Concept explainers

Valuing financial leases In Section 25-5, we listed four circumstances in which there are potential gains from leasing. Check them out by conducting a sensitivity analysis on the Greymare Bus Lines lease, assuming that Greymare does not pay tax. Try, in turn, (a) a lessor tax rate of 50% (rather than 21%), (b) straight-line

a)

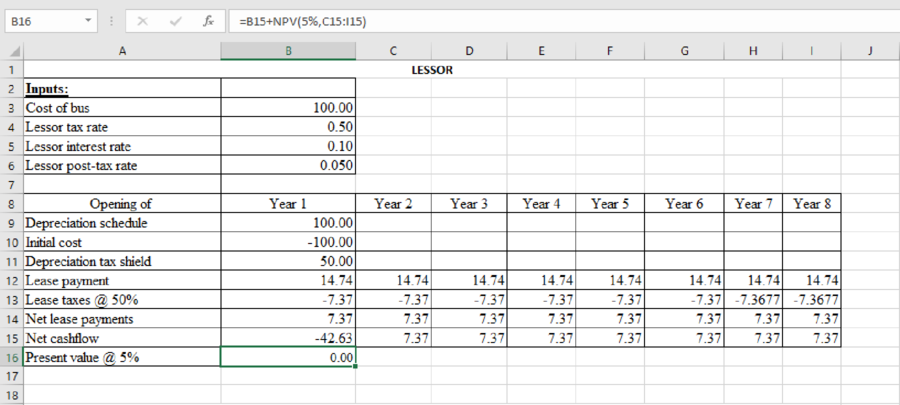

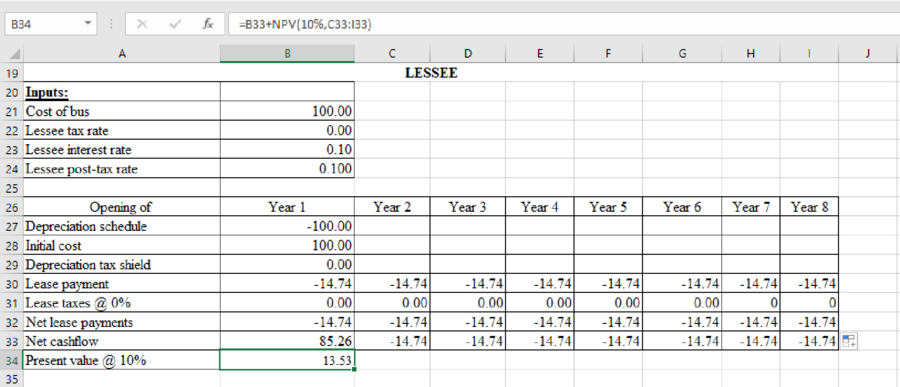

To determine: The minimum rental that would please the lessor and compute NPV to the lessee if a lessor tax rate is 50%.

Explanation of Solution

The NPV of the lessor’s cash flow contains of the cost of the bus, the PV of the depreciation tax shield, and the present value of the post-tax lease payments. To ascertain the minimum rental P, we set the NPV o zero and solve for P. we can then utilize this value for to calculate the value of the lease to the lessee.

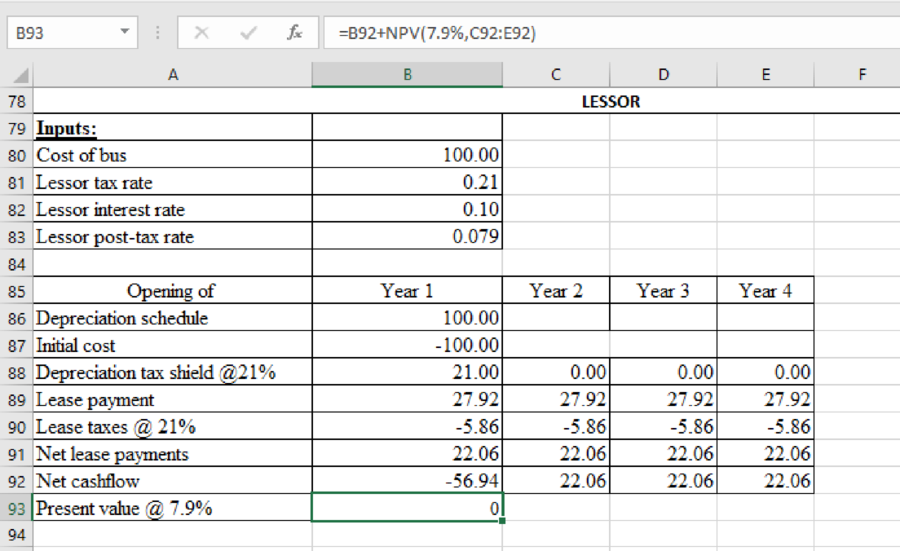

Computation of minimum rental that would satisfy the lessor and NPV to the lessee is as follows:

At a lessor tax rate of 50%, the cash flows for the lessor are:

For company G, the NPV of the cash flows is the cost of the bus saved (100) lesser the present value of the lease payments.

b)

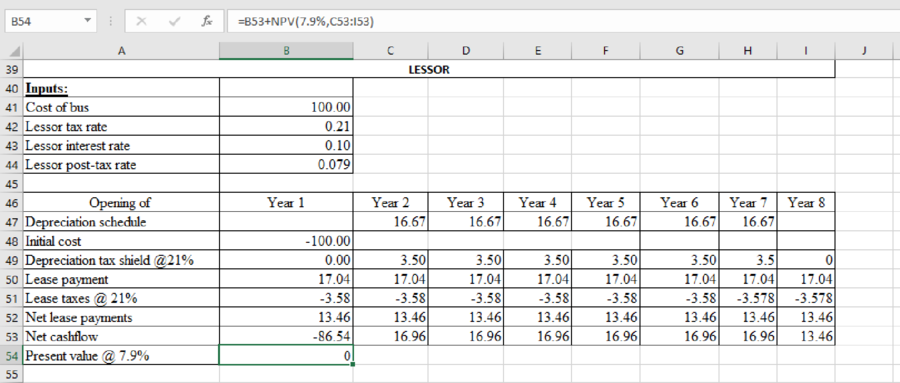

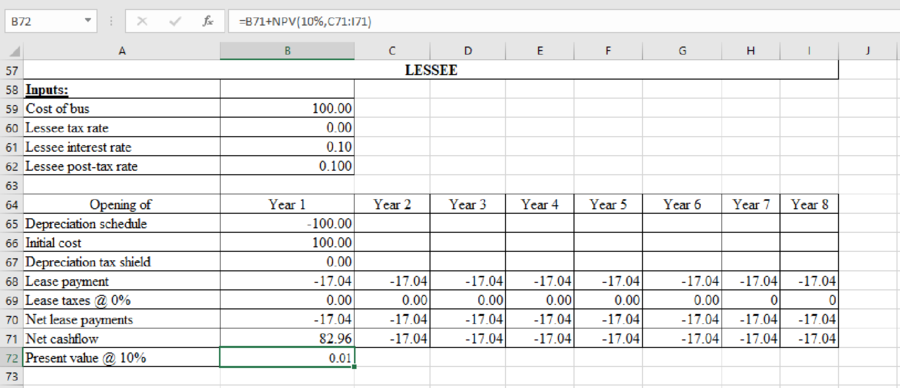

To determine: The minimum rental that would satisfy the lessor and calculate NPV to the lessee if straight line depreciation in year1 to 6.

Explanation of Solution

Computation of minimum rental that would satisfy the lessor and NPV to the lessee is as follows:

Lessor depreciation straight-line method over 6 years (tax rate back at 21%). Cash flow for the lessor are:

For company G, the NPV of the cash flow is:

c)

To determine: The minimum rental that would satisfy the lessor and calculate NPV to the lessee if a four-year lease with four annual rentals.

Explanation of Solution

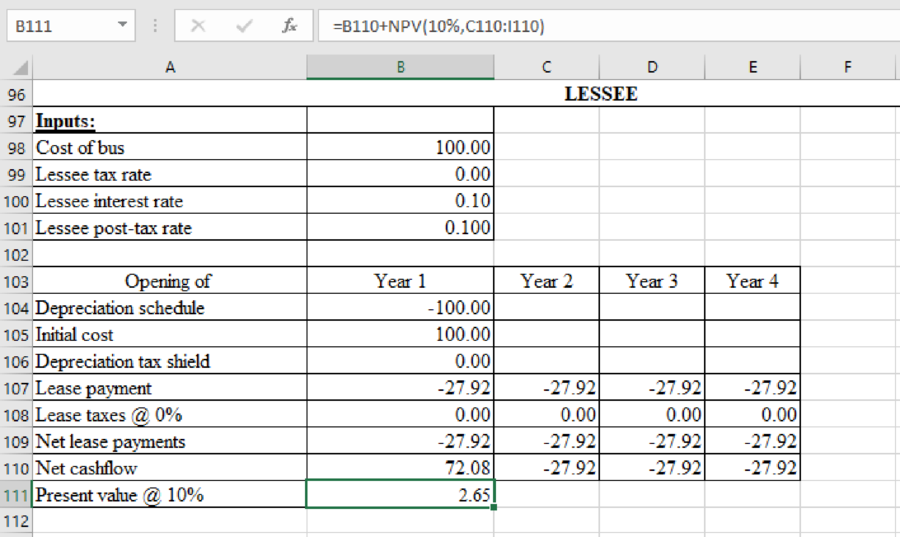

Computation of minimum rental that would satisfy the lessor and NPV to the lessee is as follows:

Four-year lease with four annual rental payments. Cash flows for the lessor are:

For company G, the NPV of cash flow is:

d)

To determine: The minimum rental that would satisfy the lessor and calculate NPV to the lessee if an interest rate of 20%.

Explanation of Solution

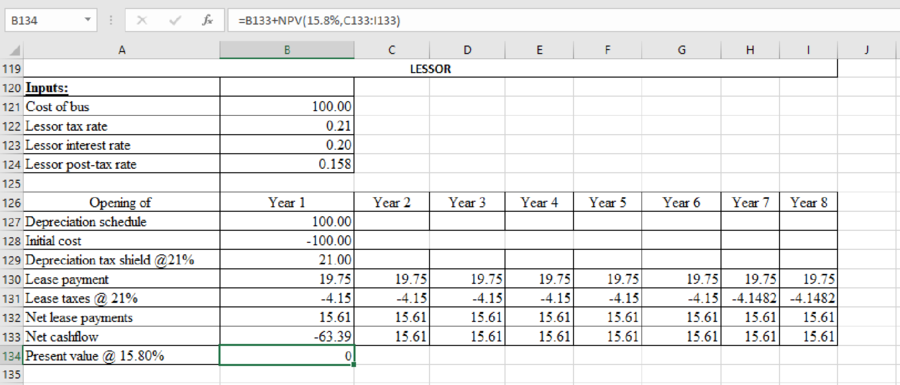

Computation of minimum rental that would satisfy the lessor and NPV to the lessee is as follows:

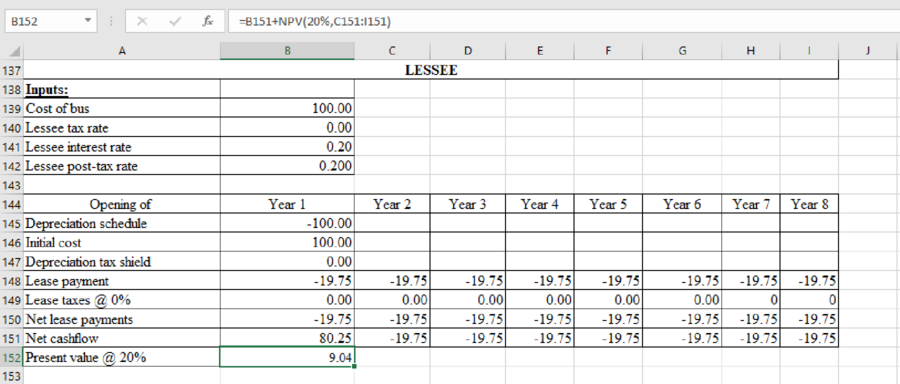

At an interest rate of 20% the cash flows for the lessor are:

For company G, the NPV of cash flow is:

Want to see more full solutions like this?

Chapter 25 Solutions

PRIN.OF CORPORATE FINANCE

- JLB Corporation is attempting to determine whether to lease or purchase research equipment. The firm is in the 23% tax bracket, and its after-tax cost of debt is currently 9%. The terms of the lease and of the purchase are as follows: Lease: Annual end-of-year lease payments of $30,000 are required over the three-year life of the lease. All maintenance costs will be paid by the lessor; insurance and other costs will be borne by the lessee. The lessee will exercise its option to purchase the asset for $6,500 at termination of the lease. Ignore any future tax benefit associated with the purchase of the equipment at the end of year 3 under the lease option. Purchase: The equipment costs $70,000 and can be financed with a 15% loan requiring annual end-of-year payments of $30,658 for three years. JLB will depreciate the equipment under MACRS using a three-year recovery period. ((See TABLE below) for the applicable depreciation percentages.) JLB will pay $2,600 per year…arrow_forwardJLB Corporation is attempting to determine whether to lease or purchase research equipment. The firm is in the 27% tax bracket, and its after-tax cost of debt is currently 9%. The terms of the lease and of the purchase are as follows: Lease: Annual end-of-year lease payments of $30,000 are required over the three-year life of the lease. All maintenance costs will be paid by the lessor; insurance and other costs will be borne by the lessee. The lessee will exercise its option to purchase the asset for $3,000 at termination of the lease. Ignore any future tax benefit associated with the purchase of the equipment at the end of year 3 under the lease option. Purchase: The equipment costs $70,000 and can be financed with a 14% loan requiring annual end-of-year payments of $30,151 for three years. JLB will depreciate the equipment under MACRS using a three-year recovery period. JLB will pay $2,200 per year for a service contract that covers all maintenance costs;…arrow_forwardApply the generalized lease valuation model to the lease considered by Alberton Shop company, assuming the frm is currently in a nontaxpaying position but expect commencing tax payments in year 3 ( G = 3). All tax benefits are assumed to be carried forward and fully absorbed in year 3. from the table below start with Step 1: to compute the PV of the lease payments from year 0 to year 2 at 8%. since $13,000 is paid each year.arrow_forward

- JLB Corporation is attempting to determine whether to lease or purchase research equipment. The firm is in the 40% tax bracket, and its after-tax cost of debt is currently 8%. The returns of the least and of the purchase are as follows:Lease Annual end-of-year lease payments of $25,200 are required over the 3-year life of the lease. All maintenance costs will be paid by the lessor; insurance and other costs will be borne by the lessee. The lessee will exercise its option to purchase the asset for $5,000 at termination of the lease. Purchase The research equipment, costing $60,000, can be financed entirely with a 14% loan requiring annual end-of-year payments of $25,844 for 3 years. The firm in this case will depreciate the equipment under MACRS using a 3-yar recovery period (33.33%, 44.45%, 14.81%, and 7.41%, respectively). The firm will pay $1,800 per year for a service contract that covers all maintenance costs; insurance and other costs will be borne by the firm. The firm plans to…arrow_forwardJLB Corporation is attempting to determine whether to lease or purchase research equipment. The firm is in the 40% tax bracket, and its after-tax cost of debt is currently 8%. The returns of the least and of the purchase are as follows:Lease Annual end-of-year lease payments of $25,200 are required over the 3-year life of the lease. All maintenance costs will be paid by the lessor; insurance and other costs will be borne by the lessee. The lessee will exercise its option to purchase the asset for $5,000 at termination of the lease. Purchase The research equipment, costing $60,000, can be financed entirely with a 14% loan requiring annual end-of-year payments of $25,844 for 3 years. The firm in this case will depreciate the equipment under MACRS using a 3-yar recovery period (33.33%, 44.45%, 14.81%, and 7.41%, respectively). The firm will pay $1,800 per year for a service contract that covers all maintenance costs; insurance and other costs will be borne by the firm. The firm plans to…arrow_forwardDifferential Analysis for a Lease or Sell Decision Granite Construction Company is considering selling excess machinery with a book value of $279,100 (original cost of $399,700 less accumulated depreciation of $120,600) for $277,600, less a 5% brokerage commission. Alternatively, the machinery can be leased for a total of $283,700 for five years, after which it is expected to have no residual value. During the period of the lease, Granite Construction Company's costs of repairs, insurance, and property tax expenses are expected to be $26,200. a. Prepare a differential analysis, dated November 7 to determine whether Granite should lease (Alternative 1) or sell (Alternative 2) the machinery. Differential Analysis Lease Machinery (Alt. 1) or Sell Machinery (Alt. 2) November 7 Lease Machinery (Alternative 1) Sell Machinery (Alternative 2) Differential Effect on Income (Alternative 2) Revenues $fill in the blank bed17bfd1ffaf9e_1 $fill in the blank bed17bfd1ffaf9e_2…arrow_forward

- Differential analysis for a lease or sell decision Burlington Construction Company is considering selling excess machinery with a book value of 115,000 (original cost of 275,000 less accumulated depreciation of 160,000) for 90,000, less a 6% brokerage commission. Alternatively, the machinery can be leased for a total of 100,000, for four years, after which it is expected to have no residual value. During the period of the lease, Burlington Construction Companys costs of repairs, insurance, and property tax expenses are expected to be 9,000. a. Prepare a differential analysis dated January 15 to determine whether Burlington Construction Company should lease (Alternative 1) or sell (Alternative 2) the machinery. b. On the basis of the data presented, would it be advisable to lease or sell the machinery? Explain.arrow_forwardReynolds Construction (RC) needs a piece of equipment that costs 200. RC can either lease the equipment or borrow 200 from a local bank and buy the equipment. Reynoldss balance sheet prior to the acquisition of the equipment is as follows: a. (1) What is RCs current debt ratio? (2) What would be the companys debt ratio if it purchased the equipment? (3) What would be the debt ratio if the equipment were leased and the lease not capitalized? (4) What would be the debt ratio if the equipment were leased and the lease were capitalized? Assume that the present value of the lease payments is equal to the cost of the equipment. b. Would the companys financial risk be different under the leasing and purchasing alternatives?arrow_forwardWhich of the following statements regarding the new accounting rules, which take effect in 2019, for leases is false? If the lease term is one year or longer, a liability must be recognized. If the lease term is less than one year, an asset must be recognized. The new lease accounting rules will result in more assets and liabilities being recognized on the balance sheet. Leasing will likely remain popular under the new lease accounting rules because leases do not require a large initial outlay of cash.arrow_forward

- (1) Assume that the lease payments were actually 280,000 per year, that Consolidated Leasing is also in the 25% tax bracket, and that it also forecasts a 200,000 residual value. Also, to furnish the maintenance support, it would have to purchase a maintenance contract from the manufacturer at the same 20,000 annual cost, again paid in advance. Consolidated Leasing can obtain an expected 10% pre-tax return on investments of similar risk. What are its NPV and IRR of leasing under these conditions? (2) What do you think the lessors NPV would be if the lease payment were set at 260,000 per year? (Hint: The lessors cash flows would be a mirror image of the lessees cash flows.)arrow_forwardLease versus Buy Consider the data in Problem 19-1. Assume that RCs tax rate is 40% and that the equipments depreciation would be 100 per year. If the company leased the asset on a 2-year lease, the payment would be 110 at the beginning of each year. If RC borrowed and bought, the bank would charge 10% interest on the loan. In either case, the equipment is worth nothing after 2 years and will be discarded. Should RC lease or buy the equipment?arrow_forwardUse the following information to decide whether this equipment lease qualifies as an operating, sales-type, or direct financing lease to a lessor. a. There is no transfer of ownership at the end of the lease term. There is no bargain purchase option. The lease term is 60% of the economic life of the leased property. The present value of lease payments, including a residual value guaranteed by the lessee, is 100% of the fair value of the leased property to the lessor. The collectability of the lease payments is reasonably assured. The leased asset was not of a specialized nature. b. Same as (a), except that the residual value is guaranteed by a third party, not the lessee. The present value of the residual value guarantee is 15% of the fair value of the leased property. c. Same as (a), except that: the present value of the lease payments, including a residual value guaranteed by the lessee, is only 50% of the fair value of the leased asset. The collectability of the minimum lease payments is not predictable.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning