Concept explainers

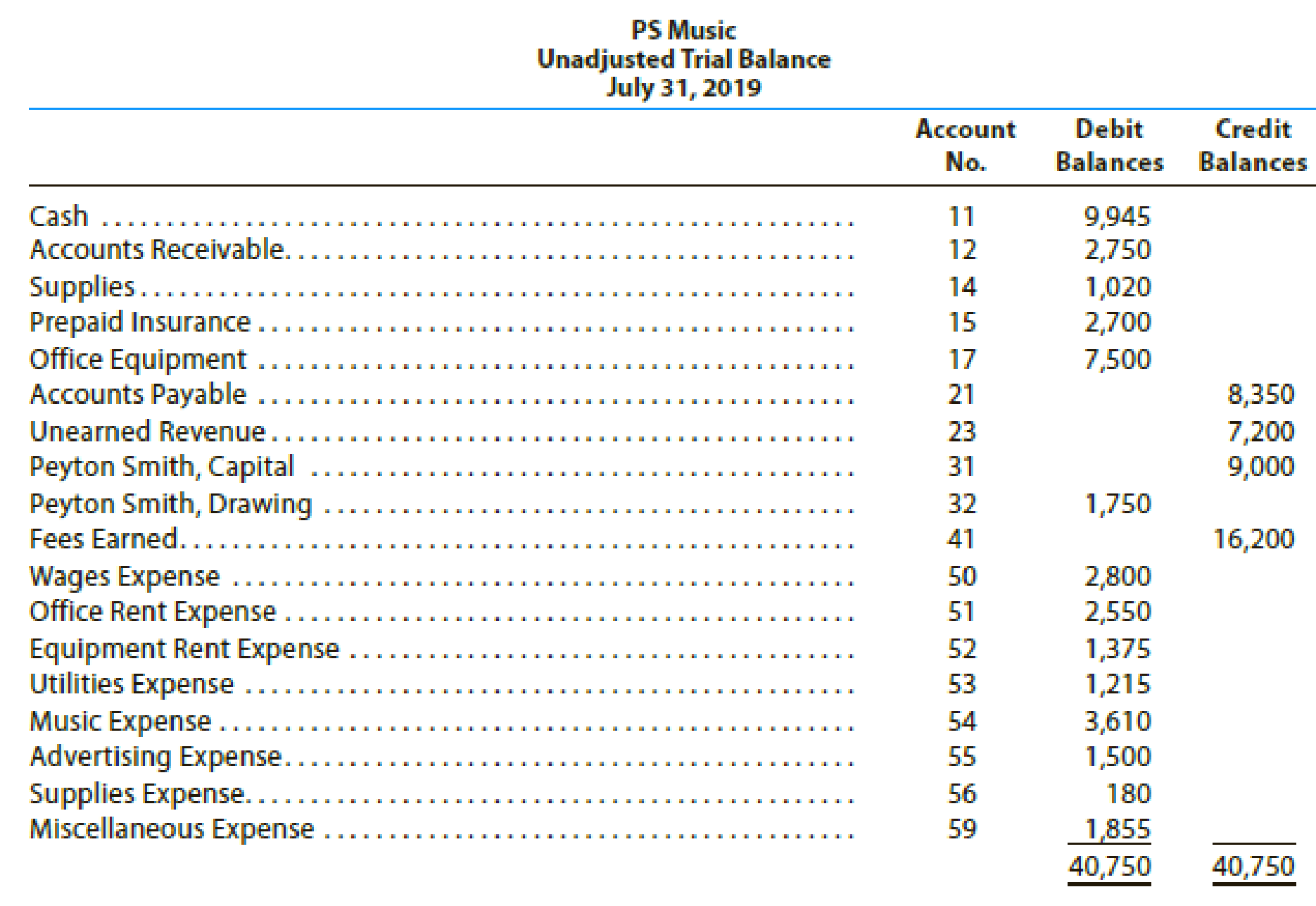

The unadjusted

The data needed to determine adjustments are as follows:

- • During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3 transaction at the end of Chapter 2.

- • Supplies on hand at July 31, $275.

- • The balance of the prepaid insurance account relates to the July 1 transaction in Chapter 2.

- •

Depreciation of the office equipment is $50. - • The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3 transaction in Chapter 2.

- • Accrued wages as of July 31 were $140.

Instructions

- 1. Prepare adjusting

journal entries. You will need the following additional accounts:

18

22 Wages Payable

57 Insurance Expense

58 Depreciation Expense

- 2.

Post the adjusting entries , inserting balances in the accounts affected. - 3. Prepare an adjusted trial balance.

(1)

Prepare adjusting entries in the books of Company PS at the end of the July 31, 2019.

Answer to Problem 1COP

Adjusting entries: Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. All adjusting entries affect at least one income statement account (revenue or expense), and one balance sheet account (asset or liability).

Rules of Debit and Credit: Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and owners’ equities.

- Credit, all increase in liabilities, revenues, and owners’ equities, all decrease in assets, expenses.

T-account: T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

- (a) The title of the account

- (b) The left or debit side

- (c) The right or credit side

Adjusted trial balance: Adjusted trial balance is a summary of all the ledger accounts, and it contains the balances of all the accounts after the adjustment entries are journalized, and posted.

Adjusting entries

| Journal Page 18 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 2019 | Accounts receivable | 12 | 1,400 | ||

| July | 31 | Fees earned (Working note 1) | 41 | 1,400 | |

| (To record the fees earned at the end of July) | |||||

| 31 | Supplies expense (Working note 2) | 56 | 745 | ||

| Supplies | 14 | 745 | |||

| (To record supplies expense incurred at the end of the July) | |||||

| 31 | Insurance expense (Working note 3) | 57 | 225 | ||

| Prepaid insurance | 15 | 225 | |||

| (To record insurance expense incurred at the end of the July) | |||||

| 31 | Depreciation expense | 58 | 50 | ||

| Accumulated depreciation-Office equipment | 18 | 50 | |||

| (To record depreciation expense incurred at the end of the July) | |||||

| 31 | Unearned revenue (Working note 4) | 23 | 3,600 | ||

| Fees earned | 41 | 3,600 | |||

| (To record the service performed to the customer at the end of the July) | |||||

| 31 | Wages expense | 50 | 140 | ||

| Wages payable | 22 | 140 | |||

| (To record wages expense incurred at the end of the July) | |||||

Table (1)

Explanation of Solution

Working note 1: Calculate the value of accrued fees during the July

Hence, fees earned during the July are $1,400.

Working note 2: Calculate the value of supplies expense

Hence, supplies expense during the July is $745.

Working note 3: Calculate the value of insurance expense

Hence, insurance expense during the July is $745.

Working note 4: Calculate the value of unearned fees at the end of the July

Hence, unearned fees at the end of the July are $3,600.

(2)

Post the adjusting entries to the ledger in the books of Company PS.

Explanation of Solution

Post the adjusting entries to the ledger account as follows:

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 3,920 | |||

| 1 | 1 | 5,000 | 8,920 | ||||

| 1 | 1 | 1,750 | 7,170 | ||||

| 1 | 1 | 2,700 | 4,470 | ||||

| 2 | 1 | 1,000 | 5,470 | ||||

| 3 | 1 | 7,200 | 12,670 | ||||

| 3 | 1 | 250 | 12,420 | ||||

| 4 | 1 | 900 | 11,520 | ||||

| 8 | 1 | 200 | 11,320 | ||||

| 11 | 1 | 1,000 | 12,320 | ||||

| 13 | 1 | 700 | 11,620 | ||||

| 14 | 1 | 1,200 | 10,420 | ||||

| 16 | 2 | 2,000 | 12,420 | ||||

| 21 | 2 | 620 | 11,800 | ||||

| 22 | 2 | 800 | 11,000 | ||||

| 23 | 2 | 750 | 11,750 | ||||

| 27 | 2 | 915 | 10,835 | ||||

| 28 | 2 | 1,200 | 9,635 | ||||

| 29 | 2 | 540 | 9,095 | ||||

| 30 | 2 | 500 | 9,595 | ||||

| 31 | 2 | 3,000 | 12,595 | ||||

| 31 | 2 | 1,400 | 11,195 | ||||

| 31 | 2 | 1,250 | 9,945 | ||||

Table (2)

| Account: Accounts Receivable Account no. 12 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 1,000 | |||

| 2 | 1 | 1,000 | |||||

| 23 | 2 | 1,750 | 1,750 | ||||

| 30 | 2 | 1,000 | 2,750 | ||||

| 31 | Adjusting | 3 | 1,400 | 4,150 | |||

Table (3)

| Account: Supplies Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 170 | |||

| 18 | 850 | 1,020 | |||||

| 31 | Adjusting | 745 | 275 | ||||

Table (4)

| Account: Prepaid Insurance Account no. 15 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | 1 | 2,700 | 2,700 | |||

| 31 | Adjusting | 3 | 225 | 2,475 | |||

Table (5)

| Account: Office equipment Account no. 17 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 5 | 1 | 7,500 | 7,500 | |||

Table (6)

| Account: Accumulated Depreciation Account no. 18 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 31 | Adjusting | 3 | 50 | 50 | ||

Table (7)

| Account: Accounts Payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 250 | |||

| 3 | 1 | 250 | |||||

| 5 | 1 | 7,500 | 7,500 | ||||

| 18 | 2 | 850 | 8,350 | ||||

Table (8)

| Account: Wages Payable Account no. 22 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 31 | Adjusting | 3 | 140 | 140 | ||

Table (9)

| Account: Unearned revenue Account no. 23 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | 1 | 7,200 | 7,200 | |||

| 31 | Adjusting | 3 | 3,600 | 3,600 | |||

Table (10)

| Account: P’s capital Account no. 31 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 4,000 | |||

| 1 | 1 | 5,000 | 9,000 | ||||

Table (11)

| Account: P’s drawings Account no. 32 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 500 | |||

| 31 | 2 | 1,250 | 1,750 | ||||

Table (12)

| Account: Fees earned Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 6,200 | |||

| 11 | 1 | 1,000 | 7,200 | ||||

| 16 | 2 | 2,000 | 9,200 | ||||

| 23 | 2 | 2,500 | 11,700 | ||||

| 30 | 2 | 1,500 | 13,200 | ||||

| 31 | 2 | 3,000 | 16,200 | ||||

| 31 | Adjusting | 3 | 1,400 | 17,600 | |||

| 31 | Adjusting | 3 | 3,600 | 21,200 | |||

Table (13)

| Account: Wages expense Account no. 50 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 400 | |||

| 14 | 1 | 1,200 | 1,600 | ||||

| 28 | 2 | 1,200 | 2,800 | ||||

| 31 | Adjusting | 3 | 140 | 2,940 | |||

Table (14)

| Account: Office rent expense Account no. 51 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 800 | |||

| 1 | 1 | 1,750 | 2,550 | ||||

Table (15)

| Account: Equipment rent expense Account no. 52 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 675 | |||

| 13 | 1 | 700 | 1,375 | ||||

Table (16)

| Account: Utilities expense Account no. 53 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 300 | |||

| 27 | 2 | 915 | 1,215 | ||||

Table (17)

| Account: Music expense Account no. 54 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 1,590 | |||

| 21 | 2 | 620 | 2,210 | ||||

| 31 | 2 | 1,400 | 3,610 | ||||

Table (18)

| Account: Advertising expense Account no. 55 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 500 | |||

| 8 | 1 | 200 | 700 | ||||

| 22 | 2 | 800 | 1,500 | ||||

Table (19)

| Account: Supplies expense Account no. 56 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 180 | |||

| 31 | Adjusting | 3 | 745 | 925 | |||

Table (20)

| Account: Insurance expense Account no. 57 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 31 | Adjusting | 3 | 225 | 225 | ||

Table (21)

| Account: Depreciation expense Account no. 58 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 31 | Adjusting | 3 | 50 | 50 | ||

Table (22)

| Account: Miscellaneous expense Account no. 59 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 415 | |||

| 4 | 900 | 1,315 | |||||

| 29 | 540 | 1,855 | |||||

Table (23)

(3)

Prepare an adjusted trial balance of Company PS at July 31, 2019.

Explanation of Solution

Prepare an adjusted trial balance of Company PS at July 31, 2019 as follows:

| Company PS | |||

| Adjusted Trial Balance | |||

| July 31, 2019 | |||

| Particulars | AccountNo. | Debit $ | Credit $ |

| Cash | 11 | 9,945 | |

| Accounts receivable | 12 | 4,150 | |

| Supplies | 14 | 275 | |

| Prepaid insurance | 15 | 2,475 | |

| Office equipment | 17 | 7,500 | |

| Accumulated depreciation-Equipment | 18 | 50 | |

| Accounts payable | 21 | 8,350 | |

| Wages payable | 22 | 140 | |

| Unearned revenue | 23 | 3,600 | |

| P's capital | 31 | 9,000 | |

| P's drawings | 32 | 1750 | |

| Fees earned | 41 | 21,200 | |

| Wages expense | 50 | 2,940 | |

| Office rent expense | 51 | 2,550 | |

| Equipment rent expense | 52 | 1,375 | |

| Utilities expense | 53 | 1,215 | |

| Music expense | 54 | 3,610 | |

| Advertising expense | 55 | 1,500 | |

| Supplies expense | 56 | 925 | |

| Insurance expense | 57 | 225 | |

| Depreciation expense | 58 | 50 | |

| Miscellaneous expense | 59 | 1,855 | |

| 42,340 | 42,340 | ||

Table (24)

The debit column and credit column of the adjusted trial balance are agreed, both having the balance of $42,340.

Want to see more full solutions like this?

Chapter 3 Solutions

Financial Accounting

- The unadjusted trial balance that you prepared for PS Music at the end of Chapter 2 should appear as follows: The data needed to determine adjustments are as follows: During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3 transaction at the end of Chapter 2. Supplies on hand at July 31, 275. The balance of the prepaid insurance account relates to the July 1 transaction at the end of Chapter 2. Depreciation of the office equipment is 50. The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3 transaction at the end of Chapter 2. Accrued wages as of July 31 were 140. Instructions 1. Prepare adjusting journal entries. You will need the following additional accounts: 2. Post the adjusting entries, inserting balances in the accounts affected. 3. Prepare an adjusted trial balance.arrow_forwardThe unadjusted trial balance that you prepared for PS Music at the end of Chapter 2 should appear as follows: The data needed to determine adjustments are as follows: a. During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3, 2016, transaction at the end of Chapter 2. b. Supplies on hand at July 31, 275. c. The balance of the prepaid insurance account relates to the July 1, 2016, transaction at the end of Chapter 2. d. Depreciation of the office equipment is 50. e. The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3, 2016, transaction at the end of Chapter 2. f. Accrued wages as of July 31, 2016, were 140. Instructions 1. Prepare adjusting journal entries. You will need the following additional accounts: 18 Accumulated DepreciationOffice Equipment 22 Wages Payable 57 Insurance Expense 58 Depreciation Expense 2.Post the adjusting entries, inserting balances in the accounts affected. 3.Prepare an adjusted trial balance.arrow_forwardThe unadjusted trial balance that you prepared for PS Music at the end of Chapter 2 should appear as follows: PS Music Unadjusted Trial Balance July 31, 2018 The data needed to determine adjustments are as follows: During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3 transaction at the end of Chapter 2. Supplies on hand at July 31, 275. The balance of the prepaid insurance account relates to the July 1 transaction at the end of Chapter 2. Depreciation of the office equipment is 50. The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3 transaction at the end of Chapter 2. Accrued wages as of July 31 were 140. Instructions 1. Prepare adjusting journal entries. You will need the following additional accounts: 18 Accumulated DepreciationOffice Equipment 22 Wages Payable 57 Insurance Expense 58 Depreciation Expense 2. Post the adjusting entries, inserting balances in the accounts affected. 3. Prepare an adjusted trial balance.arrow_forward

- The unadjusted trial balance that you prepared for PS Music at the end of Chapter 2 should appear as follows: The data needed to determine adjustments are as follows: a. During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3, 2016, transaction at the end of Chapter 2. b. Supplies on hand at July 31, 275. c. The balance of the prepaid insurance account relates to the July 1, 2016, transaction at the end of Chapter 2. d. Depreciation of the office equipment is 50. e. The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3, 2016, transaction at the end of Chapter 2. f. Accrued wages as of July 31, 2016, were 140. Instructions 1. Prepare adjusting journal entries. You will need the following additional accounts: 18 Accumulated DepreciationOffice Equipment 22 Wages Payable 57 Insurance Expense 58 Depreciation Expense 2. Post the adjusting entries, inserting balances in the accounts affected. 3. Prepare an adjusted trial balance.arrow_forwardThe trial balance for Wilson Financial Services on January 31 is as follows: Data for month-end adjustments are as follows: a. Expired or used-up insurance, 750. b. Depreciation expense on equipment, 300. c. Wages accrued or earned since the last payday, 1,055 (owed and to be paid on the next payday). d. Supplies used, 535. Required 1. Complete a work sheet for the month. (Skip this step if using CLGL.) 2. Journalize the adjusting entries. 3. If using CLGL, prepare an adjusted trial balance. 4. Prepare an income statement, a statement of owners equity, and a balance sheet. Assume that no additional investments were made during January.arrow_forwardOn July 1, a client paid an advance payment (retainer) of $10,000, to cover future legal services. During the period, the company completed $6,200 of the agreed-on services for the client. There was no beginning balance in the Unearned Revenue account for the period. Based on the information provided, make the journal entries needed to bring the balances to correct for: A. original transaction B. December 31 adjustmentarrow_forward

- On July 1, a client paid an advance payment (retainer) of $5,000 to cover future legal services. During the period, the company completed $3,500 of the agreed-on services for the client. There was no beginning balance in the Unearned Revenue account for the period. Based on the information provided, A. Make the December 31 adjusting journal entry to bring the balances to correct. B. Show the impact that these transactions had.arrow_forwardThe trial balance of The New Decors for the month ended September 30 is as follows: Data for the adjustments are as follows: a. Expired or used-up insurance, 425. b. Depreciation expense on equipment, 2,750. c. Wages accrued or earned since the last payday, 475 (owed and to be paid on the next payday). d. Supplies remaining at end of month, 215. Required 1. Complete a work sheet. (Skip this step if using GL.) 2. Journalize the adjusting entries. If you are using CLGL, use the year 2020 when recording transactions.arrow_forwardAt the end of April, the first month of operations, the following selected data were taken from the financial statements of Shelby Crawford, an attorney: In preparing the financial statements, adjustments for the following data were overlooked: Supplies used during April, 2,750. Unbilled fees earned at April 30, 23,700. Depreciation of equipment for April, 1,800. Accrued wages at April 30, 1,400. Instructions 1. Journalize the entries to record the omitted adjustments. 2. Determine the correct amount of net income for April and the total assets, liabilities, and owners equity at April 30. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The adjustment for supplies used is presented as an example.arrow_forward

- At the end of August, the first month of operations, the following selected data were taken from the financial statements of Tucker Jacobs, an attorney: In preparing the financial statements, adjustments for the following data were overlooked: Unbilled fees earned at August 31, 31,900. Depreciation of equipment for August, 7,500. Accrued wages at August 31, 5,200. Supplies used during August, 3,000. Instructions 1. Journalize the entries to record the omitted adjustments. 2. Determine the correct amount of net income for August and the total assets, liabilities, and owners equity at August 31. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The first adjustment is presented as an example.arrow_forwardThe account balances of Bryan Company as of June 30, the end of the current fiscal year, are as follows: Required 1. Data for the adjustments are as follows: a. Expired or used up insurance, 495 b. Depreciation expense on equipment, 670. c. Depreciation expense on the van, 1,190. d. Salary accrued (earned) since the last payday, 540 (owed and to be paid on the next payday). e. Supplies used during the period, 97. Your instructor may want you to use a work sheet for these adjustments. 2. Journalize the adjusting entries. 3. Prepare an income statement. 4. Prepare a statement of owners equity. Assume that there was an additional investment of 2,000 on June 10. 5. Prepare a balance sheet. 6. Journalize the closing entries using the four steps in the correct sequence. Check Figure Net Income, 13,627arrow_forwardThe following selected accounts appear in the Birch Company’s unadjusted trial balance as of December 31, the end of the fiscal year (all accounts have normal balances): Prepaid Maintenance $2,700 Commission Fees Earned $86,000 Supplies 9,400 Rent Expense 10,800 Unearned Commission Fees 9,000 RequiredPrepare the necessary adjusting entries in the general journal as of December 31, assuming the following: On September 1, the company entered into a prepaid equipment maintenance contract. Birch Company paid $2,700 to cover maintenance service for six months, beginning September 1. The payment was debited to Prepaid Maintenance. Supplies on hand at December 31 are $2,900. Unearned commission fees at December 31 are $4,000. Commission fees earned but not yet billed at December 31 are $3,500.(Note: Debit Fees Receivable.) Birch Company’s lease calls for rent of $900 per month payable on the first of each month, plus an annual amount equal to 2% of annual…arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning