(a)

Journal:

Journal is the book of original entry. Journal consists of the day-to-day financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

To journalize: The business transactions as given for Company A.

(a)

Answer to Problem 3.5AP

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| April. 1 | Cash | 18,000 | |

| Common stock | 18,000 | ||

| (To record the issuance of common stock ) |

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| April. 1 | No entry required. | ||

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| April. 2 | Rent expenses | 900 | |

| Cash | 900 | ||

| (To record the office rent paid for the month) |

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| April. 3 | Supplies | 1,300 | |

| Account payable | 1,300 | ||

| (To record the architectural supplies purchased on account) |

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| April. 10 |

| 1,900 | |

| Service revenue | 1,900 | ||

| (To record the services performed on account) |

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| April. 11 | Cash | 700 | |

| Unearned service revenue | 700 | ||

| (To record the cash earned for the service yet to provide.) |

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| April. 20 | Cash | 2,800 | |

| Service revenue | 2,800 | ||

| (To record the cash received for the service rendered) |

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| April. 30 | Salaries expense | 1,500 | |

| Cash | 1,500 | ||

| (To record the payment of salaries to secretary – receptionist) |

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| April. 30 | Accounts Payable | 300 | |

| Cash | 300 | ||

| (To record the payment of cash on account) |

Table (1)

Explanation of Solution

April. 1

- Cash is an asset and increased, hence debit cash for $18,000.

- Common stock is a component of

stockholders’ equity and increased, hence credit common stock for $18,000.

April. 1

- This transaction does not have any effect on the

accounting equation of the company since there is no change in the value of assets, liabilities and stockholder’s equity. Hence, no entry is required.

April. 2

- Rent expense is a component of stockholders’ equity and decreased, hence debit rent expenses for $900.

- Cash is an asset and decreased, hence credit cash for $900.

April. 3

- Supply is an asset and increased, hence debit supplies for $1,300.

- Account payable is a liability account and liabilities increased, hence credit account payable for $1,300.

April. 10

- Accounts receivable is an asset and increased, hence debit accounts receivable for $1,900.

- Service revenue is a component of stockholder’s equity account and increased, hence credit service revenue for $1,900.

April. 11

- Cash is an asset and increased, hence debit cash for $700.

- Unearned service revenue is a liability account and increased, hence credit unearned service revenue for $700.

April. 20

- Cash is an asset and increased, hence debit cash for $2,800.

- Service revenue is a component of stockholder’s equity account and increased, hence credit service revenue for $2,800.

April. 30

- Salaries expense is a component of stockholders’ equity and decreased, hence debit salaries expenses for $1,500

- Cash is an asset and decreased, hence credit cash for $1,500.

April. 30

- Account payable is a liability account and decreased, hence debit account payable for $300.

- Cash is an asset and decreased, hence credit cash for $300.

(b)

T-Accounts:

T-accounts are referred as T-account because its format represents the letter “T”. The T-accounts consists of the following:

- The title of accounts.

- The debit side (Dr) and,

- The credit side (Cr).

To

(b)

Explanation of Solution

| Cash | |||

| Apr. 1 | $18,000 | Apr. 2 | $900 |

| 11 | $ 700 | 30 | $1,500 |

| 20 | $ 2,800 | 30 | $300 |

| Total | $ 21,500 | Total | 2,700 |

| Bal. | $ 18,800 | ||

Table (1)

| Accounts Receivable | |||

| Apr.10 | $ 1,900 | ||

| Bal. | $ 1,900 | ||

Table (2)

| Supplies | |||

| Apr. 3 | $ 1,300 | ||

| Bal. | $ 1,300 | ||

Table (3)

| Accounts Payable | |||

| Apr. 30 | $ 300 | Apr. 3 | $1,300 |

| Bal. | $ 1,000 | ||

Table (4)

| Unearned Service Revenue | |||

| Apr. 11 | $ 700 | ||

| Bal. | $ 700 | ||

Table (5)

| Common Stock | |||

| Apr.1 | $18,000 | ||

| Bal. | $18,000 | ||

Table (6)

| Service Revenue | |||

| Apr. 10 | $ 1,900 | ||

| Apr. 20 | $ 2,800 | ||

| Bal. | $ 4,700 | ||

Table (7)

| Rent Expenses Account | |||

| Apr. 2 | $ 900 | ||

| Bal. | $ 900 | ||

Table (8)

| Salaries and wages expenses | |||

| Apr. 30 | $ 1,500 | ||

| Bal. | $ 1,500 | ||

Table (9)

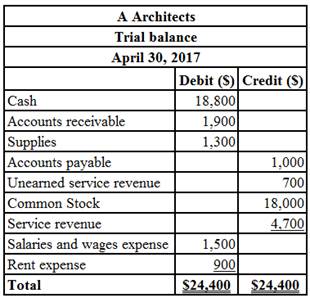

(c)

A trial balance is the summary of all the ledger accounts. The trial balance is prepared to check the total balance of the debit with the total of the balance of the credit column, which must be equal. The trial balance is usually prepared to check accuracy of ledger balances. In trial balance the debit balances are listed in the left column, and credit balances are listed in the right column

To Prepare: The trial balance of Company A as on April 30, 2017.

(c)

Explanation of Solution

Table (1)

Want to see more full solutions like this?

Chapter 3 Solutions

FINANCIAL ACCT.:TOOLS...(LL)-W/ACCESS

- In July of this year, M. Wallace established a business called Wallace Realty. The account headings are presented below. Transactions completed during the month follow. a. Wallace deposited 24,000 in a bank account in the name of the business. b. Paid the office rent for the current month, 650, Ck. No. 1000. c. Bought office supplies for cash, 375, Ck. No. 1001. d. Bought office equipment on account from Dellos Computers, 6,300. e. Received a bill from the City Crier for advertising, 455. f. Sold services for cash, 3,944. g. Paid on account to Dellos Computers, 1,500, Ck. No. 1002. h. Received and paid the bill for utilities, 340, Ck. No. 1003. i. Paid on account to the City Crier, 455, Ck. No. 1004. j. Paid truck expenses, 435, Ck. No. 1005. k. Wallace withdrew cash for personal use, 1,500, Ck. No. 1006. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardOn March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501. e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012. g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307. i. Received and paid the heating bill, 248, Ck. No. 504. j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128. k. Sold catering services for cash for the remainder of the month, 2,649. l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardIncome Statement and Balance Sheet Fort Worth Corporation began business in January 2016 as a commercial carpet-cleaning and drying service. Shares of stock were issued to the owners in exchange for cash. Equipment was purchased by making a down payment in cash and signing a note payable for the balance. Services are performed for local restaurants and office buildings on open account, and customers are given 15 days to pay their accounts. Rent for office and storage facilities is paid at the beginning of each month. Salaries and wages are paid at the end of the month. The following amounts are from the records of Fort Worth Corporation at the end of its first month of operations: Required Prepare an income statement for the month ended January 31, 2016. Prepare a balance sheet at January 31, 2016. What information would you need about Notes Payable to fully assess Fort Worths longterm viability? Explain your answer.arrow_forward

- P. Schwartz, Attorney at Law, opened his office on October 1. The account headings are presented below. Transactions completed during the month follow. a. Schwartz deposited 25,000 in a bank account in the name of the business. b. Bought office equipment on account from QuipCo, 9,670. c. Schwartz invested his personal law library, which cost 2,800. d. Paid the office rent for the month, 1,700, Ck. No. 2000. e. Bought office supplies for cash, 418, Ck. No. 2001. f. Bought insurance for two years, 944, Ck. No. 2002. g. Sold legal services for cash, 8,518. h. Paid the salary of the part-time receptionist, 1,820, Ck. No. 2003. i. Received and paid the telephone bill, 388, Ck. No. 2004. j. Received and paid the bill for utilities, 368, Ck. No. 2005. k. Sold legal services for cash, 9,260. l. Paid on account to QuipCo, 2,670, Ck. No. 2006. m. Schwartz withdrew cash for personal use, 2,500, Ck. No. 2007. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardDuring February of this year, H. Rose established Rose Shoe Hospital. The following asset, liability, and owners equity accounts are included in the chart of accounts: The following transactions occurred during the month of February: a. Rose deposited 25,000 cash in a bank account in the name of the business. b. Bought shop equipment for cash, 1,525, Ck. No. 1000. c. Bought advertising on account from Milland Company, 325. d. Bought store shelving on account from Inger Hardware, 750. e. Bought office equipment from Sharas Office Supply, 625, paying 225 in cash and placing the balance on account, Ck. No. 1001. f. Paid on account to Inger Hardware, 750, Ck. No. 1002. g. Rose invested his personal leather working tools with a fair market value of 800 in the business h. Sold services for the month of February for cash, 250. PART 1: The Accounting Cycle for a Service Business: Analyzing Business Transactions Required 1. Write the account classifications (Assets, Liabilities, Capital, Drawing, Revenue, Expense) in the fundamental accounting equation, as well as the plus and minus signs and Debit and Credit. 2. Write the account names on the T accounts under the classifications, place the plus and minus signs for each T account, and label the debit and credit sides of the T accounts. 3. Record the amounts in the proper positions in the T accounts. Write the letter next to each entry to identify the transaction. 4. Foot and balance the accounts.arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning