PRIN.OF CORPORATE FINANCE >BI<

12th Edition

ISBN: 9781260431230

Author: BREALEY

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 29, Problem 27PS

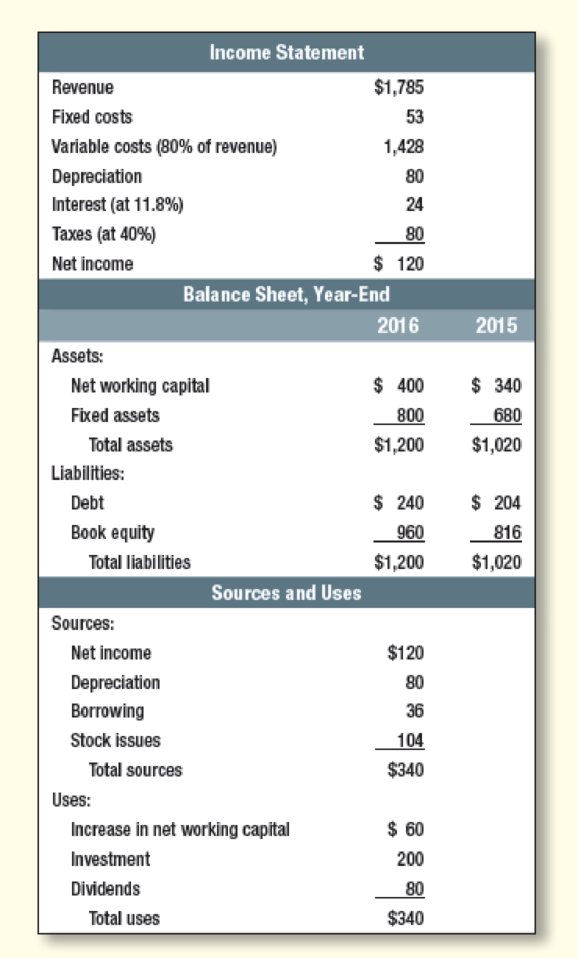

Long-term plans Table 29.19 shows the 2016 financial statements for the Executive Cheese Company. Annual

- a. Construct a model for Executive Cheese like the one in Tables 29.9 to 29.11.

- b. Use your model to produce a set of financial statements for 2017.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

You have looked at the current financial statements for J&R Homes, Company. The company has an EBIT of $3.35 million this year. Depreciation, the increase in net working capital, and capital spending were $295,000, $125,000, and $535,000, respectively. You expect that over the next five years, EBIT will grow at 15 percent per year, depreciation and capital spending will grow at 20 percent per year, and NWC will grow at 10 percent per year. The company has $19.5 million in debt and 400,000 shares outstanding. You believe that sales in Year 5 will be $45.5 million and the price-sales ratio will be 2.15. The company’s WACC is 8.6 percent and the tax rate is 22 percent.

What is the price per share of the company's stock?

You have looked at the current financial statements for J&R Homes, Company. The company has an EBIT of $4,350,000 this year. Depreciation, the increase in net working capital, and capital spending were $300,000, $148,000, and $550,000, respectively. You expect that over the next five years, EBIT will grow at 15 percent per year, depreciation and capital spending will grow at 20 per year, and NWC will grow at 10 per year. The company has $25,000,000 in debt and 455,000 shares outstanding. After Year 5, the adjusted cash flow from assets is expected to grow at 3.55 percent, indefinitely. The company’s WACC is 9.6 percent and the tax rate is 21 percent. What is the price per share of the company's stock?

PLEASE NEED THIS ASAP

You have looked at the current financial statements for Reigle Homes, Co. The company has an EBIT of $2,850,000 this year. Depreciation, the increase in net working capital, and capital spending were $225,000, $90,000, and $415,000, respectively. You expect that over the next five years, EBIT will grow at 16 percent per year, depreciation and capital spending will grow at 21 percent per year, and NWC will grow at 11 percent per year. The company has $15,100,000 in debt and 345,000 shares outstanding. You believe that sales in five years will be $22,600,000 and the price-sales ratio will be 2.4. The company’s WACC is 8.5 percent and the tax rate is 21 percent.

What is the price per share of the company's stock?

Chapter 29 Solutions

PRIN.OF CORPORATE FINANCE >BI<

Ch. 29 - Prob. 1PSCh. 29 - Prob. 2PSCh. 29 - Sources and uses of cash and working capital...Ch. 29 - Sources and uses of cash State whether each of the...Ch. 29 - Prob. 5PSCh. 29 - Forecasts of payables Dynamic Futon forecasts the...Ch. 29 - Prob. 8PSCh. 29 - Prob. 9PSCh. 29 - Prob. 10PSCh. 29 - Prob. 11PS

Ch. 29 - Cash cycle A firm is considering several policy...Ch. 29 - Prob. 13PSCh. 29 - Collections on receivables If a firm pays its...Ch. 29 - Short-term financial plans Which items in Table...Ch. 29 - Prob. 16PSCh. 29 - Short-term financial plans Work out a short-term...Ch. 29 - Prob. 18PSCh. 29 - Prob. 19PSCh. 29 - Long-term financial plans Corporate financial...Ch. 29 - Prob. 21PSCh. 29 - Long-term financial plans a. Use the Dynamic...Ch. 29 - Long-term plans The financial statements of Eagle...Ch. 29 - Forecast growth rate a. What is the internal...Ch. 29 - Forecast growth rate Bio-Plasma Corp. is growing...Ch. 29 - Long-term plans Table 29.19 shows the 2016...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Broussard Skateboard’s sales are expected to increase by 15% from $8 million in 2018 to $9.2 million in 2019. Its assets totaled $5 million at the end of 2018. Broussard is already at full capacity, so its assets must grow at the same rate as projected sales. At the end of 2018, current liabilities were $1.4 million, consisting of $450,000 of accounts payable, $500,000 of notes payable, and $450,000 of accruals. The after-tax profit margin is forecasted to be 6%, and the forecasted payout ratio is 40%. Use the AFN equation to forecast Broussard’s additional funds needed for the coming year.arrow_forwardLONG-TERM FINANCING NEEDED At year-end 2019, total assets for Arrington Inc. were 1.8 million and accounts payable were 450,000. Sales, which in 2019 were 3.0 million, are expected to increase by 25% in 2020. Total assets and accounts payable are proportional to sales, and that relationship will be maintained; that is, they will grow at the same rate as sales. Arrington typically uses no current liabilities other than accounts payable. Common stock amounted to 500,000 in 2019, and retained earnings were 475,000. Arrington plans to sell new common stock in the amount of 130,000. The firms profit margin on sates is 5%; 35% of earnings will be retained. a. What were Arringtons total liabilities in 2019? b. How much new long-term debt financing will be needed in 2020? (Hint: AFN - New stock = New long-term debt.)arrow_forwardLong-Term Financing Needed At year-end 2018, Wallace Landscapings total assets were 2.17 million, and its accounts payable were 560,000. Sales, which in 2018 were 3.5 million, are expected to increase by 35% in 2019. Total assets and accounts payable are proportional to sales, and that relationship will be maintained. Wallace typically uses no current liabilities other than accounts payable. Common stock amounted to 625,000 in 2018, and retained earnings were 395,000. Wallace has arranged to sell 195,000 of new common stock in 2019 to meet some of its financing needs. The remainder of its financing needs will be met by issuing new long-term debt at the end of 2019. (Because the debt is added at the end of the year, there will be no additional interest expense due to the new debt.) Its net profit margin on sales is 5%, and 45% of earnings will be paid out as dividends. a. What were Wallaces total long-term debt and total liabilities in 2018? b. How much new long-term debt financing will be needed in 2019? [Hint: AFN New stock = New long-term debt.)arrow_forward

- Smiley Corporations current sales and partial balance sheet are shown here. Sales are expected to grow by 10% next year. Assuming no change in operations from this year to next year, what are the projected spontaneous liabilities?arrow_forwardCost of Capital, Net Present Value Leakam Companys product engineering department has developed a new product that has a 3-year life cycle. Production of the product requires development of a new process that requires a current 100,000 capital outlay. The 100,000 will be raised by issuing 60,000 of bonds and by selling new stock for 40,000. The 60,000 in bonds will have net (after-tax) interest payments of 3,000 at the end of each of the 3 years, with the principal being repaid at the end of Year 3. The stock issue carries with it an expectation of a 17.5% return, expressed in the form of dividends at the end of each year (with 7,000 in dividends expected for each of the next 3 years). The sources of capital for this investment represent the same proportion and costs that the company typically has. Finally, the project will produce after-tax cash inflows of 50,000 per year for the next 3 years. Required: 1. Compute the cost of capital for the project. (Hint: The cost of capital is a weighted average of the two sources of capital, where the weights are the proportion of capital from each source.) 2. CONCEPTUAL CONNECTION Compute the NPV for the project. Explain why it is not necessary to subtract the interest payments and the dividend payments and appreciation from the inflow of 50,000 in carrying out this computation.arrow_forwardAssume that today is December 31, 2019, and that the following information applies to Abner Airlines: After-tax operating income [EBIT(1 - T)] for 2020 is expected to be $650 million. The depreciation expense for 2020 is expected to be $70 million. The capital expenditures for 2020 are expected to be $250 million. No change is expected in net operating working capital. The free cash flow is expected to grow at a constant rate of 7% per year. The required return on equity is 15%. The WACC is 11%. The firm has $198 million of non-operating assets. The market value of the company's debt is $3.450 billion. 330 million shares of stock are outstanding. Using the corporate valuation model approach, what should be the company's stock price today? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License