison of...Ch. 23 - ROI, Rl, DuPont method, investment decisions,...Ch. 23 - Division managers compensation, levers of control...Ch. 23 - Executive compensation, balanced scorecard. Acme...Ch. 23 - Financial and nonfinancial performance measures,...Ch. 23 - Prob. 23.40PCh. 23 - Prob. 23.41PCh. 23 - RI, EVA, measurement alternatives, goal...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Global Reach, Inc., is considering opening a new warehouse to serve the Southwest region. Darnell Moore, controller for Global Reach, has been reading about the advantages of foreign trade zones. He wonders if locating in one would be of benefit to his company, which imports about 90 percent of its merchandise (e.g., chess sets from the Philippines, jewelry from Thailand, pottery from Mexico, etc.). Darnell estimates that the new warehouse will store imported merchandise costing about 16.78 million per year. Inventory shrinkage at the warehouse (due to breakage and mishandling) is about 8 percent of the total. The average tariff rate on these imports is 5.5 percent. Required: 1. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in tariffs? Why? (Round your answer to the nearest dollar.) 2. Suppose that, on average, the merchandise stays in a Global Reach warehouse for nine months before shipment to retailers. Carrying cost for Global Reach is 6 percent per year. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.) 3. Suppose that the shifting economic situation leads to a new tariff rate of 13 percent, and a new carrying cost of 6.5 percent per year. To combat these increases, Global Reach has instituted a total quality program emphasizing reducing shrinkage. The new shrinkage rate is 7 percent. Given this new information, if Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.)arrow_forwardcompeny,whose products are sold in 30 countries worldwide, is an integrated Canadian forest products company. compeny sells the majority of its lumber products in the United States and a significant amount of its pulp products in asia.Demon also has loans from other countries. For example, on June 18, 2018, the company borrowed US$160 million at an annual interest rate of 12%. compeny must repay this loan, and interest, in U.S.dollars One of the challenges global companies face is to make themselves attractive to investors from other currencies. This is difficult to do when different accounting rules in different countries blur the real impact of earnings. For example, in 2018 compenyreported a loss of $2.3 million, using a accounting rules.Had it reported under U.S. accounting rules, its loss would have been $12.1 million. Many companies that want to be more easily compared with U.S and other global competitors have switched to U,S. accounting principles. a National Railway.…arrow_forwardDoman Industries Ltd., whose products are sold in 30 countries worldwide, is an integrated Canadian forest products company. Doman sells the majority of its lumber products in the United States and a significant amount of its pulp products in Asia. Demon also has loans from other countries. For example, on June 18, 2018, the company borrowed US$160 million at an annual interest rate of 12%. The demon must repay this loan, and interest, in U.S.dollars One of the challenges global companies face is to make themselves attractive to investors from other currencies. This is difficult to do when different accounting rules in different countries blur the real impact of earnings. For example, in 2018 Doman reported a loss of $2.3 million, using Canadian accounting rules. Had it reported under U.S. accounting rules, its loss would have been $12.1 million. Many companies that want to be more easily compared with the U.S and other global competitors have switched to U. S. accounting principles.…arrow_forward

- ABC Inc. is a U.S. firm with annual export sales to Canada of about C$500 million. Its main competitor is XYZ Inc., also based in the United States, with a subsidiary in Canada that generates about C$500 million in annual sales. Any earnings generated by the subsidiary are reinvested to support its operations. Based on the information provided, which company is subject to a higher degree of translation exposure? Explain.arrow_forwardTransfer Pricing; Ethics Zen Manufacturing Inc. is a multinational firm with sales and manufacturing units in 15 countries. One of its manufacturing units, in country X, sells its product to a retailunit in country Y for $300,000. The unit in country X has manufacturing costs of $150,000 for theseproducts. The retail unit in country Y sells the product to final customers for $450,000. Zen is considering adjusting its transfer prices to reduce overall corporate tax liability.Required1. Assume that both country X and country Y have corporate income tax rates of 40% and that no specialtax treaties or benefits apply to Zen. What would be the effect on Zen’s total tax burden if the manufacturing unit raises its price from $300,000 to $360,000?2. What would be the effect on Zen’s total taxes if the manufacturing unit raised its price from $300,000 to$360,000 and the tax rates in countries X and Y are 20% and 40%, respectively?3. Comment on any ethical issues you observe in this casearrow_forwardA company,whose products are sold in 30 countries worldwide, is an integrated Canadian forest products company. compeny sells the majority of its lumber products in the United States and a significant amount of its pulp products in asia.Demon also has loans from other countries. For example, on June 18, 2018, the company borrowed US$160 million at an annual interest rate of 12%. compeny must repay this loan, and interest, in U.S.dollars One of the challenges global companies face is to make themselves attractive to investors from other currencies. This is difficult to do when different accounting rules in different countries blur the real impact of earnings. For example, in 2018 compenyreported a loss of $2.3 million, using a accounting rules.Had it reported under U.S. accounting rules, its loss would have been $12.1 million. Many companies that want to be more easily compared with U.S and other global competitors have switched to U,S. accounting principles. a National Railway.…arrow_forward

- LFG Group, owner of the LFG, Mini and Rolls-Royce brands, has been based in Munich since its founding in 1916. But by 2022, only 17 per cent of the cars it sold were bought in Germany. In recent years, China has become LFG’s fastest-growing market, accounting for 14 per cent of LFG’s global sales volume in 2022. India, Russia and eastern Europe have also become key markets. The challenge: Despite rising sales revenues, LFG was conscious that its profits were often severely eroded by changes in exchange rates and interest rates. The company’s own calculations in its annual reports suggest that the negative effect of exchange rates and interest rates totalled €2.4bn between 2021 and 2022. LFG did not want to pass on its exchange rate/Interest costs to consumers through price increases. Its rival Porsche had done this at the end of the 1980s in the US and sales had plunged. what is the impact of foreign exchange on LFG profitability?arrow_forwardThurmond, Inc., has two divisions, one located in New York and the other located in Arizona. New York sells a specialized circuit to Arizona and just recently raised the circuit’s transfer price. This price hike had no effect on the volume of circuits transferred nor on Arizona’s option of acquiring the circuit from either New York or from an external supplier. On the basis of this information, which of the following statements is most correct? a. The profit reported by New York will increase and the profit reported by Arizona will increase. b. The profit reported by New York will decrease, the profit reported by Arizona will increase, and Thurmond’s profit will be unaffected. c. The profit reported by New York will increase, the profit reported by Arizona will decrease, and Thurmond’s profit will be unaffected. d. The profit reported by New York will increase and the profit reported by Arizona will decrease.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT- Business/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Business/Professional Ethics Directors/Executives...

Accounting

ISBN:9781337485913

Author:BROOKS

Publisher:Cengage

Financial Risks - Part 1; Author: KnowledgEquity - Support for CPA;https://www.youtube.com/watch?v=mFjSYlBS-VE;License: Standard youtube license