PRIN.OF CORPORATE FINANCE (LL) >CUSTOM<

12th Edition

ISBN: 9781260439137

Author: BREALEY

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 29, Problem 27PS

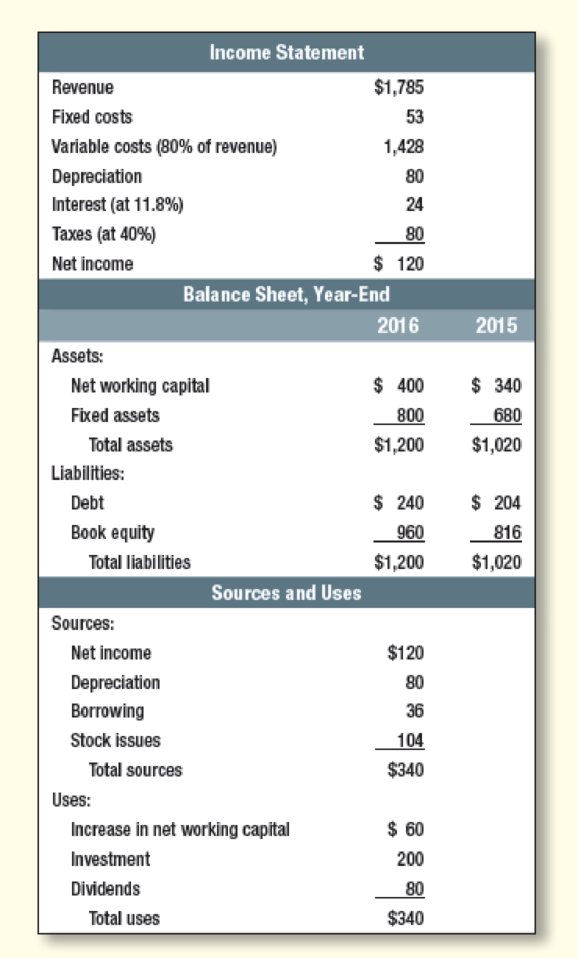

Long-term plans Table 29.19 shows the 2016 financial statements for the Executive Cheese Company. Annual

- a. Construct a model for Executive Cheese like the one in Tables 29.9 to 29.11.

- b. Use your model to produce a set of financial statements for 2017.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

For the year ending December 31, 2017, sales for Company Y were $72.11 billion. Beginning January 1, 2018 Company Y plans to invest 8.5% of their sales

amount each year and they expect their sales to increase by 7% each year over the next three years.

Company Y invests into an account earning an APR of 2.0% compounded continuously. Assume a continuous income stream.

How much money will be in the investment account on December 31, 2020?

Round your answer to three decimal places.

X billion dollars

How much money did Company Y invest in the account between January 1, 2018 and December 31, 2020?

Round your answer to three decimal places.

billion dollars

How much interest did Company Y earn on this investment between January 1, 2018 and December 31, 2020?

Round your answer to three decimal places. If intermediate values are used, be sure to use the unrounded values to determine the answer.

billion dollars

TEACHER

Submit Answer

For the year ending December 31, 2017, sales for Company Y were $78.51 billion. Beginning January 1, 2018 Company Y plans to invest 7.5% of their sales amount each year and they expect their sales to increase by 4% each year over the next three years.

Company Y invests into an account earning an APR of 2.0% compounded continuously. Assume a continuous income stream.

How much money will be in the investment account on December 31, 2020?

Round your answer to three decimal places.

84.762 X billion dollars

How much money did Company Y invest in the account between January 1, 2018 and December 31, 2020?

Round your answer to three decimal places.

billion dollars

How much interest did Company Y earn on this investment between January 1, 2018 and December 31, 2020?

Round your answer to three decimal places. If intermediate values are used, be sure to use the unrounded values to determine the answer.

billion dollars

Submit Answer

For the year ending December 31, 2017, sales for Corporation Y were $68.01 billion. Beginning January 1, 2018 Corporation Y plans to invest 7.5% of their sales amount each year and they expect their sales to

increase by 6% each year over the next three years.

Corporation Y invests into an account earning an APR of 1.4% compounded continuously. Assume a continuous income stream.

How much money will be in the investment account on December 31, 2020?

Round your answer to three decimal places.

billion dollars

How much money did Company Y invest in the account between January 1, 2018 and December 31, 2020?

Round your answer to three decimal places.

billion dollars

How much interest did Company Y earn between January 1, 2018 and December 31, 2020?

Round your answer to three decimal places. If intermediate values are used, be sure to use the unrounded values to determine the answer.

billion dollars

Submit Answer

View Previous Question Question 10 of 10

Home

My Assignments

+Request Extension…

Chapter 29 Solutions

PRIN.OF CORPORATE FINANCE (LL) >CUSTOM<

Ch. 29 - Prob. 1PSCh. 29 - Prob. 2PSCh. 29 - Sources and uses of cash and working capital...Ch. 29 - Sources and uses of cash State whether each of the...Ch. 29 - Prob. 5PSCh. 29 - Forecasts of payables Dynamic Futon forecasts the...Ch. 29 - Prob. 8PSCh. 29 - Prob. 9PSCh. 29 - Prob. 10PSCh. 29 - Prob. 11PS

Ch. 29 - Cash cycle A firm is considering several policy...Ch. 29 - Prob. 13PSCh. 29 - Collections on receivables If a firm pays its...Ch. 29 - Short-term financial plans Which items in Table...Ch. 29 - Prob. 16PSCh. 29 - Short-term financial plans Work out a short-term...Ch. 29 - Prob. 18PSCh. 29 - Prob. 19PSCh. 29 - Long-term financial plans Corporate financial...Ch. 29 - Prob. 21PSCh. 29 - Long-term financial plans a. Use the Dynamic...Ch. 29 - Long-term plans The financial statements of Eagle...Ch. 29 - Forecast growth rate a. What is the internal...Ch. 29 - Forecast growth rate Bio-Plasma Corp. is growing...Ch. 29 - Long-term plans Table 29.19 shows the 2016...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Broussard Skateboard’s sales are expected to increase by 15% from $8 million in 2018 to $9.2 million in 2019. Its assets totaled $5 million at the end of 2018. Broussard is already at full capacity, so its assets must grow at the same rate as projected sales. At the end of 2018, current liabilities were $1.4 million, consisting of $450,000 of accounts payable, $500,000 of notes payable, and $450,000 of accruals. The after-tax profit margin is forecasted to be 6%, and the forecasted payout ratio is 40%. Use the AFN equation to forecast Broussard’s additional funds needed for the coming year.arrow_forwardFor the year ending December 31, 2017, sales for Corporation Y were $63.21 billion. Beginning January 1, 2018 Corporation Y plans to invest 8.5% of their sales amount each year and they expect their sales to increase by 5% each year over the next three years. Corporation Y invests into an account earning an APR of 1.4% compounded continuously. Assume a continuous income stream. How much money will be in the investment account on December 31, 2020? Round your answer to three decimal places. billion dollars How much money did Company Y invest in the account between January 1, 2018 and December 31, 2020? Round your answer to three decimal places. billion dollars How much interest did Company Y earn between January 1, 2018 and December 31, 2020? Round your answer to three decimal places. If intermediate values are used, be sure to use the unrounded values to determine the answer. billion dollarsarrow_forwardFor the year ending December 31, 2017, sales for Corporation Y were $65.21 billion. Beginning January 1, 2018 Corporation Y plans to invest 8.5% of their sales amount each year and they expect their sales to increase by 4% each year over the next three years. Corporation Y invests into an account earning an APR of 2.2% compounded continuously. Assume a continuous income stream. How much money will be in the investment account on December 31, 2020? Round your answer to three decimal places. x billion dollars How much money did Company Y invest in the account between January 1, 2018 and December 31, 2020? Round your answer to three decimal places. billion dollars How much interest did Company Y earn between January 1, 2018 and December 31, 2020? Round your answer to three decimal places. If intermediate values are used, be sure to use the unrounded values to determine the answer. billion dollarsarrow_forward

- For the year ending December 31, 2017, sales for Company Y were $65.71 billion. Beginning January 1, 2018 Company Y plans to invest 6.5% of their sales amount each year and they expect their sales to increase by 4% each year over the next three years. Company Y invests into an account earning an APR of 1.9% compounded continuously. Assume a continuous income stream. How much money will be in the investment account on December 31, 2020? Round your answer to three decimal places. billion dollars How much money did Company Y invest in the account between January 1, 2018 and December 31, 2020? Round your answer to three decimal places. billion dollars How much interest did Company Y earn on this investment between January 1, 2018 and December 31, 2020? Round your answer to three decimal places. If intermediate values are used, be sure to use the unrounded values to determine the answer. billion dollars Submit Answerarrow_forwardFor the year ending December 31, 2017, sales for Corporation Y were $67.81 billion. Beginning January 1, 2018 Corporation Y plans to invest 9.5% of their sales amount each year and they expect their sales to increase by 7% each year over the next three years.Corporation Y invests into an account earning an APR of 2.0% compounded continuously. Assume a continuous income stream.How much money will be in the investment account on December 31, 2020?Round your answer to three decimal places.billion dollarsHow much money did Company Y invest in the account between January 1, 2018 and December 31, 2020?Round your answer to three decimal places.billion dollarsarrow_forwardFor the year ending December 31, 2017, sales for Corporation Y were $67.81 billion. Beginning January 1, 2018 Corporation Y plans to invest 9.5% of their sales amount each year and they expect their sales to increase by 7% each year over the next three years. Corporation Y invests into an account earning an APR of 2.0% compounded continuously. Assume a continuous income stream. How much money will be in the investment account on December 31, 2020?Round your answer to three decimal places.billion dollarsHow much money did Company Y invest in the account between January 1, 2018 and December 31, 2020? Round your answer to three decimal places.billion dollarsHow much interest did Company Y earn between January 1, 2018 and December 31, 2020? Round your answer to three decimal places. If intermediate values are used, be sure to use the unrounded values to determine the answer.billion dollarsarrow_forward

- For the year ending December 31, 2017, sales for Company Y were $73.91 billion. Beginning January 1, 2018 Company Y plans to invest 9.5% of their sales amount each year and they expect their sales to increase by 4% each year over the next three years.Company Y invests into an account earning an APR of 2.2% compounded continuously. Assume a continuous income stream.How much money will be in the investment account on December 31, 2020?Round your answer to three decimal places. billion dollarsHow much money did Company Y invest in the account between January 1, 2018 and December 31, 2020?Round your answer to three decimal places. billion dollarsHow much interest did Company Y earn on this investment between January 1, 2018 and December 31, 2020?Round your answer to three decimal places. If intermediate values are used, be sure to use the unrounded values to determine the answer. billion dollarsarrow_forwardFor the year ending December 31, 2017, sales for Company Y were $62.91 billion. Beginning January 1, 2018 Company Y plans to invest 8.5% of their sales amount each year and they expect their sales to increase by 5% each year over the next three years. Company Y invests into an account earning an APR of 2.0% compounded continuously. Assume a continuous income stream How much money will be in the investment account on December 31, 2020? Round your answer to three decimal places. 17.306 x billion dollars How much money did Company Y invest in the account between January 1, 2018 and December 31, 20207 Round your answer to three decimal places. 16.858 x billion dollars How much interest did Company Y earn on this investment between January 1, 2018 and December 31, 2020? Round your answer to three decimal places. If intermediate values are used, be sure to use the unrounded values to determine the answer 447 x billion dollarsarrow_forwardRentz Corporation is investigating the optimal level of current assets for the coming year. Management expects sales to increase to approximately $4 million as a result of an asset expansion presently being undertaken. Fixed assets total $1 million, and the firm plans to maintain a 60% debt-to-assets ratio. Rentz's interest rate is currently 10% on both short- term and long-term debt (which the firm uses in its permanent structure). Three alternatives regarding the projected current assets level are under consideration: (1) a restricted policy where current assets would be only 45% of projected sales, (2) a moderate policy where current assets would be 50% of sales, and (3) a relaxed policy where current assets would be 60% of sales. Earnings before interest and taxes should be 13% of total sales, and the federal-plus-state tax rate is 40%. a. What is the expected return on equity under each current assets level? Round your answers to two decimal places. Restricted policy Moderate…arrow_forward

- ABC Limited is investigating the optimal level of current assets for the coming year. Management expects sales to increase to approximately $2 million as a result of an asset expansion presently being undertaken. Fixes assets total $1 million, and the firm plans to maintain a 60% debt-to- assets ratio. ABC Limited’s weighted average interest rate is currently 8% on short- and long-term debt (which the firm uses in its permanent structure). Three alternatives regarding the projected current assets level are under consideration: (1) a restricted policy where current assets would be only 45% of projected sales, (2) a moderate policy where current assets would be 50% of sales, and (3) a relaxed policy where current assets would be 60% of sales. Earnings before interest and taxes should be 12% of total sales, and the profits tax rate is 40%.(Assumption: debt = liabilities, debt-to-assets = total liabilities / total assets) What is the expected return on equity under each current assets…arrow_forwardCURRENT ASSETS INVESTMENT POLICY Rentz Corporation is investigating the optimallevel of current assets for the coming year. Management expects sales to increase toapproximately $2 million as a result of an asset expansion presently being undertaken.Fixed assets total $1 million, and the firm plans to maintain a 60% debt-to-assets ratio.Rentz’s interest rate is currently 5% on both short- and long-term debt (which the firm uses in its permanent structure). Three alternatives regarding the projected current assets level are under consideration: (1) a restricted policy where current assets would be only 45% of projected sales, (2) a moderate policy where current assets would be 50% of sales, and (3) a relaxed policy where current assets would be 60% of sales. Earnings before interest and taxes should be 12% of total sales, and the federal-plus-state tax rate is 25%.a. What is the expected return on equity under each current assets level?b. In this problem, we assume that expected sales…arrow_forwardRentz Corporation is investigating the optimal level of current assets for the coming year. Management expects sales to increase to approximately $2 million as a result of an asset expansion presently being undertaken. Fixed assets total $3 million, and the firm plans to maintain a 60% debt-to-assets ratio. Rentz's interest rate is currently 10% on both short-term and long-term debt (which the firm uses in its permanent structure). Three alternatives regarding the projected current assets level are under consideration: (1) a restricted policy where current assets would be only 45% of projected sales, (2) a moderate policy where current assets would be 50% of sales, and (3) a relaxed policy where current assets would be 60% of sales. Earnings before interest and taxes should be 11% of total sales, and the federal-plus- state tax rate is 40%. a. What is the expected return on equity under each current assets level? Round your answers to two decimal places. Restricted policy Moderate…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License