Concept explainers

Understand the flow of costs in a

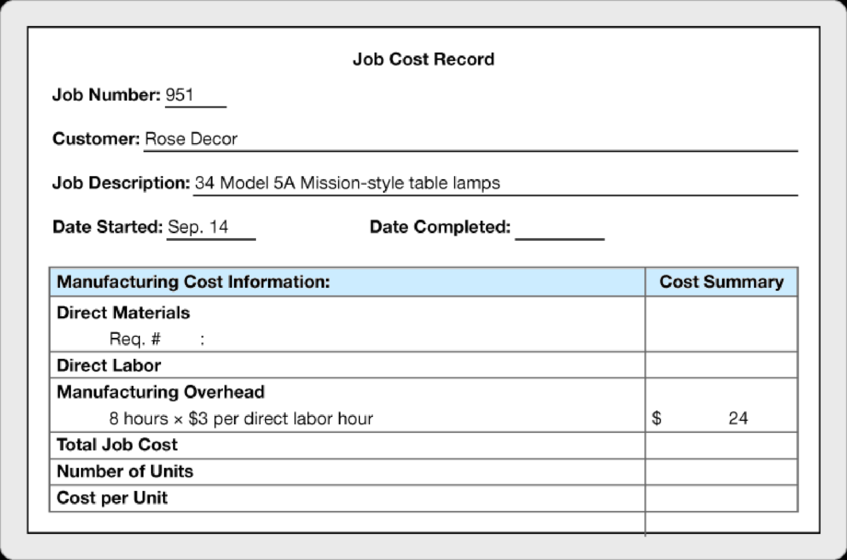

Hamilton Lighting manufactures a variety of lamps for lighting specialty stores. In September, Hamilton Lighting received an order from Rose Decor for 34 mission-style table lamps (Model 5A.) The order from Rose Decor became Job Number 951 at Hamilton Lighting.

Materials requisition #1298 for Job 951 shows that a total of $196 of direct materials were used in manufacturing the job. In addition to the materials requisition, the labor time records show that a total of $79 of direct labor costs was incurred in producing these lamps; a total of 8 direct labor hours were worked on this job.

Requirement

Add direct materials and direct labor to the Job Cost Record for Job 951. Manufacturing overhead has already been added to the Job Cost Record for this job. Assume that the job was completed on September 19. Complete the Job Cost Record by calculating the total job cost and the cost per unit. Remember that this job consisted of 34 lamps (units).

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Managerial Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (5th Edition)

- Click to watch the Tell Me More Learning Objective 3 video and then answer the questions below. 1. The journal entry to recognize depreciation on machinery is ________. a debit to Factory Overhead and a credit to Accumulated Depreciation a debit to Accumulated Depreciation and a credit to Factory Overhead a debit to Factory Overhead and a credit to Depreciation Expense a debit to Depreciation Expense and a credit to Factory Overhead 2. Process and job order cost systems are similar in ________ manner. recording and summarizing product costs classifying product costs as direct materials, direct labor, and factory overhead allocating factory overhead costs to products All of these choices are correct.arrow_forwardClick to watch the Tell Me More Learning Objective 4 video and then answer the questions below. 1. Which of the following represents the computation of direct materials cost per equivalent unit? Total direct cost for the period divided by total equivalent units of direct materials. Total equivalent units of direct materials divided by total direct cost for the period. Total direct cost for the period divided by total units of direct materials. Total units of direct materials divided by total direct cost for the period. 2. What is the conversion cost per equivalent unit, when the total conversion cost for the period is $1,225 and the total units of packaged drinking water produced during the same period is 5,000 gallons (70 percent complete). $0.17 per gallon $0.35 per gallon $2.86 per gallon None of these choices are correct.arrow_forwardE4-23A Use ABC to allocate manufacturing overhead (Learning Objective 2) Several years after reengineering its production process, Biltmore Corporation hired a new controller, Rachael Johnson. She developed an ABC system very similar to the one used by Biltmore’s chief rival, Westriver. Part of the reason Johnson developed the ABC system was because Biltmore’s profits had been declining even though the company had shifted its product mix toward the product that had appeared most profitable under the old system. Before adopting the new ABC system, Biltmore had used a plantwide overhead rate based on direct labor hours that was developed years ago. For the upcoming year, Biltmore’s budgeted ABC manufacturing overhead allocation rates are as follows: Activity Allocation Base Activity Cost Allocation Rate Materials handling # of parts $3.84 per part Machine setup # of setups $330.00 per setup Insertion of parts # of parts $30.00 per part Finishing Finishing DL hrs $54.00 per hour The…arrow_forward

- Click to watch the Tell Me More Learning Objective 2 video and then answer the questions below. 1. The first step in preparing a cost of production report is to _____. compute equivalent units of production determine the units to be assigned costs determine the cost per equivalent unit allocate costs to units transferred out and partially completed units 2. The last step in preparing a cost of production report is to _____. compute equivalent units of production determine the units to be assigned costs determine the cost per equivalent unit allocate costs to units transferred out and partially completed unitsarrow_forwardCost Identification Following is a list of cost terms described in the chapter as well as a list of brief descriptive settings for each item. Cost terms: a. Opportunity cost b. Period cost c. Product cost d. Direct labor cost e. Selling cost f. Conversion cost g. Prime cost h. Direct materials cost i. Manufacturing overhead cost j. Administrative cost Settings: 1. Marcus Armstrong, manager of Timmins Optical, estimated that the cost of plastic, wages of the technician producing the lenses, and overhead totaled 30 per pair of single-vision lenses. 2. Linda was having a hard time deciding whether to return to school. She was concerned about the salary she would have to give up for the next 4 years. 3. Randy Harris is the finished goods warehouse manager for a medium-sized manufacturing firm. He is paid a salary of 90,000 per year. As he studied the financial statements prepared by the local certified public accounting firm, he wondered how his salary was treated. 4. Jamie Young is in charge of the legal department at company headquarters. Her salary is 95,000 per year. She reports to the chief executive officer. 5. All factory costs that are not classified as direct materials or direct labor. 6. The new product required machining, assembly, and painting. The design engineer asked the accounting department to estimate the labor cost of each of the three operations. The engineer supplied the estimated labor hours for each operation. 7. After obtaining the estimate of direct labor cost, the design engineer estimated the cost of the materials that would be used for the new product. 8. The design engineer totaled the costs of materials and direct labor for the new product. 9. The design engineer also estimated the cost of converting the raw materials into their final form. 10. The auditor for a soft drink bottling plant pointed out that the depreciation on the delivery trucks had been incorrectly assigned to product cost (through overhead). Accordingly, the depreciation charge was reallocated on the income statement. Required: Match the cost terms with the settings. More than one cost classification may be associated with each setting; however, select the setting that seems to fit the item best. When you are done, each cost term will be used just once.arrow_forwardplease assist and show all workings Personal Protective Gears & More (PPGM) design and manufacture masks for students. Afterproduction, the masks are placed into individual cases, before being transferred into Finished Goods. Theaccounting records of the business reflect the following data at June 30, 2021, for the manufacturing ofmasks for Mount Marlie High School. Inventory 1/7/2020 30/6/2021Raw Materials $230,000 $260,000Factory Supplies $35,000 $24,000Work in Progress $348,300 $203,300Finished Goods $632,900 $485,000 other information Sales Revenue $5,731,000Factory Supplies Purchased 64,000Direct Factory Labor 792,000Raw Materials Purchased 560,000Plant janitorial service…arrow_forward

- Average labor cost for the first 700 units of a product is RO 50 and the average labor cost of first 1400 units is RO 45. Average time per unit is 100 minutes. The learning ratio and the average labour cost for first 2800 units will be: a. 80% and RO 36.000 b. 90% and RO 40.500 c. 85% and RO 38.250 d. 95% and RO 42.750arrow_forwardUse ABC to allocate manufacturing overhead (Learning Objective 2)Several years after reengineering its production process, King Corporation hired a new controller, Christine Erickson . She developed an ABC system very similar to the one used by King's chief rival. Part of the reason Erickson developed the ABC system was because King's profits had been declining, even though the company had shifted its product mix toward the product that had appeared most profitable under the old system . Before adopting the new ABC system, the company had used a plantwide overhead rate, based on direct labor hours developed years ago .For the upcoming year, King's budgeted ABC manufacturing overhead allocation rates are as follows :ActivityMaterials handling .......................... Machine setup ................................ Insertion of parts ............................ Finishing .........................................Allocation BaseNumber of partsNumber of setupsNumber of partsFinishing…arrow_forwardYour company has received an order for 20 units of aproduct. Th e labor cost to produce the item is $9.50 per hour. Th esetup cost for the item is $60 and material costs are $25 per unit. Th e item is sold for $92. Th e learning rate is 80 percent. Overheadis assessed at a rate of 55 percent of unit labor cost.(a) Determine the average unit cost for the 20 units if the fi rstunit takes four hours.(b) Determine the minimum number of units that need to bemade before the selling price meets or exceeds the averageunit cost.arrow_forward

- The Business 182, Section EG class for the Spring, 2021, has completely outperformed expectations. As such, we have been hired by Trek Bike Company to build a new hybrid bike. We will build the bike in a warehouse and sell it in a storefront. Because Trek’s Bikes are so expensive and so unique, we will deploy a Job Costing system. Journalize the following transactions or make the necessary calculations: 1. Calculation. Building a bicycle is labor intensive. And as such, we think the best way to allocate overhead is on Direct Labor Hours. At the beginning of the year, we estimate the following annual items: Warehouse Rent $8,000 Storefront Rent $7,000 Manufacturing Supervisor Salary $40,000 Storefront Supervisor Salary $50,000 Indirect Materials $10,000 Total Machine Hours 29,000 Hours Total Labor Hours 10,000 Hour Calculate the Budgeted Overhead Rate for the year. 2. January 10th We start building our first bike. We will call it Job…arrow_forwardBordner Company manufactures HVAC (heating, ventilation, and air conditioning) systems for commercial buildings. For each new design, Bordner faces a 90 percent learning rate. On average, the first unit of a new design takes 600 hours. Direct labor is paid 25 per hour. Required: 1. Set up a table with columns showing: the cumulative number of units, cumulative average time per unit in hours, and cumulative total time in hours. Show results by row for total production of one unit, two units, four units, eight units, and sixteen units. (Round hour answers to two significant digits.) 2. What is the total labor cost if Bordner makes the following number of units: one, four, sixteen? What is the average cost per system for the following number of systems: one, four, or sixteen? (Round your answers to the nearest dollar.) 3. Using the logarithmic function, set up a table with columns showing: the cumulative number of units, cumulative average time per unit in hours, cumulative total time in hours, and the time for the last unit. Show results by row for each of units one through eight. (Round answers to two significant digits.)arrow_forwardP10-53B Determine transfer price at a manufacturer under various scenarios (Learning Objective 4) Assume the Small Components Division of Lang Manufacturing produces a video card used in the assembly of a variety of electronic products. The division's manufacturing costs, and variable selling expenses related to the video card are as follows: Cost per unit Direct materials $ 14.00 Direct labor $ 4.00 Variable manufacturing overhead $ 8.00 Fixed manufacturing overhead (at current production level) $ 9.00 Variable selling expenses $ 10.00 The Computer Division of Lang Manufacturing can use the video card produced by the Small Components Division and is interested in purchasing the video card in-house rather than buying it from an outside supplier. The Small Components Division has sufficient excess capacity with which to make the extra video cards. Because of competition, the market price for this video card is $30 regardless of whether the…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning