Corporate Finance: The Core, Student Value Edition Plus Mylab Finance With Pearson Etext -- Access Card Package (4th Edition)

4th Edition

ISBN: 9780134426785

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 27, Problem 4P

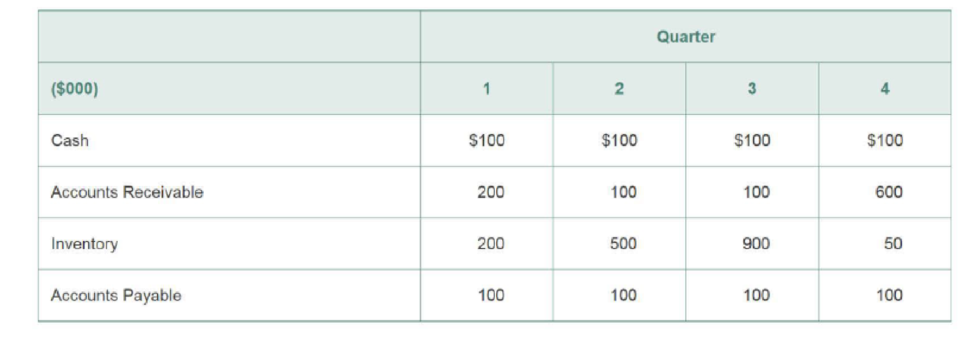

Quarterly working capital levels for your firm for the next year are included in the following table. What are the permanent working capital needs of your company? What are the temporary needs?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Towson Industries is considering an investment of $496,800 that is expected to generate returns of $150,000 per year for each of the next four years. What is the investment’s internal rate of return?

https://openstax.org/books/principles-managerial-accounting/pages/time-value-of-money

_________%

Your business partner has just presented to you a summary of projected costs and annual receipts for a new product line. He asks you to calculate the before-tax IRR & ERR for the investment opportunity. The company’s MARR = 15% quarterly. Is this investment justified?

A firm plans to invest in a new project that will last for four years and will generate revenues of $1,000,000 in year one, $1,300,000 in year two, $1,500,000 in year three and $1,250,000 in year four. The investment in Net Working Capital needs to be 15% of the revenue in the following time period. What is the cash flow from changes in Net Working Capital in year three?

Chapter 27 Solutions

Corporate Finance: The Core, Student Value Edition Plus Mylab Finance With Pearson Etext -- Access Card Package (4th Edition)

Ch. 27.1 - Prob. 1CCCh. 27.1 - What is the effect of seasonalities on short-term...Ch. 27.2 - Prob. 1CCCh. 27.2 - What is the difference between temporary and...Ch. 27.3 - Prob. 1CCCh. 27.3 - Describe common loan stipulations and fees.Ch. 27.4 - What is commercial paper?Ch. 27.4 - How is interest paid on commercial paper?Ch. 27.5 - Prob. 1CCCh. 27.5 - What is the difference between a floating lien and...

Ch. 27 - Prob. 1PCh. 27 - Sailboats Etc. is a retail company specializing in...Ch. 27 - What is the difference between permanent working...Ch. 27 - Quarterly working capital levels for your firm for...Ch. 27 - Prob. 5PCh. 27 - Prob. 6PCh. 27 - Prob. 7PCh. 27 - Prob. 8PCh. 27 - Which of the following one-year 1000 bank loans...Ch. 27 - The Needy Corporation borrowed 10,000 from Bank...Ch. 27 - Prob. 11PCh. 27 - Prob. 12PCh. 27 - Prob. 13PCh. 27 - The Signet Corporation has issued four-month...Ch. 27 - Prob. 15PCh. 27 - Prob. 16PCh. 27 - Prob. 17PCh. 27 - Prob. 18P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Estimate the required net operating working capital (NOWC) for each year and the cash flow due to changes in NOWC.arrow_forwardSuppose a firm estimates its overall cost of capital for the coming year to be 10%. What might be reasonable costs of capital for average-risk, high-risk, and low-risk projects?arrow_forwardThe following historical information is from Assisi Community Markets. Calculate the working capital and current ratio for each year. What observations do you make, and what actions might the owner consider taking?arrow_forward

- Towson Industries is considering an investment of $256,950 that is expected to generate returns of $90,000 per year for each of the next four years. What Is the Investments internal rate of return?arrow_forwardHernandez Corporation expects to have the following data during the coming year. What is Hernandez's expected ROE? (Show your work) Assets = $200,000 D/A = 65% EBIT = $25,000 Interest rate = 8% Tax rate = 40%arrow_forwardWhat is the rate of return on an investment of $10,606 if the company will receive $2,000 each year for the next 10 years? Please show work.arrow_forward

- The following three investment opportunities are available. The returns for each investment for each year vary, but the first cost of each is $20,000. Based on a future worth analysis, which investment is preferred? MARR is 9%/year.arrow_forwardNet Working CapitalIf your corporation's current assets are $350 and your current liabilities are $250, what is the net working capital for 2020? Please show your formula and calculations in the space provided.arrow_forwardConsider the following sets of investment projects, each of which has a three year investment life: Compute the net future worth of each project at i = 16%.arrow_forward

- For the investment situation below, identify the annual interest rate, the length of the investment in years, the periodic interest rate, and the number of periods of the investment. 8% compounded bi-monthly for 10 years What is the annual interest rate?arrow_forwardA firm has a liability cash flow of 100 at the end of year two and a second liability cash flow of 200 at the end of year three. The firm also has asset cash flows of X at the end of years one and five. Using an annual effective interest rate of 10%, calculate the absolute value of the difference between the Macaulay durations of the asset and liability cash flows.arrow_forwardCompute the Payback Period, Discounted Payback Period, Net Present Value, Internal Rate of Return, and Productivity Index of all four alternatives based on cash flow. use 10 percent for the cost of capital in the calculations. For the Payback Period and for the Discounted Payback Period, compute to the midyear points. ALL Information is in the PNGs!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License