Evaluating division performance

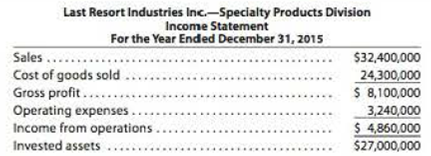

Last Resort Industries Inc. is a privately held diversified company with five separate divisions organized as investment centers. A condensed income statement for the Specialty Products Division for the past year, assuming no Service department charges, is as follows:

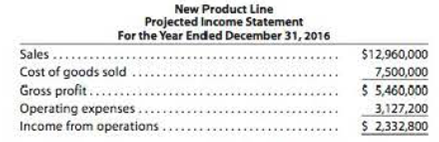

The manager of the Specialty Products Division was recently presented with the opportunity to add an additional product line, which would require invested assets of $14,400,000. A

The Specialty Products Division currently has $27.000.000 in invested assets, and Last Resort Industries Inc.’s overall rate of

The president is concerned that the manager of the Specialty Products Division rejected the addition of the new product line, even though all estimates indicated that the product line would be profitable and would increase overall company income. You have been asked to analyze the possible reasons why the Specialty Products Division manager rejected the new product line.

- 1. Determine the rate of return on investment for the Specialty Products Division for the past year.

- 2. Determine the Specialty Products Division manager’s bonus for the past year.

- 3. Determine the estimated rate of return on investment for the new product line. Round whole percents to one decimal place and investment turnover to two decimal places.

- 4. - Why might the manager of the Specialty Products Division decide to reject the new product line? Support your answer by determining the projected rate of return all investment for 2016, assuming that the new product line was launched in the Specialty Products Division, and 2016 actual operating results were similar to those of 2015.

- 5. Can you suggest an alternative performance measure for motivating division managers to accept new investment opportunities that would increase the overall company income and rate of return on investment?

Trending nowThis is a popular solution!

Chapter 23 Solutions

FINANCIAL+MANG.-W/ACCESS PRACTICE SET

- The three divisions of Yummy Foods are Snack Goods, Cereal, and Frozen Foods. The divisions are structured as investment centers. The following responsibility reports were prepared for the three divisions for the prior year: a. Which division is making the best use of invested assets and should be given priority for future capital investments? b. b. Assuming that the minimum acceptable return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions? Explain. c. c. Identify opportunities for improving the companys financial performance.arrow_forwardForchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).arrow_forwardThe vice president of operations of Pavone Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year for each division are as follows: Business Division Consumer Division Sales $2,160,000 $2,520,000 Cost of goods sold 1,270,000 1,330,000 Operating expenses 652,400 837,200 Invested assets 744,828 2,100,000 Required: 1. Prepare condensed divisional income statements for the year ended December 31, assuming that there were no service department charges. 2. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for each division. If required, round your final answers to one decimal place. 3. If management wants a minimum acceptable return of 17.00%, determine the residual income for each division. Use the minus sign to indicate a negative income. Round final answers to nearest…arrow_forward

- The vice president of operations of Scott Hall and Associates is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year for each division are as follows: Category Sales Cost of goods sold Operating expenses Invested assets C. Road Bike Division $1,750,000 1,300,000 202,000 1,400,000 Mountain Bike Division $1,810,000 1,440,000 236,800 800,000 Instructions a. Prepare condensed divisional income statements for the year ended December 31, 2021, assuming that there were no service department charges. b. Using the DuPont formula for return on investment, determine the profit margin percentage, investment turnover, and return on investment for each division. (Round percentages and the investment turnover to two places behind the decimal.) If management's minimum acceptable return on investment is 10%, determine the residual income for each division. d. In your own words evaluate the performance of the…arrow_forwardDivisional income statements for the year 2020 for the two divisions of a company appear below. Eastern Division Western Division Sales $5,000,000 $4,500,000 Operating Expenses 3,800,000 3,000,000 Operating Profit $1,200,000 $1,500,000 Invested Assets $6,000,000 $8,000,000 a. Based on the data above, compute the ROI for the Eastern Division and the Western Division. Please use the Du Pont Model. b. The company is planning to invest an additional $600,000 in assets in one or the other of the divisions. Which division should the company expand? Why? c. What is the advantage of using ROI rather than the dollar amount…arrow_forwardDivisional income statements for the year 2020 for the two divisions of a company appear below. Eastern Division Western Division Sales $5,000,000 $4,500,000 Operating Expenses 3,800,000 3,000,000 Operating Profit $1,200,000 $1,500,000 Invested Assets $6,000,000 $8,000,000 1. Based on the data above, compute the ROI for the Eastern Division and the Western Division. Please use the Du Pont Model. Show all work and round to second decimal places. 2. The company is planning to invest an additional $600,000 in assets in one or the other of the divisions. Which division should the company expand? Why? 3. What is the…arrow_forward

- The Custodial Division of Clark's Corporate Services (CCS) has assets of $1.2 million. During the past year, the division had profits of $228,000. CCS has a cost of capital of 7.5 percent. Ignore taxes. Required: a. Compute the divisional ROI for the Custodial Division. b. Compute the divisional RI for the Custodial Division. Complete this question by entering your answers in the tabs below. Required A Required B Compute the divisional ROI for the Custodial Division. Divisional ROI % Required A Required B >arrow_forwardHardin Company is a division of a major corporation. The following data are for the latest year ofoperations:Sales $ 19,600,000 Net operating income $ 470,400 Average operating assets $ 5,000,000 The company's minimum required rate of return 10 % Required:a. What is the division's margin?b. What is the division's turnover?c. What is the division's return on investment (ROI)?d. What is the division's residual income?arrow_forwardThe vice president of operations of Recycling Industries is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year for each division are as follows: Category Business Division Consumer Division Sales $42,750,000 $55,000,000 Cost of goods sold 23,000,000 31,000,000 Operating expenses 11,200,000 14,500,000 Invested assets 35,250,000 67,000,000 Prepare condensed divisional income statements for the year ended December 31, 2020, assuming that there were no service department charges. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for each division. (Round percentages to one decimal place and the investment turnover to two decimal places.) If management desires a minimum acceptable return on investment of 10%, determine the residual income for each division. Discuss the…arrow_forward

- Far Sight is a division of a major corporation. The following data are for the latest year of operations: Required: a. What is the division's return on investment (ROI)?b. What is the division's residual income? Sales 24,480,000 Net operating income 1.738.000 average operating assets 6,000 rate of return 16%arrow_forwardHardin Company is a division of a major corporation. The following data are for the latest year of operations: Sales $ 19,600,000 Net operating income $ 470,400 Average operating assets $ 5,000,000 The company's minimum required rate of return 10 % Required: What is the division's residual income?arrow_forwardThe vice president of operations of Scott Hall and Associates is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year for each division are as follows: Category Road Bike Division Mountain Bike Division Sales $1,750,000 $1,810,000 Cost of goods sold 1,300,000 1,440,000 Operating expenses 202,000 236,800 Invested assets 1,400,000 800,000 Prepare condensed divisional income statements for the year ended December 31, 2021, assuming that there were no service department charges. Using the DuPont formula for return on investment, determine the profit margin percentage, investment turnover, and return on investment for each division. (Round percentages and the investment turnover to two places behind the decimal.) If management’s minimum acceptable return on investment is 10%, determine the residual income for each division. In your own words…arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning