FOCUS ON PERSONAL FINANCE LL/ACCESS >BI

6th Edition

ISBN: 9781260529326

Author: Kapoor

Publisher: McGraw-Hill Publishing Co.

expand_more

expand_more

format_list_bulleted

Question

Chapter 3, Problem 1P

Summary Introduction

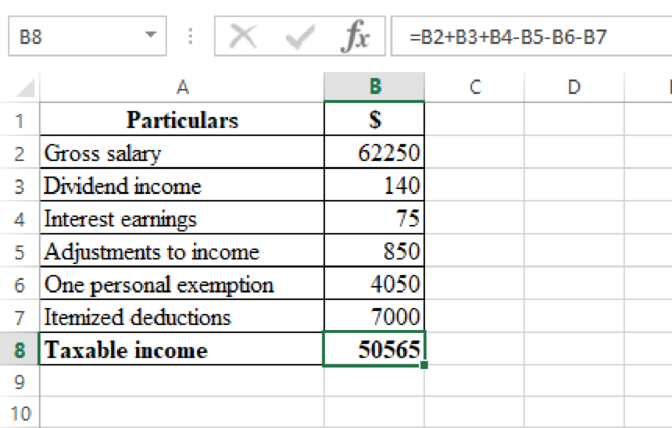

To determine: The taxable income of person D.

Expert Solution & Answer

Explanation of Solution

Computation of taxable income:

Hence, the taxable income is $50,565.

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

What is the correct answer to the following questions (1,2 and 3):

1. How much is the taxable income?

2. How much is the income tax due?

3. How much of Taylor's income is subject to final tax?

What would be the marginal tax rate for a single person who has the following taxable income?

1. $35,310

2. $67,710

3. $87,000

4. $111,750

Eddie, a single taxpayer, has W-2 income of $36,741. Using the tax tables, he has determined that his tax liability is:

Multiple Choice

$2,749.

$4,019.

$2,555.

$4,213.

Chapter 3 Solutions

FOCUS ON PERSONAL FINANCE LL/ACCESS >BI

Knowledge Booster

Similar questions

- Refer to the previous problem 8. If Stan's parents elected to report Stan's income on his parents' return, what would the tax on Stan's income be?arrow_forwardCameron is single and has taxable income of $92,616. Determine his tax liability using the tax tables and using the tax rate schedule. Why is there a difference between the two amounts? Grading Criteria: Determines tax liabilities using tax tables and tax rate schedules (P41).arrow_forwardUse the Tax Rate Tables, Exhibit 18-3, to calculate the tax liability (in $) for the taxpayer. Name : Rua Filing Status : head of the household Taxable income : $185,400 what is the Tax Liablity ??arrow_forward

- If Jose had a filing status of Head of Household and a taxable income of $111,597 in the year 2015, how much did he owe for federal income tax? Do not round any intermediate computations. Round your answer to the nearest dollar. $arrow_forwardKarla has the following incomes and tax deductionsNet Employment Income$62,350.00Capital Gains$97,650.00Allowable Capital Losses$2,715.00Contribution to RRSP$4,560.00Loss in Business$11,560.00 What is the Taxable Income for Karla?arrow_forwardCameron is single and has taxable income of $53,342. Determine his tax liability using the tax tables and using the tax rate schedule. Why is there a difference between the two amounts?arrow_forward

- Ben Jefferson arrived at the following tax information: Gross salary, $41,780 Interest earnings, $225 Dividend income, $80 One personal exemption, $2,650 Itemized deductions, $3,890 Adjustments to income, $1,150 What amount would Ben report as taxable income?arrow_forwardUsing the table below, use the 2022 tax code, find out what your taxable income is, filing single. You can assume you take an itemized deduction. Also find out what tax bracket you are in and how much you pay in taxes. For simplicity consider your dividend income taxed the same way as your salary income.arrow_forwardDoes anyone know which tax form she should use to claim her deduction of 2,500? Is it Schedule C?arrow_forward

- What is the amount of the tax liability for a single person having taxable income of $59,200? Use the appropriate Tax Tables 2022 and Tax Rate Schedule 2022arrow_forwardUse the Tax Rate Tables, Exhibit 18-3, to calculate the tax liability (in $) for the taxpayer. Name Filing Status Taxable Income Tax Liability Rua head of household $195,300arrow_forward1. Lacy is a single taxpayer. In 2021, her taxable income is $44,600. What is her tax liability in each of the following alternative situations? Use Tax Rate Schedule, Dividends, and Capital Gains Tax Rates for reference. (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. Her $44,600 of taxable income includes $7,600 of qualified dividends What is the tax Liability ?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT