MASTERY PROBLEM

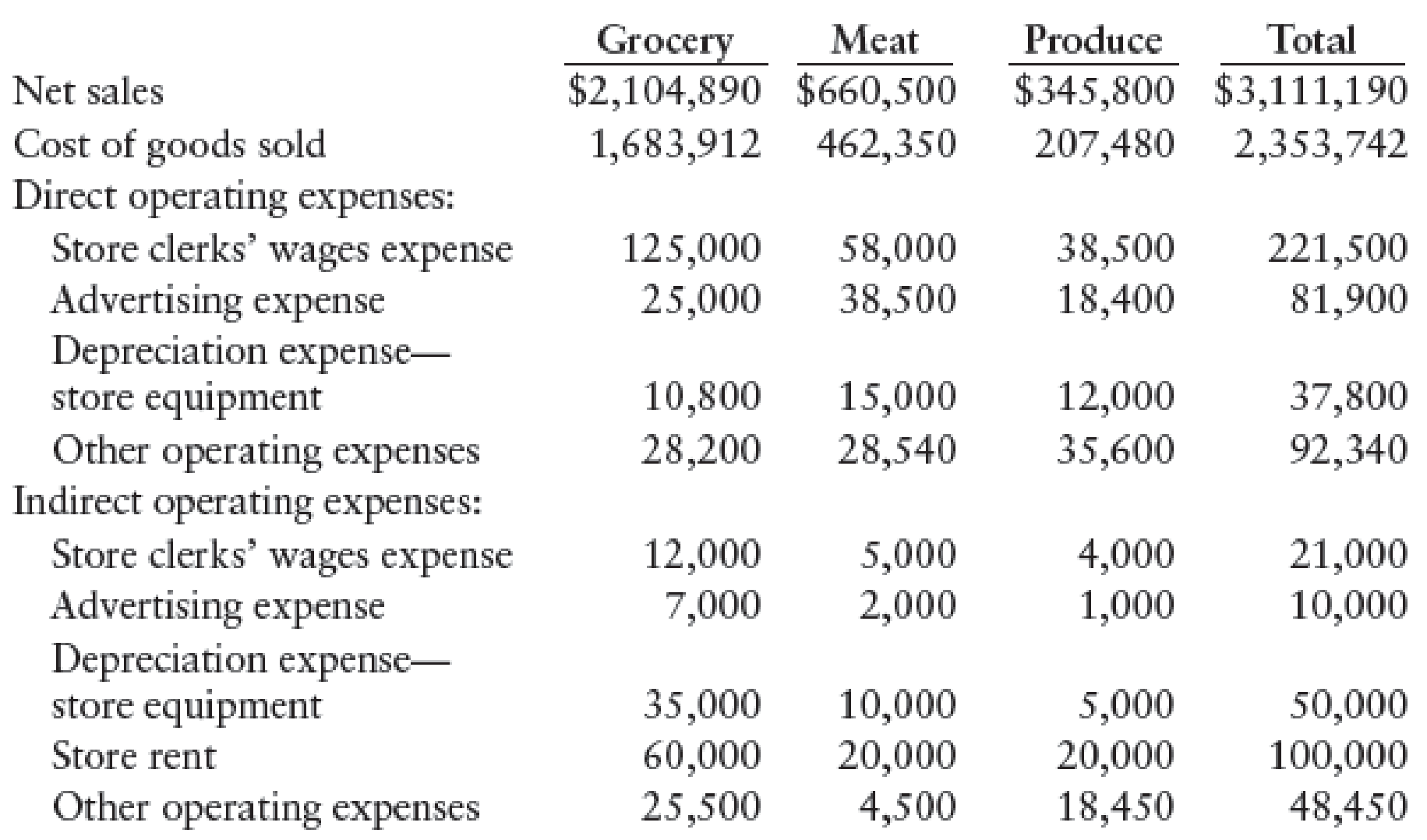

Bob’s Acme Supermarket has been in operation for many years, offering high-quality groceries, produce, and meat at reasonable prices. Accounting records are maintained on a departmental basis with assignment of direct expenses and allocation of indirect expenses through the use of various procedures. Selected operating information for the year ended December 31, 20--, is as follows:

REQUIRED

1. (a) Prepare an income statement showing departmental operating income.

(b) Compute the gross profit percentage and operating income percentage for each department (round to the nearest tenth of a percent).

2. (a) Prepare an income statement showing departmental and total direct operating margins.

(b) Compute the departmental direct operating margin percentage for each department (round to the nearest tenth of a percent).

3. Should Bob be concerned about the profitability of the three departments? Should any of the departments be discontinued?

1-a

Prepare an income statement for A Supermarket for the year ended December 31, 20--, showing the departmental operating income.

Explanation of Solution

Departmental operating income: The departmental income statement reports the departmental operating income, which is the excess of departmental gross profit over the operating expenses incurred.

Formula for departmental operating income:

Prepare an income statement for A Supermarket for the year ended December 31, 20--, showing the departmental operating income.

| A Supermarket | ||||

| Income Statement | ||||

| For the Year Ended December 31, 20-- | ||||

| Grocery | Meat | Produce | Total | |

| Sales | $2,104,890 | $660,500 | $345,800 | $3,111,190 |

| Cost of goods sold | 1,683,912 | 462,350 | 207,480 | 2,353,742 |

| Gross profit | $420,978 | $198,150 | $138,320 | $757,448 |

| Operating expenses: | ||||

| Store clerks’ wages expense | $137,000 | $63,000 | $42,500 | $242,500 |

| Advertising expense | 32,000 | 40,500 | 19,400 | 91,900 |

| Depreciation expense-Equipment | 45,800 | 25,000 | 17,000 | 87,800 |

| Store rent | 60,000 | 20,000 | 20,000 | 100,000 |

| Other operating expenses | 53,700 | 33,040 | 54,050 | 140,790 |

| Total operating expenses | 328,500 | 181,540 | 152,950 | 662,990 |

| Operating income | $92,478 | $16,610 | $(14,630) | $94,458 |

Table (1)

Thus, the income statement of A Supermarket shows a departmental operating income (loss) of $92,478 and $16,610, and $(14,630) for grocery, meat, and produce departments respectively.

b.

Ascertain the gross profit percentage and operating income percentage for all the departments.

Explanation of Solution

Gross profit percentage: The percentage of gross profit generated by every dollar of net sales is referred to as gross profit percentage. This ratio measures the profitability of a company by quantifying the amount of income earned from sales revenue generated after cost of goods sold are paid. The higher the ratio, the more ability to cover operating expenses.

Formula to compute gross profit percentage:

Operating income percentage: This ratio gauges the operating profitability by quantifying the amount of operating income earned from business operations from the sales generated.

Formula of operating income percentage:

Ascertain the departmental gross profit percentage for all the departments.

| Departments | Departmental Gross Profit | ÷ | Sales | = | Departmental Gross Profit Percentage |

| Grocery | $420,978 | ÷ | $2,104,890 | = | 20% |

| Meat | 198,150 | ÷ | 660,500 | = | 30% |

| Produce | 138,320 | ÷ | 345,800 | = | 40% |

Table (2)

Note: Refer to Table (1) for the value and computation of departmental gross profit for all the departments.

Ascertain the operating income percentage for both the departments.

| Departments | Operating Income | ÷ | Sales | = | Operating Income Percentage |

| Grocery | $92,478 | ÷ | $2,104,890 | = | 4.4% |

| Meat | 16,610 | ÷ | 660,500 | = | 2.5% |

| Produce | (14,630) | ÷ | 345,800 | = | (4.2)% |

Table (3)

Note: Refer to Table (1) for the value and computation of operating income for all the departments.

Thus, the departmental gross profit percentage of Departments Grocery, Meat, and Produce is 20%, 30%, and 40%, and the operating income percentage of Departments Grocery, Meat, and Produce is 4.4%, 2.5% and (4.2)%.

2-a

Prepare an income statement for A Supermarket for the year ended December 31, 20--, showing the departmental direct operating margin for all the departments and the total company.

Explanation of Solution

Departmental direct operating margin: The departmental income statement reports the departmental direct operating margin, which is the excess of departmental gross profit over the direct operating expenses incurred.

Formula for departmental direct operating margin:

Prepare an income statement for A Supermarket for the year ended December 31, 20--, showing the departmental direct operating margin for all the departments and the total company.

| A Supermarket | ||||

| Income Statement | ||||

| For the Year Ended December 31, 20-- | ||||

| Grocery | Meat | Produce | Total | |

| Sales | $2,104,890 | $660,500 | $345,800 | $3,111,190 |

| Cost of goods sold | 1,683,912 | 462,350 | 207,480 | 2,353,742 |

| Gross profit | $420,978 | $198,150 | $138,320 | $757,448 |

| Direct operating expenses: | ||||

| Store clerks’ wages expense | $125,000 | $58,000 | $38,500 | $221,500 |

| Advertising expense | 25,000 | 38,500 | 18,400 | 81,900 |

| Depreciation expense-Equipment | 10,800 | 15,000 | 12,000 | 37,800 |

| Other operating expenses | 28,200 | 28,540 | 35,600 | 92,340 |

| Total operating expenses | 189,000 | 140,040 | 104,500 | 433,540 |

| Direct operating margin | $231,978 | $58,110 | $33,820 | $323,908 |

| Indirect operating expenses: | ||||

| Store clerks’ wages expense | $21,000 | |||

| Advertising expense | 10,000 | |||

| Depreciation expense-Equipment | 50,000 | |||

| Store rent | 100,000 | |||

| Other operating expenses | 48,450 | |||

| Total operating expenses | 229,450 | |||

| Operating income | $94,458 | |||

Table (4)

Thus, the income statement of A Supermarket shows a departmental direct operating margin of $231,978 and $58,110, and $33,820 for grocery, meat, and produce departments respectively, and total operating income of $94,458.

b.

Compute the departmental direct operating margin percentage of all the departments.

Explanation of Solution

Direct operating margin percentage: This ratio gauges the operating profitability by quantifying the amount of direct operating income earned from business operations from the sales generated.

Formula of direct operating margin percentage:

Ascertain the direct operating margin percentage for all the departments.

| Departments | Direct Operating Margin | ÷ | Sales | = | Direct Operating Margin Percentage |

| Grocery | $231,978 | ÷ | $2,104,890 | = | 11.0% |

| Meat | 58,110 | ÷ | 660,500 | = | 8.8% |

| Produce | 33,820 | ÷ | 345,800 | = | 9.8% |

Table (5)

Note: Refer to Table (4) for the value and computation of direct operating margin for all the departments.

Thus, the departmental direct operating margin percentage of grocery, meat, and produce departments is 11.0%, 8.8%, and 9.8% respectively.

3.

Explain whether B should be concerned about the profitability of A Supermarket and whether to discontinue any of the departments.

Explanation of Solution

B should not concerned of the profitability of any of the departments of A Supermarket because the operating income of the department produce might not be effective, but the direct operating margin of the department is $33,820. So, produce department should not be discontinued because the operating income of the company would be reduced by $33,820, the direct operating margin of the produce department.

Thus, none of the departments should be discontinued.

Want to see more full solutions like this?

Chapter 25 Solutions

College Accounting, Chapters 1-27

- INCOME STATE MENT WITH DEPARTMENTAL OPERATING INCOME AND TOTAL OPERATING INCOME Alexa Cole owns a business called Alexas Bakery. She has divided her business into two departments: breads and pastries. The following information is provided for the fiscal year ended June 30, 20--: REQUIRED 1. Prepare an income statement showing departmental operating income and total operating income. 2. Calculate departmental operating expense and operating income percentages.arrow_forwardINCOME STATEMENT WITH DEPART MENTAL GROSS PROFIT AND OPERATING INCOME Bacon and Hand Distributors has divided its business into two departments: retail sales and wholesale sales. The following information is provided for the year ended December 31, 20--: REQUIRED 1. Prepare an income statement showing departmental gross profit and total operating income. 2. Calculate departmental gross profit percentages.arrow_forwardINCOME STATEMENT WITH DEPART MENTAL GROSS PROFIT AND OPERATING INCOME Thomas and Hill Distributors has divided its business into two departments: commercial sales and industrial sales. The following information is provided for the year ended December 31, 20--: REQUIRED 1. Prepare an income statement showing departmental gross profit and total operating income. 2. Calculate departmental gross profit percentages.arrow_forward

- GROSS PROFIT SECTION OF DE PART MENT AL INCO ME ST ATE MENT Bill Walters and Alice Jennings are partners in a business called Walters and Jennings Sportswear that sells athletic footwear. They have organized the business on a departmental basis as follows: running shoes, walking shoes, and specialty shoes. At the end of the first year of operation, the sales and cost of goods sold for the three departments are as follows: Prepare the gross profit section of a departmental income statement for the year ended December 31, 20--. Show the gross profit for each department and for the business in total.arrow_forwardKanye Achebe just became the operations manager of Weston Transportation. Weston transports large crates for online companies and transports containers overseas. Kanye would like to evaluate each divisional manager on a basis similar to segmental reporting required by generally accepted accounting principles (GAAP) financial statements contained in annual reports. These data include a presentation of net sales, operating profit and loss before and after taxes, total identifiable assets, and depreciation for segment reported. Kanye thinks that evaluating business division managers by the same criteria as the total company is appropriate. A. Explain why you think the chief financial officer (CFO) disagrees and tells Kanye that publicly reporting information might demotivate managers. B. For better evaluation of the managers, what type of information should Kanye propose that the CFO might accept?arrow_forwardProfit center responsibility reporting for a service company Red Line Railroad Inc. has three regional divisions organized as profit centers. The chief executive officer (CEO) evaluates divisional performance, using operating income as a percent of revenues. The following quarterly income and expense accounts were provided from the trial balance as of December 31: The company operates three support departments: Shareholder Relations, Customer Support, and Legal. The Shareholder Relations Department conducts a variety of services for shareholders of the company. The Customer Support Department is the companys point of contact for new service, complaints, and requests for repair. The department believes that the number of customer contacts is a cost driver for this work. The Legal Department provides legal services for division management. The department believes that the number of hours billed is a cost driver for this work. The following additional information has been gathered: Instructions 1. Prepare quarterly income statements showing operating income for the three divisions. Use three column headings: East, West, and Central. 2. Identify the most successful division according to the profit margin. Round to the nearest whole percent. 3. Provide a recommendation to the CEO for a better method for evaluating the performance of the divisions. In your recommendation, identify the major weakness of the present method.arrow_forward

- Profit Center Responsibility Reporting Glades Sporting Goods Co. operates two divisions—the Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the trial balance as of December 31, 20Y8, the end of the fiscal year, after all adjustments, including those for inventories, were recorded and posted: Sales—Winter Sports Division $31,920,000 Sales—Summer Sports Division 35,264,000 Cost of Goods Sold—Winter Sports Division 19,152,000 Cost of Goods Sold—Summer Sports Division 20,368,000 Sales Expense—Winter Sports Division 5,472,000 Sales Expense—Summer Sports Division 4,864,000 Administrative Expense—Winter Sports Division 3,192,000 Administrative Expense—Summer Sports Division 3,131,200 Advertising Expense 1,025,000 Transportation Expense 400,400 Accounts Receivable Collection Expense 245,700 Warehouse Expense 3,040,000 The bases to be used in allocating expenses, together with other essential…arrow_forwardProfit Center Responsibility Reporting Championship Sports Inc. operates two divisions—the Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the trial balance as of December 31, 20Y9, the end of the fiscal year, after all adjustments, including those for inventories, were recorded and posted: Sales—Winter Sports Division $8,900,000 Sales—Summer Sports Division 16,400,000 Cost of Goods Sold—Winter Sports Division 5,000,000 Cost of Goods Sold—Summer Sports Division 9,000,000 Sales Expense—Winter Sports Division 650,000 Sales Expense—Summer Sports Division 1,200,000 Administrative Expense—Winter Sports Division 800,000 Administrative Expense—Summer Sports Division 1,450,000 Advertising Expense 1,090,000 Transportation Expense 192,000 Accounts Receivable Collection Expense 68,000 Warehouse Expense 1,800,000 The bases to be used in allocating expenses, together with other information, are as…arrow_forwardProfit Center Responsibility Reporting Glades Sporting Goods Co. operates two divisions—the Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the trial balance as of December 31, 20Y8, the end of the fiscal year, after all adjustments, including those for inventories, were recorded and posted: Sales—Winter Sports Division $24,255,000 Sales—Summer Sports Division 26,796,000 Cost of Goods Sold—Winter Sports Division 14,553,000 Cost of Goods Sold—Summer Sports Division 15,477,000 Sales Expense—Winter Sports Division 4,158,000 Sales Expense—Summer Sports Division 3,696,000 Administrative Expense—Winter Sports Division 2,425,500 Administrative Expense—Summer Sports Division 2,379,300 Advertising Expense 1,037,000 Transportation Expense 522,000 Accounts Receivable Collection Expense 250,200 Warehouse Expense 2,310,000 The bases to be used in allocating expenses, together with other essential…arrow_forward

- Profit Center Responsibility Reporting Glades Sporting Goods Co. operates two divisions—the Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the trial balance as of December 31, 20Y8, the end of the fiscal year, after all adjustments, including those for inventories, were recorded and posted: Sales—Winter Sports Division $12,600,000 Sales—Summer Sports Division 16,300,000 Cost of Goods Sold—Winter Sports Division 7,560,000 Cost of Goods Sold—Summer Sports Division 9,454,000 Sales Expense—Winter Sports Division 2,016,000 Sales Expense—Summer Sports Division 2,282,000 Administrative Expense—Winter Sports Division 1,260,000 Administrative Expense—Summer Sports Division 1,450,700 Advertising Expense 578,000 Transportation Expense 265,660 Accounts Receivable Collection Expense 174,000 Warehouse Expense 1,540,000 The bases to be used in allocating expenses, together with other essential…arrow_forwardProfit Center Responsibility Reporting Glades Sporting Goods Co. operates two divisions—the Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the trial balance as of December 31, 20Y8, the end of the fiscal year, after all adjustments, including those for inventories, were recorded and posted: Sales—Winter Sports Division $12,600,000 Sales—Summer Sports Division 16,300,000 Cost of Goods Sold—Winter Sports Division 7,560,000 Cost of Goods Sold—Summer Sports Division 9,454,000 Sales Expense—Winter Sports Division 2,016,000 Sales Expense—Summer Sports Division 2,282,000 Administrative Expense—Winter Sports Division 1,260,000 Administrative Expense—Summer Sports Division 1,450,700 Advertising Expense 578,000 Transportation Expense 265,660 Accounts Receivable Collection Expense 174,000 Warehouse Expense 1,540,000 The bases to be used in allocating expenses, together with other essential…arrow_forwardQuestion Content Area Profit center responsibility reporting Championship Sports Inc. operates two divisions—the Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the trial balance as of December 31, 20Y9, the end of the fiscal year, after all adjustments, including those for inventories, were recorded and posted: Line Item Description Amount Sales—Winter Sports Division $9,600,000 Sales—Summer Sports Division 15,000,000 Cost of Goods Sold—Winter Sports Division 5,500,000 Cost of Goods Sold—Summer Sports Division 9,500,000 Sales Expense—Winter Sports Division 780,000 Sales Expense—Summer Sports Division 1,000,000 Administrative Expense—Winter Sports Division 700,000 Administrative Expense—Summer Sports Division 1,440,000 Advertising Expense 1,099,000 Transportation Expense 150,000 Accounts Receivable Collection Expense 67,000 Warehouse Expense 966,000 The bases to be used in allocating…arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College