MANAGERIAL ACCOUNTING F/MGRS.

6th Edition

ISBN: 9781264100590

Author: Noreen

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 3.24P

Plantwide versus Multiple Predetermined Overhead Rates LO 3–1, LO 3–2

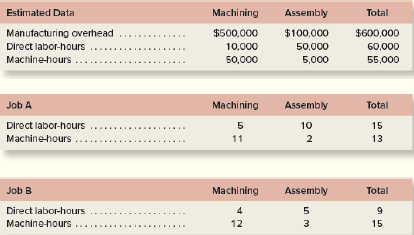

Mason Company has two manufacturing departments—Machining and Assembly. The company considers all of itsmanufacturing overhead costs to be fixed costs. It provided the following estimates at the beginning of the year as well as thefollowing information with respect to Jobs A and B:

Required:

- If Mason Company uses a plantwide predetermined overhead rate with direct labor-hours as the allocation base, how much

manufacturing overhead cost would be applied to Job A? Job B? - Assume Mason Company uses departmental predetermined overhead rates. The Machining Department is allocated based on machine-hours and the Assembly Department is allocated based on direct labor-hours. How much manufacturing overhead cost would be applied to Job A? Job B?

- If Mason multiplies its

job costs by a markup percentage to establish selling prices, how might plantwide overhead allocation adversely affect the company’s pricing decisions?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

es

Problem 2-16 (Algo) Plantwide Predetermined Overhead Rates; Pricing [LO2-1, LO2-2, LO2-3]

Landen Corporation uses a job-order costing system. At the beginning of the year, the company made the following estimates:

Direct labor-hours required to support estimated production

Machine-hours required to support estimated production

Fixed manufacturing overhead cost

Variable manufacturing overhead cost per direct labor-hour

Variable manufacturing overhead cost per machine-hour

During the year, Job 550 was started and completed. The following information is available with respect to this job:

Direct materials

Direct labor cost

Direct labor-hours

Machine-hours

$187

$ 370

15

110,000

55,000

$ 308,000

5

$ 3.20

$ 6.40

Required:

1. Assume that Landen has historically used a plantwide predetermined overhead rate with direct labor-hours as the allocation base.

Under this approach:

a. Compute the plantwide predetermined overhead rate.

b. Compute the total manufacturing cost of Job 550.

c. If Landen…

-S

Exercise 2-12 (Algo) Computing Predetermined Overhead Rates and Job Costs [LO2-1, LO2-2, LO2-3]

Moody Corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. At the

beginning of the year, the company made the following estimates:

Machine-hours required to support estimated production

Fixed manufacturing overhead cost

Variable manufacturing overhead cost per machine-hour

Required:

1. Compute the plantwide predetermined overhead rate.

2. During the year, Job 400 was started and completed. The following information was available with respect to this job:

Direct materials

Direct labor cost

Machine-hours used

$ 330

$ 260

36

Compute the total manufacturing cost assigned to Job 400.

3. If Job 400 includes 50 units, what is the unit product cost for this job?

4. If Moody uses a markup percentage of 120% of its total manufacturing cost, then what selling price per unit would it have

established for Job 400?

Complete this question by…

Problem 2-18 (Algo) Plantwide Predetermined Overhead Rates; Pricing [LO2-1, LO2-2, LO2-3]

Landen Corporation uses job-order costing. At the beginning of the year, it made the following estimates:

Direct labor-hours required to support estimated production

Machine-hours required to support estimated production

Fixed manufacturing overhead cost

Variable manufacturing overhead cost per direct labor-hour

Variable manufacturing overhead cost per machine-hour

During the year, Job 550 was started and completed. The following information pertains to this job:

Direct materials

Direct labor cost

Direct labor-hours.

Machine-hours

$ 195

$288

150,000

75,000

$ 420,000

15

5

$ 4.60

$ 9.20

Required:

1. Assume Landen has historically used a plantwide predetermined overhead rate with direct labor-hours as the allocation base.

Under this approach:

a. Compute the plantwide predetermined overhead rate.

b. Compute the total manufacturing cost of Job 550.

c. If Landen uses a markup percentage of 200% of its…

Chapter 3 Solutions

MANAGERIAL ACCOUNTING F/MGRS.

Ch. 3 - Prob. 3.1QCh. 3 - Prob. 3.2QCh. 3 - Prob. 3.3QCh. 3 - Prob. 3.4QCh. 3 - Prob. 3.5QCh. 3 - Prob. 3.6QCh. 3 - Prob. 3.7QCh. 3 - Prob. 3.8QCh. 3 - Prob. 3.9QCh. 3 - Prob. 3.10Q

Ch. 3 - Prob. 3.11QCh. 3 - Prob. 3.12QCh. 3 - Prob. 3.13QCh. 3 - Prob. 1AECh. 3 - Prob. 1TF15Ch. 3 - Prob. 3.1ECh. 3 - Prob. 3.2ECh. 3 - Prob. 3.3ECh. 3 - Prob. 3.4ECh. 3 - Prob. 3.5ECh. 3 - Prob. 3.6ECh. 3 - Prob. 3.7ECh. 3 - Prob. 3.8ECh. 3 - Prob. 3.9ECh. 3 - Prob. 3.10ECh. 3 - Prob. 3.11ECh. 3 - Prob. 3.12ECh. 3 - Prob. 3.13ECh. 3 - Prob. 3.14ECh. 3 - Prob. 3.15ECh. 3 - Prob. 3.16PCh. 3 - Prob. 3.17PCh. 3 - Prob. 3.18PCh. 3 - Prob. 3.19PCh. 3 - Prob. 3.20PCh. 3 - Prob. 3.21PCh. 3 - Prob. 3.22PCh. 3 - Prob. 3.23PCh. 3 - Plantwide versus Multiple Predetermined Overhead...Ch. 3 - Prob. 3.25PCh. 3 - Prob. 3.26C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Overhead application rate Roll Tide Manufacturing Inc. uses a job order cost system and standard costs. It manufactures one product, whose standard cost follows: The standards are based on normal capacity of 2,700 direct labor hours. Actual activity for March follows: Required: 1. Compute the variable and fixed factory overhead rates per unit. 2. Compute the variable and fixed overhead rates per direct labor hour. 3. Determine the total fixed factory overhead based on normal capacity.arrow_forwardOverhead Applied to Jobs, Departmental Overhead Rates Xania Inc. uses a normal job-order costing system. Currently, a plantwide overhead rate based on machine hours is used. Xania's plant manager has heard that departmental overhead rates can offer significantly better cost assignments than a plantwide rate can offer. Xania has the following data for its two departments for the coming year: Overhead costs (expected) Normal activity (machine hours) Required: Department A Department B 1. Compute a predetermined overhead rate for the plant as a whole based on machine hours. Round your answer to two decimal places. 5.75 ✔per machine hour Plantwide 2. Compute predetermined overhead rates for each department using machine hours. (Note: Round to two decimal places, if necessary.) 8.28 ✔ per machine hour 2.89✔ per machine hour Departmental $ 3. Conceptual Connection: Job 73 used 20 machine hours from Department A and 50 machine hours from Department B. Job 74 used 50 machine hours from…arrow_forward- ok k int ences w 3 E Overhead information for Cran-Mar Company for October follows: Total factory overhead cost incurred Budgeted fixed factory overhead cost Total standard overhead rate per machine hour (MH) D Standard variable factory overhead rate per MH Standard MHS allowed for the units manufactured here to search Required: 1. What is the standard fixed factory overhead rate per machine hour (MH)? 2. What is the denominator activity level that was used to establish the fixed factory overhead application rate? 3. Two-way analysis (breakdown) of the total factory overhead cost variance: calculate the following factory overhead cost variances for October and indicate whether each variance is favorable (F) or unfavorable (U). a. Total flexible-budget variance. b. Production volume variance. c. Total overhead cost variance. 4. Calculate the production volume variance and indicate whether the variance is favorable (F) or unfavorable (U). Complete this question by entering your answers…arrow_forward

- Sybil, Inc. uses a predetermined overhead allocation rate to allocate manufacturing overhead costs to jobs. The company recently completed Job 300X. This job used 14 machine hours and 2 direct labor hours. The predetermined overhead allocation rate is calculated to be $40 per machine hour. What is the amount of manufacturing overhead allocated to Job 300X using machine hours as the allocation base? Question content area bottom Part 1 A. $80 B. $480 C. $640 D. $560arrow_forwardts Problem 2-24 (Algo) Plantwide Versus Multiple Predetermined Overhead Rates [LO2-1, LO2-2] Mason Company has two manufacturing departments-Machining and Assembly. All of the company's manufacturing overhead costs are fixed costs. It provided the following estimates at the beginning of the year as well as the following information for Jobs A and B: Estimated Data Manufacturing overhead Direct labor-hours Machine-hours Job A Direct labor-hours Machine-hours. Job B Direct labor-hours Machine-hours Machining $ 726,000 11,000 66,000 Machining Assembly 5 10 11 Machining 4 12 Assembly $ 121,000 66,000 6,000 2 1. Manufacturing overhead applied Job A 1. Manufacturing overhead applied Job B 2. Manufacturing overhead applied Job A 2. Manufacturing overhead applied Job B Assembly 5 3 Total 15 13 Total 9 15 Required: 1. If Mason Company uses a plantwide predetermined overhead rate with direct labor-hours as the allocation base, how much manufacturing overhead cost would be applied to Job A? Job…arrow_forwardTest yourself ABC Company is producing three products, A, B and C in Direct labor hours their unit. A В C 10,000 15,000 25,000 Number of orders 15 25 10 placed During the year 2019,the total overhead expenses Machine set up hours 150 300 50 are; Requirement 1. Calculated pre-determined overhead rate if overhead is applied based on the direct labor hours .Compute overhead rates using activity based costing. Determine the difference in the amount of overhead allocated to each Procurement cost RO200,000 Machine set up cost RO100,000 product between the two methods.arrow_forward

- Question No.6 Hunter Company manufactures two products (XX and YY). The overhead costs have been divided into four cost pools that use the following activity drivers. Product Number of Orders Number of Set-ups Number of Labor Transactions Labor Hours XX YY Cost per pool 60 20 Rs.16,000 20 80 Rs.13,000 50 70 Rs.2,400 2,000 500 Rs.20,000 Required: Compute the allocation rates for each of the activity drivers listed. Allocate the overhead costs to product XX and product YY using activity-based costing. Compute the overhead rate using machine hours under the functional-based costing system. Allocate the overhead cost to Product XX and YY using the functional-based costing system overhead rate calculated in part C.arrow_forward1 Assume Delph uses departmental predetermined overhead rates based on machine-hours.a Compute the departmental predetermined overhead rates.b Compute the total manufacturing cost assigned to Job D-70 and Job C-200.c If Delph establishes bid prices that are 150% of total manufacturing cost, what bid prices would it have established for Job D-70 andJob C-200?d What is Delph's cost of goods sold for the year? 2 Assume Delph chooses to combine its departmental rates from requirement 1 into a plantwide predetermined overhead rate based onmachine hours.a Compute the plantwide predetermined overhead rate.b Compute the total manufacturing cost assigned to Job D-70 and Job C-200.c If Delph establishes bid prices that are 150% of total manufacturing cost, what bid prices would it have established for Job D-70 andJob C-200?d What is Delph's cost of goods sold for the year? 3 What managerial insights are revealed by the computations that you performed in this problem? (Hint: Do the cost of…arrow_forwardQuestion No.5 Ivory Corporation manufactures two products (A and B). The overhead costs have been divided into four cost pools that use the following activity drivers: Product Number of Orders Number of Set-ups Number of Labor Transactions Labor Hours A B Cost per pool 20 5 Rs.15,000 35 70 Rs.8,400 1,000 1,500 Rs.120,000 75 125 Rs.40,000 Required: Compute the allocation rates for each of the activity drivers listed. Allocate the overhead cost to Product A and B using activity-based-costing. Compute the overhead rate using machine hours under the functional based costing system. Allocate the overhead cost to Product A and B using the functional-based costing system overhead rate calculated in part C.arrow_forward

- S ipped Book erences Kunkel Company makes two products and uses a conventional costing system in which a single plantwide predetermined overhead rate is computed based on direct labor-hours. Data for the two products for the upcoming year follow: Mercon $ 10.00 Direct materials cost per unit Direct labor cost per unit Direct labor-hours per unit Number of units produced $ 3.00 0.20 10,000 These products are customized to some degree for specific customers. Wurcon $ 8.00 $ 3.75 0.25 40,000 Required: 1. The company's manufacturing overhead costs for the year are expected to be $336,000. Using the company's conventional costing system, compute the unit product costs for the two products. 2. Management is considering an activity-based costing system in which half of the overhead would continue to be allocated on the basis of direct labor-hours and half would be allocated on the basis of engineering design time. This time is expected to be distributed as follows during the upcoming year: 1.…arrow_forwardQuestion No.5 Hunter Company manufactures two products (XX and YY). The overhead costs have been divided into four cost pools that use the following activity drivers. Product Number of Orders Number of Set-ups Number of Labor Transactions Labor Hours XX YY Cost per pool 60 20 Rs.16,000 20 80 Rs.13,000 50 70 Rs.2,400 2,000 500 Rs.20,000 Required: Compute the allocation rates for each of the activity drivers listed. Allocate the overhead costs to product XX and product YY using activity-based costing. Compute the overhead rate using machine hours under the functional-based costing system. Allocate the overhead cost to Product XX and YY using the functional-based costing system overhead rate calculated in part ©.arrow_forwardProblem 2-16 (Algo) Plantwide Predetermined Overhead Rates; Pricing [LO2-1, LO2-2, LO2-3] Landen Corporation uses a job-order costing system. At the beginning of the year, the company made the following estimates: Direct labor-hours required to support estimated production 60,000 Machine-hours required to support estimated production 30,000 Fixed manufacturing overhead cost $ 180,000 Variable manufacturing overhead cost per direct labor-hour $ 1.00 Variable manufacturing overhead cost per machine-hour $ 2.00 During the year, Job 550 was started and completed. The following information is available with respect to this job: Direct materials $ 213 Direct labor cost $ 323 Direct labor-hours 15 Machine-hours 5 Required: 1. Assume that Landen has historically used a plantwide predetermined overhead rate with direct labor-hours as the allocation base. Under this approach: a. Compute the plantwide predetermined overhead rate. b. Compute the total…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

alue Chain Analysis EXPLAINED | B2U | Business To You; Author: Business To You;https://www.youtube.com/watch?v=SI5lYaZaUlg;License: Standard Youtube License