PRIN.OF CORPORATE FINANCE >BI<

12th Edition

ISBN: 9781260431230

Author: BREALEY

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 25, Problem 1PS

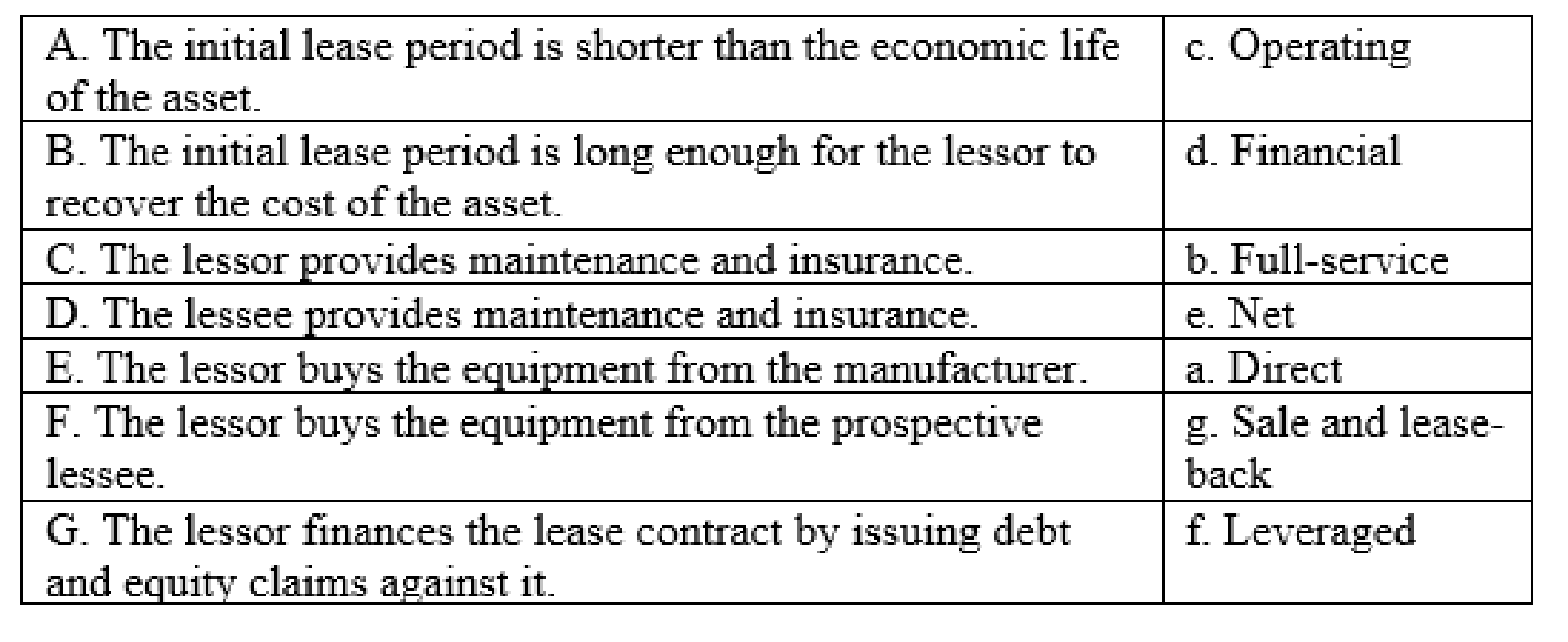

Types of lease* The following terms are often used to describe leases:

- a. Direct

- b. Full-service

- c. Operating

- d. Financial

- e. Net

- f. Leveraged

- g. Sale and lease-back

Match one or more of these terms with each of the following statements:

- A. The initial lease period is shorter than the economic life of the asset.

- B. The initial lease period is long enough for the lessor to recover the cost of the asset.

- C. The lessor provides maintenance and insurance.

- D. The lessee provides maintenance and insurance.

- E. The lessor buys the equipment from the manufacturer.

- F. The lessor buys the equipment from the prospective lessee.

- G. The lessor finances the lease contract by issuing debt and equity claims against it.

Expert Solution & Answer

Summary Introduction

To discuss: Match the given terms with the suitable statements.

Explanation of Solution

The given terms are matched with the appropriate statements as follows:

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

Which of the following statements is characteristic of leases?

a.If a lease is classified as an operating lease, the lessee records an asset on its statement of financial position.

b.Lease agreements are not a popular form of financing the purchase of assets because leases require a large initial outlay of cash.

c.If a lessor classifies a lease as a finance lease, the lessor records a lease liability on its statement of earnings.

d.Accounting recognizes two types of leases—operating and finance.

Which type of lease will not increase a company’s assets or long-term liabilities?

Select one:

a. A one-year operating lease

b. A lease for an asset of a specialized nature with no alternative use at the end of the lease term

c. A finance lease

d. A lease that transfers ownership of the asset to the lessee by the end of the lease term

(Comparison of Different Types of Accounting by Lessee and Lessor)Part 1: Capital leases and operating leases are the two classifications of leases described in FASB pronouncements from the standpoint of the lessee.Instructions(a) Describe how a capital lease would be accounted for by the lessee both at the inception of the lease and during the first year of the lease, assuming the lease transfers ownership of the property to the lessee by the end of the lease.(b) Describe how an operating lease would be accounted for by the lessee both at the inception of the lease and during the first year of the lease, assuming equal monthly payments are made by the lessee at the beginning of each month of the lease. Describe the change in accounting, if any, when rental payments are not made on a straight-line basis.Do not discuss the criteria for distinguishing between capital leases and operating leases.Part 2: Sales-type leases and direct-financing leases are two of the classifications of leases…

Chapter 25 Solutions

PRIN.OF CORPORATE FINANCE >BI<

Ch. 25 - Types of lease The following terms are often used...Ch. 25 - Reasons for leasing Some of the following reasons...Ch. 25 - Operating leases Explain why the following...Ch. 25 - Lease characteristics True or false? a. Lease...Ch. 25 - Lease treatment in bankruptcy What happens if a...Ch. 25 - Nonrecourse debt Lenders to leveraged leases hold...Ch. 25 - Operating leases Acme has branched out to rentals...Ch. 25 - Prob. 9PSCh. 25 - Prob. 10PSCh. 25 - Technological change and operating leases Look at...

Ch. 25 - Prob. 12PSCh. 25 - Taxes and leasing Look again at the bus lease...Ch. 25 - Taxes and leasing In Section 25-4 we showed that...Ch. 25 - Valuing financial leases A lease with a varying...Ch. 25 - Prob. 18PSCh. 25 - Valuing leases The Safety Razor Company has a...Ch. 25 - Lease treatment in bankruptcy How does the...Ch. 25 - Leveraged leases How would the lessee in Figure...Ch. 25 - Prob. 22PSCh. 25 - Valuing leases Suppose that the Greymare lease...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Use the following information to decide whether this equipment lease qualifies as an operating, sales-type, or direct financing lease to a lessor. a. There is no transfer of ownership at the end of the lease term. There is no bargain purchase option. The lease term is 60% of the economic life of the leased property. The present value of lease payments, including a residual value guaranteed by the lessee, is 100% of the fair value of the leased property to the lessor. The collectability of the lease payments is reasonably assured. The leased asset was not of a specialized nature. b. Same as (a), except that the residual value is guaranteed by a third party, not the lessee. The present value of the residual value guarantee is 15% of the fair value of the leased property. c. Same as (a), except that: the present value of the lease payments, including a residual value guaranteed by the lessee, is only 50% of the fair value of the leased asset. The collectability of the minimum lease payments is not predictable.arrow_forwardDefine each of the following terms: a. Lessee; lessor b. Operating lease; financial lease; sale-and-leaseback; combination lease; synthetic lease; SPE c. Offbalance sheet financing; capitalizing d. FASB Statement 13; ASU 2016-02 e. Guideline lease f. Residual value g. Lessees analysis; lessors analysis h. Net advantage to leasing (NAL) i. Alternative minimum tax (AMT)arrow_forwardA lease agreement whereby the lessor shall recognized gross profit at inception of the lease? a. Multi-agreement lease b. Direct finance lease c. Operating lease d. Dealers leasearrow_forward

- Initial direct costs incurred by the lessor under a sales-type lease should be a. Deferred and allocated over the economic life of the leased property. b. Expensed in the period incurred. c. Deferred and allocated over the term of the lease in proportion to the recognition of rental income. d. Added to the gross investment in the lease and amortized over the term of the lease as a yield adjustment.arrow_forwardThe difference of gross investment in the lease and net investment in the lease of the lessor is? A. Total amount of interest that the lessee shall recognized as interest expense over the lease term. B. Interest income at inception of the lease. C. Total amount of interest that the lessor shall recognized as interest income over the lease term. D. Initial direct cost.arrow_forwardWhich of the following statements is true about initial direct costs? A. Initial direct costs of a sales-type lease should be expensed at the commencement of the lease only if no selling profit or loss has been incurred. B. Initial direct costs are ownership-type costs such as insurance, maintenance, and taxes. C. Initial direct costs of an operating lease should be recorded by the lessor as a prepaid asset. D. Initial direct costs should always be debited against income by the lessor in the period of the inception of the lease.arrow_forward

- Which one of the following would normally lead to a lease being classified as an operating lease? a. The lease term is for a period of more than half of the expected economic life of the underlying asset. b. At the inception date of the lease agreement, the present value of the total lease payments is for an amount substantially less than the fair value of the underlying asset. c. The lease is cancellable, and all losses associated with the cancellation will be incurred by the lessee. d. It is reasonably certain at the inception date that the lessee will exercise an option to purchase the underlying asset at the end of the lease term for a price substantially lower than its expected fair value.arrow_forwardWhich of the following statements characterizes a sales-type lease? A)The lessor recognizes only interest revenue over the life of the asset.. B)The lessor recognizes only interest revenue over the lease term. C)The lessor recognizes a dealer profit at lease inception and interest revenue over the lease term. D)The lessor recognizes a dealer profit at lease inception and interest revenue over the useful life.arrow_forwardA lease is classified as financial because it meets the criteria that the term of the lease is more than 75% of the life of the leased asset. For how long should that asset be amortized? A) The term of the lease B) An average of the useful life and term of the lease C) It is not amortized because it is not the owner D) The useful life.arrow_forward

- Answer True or False Initial direct costs are immediately recognized as an expense by the lessor when the cost incurred in conjunction with an operating lease. Both finance and operating leases are subject to capitalization. Under an operating lease, the lease bonus paid by the lessee to the lessor and amortized over the lease term as a reduction to lease income. When rental payments vary over the term of the operating lease, the lessor should recognize lease income on a straight-line basis, unless there is another method that is more appropriate Initial direct costs are immediately recognized as an expense by the lessor when the cost incurred in conjunction with an operating lease. The lessor uses the implicit interest rate in determining the present value of the lease payments Termination penalties are included in the lease payments if the lease term reflects the lessee exercising an option to terminate the lease. In a sale and leaseback transaction that qualifies as a sale under…arrow_forwardIn a lease that is not classified as a manufacturer's lease, initial direct cost is a. added to the cost of the asset to get the gross investment in the lease. b. added to the cost of the liability to get the net investment in the lease. c. added to the cost of the liability to get the gross investment in the lease. d. added to the cost of the asset to get the net investment in the lease.arrow_forwardSee attached picture 1. Duscuss the nature of this lease in relation to the lessor and compute the amount of each of the following items: A. Lease receivable at inception of the lease B. Sales Price C. Cost of salesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Accounting for Finance and Operating Leases | U.S. GAAP CPA Exams; Author: Maxwell CPA Review;https://www.youtube.com/watch?v=iMSaxzIqH9s;License: Standard Youtube License