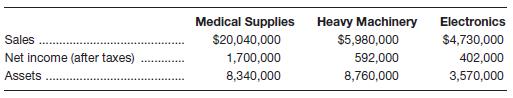

The Global Products Corporation has three subsidiaries.

a. Which division has the lowest return on sales?

b. Which division has the highest

c. Compute the return on assets for the entire corporation.

d. If the

a.

To calculate: The division with the lowest return on sales.

Introduction:

Return on sales:

It is used to compute the ratio which shows the degree to which a company makes money from its business activities. It is calculated by dividing the net income by sales.

Answer to Problem 29P

The medical supply division is the one with the lowest return on sales, that is, 8.48%. Whereas, the return on sales of heavy machinery division is 9.90% and that of electronics is 8.50%.

Explanation of Solution

Calculation of the return on sales of medical supplies:

Calculation of the return on sales of heavy machinery:

Calculation of the return on sales of electronics:

b.

To determine: The division with the highest ROA.

Introduction:

Return on assets (ROA):

It is used to compute the ratio which shows the degree to which a company makes money from its business activities. It is computed by dividing the net income of a company by its sales.

Answer to Problem 29P

The medical supply division is the one with the highest ROA, that is, 20.38%. Whereas, the ROA of heavy machinery division is 6.76% and that of electronics is 11.26%.

Explanation of Solution

The calculation of the ROA of medical supplies:

The calculation of the ROA of heavy machinery:

The calculation of the ROA of electronics:

c.

To calculate: The ROA for the entire corporation.

Introduction:

Return on assets (ROA):

It is used to compute the ratio which shows the degree to which a company makes money from its business activities. It is computed by dividing the net income of a company by its sales.

Answer to Problem 29P

The ROA for entire corporation is 13.03%.

Explanation of Solution

Calculation of the ROA for the entire corporation:

Working Notes:

Calculation of the corporate net income:

Calculation of the corporate total assets:

d.

To calculate: For the whole corporation, the new ROA.

Introduction:

Return on assets (ROA):

It is used to compute the ratio which shows the degree to which a company makes money from its business activities. It is computed by dividing the net income of a company by its sales.

Answer to Problem 29P

The new return on assets for the corporation as a whole is 18.81%.

Explanation of Solution

Calculation of new return on assets for the entire corporation:

Working Notes:

Calculation of the return on redeployed assets of heavy machinery:

Calculation of the corporate net income:

Calculation of the corporate total assets:

Want to see more full solutions like this?

Chapter 3 Solutions

Foundations Of Financial Management

- The condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that 143,750,000 of assets have been invested in the Consumer Products Division. b. If expenses could be reduced by 3,450,000 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on investment for the Consumer Products Division?arrow_forwardThe three divisions of Yummy Foods are Snack Goods, Cereal, and Frozen Foods. The divisions are structured as investment centers. The following responsibility reports were prepared for the three divisions for the prior year: a. Which division is making the best use of invested assets and should be given priority for future capital investments? b. b. Assuming that the minimum acceptable return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions? Explain. c. c. Identify opportunities for improving the companys financial performance.arrow_forwardUse the following information for Exercises 11-31 and 11-32: Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last years results: Washingtons actual cost of capital was 12%. Exercise 11-31 Economic Value Added Refer to the information for Washington Company above. Required: 1. Calculate the EVA for the Adams Division. 2. Calculate the EVA for the Jefferson Division. 3. CONCEPTUAL CONNECTION Is each division creating or destroying wealth? 4. CONCEPTUAL CONNECTION Describe generally the types of actions that Washingtons management team could take to increase Jefferson Divisions EVA?arrow_forward

- A multinational corporation has a number of divisions, two of which are the North American Division and the Pacific Rim Division. Data on the two divisions are as follows: Round all rates of return to four significant digits. Required: 1. Compute residual income for each division. By comparing residual income, is it possible to make a useful comparison of divisional performance? Explain. 2. Compute the residual rate of return by dividing the residual income by the average operating assets. Is it possible now to say that one division outperformed the other? Explain. 3. Compute the return on investment for each division. Can we make meaningful comparisons of divisional performance? Explain. 4. Add the residual rate of return computed in Requirement 2 to the required rate of return. Compare these rates with the ROI computed in Requirement 3. Will this relationship always be the same?arrow_forwardForchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).arrow_forwardBanyan Industries has two divisions, a tax rate of 30%, and a minimum rate of return of 20%. Division A has a weighted average cost of Capital of 9.5% and is looking at a new project that will generate a profit of $1,200,000 from a machine that costs $4,000,000. Division B has a weighted average cost of capital of 9.5% and is looking at a new project that will generate a profit of $1,350,000 from a machine that costs $5,000.000. A. Calculate the EVA for each of Banyans divisions. B. Calculate the RI for each of Banyans division. C. If Banyan uses EVA to evaluate the projects, which division has the better project and by how much? D. If Banyan uses RI, which division has the better project and by how much? E. What are some of the reasons for the similarity or difference that you found in the use of EVA versus RI?arrow_forward

- FedEx Corporation and United Parcel Service, Inc. compete in the package delivery business. The major fixed assets for each business include aircraft, sorting and handling facilities, delivery vehicles, and information technology. The sales and average book value of fixed assets reported on recent financial statements for each company were as follows: a. Compute the fixed asset turnover ratio for each company. Round to one decimal place. b. Which company appears more efficient in using fixed assets? c. Interpret the meaning of the ratio for the more efficient company.arrow_forwardThe operating income and the amount of invested assets in each division of Conley Industries are as follows: Operating Income Invested Assets Retail Division $184,800 $840,000 Commercial Division 142,500 570,000 Internet Division 197,600 760,000 a. Compute the return on investment for each division. (Round to the nearest whole percentage.) Division Percent Retail Division % Commercial Division % Internet Division % b. Which division is the most profitable per dollar invested?arrow_forwardRundle Transport Company divides its operations into four divisions. A recent income statement for its West Division follows. RUNDLE TRANSPORT COMPANY West Division Income Statement for Year 3 Revenue $ 620,000 Salaries for drivers (470,000 ) Fuel expenses (62,000 ) Insurance (82,000 ) Division-level facility-sustaining costs (52,000 ) Companywide facility-sustaining costs (142,000 ) Net loss $ (188,000 ) Required By how much would companywide income increase or decrease if West Division is eliminated? Should West Division be eliminated? Assume that West Division is able to increase its revenue to $690,000 by raising its prices. Determine the amount of the increase or decrease that would occur in companywide net income if the segment were eliminated. Should West Division be eliminated if revenue were $690,000? What is the minimum amount of revenue required to justify continuing the operation of West Division?arrow_forward

- Eacher Wares is a division of a major corporation. The following data are for the latest year of operations: Sales $14,720,000 Net operating income $1,000,960 Average operating assets $4,000,000 The company’s minimum required rate of return 14% a. What is the division's margin?b. What is the division's turnover?c. What is the division's return on investment (ROI)?d. What is the division's residual income?arrow_forwardThe Cook Corporation has two divisions--East and West. The divisions have the following revenues and expenses: East West Sales $ 601,000 $ 504,000 Variable costs 229,000 298,000 Traceable fixed costs 149,500 190,000 Allocated common corporate costs 126,600 154,000 Net operating income (loss) $ 95,900 $ (138,000 ) The management of Cook is considering the elimination of the West Division. If the West Division were eliminated, its traceable fixed costs could be avoided. Total common corporate costs would be unaffected by this decision. Given these data, the elimination of the West Division would result in an overall company net operating income (loss) of: Multiple Choice $95,900 $(58,100) $(138,000) $(42,100)arrow_forwardThe condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): Sales $744,000 Cost of goods sold (334,800) Gross profit $409,200 Administrative expenses (148,800) Operating income $260,400 The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $1,240,000 of assets have been invested in the Consumer Products Division. Round the investment turnover to one decimal place. Profit margin % Investment turnover Return on investment % b. If expenses could be reduced by $37,200 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on investment for the Consumer Products Division? Round the investment…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning