Concept explainers

(a)

(a)

Explanation of Solution

The given information:

Supply equation for ice cream is

Calculation:

Rearrange Equation (1) in terms of price derive the inverse demand equation.

The inverse demand equation is

Rearrange Equation (2) in terms of price derive the inverse supply equation.

The inverse supply equation is

The intersecting point of the demand and supply curve is the equilibrium point. Calculation of equilibrium price is shown below:

Equilibrium price is $5.

Substitute the price in the demand equation (Equation (1)) to calculate the equilibrium quantity.

Equilibrium quantity is 10 units (10 gallon of ice cream).

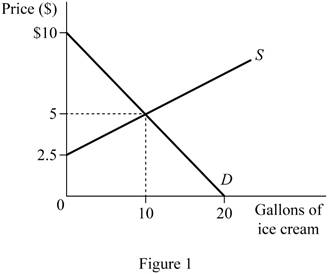

From the above information, the market for ice cream is shown below:

In Figure 1, the vertical axis measures the price of ice cream and the horizontal axis measures gallon of ice cream. The upward sloping curve is the supply curve and downward sloping curve is the demand curve of ice cream. The intersecting point of the demand and supply curve is the equilibrium point. Thus, the equilibrium price is $5 and quantity is 10 units.

(b)

New demand equation.

(b)

Explanation of Solution

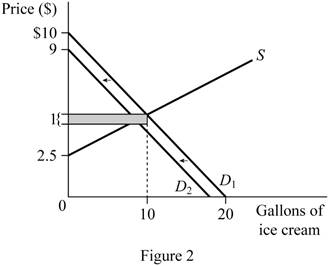

The imposition of tax increases the price, when price increases, the demand for the goods will decrease, which shifts the demand curve leftward. The new demand curve is shown in below figure.

In Figure 2, the vertical axis measures the price of ice cream and the horizontal axis measures the gallon of ice cream. The upward sloping curve is the supply curve and downward sloping curve is the demand curve of ice cream. The demand curve shift inward by the imposition of tax by $1.

(c)

New price and quantity.

(c)

Explanation of Solution

The new demand equation can be written as follows:

The new demand equation is

The new equilibrium price can be calculated as follows:

The new price is $4.67.

Substitute the price in the demand equation (Equation (2)) to calculate the

New quantity is 8.68 units.

(d)

Burden of tax.

(d)

Explanation of Solution

After imposition of tax ($1), the buyer would pay $5.67

(e)

(e)

Explanation of Solution

To find out the consumer surplus, the choke price has to be calculated. The calculation of choke price is shown below:

Substitute the value of quantity as zero in Equation (1).

The demand choke price (maximum willing price) is $10.

Consumer surplus before tax imposition is calculated as follows:

Consumer surplus is $25.

Consumer surplus after tax imposition is calculated as follows:

To find out the consumer surplus after tax, the choke price has to be calculated. The calculation of choke price is shown below:

Substitute the value of quantity as zero in Equation (5).

The demand choke price (maximum willing price) is $9.

Consumer surplus after tax imposition is calculated as follows:

Consumer surplus is $18.79.

(f)

Producer surplus.

(f)

Explanation of Solution

To find out the producer surplus, the choke price has to be calculated. The calculation of choke price is shown below:

Substitute the value of quantity as zero in Equation (2).

The supply choke price (minimum acceptable price) is $2.5.

Producer surplus before tax imposition is calculated as follows:

Producer surplus is $12.50.

Producer surplus after tax imposition is calculated as follows”

Producer surplus is $9.42.

(g)

Total tax revenue.

(g)

Explanation of Solution

Total tax revenue can be calculated as follows:

Tax revenue is $8.68.

(h)

(h)

Explanation of Solution

Deadweight loss can be calculated as follows:

Deadweight loss is $0.66.

Want to see more full solutions like this?

Chapter 3 Solutions

LaunchPad for Goolsbee's Microeconomics (Six Month Access)

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education