Principles of Accounting

12th Edition

ISBN: 9781285607047

Author: NEEDLES

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 14AP

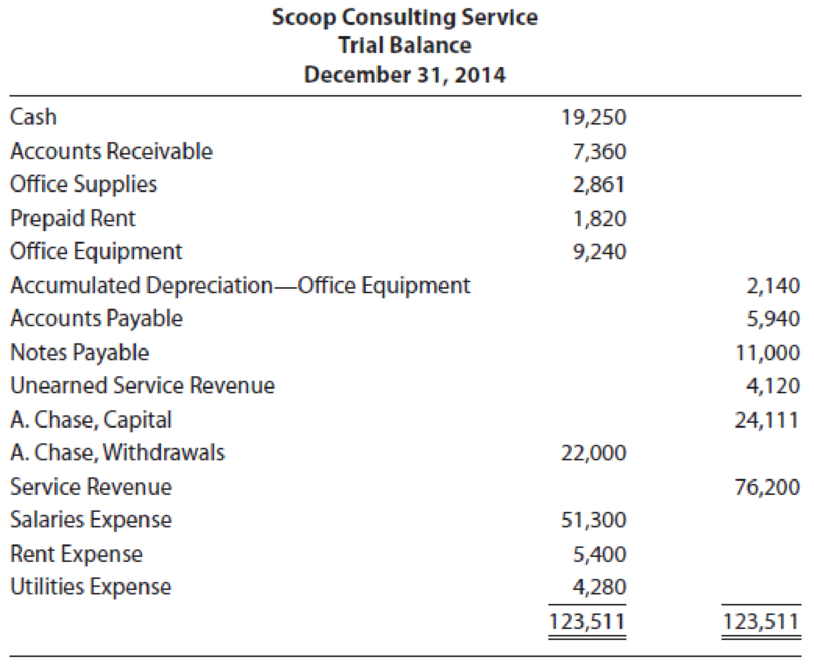

Scoop Consulting Service’s

The following information is also available:

- a. Ending inventory of office supplies, $564

- b. Prepaid rent expired, $470

- c.

Depreciation of office equipment for the period, $820 - d. Accrued interest expense at the end of the period, $730

- e. Accrued salaries at the end of the period, $630

- f. Service revenue still unearned at the end of the period, $2,722

- g. Service revenue earned but unrecorded, $2,500

REQUIRED

- 1. Open T accounts for the accounts in the trial balance plus the following: Interest Payable; Salaries Payable; Office Supplies Expense; Depreciation Expense—Office Equipment; and Interest Expense. Enter the balances shown on the trial balance.

- 2. Determine the

adjusting entries and post them directly to the T accounts. - 3. Prepare an adjusted trial balance.

- 4. ACCOUNTING CONNECTION ▶ Which financial statements do each of the above adjustments affect? Which financial statement is not affected by the adjustments?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Unadjusted account balances at December 31, 2019, for Rapisarda Company are as follows: The following data are not yet recorded:a. Depreciation on the equipment is $18,350.b. Unrecorded wages owed at December 31, 2019: $4,680.c. Prepaid rent at December 31, 2019: $9,240.d. Income taxes expense: $5,463.Required:Prepare a completed worksheet for Rapisarda Company.

The balance in the unearned rent account for Jones Co. as of December 31 is $1,200. If Jones Co. failed to record the adjusting entry for $600 of rent earned during December, the effect on the balance sheet and income statement for December would be:

A. Assets understated by $600; net income overstated by $600.

B. Liabilities understated by $600; net income understated by $600.

C. Liabilities overstated by $600; net income understated by $600.

D. Liabilities overstated by $600; net income overstated by $600.

At December 31, the unadjusted trial balance of H&R Tacks reports Equipment of $25,500 and zero balances in Accumulated

Depreciation and Depreciation Expense. Depreciation for the period is estimated to be $5,100.

Required:

1. Prepare the adjusting journal entry on December 31.

2. Post the beginning balances and adjusting entries to the following T-accounts.

Complete this question by entering your answers in the tabs below.

Required 11 Required 2

Post the beginning balances and adjusting entries to the following T-accounts.

Accumulated Depreciation

Beginning

Balance

Debit

Ending Balance

Credit

Answer is not complete.

5,100

5,100

Beginning

Balance

Debit

Ending Balance

Credit

Chapter 3 Solutions

Principles of Accounting

Ch. 3 - Prob. 1DQCh. 3 - Will the carrying value of a long-term asset...Ch. 3 - If, at the end of the accounting period, you were...Ch. 3 - Prob. 4DQCh. 3 - Prob. 5DQCh. 3 - Prob. 6DQCh. 3 - Match the concepts of accrual accounting that...Ch. 3 - The Prepaid Insurance account began the year with...Ch. 3 - The Supplies account began the year with a balance...Ch. 3 - Prob. 4SE

Ch. 3 - Prob. 5SECh. 3 - During the month of August, deposits in the amount...Ch. 3 - Prob. 7SECh. 3 - Malesherbes Companys adjusted trial balance on...Ch. 3 - Prob. 9SECh. 3 - Prob. 10SECh. 3 - Carlos Companys accountant makes the assumptions...Ch. 3 - Four conditions must be met before revenue should...Ch. 3 - Prob. 3EACh. 3 - Prob. 4EACh. 3 - Prob. 5EACh. 3 - Prob. 6EACh. 3 - Prob. 7EACh. 3 - Prob. 8EACh. 3 - Prepare year-end adjusting entries for each of the...Ch. 3 - Prob. 10EACh. 3 - Prob. 11EACh. 3 - Wipro Companys income statement included the...Ch. 3 - At the end of the first three months of operation,...Ch. 3 - On November 30, the end of the current fiscal...Ch. 3 - Kinokawa Consultants Companys trial balance on...Ch. 3 - Hertz Limo Service was organized to provide...Ch. 3 - At the end of its fiscal year, Berwyn Cleaners...Ch. 3 - Brave Advisors Services trial balance on December...Ch. 3 - Prob. 7PCh. 3 - Prob. 8PCh. 3 - Prob. 9APCh. 3 - On March 31, the end of the current fiscal year,...Ch. 3 - Lee Technology Corporations trial balance on...Ch. 3 - Prob. 12APCh. 3 - Prob. 13APCh. 3 - Scoop Consulting Services trial balance on...Ch. 3 - Prob. 15APCh. 3 - Prob. 16APCh. 3 - Never Flake Company provided a rust-prevention...Ch. 3 - Prob. 2CCh. 3 - Prob. 3CCh. 3 - Prob. 4CCh. 3 - Prob. 5CCh. 3 - Prob. 6C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On November 30, 2019, Davis Company and the following account balances: 1. Prepare general journal entries to record preceding transactions. 2. Post to general ledger T-accou11ts. 3. Prepare a year-end trial balance on a worksheet and complete the worksheet using the following information: (a) accrued salaries at year-end total $1,200; (b ) for simplicity, the building and equipment are being depreciated using the stright-line method over an estimated life of 20 years with no residual all c) supplies on hand at the end of the year total $630; (d ) bad debts expense for the year totals $830; and (e ) the income tax rate is 30%; income taxes are payable in the first quarter of 2020. 4. Prepare company's financial statements for 2019 . 5. Prepare 2019 (a) adjusting and (b) closing entries in the general journal.arrow_forwardSafety First Company completed all of its October 31,2020 adjustments in preparation for preparing its financial statements which resulted in the following trial balance Other information: All accounts have normal balances $26,400 of the Notes payable balance is due by October 31, 2021 The final task in the year end process was to access the assets for impairment, which resulted in the following schedule Required: Prepare the entries to record any impairment losses at October 31, 2020. Assume the company recorded no impairment losses in the previous years Prepare a classified balance sheet at October 31, 2020 What is the impact on the financial statements of an impairment loss?arrow_forwardAt December 31, the unadjusted trial balance of H&R Tacks reports Equipment of $32,000 and zero balances in Accumulated Depreciation and Depreciation Expense. Depreciation for the period is estimated to be $6,400. Required: 1. Prepare the adjusting journal entry on December 31. 2 Prepare the T-accounts for each account, enter the unadjusted balances, post the adjusting journal entry, and report the adjusted balance.arrow_forward

- The following unadjusted trial balance contains the accounts and balances of Dylan Delivery Company as of December 31, 2017. Unrecorded depreciation on the trucks at the end of the year is $9,602. The total amount of accrued interest expense at year-end is $8,000. The cost of unused office supplies still available at year-end is $1,200. 1. Use the above information about the company’s adjustments to complete a 10-column work sheet.2a. Prepare the year-end closing entries for Dylan Delivery Company as of December 31, 2017.2b. Determine the capital amount to be reported on the December 31, 2017 balance sheet.arrow_forwardPrepare the journal entries for the following transactions provided by MPM as at January 31, 2011 and post them to their respective general ledger accounts. a. Depreciation $100 b. Prepaid rent expired $400 c. Interest expense accrued $900 d. Employee salaries owed for Monday to Thursday for a five day workweek: weekly payroll $14,000 e. Unearned service revenue $800arrow_forwardRequired 1. Prepare and complete a 10-column work sheet for fiscal year 2019, starting with the unadjusted trial balance and including adjustments based on these additional facts. a. The supplies available at the end of fiscal year 2019 had a cost of $7,900. b. The cost of expired insurance for the fiscal year is $10,600. c. Annual depreciation on equipment is $7,000. d. The April utilities expense of $800 is not included in the unadjusted trial balance because the bill arrived after the trial balance was prepared. The $800 amount owed needs to be recorded. e. The company’s employees have earned $2,000 of accrued and unpaid wages at fiscal year-end. f. The rent expense incurred and not yet paid or recorded at fiscal year-end is $3,000. g. Additional property taxes of $550 have been assessed for this fiscal year but have not been paid or recorded in the accounts. h. The $300 accrued interest for April on the long-term notes payable has not yet been paid or recorded. 2. Using information…arrow_forward

- Hardys Landscape Services total revenue on account for 2018 amounted to 273,205. The company, which uses the allowance method, estimates bad debts at percent of total revenue on account. Required Journalize the following selected entries: 2012 Dec. 12Record services performed on account for E. E. Morton, 245. 31Record the adjusting entry for Bad Debts Expense. 31Record the closing entry for Bad Debts Expense. 2013 Feb. 18Write off the account of E. E. Morton as uncollectible, 245. Check Figure Adjusting entry amount, 1,366.03arrow_forwardThe balance in the unearned rent account for Jones Co. as of December 31 is $1 ,20(). If Jones Co. failed to record the adjusting entry for $600 of rent earned during December, the effect on the balance sheet and income statement for December would 1w: A. Assets understated by $600; net income overstated by $600. B. Liabilities understated by $600; net income understated by $600. C. Liabilities overstated by $600; net income understated by $600. D. Liabilities overstated by $600; net income overstated by $600.arrow_forwardThe following accounts appear in the ledger of Sheldon Company on January 31, the end of this fiscal year. The data needed for adjustments on January 31 are as follows: ab.Merchandise inventory, January 31, 55,750. c.Insurance expired for the year, 1,285. d.Depreciation for the year, 5,482. e.Accrued wages on January 31, 1,556. f.Supplies used during the year 1,503. Required 1. Prepare a work sheet for the fiscal year ended January 31. Ignore this step if using QuickBooks or general ledger. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. Ignore this step if using CLGL. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. Check Figure Net loss, 1,737arrow_forward

- The trial balance of Jillson Company as of December 31, the end of its current fiscal year, is as follows: Here are the data for the adjustments. ab. Merchandise Inventory at December 31, 54,845.00. c. Store supplies inventory (on hand), 488.50. d. Insurance expired, 680. e. Salaries accrued, 692. f. Depreciation of store equipment, 3,760. Required Complete the work sheet after entering the account names and balances onto the work sheet.arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. amount due for employee salaries, $4,800 B. actual count of supplies inventory, $ 2,300 C. depreciation on equipment, $3,000arrow_forwardAt the end of 2019, Framber Company received 8,000 as a prepayment for renting a building to a tenant during 2020. The company erroneously recorded the transaction by debiting Cash and crediting Rent Revenue in 2019 instead of 2020. Upon discovery of this error in 2020, what correcting journal entry will Framber make? Ignore income taxes.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning  Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY