• LO3–2, LO3–3

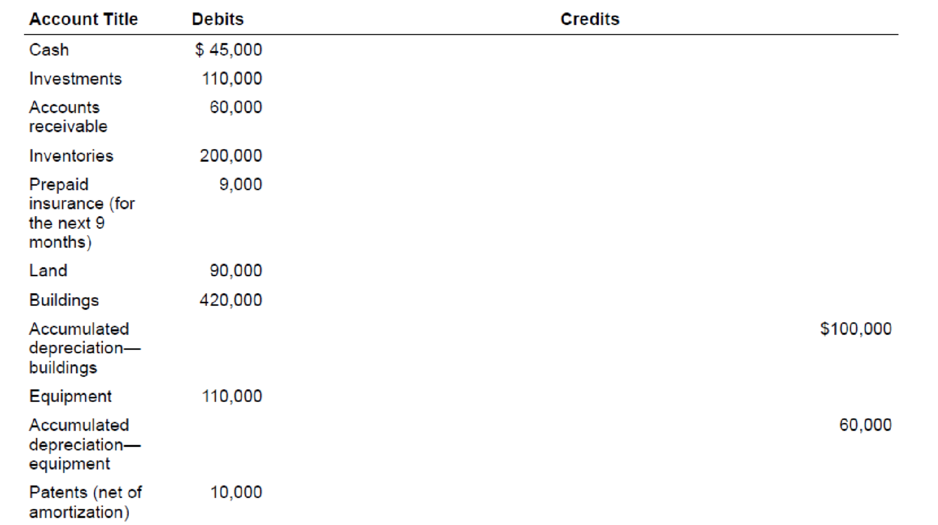

The following is a December 31, 2018, post-closing

Additional Information:

1. The investment account includes an investment in common stock of another corporation of $30,000 which management intends to hold for at least three years. The balance of these investments is intended to be sold in the coming year.

2. The land account includes land which cost $25,000 that the company has not used and is currently listed for sale.

3. The cash account includes $15,000 restricted in a fund to pay bonds payable that mature in 2021 and $23,000 restricted in a three-month Treasury bill.

4. The notes payable account consists of the following:

a. a $30,000 note due in six months

b. a $50,000 note due in six years

c. a $50,000 note due in five annual installments of $10,000 each, with the next installment due February 15, 2019

5. The $60,000 balance in

6. The common stock account represents 100,000 shares of no par value common stock issued and outstanding. The corporation has 500,000 shares authorized.

Required:

Prepare a classified balance sheet for the Almway Corporation at December 31, 2018.

Trending nowThis is a popular solution!

Chapter 3 Solutions

Intermediate Accounting

- Working capital and current ratio Current assets and current liabilities for HQ Properties Company follow: 2019 2018 Current assets 2,175,000 1,900,000 Current liabilities 1,500,000 1,250,000 a.Determine the working capital and current ratio for 2019 and 2018. b.Does the change in the current ratio from 2018 to 2019 indicate a favorable or an unfavorable change?arrow_forwardInvestment reporting Teasdale Inc. manufactures and sells commercial and residential security equipment. The comparative unclassified balance sheets for December 31, Year 2 and Year 1 are provided below. Selected missing balances are shown by letters. Teasdale Inc. Balance Sheet December 31, Year 2 and Year 1 Dec. 31, Year 2 Dec. 31, Year 1 Cash 160,000 156,000 Accounts receivable (net) 11S.OOO 108,000 Available for-sale investments (at cost)Note 1 a. 91,200 Plus valuation allowance for available-for-sale investments b. 8,776 Available for-sale investments (fair value) c 99,976 Interest receivable d. Investment in Wright Co. stockNote 2 e. 69,200 Office equipment (net) 96,000 105,000 Total assets f. 5538,176 Accounts payable 91,000 72,000 Common stock 80,000 80,000 Excess of issue price over par 250,000 250,000 Retained earnings g 127,400 Unrealized gain (loss) on available for-sale investments h. 8,776 Total liabilities and stockholders' equity S i. 5538,176 Note 1. Investments are classified as available for sale. The investments at cost and fair value on December 31, Year 1, are as follows: No. of Shares Cost per Share Total Cost Total Fair Value Alvarez Inc stock 960 38,00 36,480 39,936 Hirsch Inc. stock 1,900 28,80 4,720 60,040 91,200 99,976 Note 2. The Investment in Wright Co. stack is an equity method investment representing 30% of the outstanding shares of Wright Co. The following selected investment transactions occurred during Year 2: Mar. 18. Purchased 800 shares of Richter Inc. at 40, including brokerage commission. Richter is classified as an available-for-sale security. July 12. Dividends of 12,000 art: received on the Wright Co. investment. Oct 1. Purchased 24,000 of Toon Co. 4%, 10-year bonds at 100. the bonds are classified as available for sale. The bonds pay interest on October 1 and April 1. December 31. Wright Co. reported a total net income of 80,000 for Year 2. Teasdale recorder equity earnings for its share of Wright Co. net income. 31. Accrued interest for three months on the Toon Co. bonds purchased on October 1. 31. Adjusted the available-for-sale investment portfolio to fair value, using the following fair value per-share amounts: Available for Sale Investments Fair Value Alvarez Inc. stock 41,50 per share Hirsch Inc stock 26,00 per share Richter Inc. stock 48,00 per share Toon Co. bonds 101 per 100 of face amount 31. Closed the Teasdale Inc. net income of 51,240. Teasdale Int. paid no dividends during the year. Instructions Determine the missing letters in the unclassified balance sheet. Provide appropriate supporting calculations.arrow_forwardPart B ( 7 marks) (Note this question IS related to Part A) SuperElectronics Limited Adjusted Trial Balance As at 30 June 2020 Debit Credit $ $ Cash 87,000 Accounts receivable 89,000 Allowance for Doubtful debts 4,300 Supplies 4,000 Plant & Equipment 218,000 Accumulated depreciation 64,000 Accounts Payable 38,000 Wages Payable 11,500 Loan payable ( not due until 2025) 50,000 Share capital 100,000 Retained Earnings 105,250 Dividends paid 10,000 Sales Revenue 368,000 Interest revenue 1,120 Doubtful debts expense 2,460 Depreciation expense 19,680 Rent & utilities expense 19,230 Wages and Salaries expense 281,000 Advertising expense 9,300 Interest expense 2,500 Totals 742,170 742,170 Required Prepare the Statement of Financial Position ( Balance…arrow_forward

- Serial Problem Business Solutions LO P1, A1 Selected ledger account balances for Business Solutions follow. For Three MonthsEnded December 31, 2019 For Three MonthsEnded March 31, 2020 Office equipment $ 8,100 $ 8,100 Accumulated depreciation—Office equipment 405 810 Computer equipment 20,000 20,000 Accumulated depreciation—Computer equipment 1,250 2,500 Total revenue 31,334 44,900 Total assets 83,360 121,668 Required:1. Assume that Business Solutions does not acquire additional office equipment or computer equipment in 2020. Compute amounts for the year ended December 31, 2020, for Depreciation expense—Office equipment and for Depreciation expense—Computer equipment (assume use of the straight-line method).2. Given the assumptions in part 1, what is the book value of both the office equipment and the computer equipment as of December 31, 2020?3. Compute the three-month total asset turnover for Business…arrow_forwardQuestion 2Prepare a statement of Profit and Loss Appropriation, capital account, current account for theyear ended 31 December 2020 and extract of statement of financial position at that date, fromthe following:i) Net profit RM30,350ii) Interest to be charged on capital: Wong RM2,000; Pang RM1,500; Halim RM900.iii) Interest to be charged on drawings: Wong RM240; Pang RM180; Halim RM130.iv) Salaries to be credited: Pang RM2,000; Halim RM3,500v) Profit to be shared: Wong 50%; Pang 30%; Halim 20%vi) Current account b/f: Wong RM1,860; Pang RM946; Halim RM717vii) Capital account b/f: Wong RM40,000; Pang RM30,000; Halim RM18,000viii) Drawings: Wong RM 9,200; Pang RM7,100; Halim RM6,900arrow_forwardhd.10. Question 1 Loftus et al (2023) Exercise 13.5 Amended The following information was extracted from records of Nawa Ltd for the year ended 30 June 2024. NAWA LTD Statement of financial position (extract) as at 30 June 2024 Assets Accounts receivable $ 50 000 Allowance for doubtful debts (5 000 ) $ 45 000 Motor vehicles 250 000 Accumulated depreciation — motor vehicles (50 000 ) 200 000 Liabilities Interest payable 5 000 Additional information • The accumulated tax depreciation for motor vehicles at 30 June 2024 was $100 000. • As at 30 June 2023, the balance in the deferred tax asset was $2,000 and the balance in the deferred tax liability was $8,000. • The income tax rate is 30%. Required: Prepare a deferred tax worksheet for Nawa Ltd and the end of year deferred tax journal entry required to bring the deferred tax accounts to their ending balances as at 30 June 2024.arrow_forward

- Question C4 The following trial balance was extracted from the books of Amal Ltd on 31/12/2020 Dr Cr $ $ Share Capital: 300,000 Ordinary shares of $ 1 each 300,000 Share Premium 22,500 Retained Earnings 44,610 Land (Cost) 420,000 Office Building 73,500 Furniture & Fittings (Cost) 13,500 Accumulated Depreciation on: Furniture and fittings 9,000 Office building 7,500 Other Income Received 12,000 Trade Receivables 28,425 Trade Payables 19,395 Inventory in trade 1.1.2020 28,395 Allowance for Bad Debts 1,350 Interest…arrow_forwardPls answer number 5 with solutions On January 1, 20x1 WRECK RUIN Co. acquired land by issuing a three-year, 12%, ₱4,000,000 note payable. Principal and all accrued interests are due on December 31, 20x3. How much is the interest expense in 20x2? a. 1,017,600 c. 537,600 b. 960,000 d. 764,213arrow_forwardQuestion 4 of 4 Current Attempt in Progress Ivanhoe Company provides you with the following balance sheet information as of December 31, 2025. Current assets $9,800 Current liabilities $10,000 Long-term assets 22,310 Long-term liabilities 12,040 Total assets $32,110 Stockholders' equity 10,070 Total liabilities and stockholders' equity $32,110 In addition, Ivanhoe reported net income for 2025 of $13,760, income tax expense of $2,816, and interest expense of $1,170. (a) Compute the current ratio and working capital for lvanhoe for 2025. (Round current ratio to 2 decimal ploces, e.3. 2.75. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.s. (45).) Current ratio Working capital please answer do not image formatarrow_forward

- ln 1/1/2020 the balance of retained earnings is 60 000 lD ., the net income for the year 350 000 lD. , dividends declared on 310 000 lD ., additional depreciation in building 40 000 lD., the retained earnings in 31/12/2020 is :- 410 000 lD . 60 000 lD . 40 000 lD . 100 000 lD . no one.arrow_forwardQ#3 Following in the adjusted trial balance of M/s Rizwan for the year 2020ACCOUNT TITLES DEBIT CREDITCash 150000Inventory 10,000Prepaid rent 50,000Office Supplies 60,000Land 900,000Building 800,000Accumulated Depreciation 40,000Accounts payable 80,000Salaries payable 55,000Long term loan 390,000Purchases 400,000Sales 600,000Purchase returns 18,000Sales returns 14,000Transportation-in 5,000Interest expense 2,000Salaries expense 44,000Depreciation expense 29,000Electricity expense 5,000Interest expense 5,000Interest payable 25,000Commission Income 22,000Capital 1,254,000Drawing 10000Total 2,484,000 2,484,000Inventory Closing Rs. 50,000REQUIRED a) Prepare Income Statement for the year ended December 31, 2020.arrow_forwardD&R A3 3 - 1 Question 3. FRA Pricing, Valuation, Payoff, and Hedging Today is June 1. Sustainable Corporation has an obligation of $25 million coming due on August 1. The company is planning to borrow this amount on August 1 to fulfill its obligation, and plans to pay back the loan on December 1. The company’s borrowing rate is LIBOR + 125 basis points. The company’s bank presents it with the following LIBOR term structure: # days LIBOR 30 0.90% 60 1.00% 90 1.05% 120 1.10% 150 1.15% 180 1.18% 210 1.20% 240 1.21% For the calculation of interest, the bank assumes 30 days in a month, and 360 days in a year. Ms. Devro, the VP Finance of Sustainable, is worried that LIBOR will increase between June and August, thus increasing the company’s borrowing cost. She advises that the company enters into a forward rate agreement (FRA) with its bank to hedge its interest rate risk. She has asked you, the treasurer of the company, to…arrow_forward

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,