College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 25, Problem 1CP

CHALLENGE PROBLEM

This problem challenges you to apply your cumulative accounting knowledge to move a step beyond the material in the chapter.

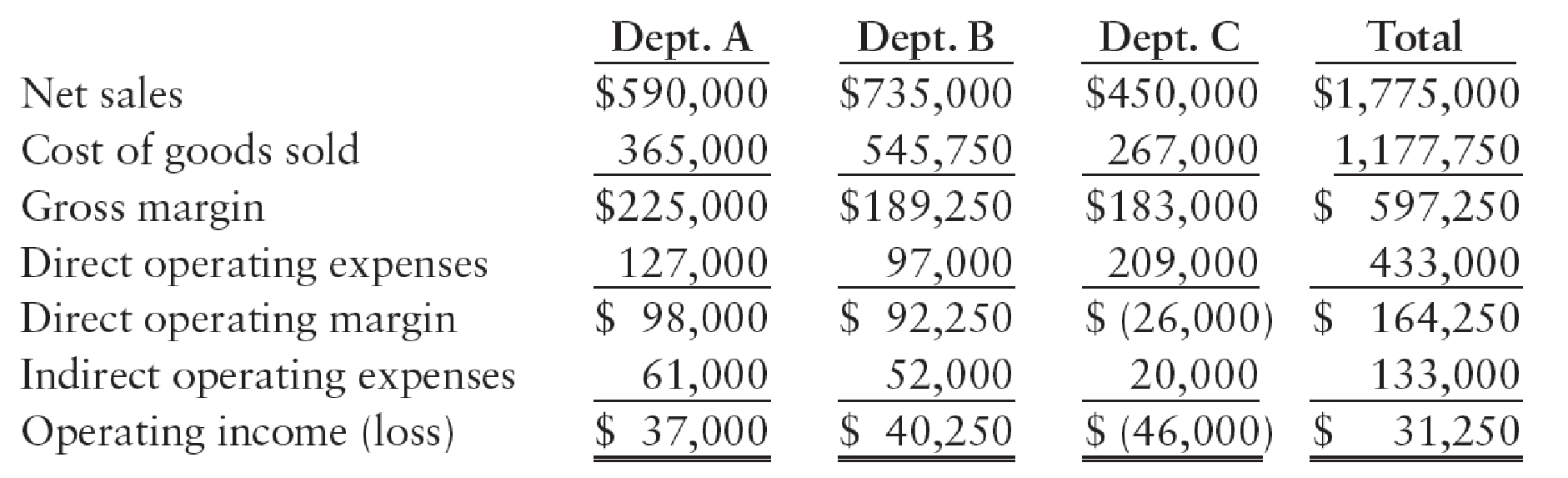

The results of the operating activities of Kobe Company for the current year are as follows:

Based on these results, Kobe is considering discontinuing department C and establishing a new department D. The estimated revenues and expenses of the new department are as follows:

In addition, the proposed change will cause total indirect operating expenses to increase by $22,000.

REQUIRED

Determine whether Kobe should discontinue department C and establish department D.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The results of the operating activities of Kobe Company for the current year are as follows:

Based on these results, Kobe is considering discontinuing department C and establishing a new department D. The estimated revenues and expenses of the new department are as follows: Dept. DNet sales $480,000Cost of goods sold 270,000Direct operating expenses 185,000In addition, the proposed change will cause total indirect operating expenses to increase by $22,000.RequiredDetermine whether Kobe should discontinue department C and establishdepartment D.

Obtain the latest two Ford and General Motors Annual Reports online, like you have been doing for other companies in previous Module discussions. Please make sure the Annual Report you obtain is the latest two years.

A particularly important financial accounting and financial statement measure is a company’s ability to use its assets efficiently and effectively to generate sales.

Calculate the total asset turnover for both Ford and General Motors for the latest two fiscal years ending. Show the bases for your calculation at the start of your initial response for both companies. Answer the following questions as part of your initial response:

What is Ford’s trend for the total asset turnover ratio the past two years?

What is General Motors' trend for the total asset turnover ratio the past two years?

Comparing the trend in the total asset turnover for Ford and General Motors to each other the past two years, what do the trends tell us? Is there any reason(s) they are or may be…

Solve the following problem in good accounting form.

During 2009, Mason Construction, Inc. started work on a P 5,200,000 fixedprice construction contract to be completed in two years. The accounting records disclosed the following data for the year ended December 31, 2009: Cost incurred P 2,650,000Estimated cost to complete 2,720,000Progress billings 2,500,000Collections 2,000,000.

What amount of net income or loss should have been recognized in 2009?

Chapter 25 Solutions

College Accounting, Chapters 1-27

Ch. 25 - A department that incurs costs and generates...Ch. 25 - Departmental gross profit is the difference...Ch. 25 - Prob. 3TFCh. 25 - Direct expenses are operating expenses incurred...Ch. 25 - Departmental direct operating margin is the...Ch. 25 - A department that incurs costs but does not...Ch. 25 - The difference between a departments net sales and...Ch. 25 - Prob. 3MCCh. 25 - The difference between a departments gross profit...Ch. 25 - The difference between a departments gross profit...

Ch. 25 - Prob. 1CECh. 25 - Prob. 2CECh. 25 - Prob. 3CECh. 25 - Prob. 1RQCh. 25 - Prob. 2RQCh. 25 - Prob. 3RQCh. 25 - Prob. 4RQCh. 25 - Prob. 5RQCh. 25 - Prob. 6RQCh. 25 - Prob. 7RQCh. 25 - Prob. 8RQCh. 25 - Distinguish between departmental gross profit,...Ch. 25 - Prob. 10RQCh. 25 - GROSS PROFIT SECTION OF DE PART MENT AL INCO ME ST...Ch. 25 - ALLOCATING OPERATING EXPENSESQUARE FEET Weaverling...Ch. 25 - ALLOCATING OPERATING EXPENSERELATIVE NET SALES...Ch. 25 - ALLOCATING OPERATING EXPENSEMILES DRIVEN Mercado...Ch. 25 - COMPUTING OPERATING INCOME The sales, cost of...Ch. 25 - Prob. 6SEACh. 25 - INCOME STATEMENT WITH DEPART MENTAL GROSS PROFIT...Ch. 25 - INCOME STATE MENT WITH DEPARTMENTAL OPERATING...Ch. 25 - INCOME STATEMENT WITH DEPART MENTAL DIRECT...Ch. 25 - Prob. 10SPACh. 25 - GROSS PROFIT SECTION OF DEPART MENTAL INCOME...Ch. 25 - Prob. 2SEBCh. 25 - ALLOCATING OPERATING EXPENSERELATIVE NET SALES...Ch. 25 - ALLOCATING OPERATING EXPENSEMILES DRIVEN Herbert...Ch. 25 - Prob. 5SEBCh. 25 - Prob. 6SEBCh. 25 - INCOME STATEMENT WITH DEPART MENTAL GROSS PROFIT...Ch. 25 - Prob. 8SPBCh. 25 - Prob. 9SPBCh. 25 - Prob. 10SPBCh. 25 - Prob. 1MYWCh. 25 - Prob. 1ECCh. 25 - MASTERY PROBLEM Bobs Acme Supermarket has been in...Ch. 25 - CHALLENGE PROBLEM This problem challenges you to...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume you are the controller of a large corporation, and the chief executive officer (CEO) has requested that you refrain from posting closing entries at 20X1 year-end, with the intention of combining the two years profits in year 20X2, in an effort to make that years profits appear stronger. Write a memo to the CEO, to offer your response to the request to skip the closing entries for year 20X1.arrow_forwardMay I ask for an explanation and solution to the question for a better understanding. Thank you! 15. The following data for the years ended December 31, 2019 and 2020 were presented to the management Zigzag Company: 2020 = Net sales: 1,363,000, Cost of Sales: 911,800, Gross Profit: 451,200; 2019 = Net Sales: 1,250,000, Cost of Sales: 776,000, Gross Profit: 474,000. The management requested you to determine the cause of the decline in gross profit on sales in spite of the favorable information given by the sales division that the quantity sold in 2020 was higher than in 2019 and that the production costs in 2020 were lower than that of 2019 by 6%. The percent change in volume is: a. 17.50% b. 14.00% c. 25.00% d. 20.00%arrow_forwardETHICS (Rule-Making Issues) When the FASB issues new pronouncements, the implementation date is usually12 months from date of issuance, with early implementation encouraged. Karen Weller, controller, discusses with her financialvice president the need for early implementation of a rule that would result in a fairer presentation of the company’s financialcondition and earnings. When the financial vice president determines that early implementation of the rule will adversely affectthe reported net income for the year, he discourages Weller from implementing the rule until it is required. InstructionsAnswer the following questions.(a) What, if any, is the ethical issue involved in this case?(b) Is the financial vice president acting improperly or immorally?(c) What does Weller have to gain by advocacy of early implementation?(d) Which stakeholders might be affected by the decision against early implementation?arrow_forward

- COURSE: ACCOUNTABILITY - INFLATION EFFECTS A company closes its fiscal year with assets of $150,000 and liabilities of $68,000. Initial capital contributed was $50,000. At end of period there was a new capital contribution of $30,000. Inflation rate for period is 10%.Answer:(a) Determine profit or loss for period without adjustment and with inflation adjustment.b) Perform a comparative analysis and indicate how inflation affects performance. Comment on your results HINT: be careful with those items (accounts) that are subject to inflation or are notarrow_forwardQuestion When the FASB issues new standards, the implementation date is frequently 12 months from date of issuance, and early implementation is encouraged. Becky Hoger, controller, discusses with her financial vice president the need for early implementation of a standard that would result in a fairer presentation of the Company’s financial condition and earnings. When the financial vice president determines that early implementation of the standard will adversely affect the reported net income for the year, he discourages Hoger from implementing the standard until it is required. Required: a. What, if any, ethical issue is involved in this case? b. Is the financial vice president acting improperly or immorally? c. What does Hoger have to gain by advocacy of early implementation? d. Who might be affected by the decision against early implementation? (CMA adapted)arrow_forwardA colleague of yours has been reviewing the second-quarter income statements for a number of companies and is questioning a number of the expense items included in the statements. For each of the following independent questions, provide a written response to your colleague’s questions.1. A footnote accompanying Company A’s second-quarter income statement states that $360,000 was expended on research and development during the quarter on activities that should benefit operations over the next 24 months. Why does the second quarter reflect an expense of $120,000 rather than $15,000?2. Company B reported pretax income in both the first and second quarters, and the statutory tax rate during those periods and for the balance of the year is 30%. Assume that there were no net operating losses in prior years for tax purposes. However, both of the quarters reported an effective tax rate of less than 30%. What could possibly explain this?3. Assume the same facts as in part (2) except that the…arrow_forward

- Required information Skip to question [The following information applies to the questions displayed below.] CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below: Sales $ 4,980,000 Net operating income $ 298,800 Average operating assets $ 830,000 The following questions are to be considered independently. Required: 1. Compute the company's return on investment (ROI). (Do not round intermediate calculations. Round your answer to 2 decimal places.) Return on investment (ROI) %arrow_forwarddo you want to improve the qualitative characteristics of your firms financial statements. Which of the following options would most likely improve the timeliness of your company's financial statements? 1. decreasing the useful life of property plant and equipment from 10 years to five 2. increasing the number of disclosures 3. increasing the frequency of statements from annually to quarterly 4. changing the timing of born revenues are recognizedarrow_forwardFinancial Difficulty: The “Going-Concern” Problem. Pitts Company has experienced significant financial difficulty. Current liabilities exceed current assets by $1 million, cash has decreased to $10,000, the interest on the long-term debt has not been paid, and a customer has brought a lawsuit against Pitts for $500,000 on a product liability claim. Significantquestions concerning the going-concern status of the company exist. The lawsuit and information about the going-concern status have been appropriately described in footnote 3 to the financial statements.Required:a. Draft AOW’s report, assuming that the auditors decide that an unmodified opinion instead of a disclaimer of opinion is appropriate in the circumstances.b. Draft AOW’s report, assuming that the auditors decide the uncertainties are so serious that they do not wish to express an opinion on Pitts’ financial statementsarrow_forward

- Analyzing Operational ChangesOperating results for department B of Shaw Company during 2019 are as follows: Sales $800,000 Cost of goods sold 480,000 Gross profit 320,000 Direct expenses 200,000 Common expenses 123,000 Total expenses 323,000 Net loss $(3,000) If department B could maintain the same physical volume of product sold while raising selling prices an average of 6% and making an additional advertising expenditure of $40,000, what would be the effect on the department’s net income or net loss? (Ignore income tax in your calculations.) Use a negative sign with your answer to indicate if the effect increases the company's net loss. If Department B increased its selling price by 6%, the effect on net income (loss) would be $Answerarrow_forwardFinancial update as of June 15 • Your existing business generates $135,000 in EBIT. • The corporate tax rate applicable to your business is 25%. • The depreciation expense reported in the financial statements is $25,714. • You don’t need to spend any money for new equipment in your existing cafés; however, you do need $20,250 of additional cash. • You also need to purchase $10,800 in additional supplies—such as tableclothes and napkins, and more formal tableware—on credit. • It is also estimated that your accruals, including taxes and wages payable, will increase by $6,750. Based on your evaluation you have______in free cash flow.arrow_forwardHorizontal Analysis Mike Sanders is considering the purchase of Kepler Company, a firm specializing in the manufacture of office supplies. To be able to assess the financial capabilities of the company, Mike has been given the company’s financial statements for the 2 most recent years. Kepler CompanyComparative Balance Sheets This Year Last Year Assets Current assets: Cash $50,000.00 $100,000.00 Accounts receivable, net 300,000.00 150,000.00 Inventory 600,000.00 400,000.00 Prepaid expenses 25,000.00 30,000.00 Total current assets $975,000.00 $680,000.00 Property and equipment, net 125,000.00 150,000.00 Total assets $1,100,000.00 $830,000.00 Liabilities and Stockholders’ Equity Current liabilities: Accounts payable $400,000.00 $290,000.00 Short-term notes payable 200,000.00 60,000.00 Total current liabilities $600,000.00 $350,000.00 Long-term bonds payable, 12% 100,000.00 150,000.00 Total liabilities $700,000.00 $500,000.00…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Introduction to Divisional performance measurement - ACCA Performance Management (PM); Author: OpenTuition;https://www.youtube.com/watch?v=pk8Mzoqr4VA;License: Standard Youtube License