Corporate Finance: The Core (4th Edition) (Berk, DeMarzo & Harford, The Corporate Finance Series)

4th Edition

ISBN: 9780134202648

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 17P

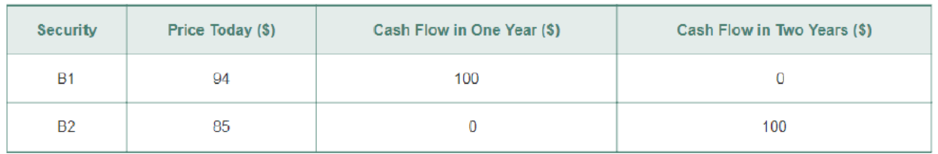

Consider two securities that pay risk-

- a. What is the no-arbitrage price of a security that pays cash flows of $100 in one year and $100 in two years?

- b. What is the no-arbitrage price of a security that pays cash flows of $100 in one year and $500 in two years?

- c. Suppose a security with cash flows of $50 in one year and $100 in two years is trading for a price of $130. What arbitrage opportunity is available?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Consider two securities that pay risk-free cash flows over the next two years and that have the current market prices shown here:

Security Price Today Cash Flow in One Year Cash Flow in Two Years

B1 $192 $200 0

B2 $176 0 $200

What is the no-arbitrage price of a security that pays cash flows of $200 in one year and $200 in two years?

What is the no-arbitrage price of a security that pays cash flows of $200 in one year and $1600 in two years?

Suppose a security with cash flows of $100 in one year and $200 in two years is trading for a price of $260. What arbitrage opportunity is available?

The promised cash flows of three securities are listed below. If the cash flows are risk-free, and the risk-free interest rate is 5.0%, determine the no-arbitrage price of each security before the first cash flow is paid.

Security

Cash Flow Today ($)

Cash Flow in One Year ($)

A

800

800

B

0

1600

C

1,600

0

The no-arbitrage price of security A is how much? ? (Round to the nearest cent.)

The no-arbitrage price of security B is how much? ? (Round to the nearest cent.)

The no-arbitrage price of security C is how much? ? (Round to the nearest cent.)

Assume the zero-coupon yields on default-free securities are as summarized in the following table:

Maturity

1 year

2 years

3 years

4 years

5 years

Zero-Coupon Yields

7.00%

7.60%

7.90%

8.30%

8.70%

What is the maturity of a default-free security with annual coupon payments and a yield to maturity of

7.00%?

Why?

What is the maturity of a default-free security with annual coupon payments and a yield to maturity of

7.00%?

A.

One year

B.

Two years

C.

Three years

D.

Four years

E.

Five years

Chapter 3 Solutions

Corporate Finance: The Core (4th Edition) (Berk, DeMarzo & Harford, The Corporate Finance Series)

Ch. 3.1 - Prob. 1CCCh. 3.1 - If crude oil trades in a competitive market, would...Ch. 3.2 - How do you compare costs at different points in...Ch. 3.2 - Prob. 2CCCh. 3.3 - What is the NPV decision rule?Ch. 3.3 - Why doesnt the NPV decision rule depend on the...Ch. 3.4 - Prob. 1CCCh. 3.4 - Prob. 2CCCh. 3.5 - If a firm makes an investment that has a positive...Ch. 3.5 - Prob. 2CC

Ch. 3.5 - Prob. 3CCCh. 3.A - The table here shows the no-arbitrage prices of...Ch. 3.A - Suppose security Chas a payoff of 600 when the...Ch. 3.A - Prob. A.3PCh. 3.A - Prob. A.4PCh. 3.A - Prob. A.5PCh. 3.A - Consider a portfolio of two securities: one share...Ch. 3.A2 - Why does the expected return of a risky security...Ch. 3.A2 - Prob. 2CCCh. 3.A3 - Prob. 1CCCh. 3.A3 - Prob. 2CCCh. 3 - Honda Motor Company is considering offering a 2000...Ch. 3 - You are an international shrimp trader. A food...Ch. 3 - Prob. 3PCh. 3 - Prob. 4PCh. 3 - You have decided to take your daughter skiing in...Ch. 3 - Suppose the risk-free interest rate is 4%. a....Ch. 3 - You have an investment opportunity in Japan. It...Ch. 3 - Your firm has a risk-free investment opportunity...Ch. 3 - You run a construction firm. You have just won a...Ch. 3 - Your firm has identified three potential...Ch. 3 - Your computer manufacturing firm must purchase...Ch. 3 - Prob. 12PCh. 3 - Prob. 13PCh. 3 - An American Depositary Receipt (ADR) is security...Ch. 3 - Prob. 15PCh. 3 - An Exchange-Traded Fund (ETF) is a security that...Ch. 3 - Consider two securities that pay risk-free cash...Ch. 3 - Prob. 18P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- An investor in Treasury securities expects inflation to be 2.1% in Year 1, 2.7% in Year 2, and 3.65% each year thereafter. Assume that the real risk-free rate is 1.95% and that this rate will remain constant. Three-year Treasury securities yield 5.20%, while 5-year Treasury securities yield 6.00%. What is the difference in the maturity risk premiums (MRPs) on the two securities; that is, what is ?arrow_forwardConsider the following data for two risk factors (1 and 2) and two securities (J and L):λ0 = 0.07 λ1 = 0.04 λ2 = 0.06bJ1 = 0.10 bJ2 = 1.60 bL1 = 1.80 bL2 = 2.45a. Compute the expected returns for both securities. b. Suppose that Security J is currently priced at $50 while the price of Security L is $15.00.Further, it is expected that both securities will pay a dividend of $0.95 during the coming year.What is the expected price of each security one year from now? c. Compute the correlation between stock A and stock B considering the following data.Standard deviation of stock A = 10 percentStandard deviation of stock B = 17 percentCovariance between the two stocks = 90.arrow_forwardABC Co. has a large amount of variable rate financing due in one year. The management is concerned about the possibility of increases in short-term rates. Which would be an effective way of hedging this risk?a. Buy Treasury notes in the futures market.b. Sell Treasury notes in the futures market.c. Buy an option to purchase Treasury bonds.d. Sell an option to purchase Treasury bondsarrow_forward

- An investor in Treasury securities expects inflation to be 2.1% in Year 1, 3.0% in Year 2, and 4.25% each year thereafter. Assume that the real risk-free rate is 2.25% and that this rate will remain constant. Three-year Treasury securities yield 5.20%, while 5-year Treasury securities yield 6.00%. What is the difference in the maturity risk premiums (MRPs) on the two securities; that is, what is MRP5 - MRP3? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardAn investor in Treasury securities expects inflation to be 2.1%in Year 1, 2.7% in Year 2, and 3.65% each year thereafter. Assume that the real risk-free rateis 1.95% and that this rate will remain constant. Three-year Treasury securities yield 5.20%,while 5-year Treasury securities yield 6.00%. What is the difference in the maturity riskpremiums (MRPs) on the two securities; that is, what is MRP5 - MRP3?arrow_forwardyou are considering investing in a four year security which pays 6,000 in one year. 6,000 in two years, 6,000 in 3 years and 17,500 in 4 years. the security currently trades at a price of of 18,483.77. What is the yield to maturity of the security? What is duration?arrow_forward

- The pure expectations theory, or the expectations hypothesis, asserts that long-term interest rates can be used to estimate future short-term interest rates. Based on the pure expectations theory, is the following statement true or false? Q1. A certificate of deposit (CD) for two years will have the same yield as a CD for one year followed by an investment in another one-year CD after one year. a. True b. False Q2. The yield on a one-year Treasury security is 4.9200%, and the two-year Treasury security has a 5.9040% yield. Assuming that the pure expectations theory is correct, what is the market’s estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate calculations.) a. 5.8627% b. 6.8973% c. 7.8629% d. 8.7596% Q3. Recall that on a one-year Treasury security the yield is 4.9200% and 5.9040% on a two-year Treasury security. Suppose the one-year security does not have a maturity risk premium, but the two-year security does and it is 0.2%. What is…arrow_forwardSuppose you are a bond dealer looking for arbitrage opportunities. The first column in the table below shows the current prices of the four government bonds (without default risk). Assume that you can buy and short these bonds at a given price. The remaining columns of the table are the cash flows generated by the bonds at the end of the first, second and third years. All bonds mature at the end of the third year. Are there arbitrage opportunities for the prices of these four types of bonds? If it exists, how can you seize this opportunity?arrow_forwardSuppose that the current one-year rate and expected one-year T-bill rates over the following three years (i.e., year 2, 3, and 4, respectively) are as follows: 1R1 = 5%, E(2r1)=6%, E(3r1)= 7%, E(4r1)=7.5% Using the unbiased expectations theory, calculate the current rates for three-year and four-year Treasury securities.arrow_forward

- The following information was gathered by a security analyst. The real rate of interest is 4% and is expected to remain constant for the next 5 years, Inflation is expected to be 2% next year, 3.5% the following year, 5% the third to fifth year. The maturity risk premium is expected to be 0.3 x (t-1)%, The liquidity premium on relevant 5-year securities is 0.75% and the default risk premium on relevant 5-year securities is 0.6%. What is the yield in percent on a 5-year corporate bond? A 10-year Treasury bond yields 6.4%, and a 10-year corporate bond yields 8.4%. The market expects that inflation will average 2.5% over the next 10 years. Assume that maturity risk premium is equal to 0.3(T-1)%, and that the annual real risk-free rate will remain constant over the next 10 years. What is the liquidity risk premium of the 10-year treasury bond? A 10-year Treasury bond yields 6.4%, and a 10-year corporate bond yields 8.4%. The market expects that inflation will average 2.5% over the next 10…arrow_forwardAssume the following: The real risk-free rate, r*, is expected to remain constant at 3%. Inflation is expected to be 3% next year and then to be constant at 2% a year thereafter. The maturity risk premium is zero. Given this information, which of the following statements is CORRECT? a. A 5-year corporate bond must have a lower yield than a 7-year Treasury security. b. The yield curve for U.S. Treasury securities will be upward sloping. c. A 5-year corporate bond must have a lower yield than a 5-year Treasury security. d. The real risk-free rate cannot be constant if inflation is not expected to remain constant. e. This problem assumed a zero maturity risk premium, but that is probably not valid in the real world.arrow_forwardTwo bonds, A and B, have the same credit rating, the same par value, and the same coupon rate. Bond A has 30 years to maturity and bond B has 5 years to maturity. Please demonstrate your understanding of interest rate risk by answering the following questions : As a bond investor, if you expect a slowdown in the economy over the next 12 months, what would be your investment strategy?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

The U.S. Treasury Markets Explained | Office Hours with Gary Gensler; Author: U.S. Securities and Exchange Commission;https://www.youtube.com/watch?v=uKXZSzY2ZbA;License: Standard Youtube License