Concept explainers

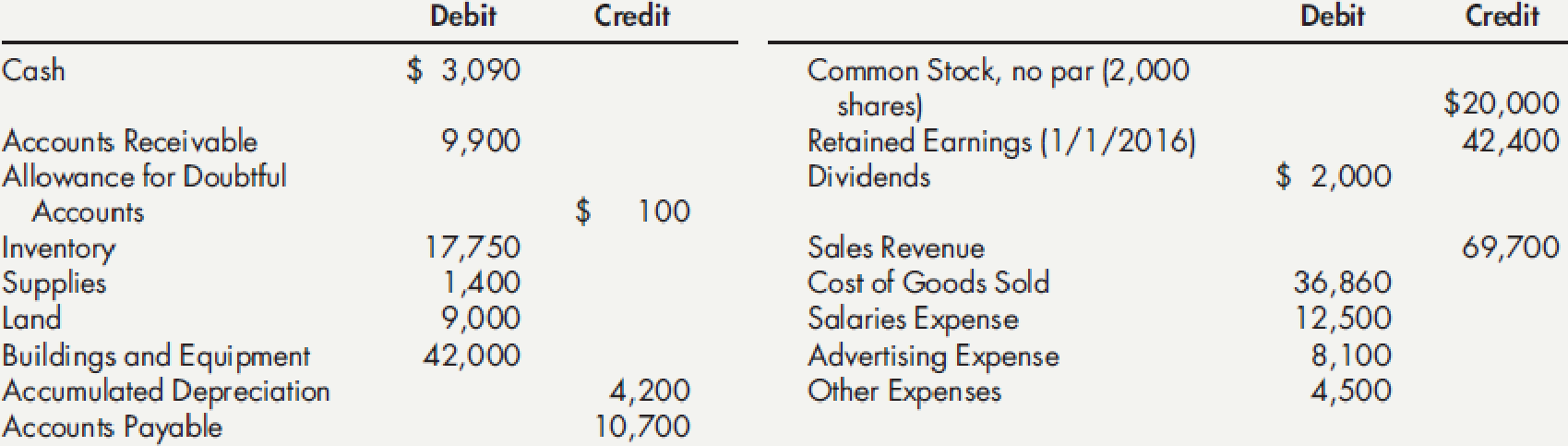

Comprehensive On November 30, 2016, Davis Company had the following account balances:

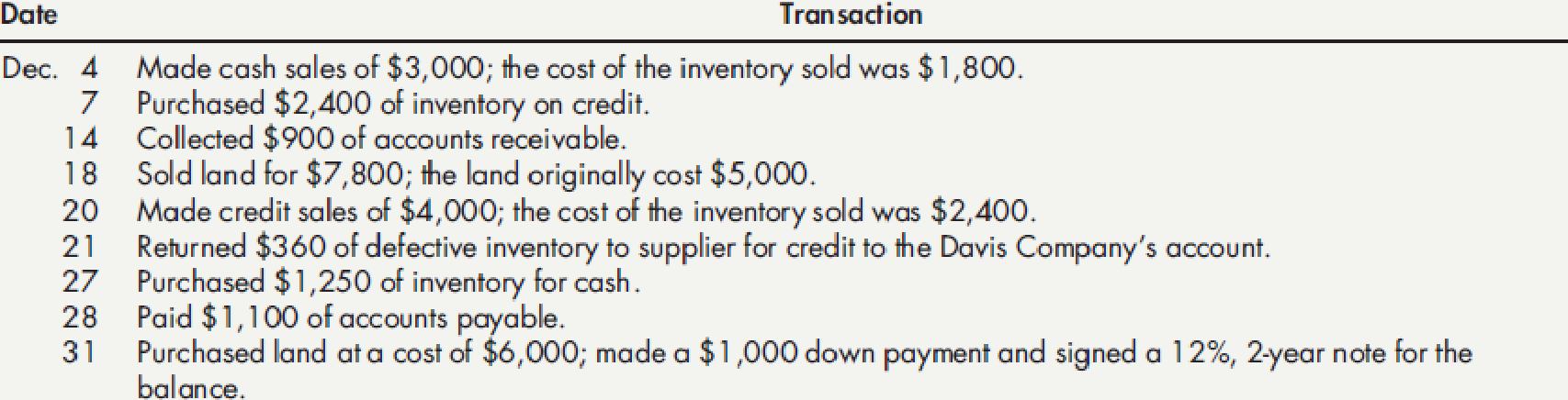

During the month of December, Davis entered into the following transactions:

Required:

- 1. Prepare general

journal entries to record the preceding transactions. - 2. Post to general ledger T-accounts.

- 3. Prepare a year-end

trial balance on a worksheet and complete the worksheet using the following information: (a) accrued salaries at year-end total $1,200; (b) for simplicity, the building and equipment are beingdepreciated using the straight-line method over an estimated life of 20 years with no residual value; (c) supplies on hand at the end of the year total $630; (d)bad debts expense for the year totals $830; and (e) the income tax rate is 30%; income taxes are payable in the first quarter of 2017. - 4. Prepare the company’s financial statements for 2016.

- 5. Prepare the 2016 (a) adjusting and (b) closing entries in the general journal.

1.

Prepare the journal entries to record the given transactions.

Explanation of Solution

Accounting rules for journal entries:

- To record the increase of balance in account: Debit assets, expenses, losses and credit liabilities, capital, revenue and gains.

- To record the decrease of balance in account: Credit assets, expenses, losses and debit liabilities, capital, revenue and gains.

Prepare the journal entries to record the given transactions:

| Date | Account Title and Explanation | Debit($) | Credit($) |

| December 4 | Cash | 3,000 | |

| Sales Revenue | 3,000 | ||

| (To record the cash sales) | |||

| December 4 | Cost of Goods Sold | 1,800 | |

| Inventory | 1,800 | ||

| (To record the cost of ale) | |||

| December 7 | Inventory | 2,400 | |

| Accounts Payable | 2,400 | ||

| (To record the purchase of inventory on account) | |||

| December 14 | Cash | 900 | |

| Accounts Receivable | 900 | ||

| (To record amount of accounts receivable collected) | |||

| December 18 | Cash | 7,800 | |

| Gain on sale of land | 2,800 | ||

| Land | 5,000 | ||

| (To record the gain on sale of land) | |||

| December 20 | Accounts Receivable | 4,000 | |

| Sales Revenue | 4,000 | ||

| (To record the credit sales) | |||

| December 20 | Cost of goods sold | 2,400 | |

| Inventory | 2,400 | ||

| (To record the cost of goods sold) | |||

| December 21 | Accounts Payable | 360 | |

| Inventory | 360 | ||

| (To record the returned defective merchandise for credit) | |||

| December 27 | Inventory | 1,250 | |

| Cash | 1,250 | ||

| (To record purchased inventory for cash) | |||

| December 28 | Accounts payable | 1,100 | |

| Cash | 1,100 | ||

| (To record accounts payable amount paid) | |||

| December 31 | Land | 6,000 | |

| Cash | 1,000 | ||

| Notes Payable | 5,000 | ||

| (To record the purchase of land by paying cash and issuing 12% of note) |

Table (1)

2.

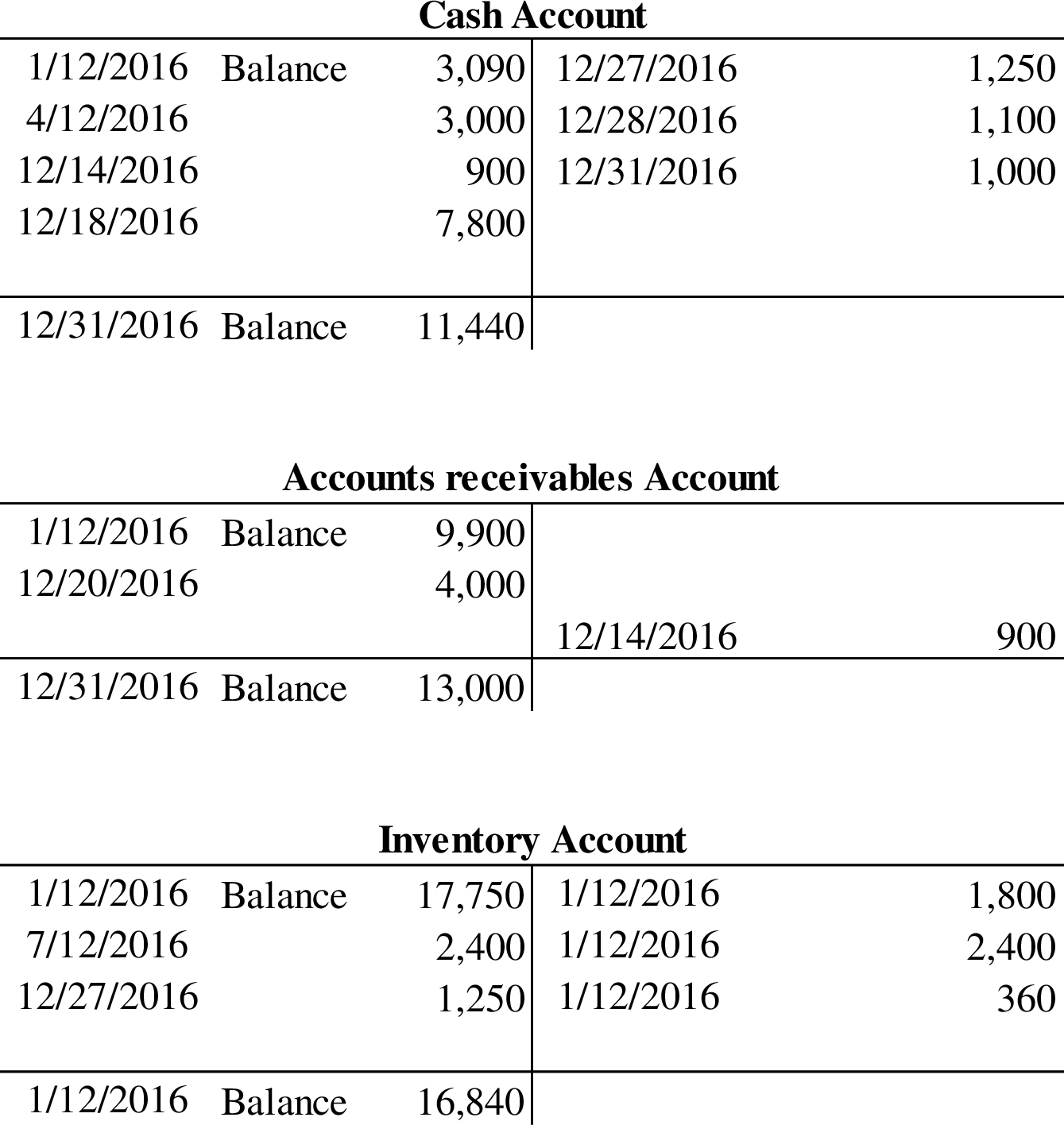

Post the part 1 entries to general ledger T-Accounts.

Explanation of Solution

T-account: T-account is the form of the ledger account, where the journal entries are posted to this account. It is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.

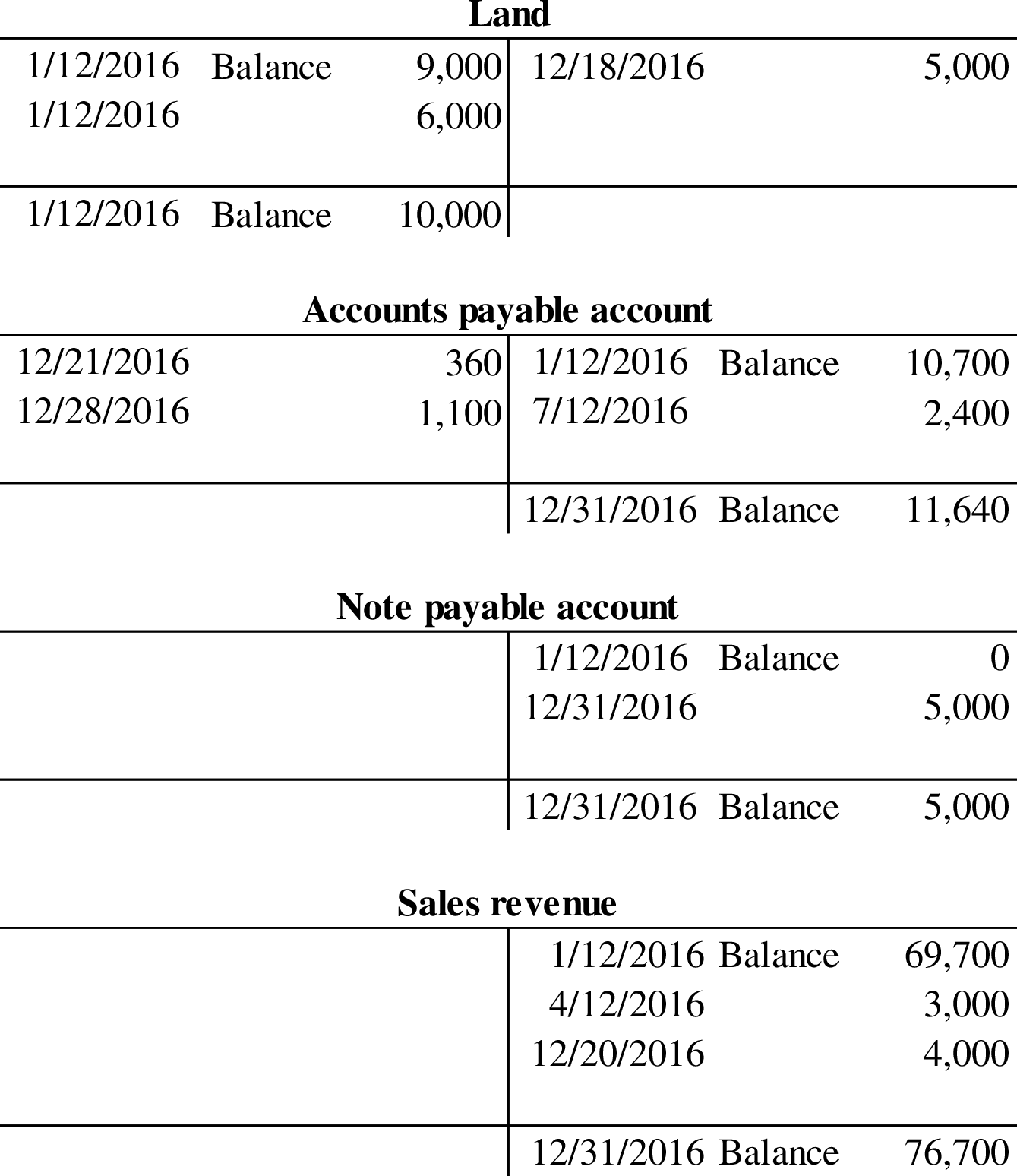

Post the part 1 entries to general ledger T-Accounts:

3.

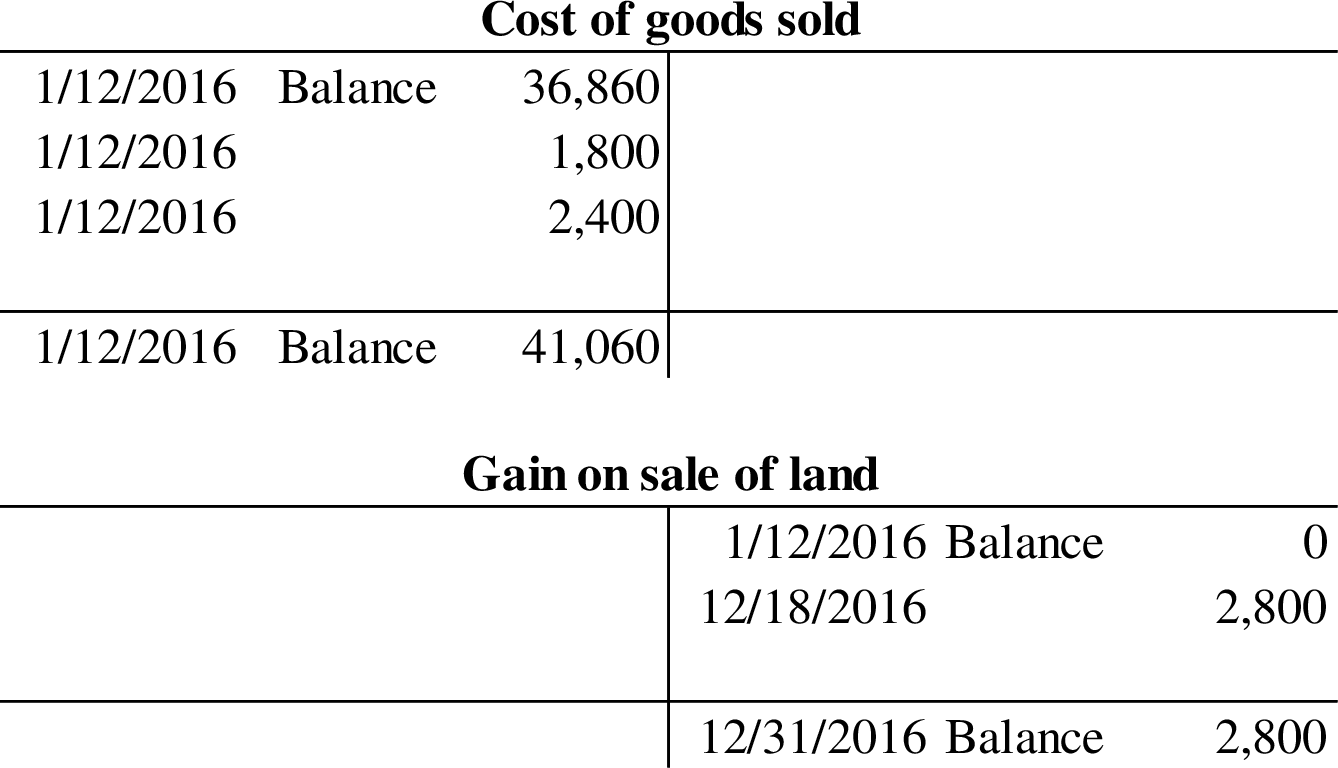

Prepare the worksheet with the given information.

Explanation of Solution

Prepare the worksheet with the given information:

Worksheet: A worksheet is a tool that is used while preparing a financial statement. It is a type of form, having multiple columns and it is used in the adjustment process.

Table (2)

4.

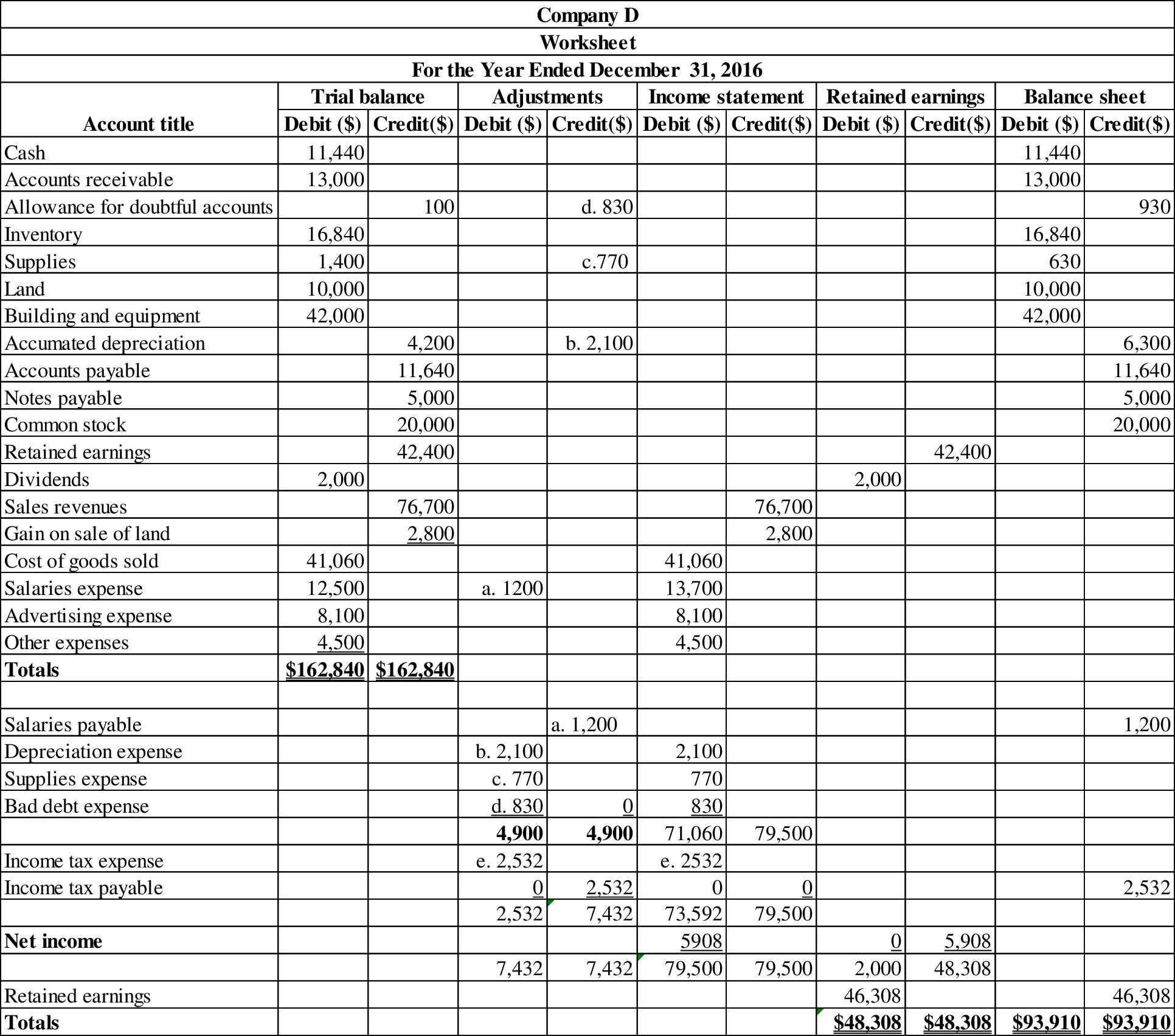

Prepare the financial statements of Company D.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare income statement:

| Company D | ||

| Income statement | ||

| For the Year Ended December 31, 2016 | ||

| Particulars | Amount($) | Amount($) |

| Sales revenue | 76,700 | |

| Less: Cost of goods sold | (41,060) | |

| Gross profit | 35,640 | |

| Less: Operating expenses: | ||

| Salaries expense | 13,700 | |

| Advertising expense | 8,100 | |

| Depreciation expense | 2,100 | |

| Supplies expense | 770 | |

| Bad debt expense | 830 | |

| Other expenses | 4,500 | |

| Total operating expense | (30,000) | |

| Income from operations | 5,640 | |

| Other items: | ||

| Gain on sale of land | 2,800 | |

| Income before income taxes | 8,440 | |

| Less: Income tax expense | (2,532) | |

| Net income | $5,908 | |

| Earnings per share | $2.95 | |

Table (3)

Statement of Retained Earnings: Statement of retained earnings shows, the changes in the retained earnings, and the income left in the company after payment of the dividends, for the accounting period.

Prepare statement of retained earnings:

| D Company | ||

| Statement of Retained Earnings | ||

| For the Year Ended December 31, 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Retained earnings, January 1, 2016 | 42,400 | |

| Add: Net income | 5,908 | |

| Subtotal | 48,308 | |

| Less: Dividends | (2,000) | |

| Retained earnings at December 31, 2016 | $46,308 | |

Table (4)

Balance Sheet: Balance Sheet is one of the financial statements which summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare the balance sheet:

| Company D | ||

| Balance Sheet | ||

| At December 31, 2016 | ||

| Assets | ||

| Current assets: | Amount ($) | Amount ($) |

| Cash | 11,440 | |

| Accounts receivable | 13,000 | |

| Less: Allowance for doubt accounts | (930) | 12,070 |

| Inventory | 16,840 | |

| Supplies | 630 | |

| Total current assets | 40,980 | |

| Property, plant and equipment: | ||

| Land | 10,000 | |

| Building and equipment | 42,000 | |

| Less: Accumulated depreciation | (6,300) | 35,700 |

| Net property, plant and equipment | 45,700 | |

| Total assets | $86,680 | |

| Liabilities | ||

| Current liabilities: | ||

| Accounts payable | 11,640 | |

| Salaries payable | 1,200 | |

| Income taxes payable | 2,532 | |

| Total liabilities | ||

| Long-term liabilities: | 15,372 | |

| Notes payable due 31/12/18 | 5,000 | |

| Shareholders’ Equity | ||

| Contributed Capital: | ||

| Common stock | 20,000 | |

| Retained earnings | 46,308 | |

| Total shareholders’ equity | 66,308 | |

| Total liabilities and shareholders’ equity | $86,680 | |

Table (5)

5 (a)

Prepare adjusting entries for the year 2016.

Explanation of Solution

Adjusting entries: Adjusting entries are the journal entries which are recorded at the end of the accounting period to correct or adjust the revenue and expense accounts, to concede with the accrual principle of accounting.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Prepare adjusting entries for the year 2016:

| Date | Accounts title and explanation | Debit ($) | Credit ($) |

| 2016 | Salaries Expense | 1,200 | |

| December 31 | Salaries Payable | 1,200 | |

| (To record the amount of accrued salaries for the period) | |||

| 2016 | Depreciation Expense | 2,100 | |

| December 31 | Accumulated Depreciation - Building and Equipment | 2,100 | |

| (To record the amount of depreciation expense for the period) | |||

| 2016 | Supplies Expense | 770 | |

| December 31 | Supplies | 770 | |

| (To record the amount of supplies used during the period) | |||

| 2016 | Bad debt expense | 830 | |

| December 31 | Allowance for Doubtful Accounts | 830 | |

| (To record the bad debt expense for the period) | |||

| 2016 | Income Tax Expense | 2,532 | |

| December 31 | Income Tax Payable | 2,532 | |

| (To record the income tax liability on earnings |

Table (6)

5 (b)

Prepare the closing entries for December 31, 2016.

Explanation of Solution

Closing entries: Closing entries are those journal entries, which are passed to transfer the final balances of temporary accounts such as revenues account, expenses account and dividend account to the retained earnings account. Closing entries produce a zero balance in each temporary account.

Prepare the closing entries for December 31, 2016.

| Date | Accounts title and explanation | Debit | Credit |

| ($) | ($) | ||

| December 31, 2016 | Sales Revenue | 76,700 | |

| Gain on Sale of Land | 2,800 | ||

| Income Summary | 79,500 | ||

| (To close the revenue accounts) | |||

|

December 31, 2016 | Income Summary | 73,592 | |

| Cost of Goods Sold | 41,060 | ||

| Salaries Expense | 13,700 | ||

| Advertising Expense | 8,100 | ||

| Depreciation Expense | 2,100 | ||

| Supplies Expense | 770 | ||

| Bad Debt Expense | 830 | ||

| Other Expense | 4,500 | ||

| Income Tax Expense | 2,532 | ||

| (To close the expense accounts) | |||

| December 31, 2016 | Income Summary | 5,908 | |

| Retained Earnings | 5,908 | ||

| (To close the income summary account) | |||

| December 31, 2016 | Retained Earnings | 2,000 | |

| Dividends | 2,000 | ||

| (To close the dividends account) |

Table (7)

Want to see more full solutions like this?

Chapter 3 Solutions

Bundle: Intermediate Accounting: Reporting And Analysis, 2017 Update, Loose-leaf Version, 2nd + Lms Integrated Cengagenowv2, 2 Terms Printed Access Card

- The following accounts appear in the ledger of Celso and Company as of June 30, the end of this fiscal year. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. Required 1. Prepare a work sheet for the fiscal year ended June 30. Ignore this step if using CLGL. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. 7. Journalize the reversing entry as of July 1, for the wages that were accrued in the June adjusting entry. Check Figure Net income, 14,066arrow_forwardThe following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2019: Instructions 1. Prepare a multiple-step income statement. 2. Prepare a statement of owners equity. 3. Prepare a balance sheet, assuming that the current portion of the note payable is 50,000. 4. Briefly explain how multiple-step and single-step income statements differ.arrow_forwardThe transactions completed by AM Express Company during March 2016, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March 2016, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals, and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forward

- The following accounts appear in the ledger of Sheldon Company on January 31, the end of this fiscal year. The data needed for adjustments on January 31 are as follows: ab.Merchandise inventory, January 31, 55,750. c.Insurance expired for the year, 1,285. d.Depreciation for the year, 5,482. e.Accrued wages on January 31, 1,556. f.Supplies used during the year 1,503. Required 1. Prepare a work sheet for the fiscal year ended January 31. Ignore this step if using QuickBooks or general ledger. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. Ignore this step if using CLGL. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. Check Figure Net loss, 1,737arrow_forwardPrepare journal entries to record the following transactions for the month of November: A. on first day of the month, issued common stock for cash, $20,000 B. on third day of month, purchased equipment for cash, $10,500 C. on tenth day of month, received cash for accounting services, $14,250 D. on fifteenth day of month, paid miscellaneous expenses, $3,200 E. on last day of month, paid employee salaries, $8,600arrow_forwardReconstructing a Beginning Account Balance During the month, services performed for customers on account amounted to $7,500 and collections from customers in payment of their accounts totaled $6,000. At the end of the month, the Accounts Receivable account had a balance of $2,500. What was the Accounts Receivable balance at the beginning of the month?arrow_forward

- Prepare journal entries to record the following transactions that occurred in March: A. on first day of the month, purchased building for cash, $75,000 B. on fourth day of month, purchased inventory, on account, $6,875 C. on eleventh day of month, billed customer for services provided, $8,390 D. on nineteenth day of month, paid current month utility bill, $2,000 E. on last day of month, paid suppliers for previous purchases, $2,850arrow_forwardSelected accounts and related amounts for Clairemont Co. for the fiscal year ended May 31, 2016, are presented in Problem 6-5A. Instructions 1. Prepare a single-step income statement in the format shown in Exhibit 11. 2. Prepare a statement of owners equity. 3. Prepare an account form of balance sheet, assuming that the current portion of the note payable is 50,000. 4. Prepare closing entries as of May 31, 2016.arrow_forwardPrepare journal entries to record the following transactions for the month of July: A. on first day of the month, paid rent for current month, $2,000 B. on tenth day of month, paid prior month balance due on accounts, $3,100 C. on twelfth day of month, collected cash for services provided, $5,500 D. on twenty-first day of month, paid salaries to employees, $3,600 E. on thirty-first day of month, paid for dividends to shareholders, $800arrow_forward

- Selected accounts and related amounts for Kanpur Co. for the fiscal year ended June 30, 2016, are presented in Problem 6-5B. Instructions 1. Prepare a single-step income statement in the format shown in Exhibit 11. 2. Prepare a statement of owners equity. 3. Prepare an account form of balance sheet, assuming that the current portion of the note payable is 7,000. 4. Prepare closing entries as of June 30, 2016.arrow_forwardEddie Edwards and Phil Bell own and operate The Second Hand Equipment Shop. The following transactions involving notes and interest were completed during the last three months or 20--: REQUIRED 1. Prepare general journal entries for the transactions. 2. Prepare necessary adjusting entries for the notes outstanding on December 31.arrow_forwardGlobal Services Company had the following transactions during the month of August: a. Record the August revenue transactions for Global Services Company into the following revenue journal format: b. What is the total amount posted to the accounts receivable and fees earned accounts from the revenue journal for August? c. What is the August 31 balance of the Morgan Corp. customer account assuming a zero balance on August 1?arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning  Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College