Concept explainers

The general ledger of Jackrabbit Rentals at January 1, 2018, includes the following account balances:

| Accounts | Debits | Credits |

| Cash | $ 41,500 | |

| 25,700 | ||

| Land | 110,800 | |

| Accounts Payable | $ 15,300 | |

| Notes Payable | 30,000 | |

| Common Stock | 100,000 | |

| 32,700 | ||

| Totals | $178,000 | $178,000 |

The following is a summary of the transactions for the year

a. January 12 Provide services to customers on account, $62,400.

b. February 25 Provide services to customers for cash, $75,300.

c. March 19 Collect on accounts receivable, S45,700.

d. April 30 Issue shares of common stock in exchange for $30,000 cash.

e. June 16 Purchase supplies on account, $12,100.

f. July 7 Pay on accounts payable, $11,300.

g. September 30 Pay salaries for employee work in the current war, $64,200.

h. November 22 Pay advertising for the current year, $22,500.

i. December 30 Pay $2,900 cash dividends to stockholders.

Required:

1. Set up the necessary T-accounts and enter the beginning balances from the

2. Record each of the summary transactions listed above.

3. Post the transactions to the accounts.

4. Prepare an unadjusted trial balance.

5. Record

6. Post adjusting entries.

Requirement – 1

To prepare: The T-accounts and enter the beginning balance from the trial balance.

Explanation of Solution

T-account:

T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

- (a) The title of the account

- (b) The left or debit side

- (c) The right or credit side

The T-accounts of given item in trial balance are as follows:

| Cash | |||

| Jan. 1 | $41,500 | ||

| Bal. | $41,500 | ||

| Land | |||

| Jan. 1 | $110,800 | ||

| Bal. | $110,800 | ||

| Retained earnings | |||

| Jan. 1 | $32,700 | ||

| Bal. | $32,700 | ||

|

Accounts receivables | |||

| Jan. 1 | $25,700 | ||

| Bal. | $25,700 | ||

| Accounts payable | |||

| Jan.1 | $15,300 | ||

| Bal. | $15,300 | ||

| Notes payable | |||

| Jan. 1 | $30,000 | ||

| Bal. | $30,000 | ||

| Common stock | |||

| Jan. 1 | $100,000 | ||

| Bal. | $100,000 | ||

Requirement – 2

To record: The journal entries for given transactions.

Explanation of Solution

Journal:

Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

The journal entries for given transactions of Company J are as follows:

| Date | Account Title and Explanation | Debit($) | Credit($) |

| 2018 | Accounts receivable | 62,400 | |

| January, 12 | Service revenue | 62,400 | |

| (To record the recognized service revenue on account ) | |||

| 2018 | Cash | 75,300 | |

| February, 25 | Service revenue | 75,300 | |

| (To record cash collection from customer) | |||

| 2018 | Cash | 45,700 | |

| March, 19 | Accounts receivables | 45,700 | |

| (To record cash collection on account) | |||

| 2018 | Cash | 30,000 | |

| April, 30 | Common stock | 30,000 | |

| (To record the cash received from issuance of common stock) | |||

| 2018 | Supplies | 12,100 | |

| June, 16 | Accounts payable | 12,100 | |

| (To record the purchase of supplies on account) | |||

| 2018 | Accounts payable | 11,300 | |

| July, 7 | Cash | 11,300 | |

| (To record the payment of cash on account) | |||

| 2018 | Salary expense | 64,200 | |

| September 30 | cash | 10,000 | |

| (To record payment of salaries for work in the current period) | |||

| 2018 | Advertising expense | 22,500 | |

| November 22 | cash | 22,500 | |

| To record payment of advertising) | |||

| 2018 | Dividends | 2,900 | |

| December 30 | Cash | 2,900 | |

| (To record the payment of dividends) | |||

Table (1)

Requirement – 3

To post: The transactions to T-accounts.

Explanation of Solution

T-account:

T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

- (a) The title of the account

- (b) The left or debit side

- (c) The right or credit side

T-accounts of above transactions are as follows:

| Cash | |||

| Jan.1 | $41,500 | July.7 | $11,300 |

| Feb.25 | $75,300 | Sep.30 | $64,200 |

| Mar.19 | $45,700 | Nov.22 | $22,500 |

| Apr.30 | $30,000 | Dec.30 | $2,900 |

| Total | $192,500 | Total | 100,900 |

| Bal. | $91,600 | ||

| Land | |||

| Jan.1 | $110,800 | ||

| Bal. | $110,800 | ||

| Retained earnings | |||

| Jan.1 | $32,700 | ||

| Bal. | $32,700 | ||

|

Salaries expenses | |||

| Jan.1 | $0 | ||

| Bal. | $64,200 | ||

| Accounts receivable | |||

| Jan.1 | $25,700 | ||

| Jan.12 | $62,400 | Mar.19 | $45,700 |

| Accounts payable | |||

| Jan.1 | $15,300 | ||

| Bal. | $11,300 | Jun.16 | $12,100 |

| Notes payable | |||

| Jan. 1 | $30,000 | ||

| Bal. | $30,000 | ||

| Dividends | |||

| Jan.1 | $0 | ||

| Dec.30 | $2,900 | ||

| Advertising expense | |||

| Jan. 1 | $0 | ||

| Nov.22 | $22,500 | ||

| Bal. | $22,500 | ||

| Supplies | |||

| Jan.1 | $0 | ||

| Jun.16 | $12,100 | ||

| Bal. | $12,100 | ||

| Salaries payable | |||

| Jan. 1 | $0 | ||

| Dec.31 | $1,500 | ||

| Common stock | |||

| Jan. 1 | $100,000 | ||

| Apr.30 | $30,000 | ||

| Bal. | $130,000 | ||

| Service revenue | |||

| Jan.1 | $0 | ||

| Jan.12 | $62,400 | ||

| Feb.25 | $75,300 | ||

Requirement – 4

To prepare: The unadjusted trial balance of Company J.

Explanation of Solution

Unadjusted trial balance:

The unadjusted trial balance is the summary of all the ledger accounts before making adjusting journal entries at the end of the period.

| Company J | ||

| Unadjusted Trial Balance | ||

| December 31, 2018 | ||

| Accounts | Debit Amount($) |

Credit Amount($) |

| Cash | 91,600 | |

| Accounts Receivable | 42,400 | |

| Supplies | 12,100 | |

| Land | 110,800 | |

| Accounts payable | 16,100 | |

| Salaries payable | 0 | |

| Interest payable | 0 | |

| Notes payable | 30,000 | |

| Common stock | 130,000 | |

| Retained earnings | 32,700 | |

| Dividends | 2,900 | |

| Service revenue | 137,700 | |

| Salaries expense | 64,200 | |

| Advertising expense | 22,500 | |

| Interest expense | 0 | |

| Supplies expense | 0 | |

| Totals | $346,500 | $346,500 |

Table (2)

Therefore, the total of debit, and credit columns of unadjusted trial balance is $346,500 and agree.

Requirement – 5

To record: The given adjusting entries of Company J.

Explanation of Solution

Adjusting entries:

Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. The purpose of adjusting entries is to adjust the revenue, and the expenses during the period in which they actually occurs.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Adjusting entries of Company P are as follows:

Depreciation expense:

| Date | Accounts title and explanation | Post Ref. | Debit ($) | Credit ($) |

| December 31, 2018 | Interest Expense | 2,500 | ||

| Interest payable | 2,500 | |||

| (To record the amount of accrue interest on notes payable) |

Table (3)

Following is the rule of debit and credit of above transaction:

- Interest expense is an expense, and it decreased the value of stockholder’s equity. Therefore, it is debited.

- Interest payable is a liability. There is a increase in the value of liability. Therefore it is credited.

Office supplies expense:

| Date | Accounts title and explanation | Post Ref. | Debit ($) | Credit ($) |

| December 31, 2018 | Supplies expense | 9,800 | ||

|

Supplies (1) | 9,800 | |||

| (To record the supplies expense incurred at the end of the accounting year) |

Table (4)

Following is the rule of debit and credit of above transaction:

- Supplies expense is an expense, and it decreased the value of stockholder’s equity. Therefore, it is debited.

- Supplies are an asset account. There is a decrease in assets, therefore it is credited.

Deferred revenue:

| Date | Accounts title and explanation | Post Ref. | Debit ($) | Credit ($) |

| December 31, 2018 | Salaries expense | 1,500 | ||

| Salaries payable | 1,500 | |||

| (To record the salary payable for the current period) |

Table (5)

Following is the rules of debit and credit of above transaction:

- Salaries expense is an expense. There is a decrease in the value of stockholder’s equity. Therefore, it is debited.

- Salaries payable is a liability. There is a increase in the value of liability. Therefore it is credited

Working note:

1. Calculate the supplies used during the year

Requirement – 6

To post: The adjusting entries to appropriate T-accounts.

Explanation of Solution

| Cash | |||

| Jan.1 | $41,500 | July.7 | $11,300 |

| Feb.25 | $75,300 | Sep.30 | $64,200 |

| Mar.19 | $45,700 | Nov.22 | $22,500 |

| Apr.30 | $30,000 | Dec.30 | $2,900 |

| Total | $192,500 | Total | 100,900 |

| Bal. | $91,600 | ||

| Land | |||

| Jan.1 | $110,800 | ||

| Interest payable | |||

| Jan.1 | $0 | ||

| Dec.31 | $2,500 | ||

| Retained earnings | |||

| Jan.1 | $32,700 | ||

| Dec.31 | $100,500 | Dec.31 | $137,700 |

| Dec.31 | $2,900 | ||

| Bal. | $67,000 | ||

| Salaries Expense | |||

| Jan.1 | $0 | ||

| Sep.30 | $64,200 | ||

| Dec.30 | $1,500 | ||

| Bal.65,700 | |||

| Supplies Expense | |||

| Jan.1 | $0 | ||

| Dec.31 | $9,800 | Bal. | $9,800 |

| Total | $0 | ||

| Accounts payable | |||

| Jan.1 | $15,300 | ||

| Bal. | $11,300 | Jun.16 | $12,100 |

| Notes payable | |||

| Jan. 1 | $30,000 | ||

| Bal. | $30,000 | ||

| Dividends | |||

| Jan.1 | $0 | ||

| Dec.30 | $2,900 | ||

| Advertising expense | |||

| Jan. 1 | $0 | ||

| Nov.22 | $22,500 | ||

| Bal. | $22,500 | ||

| Supplies | |||

| Jan.1 | $0 | ||

| Jun.16 | $12,100 | ||

| Bal. | $9,800 | ||

| Common stock | |||

| Jan. 1 | $100,000 | ||

| Apr.30 | $30,000 | ||

| Bal. | $130,000 | ||

|

Service revenue | |||

| Jan.1 | $0 | ||

| Jan.12 | $62,400 | ||

| Feb.25 | $75,300 | ||

| Bal. | $137,700 | ||

| Interest expense | |||

| Jan.1 | $0 | ||

| Dec.30 | $2,500 | ||

Requirement – 7

To prepare: The adjusted trial balance of Company J.

Explanation of Solution

Adjusted trial balance:

Adjusted trial balance is a summary of all the ledger accounts, and it contains the balances of all the accounts after the adjustment entries are journalized, and posted.

Adjusted trial balance of Company J is as follows:

| Company J | ||

| Adjusted Trial Balance | ||

| December 31, 2018 | ||

| Accounts | Debit Amount($) |

Credit Amount($) |

| Cash | 91,600 | |

| Accounts Receivable | 42,400 | |

| Supplies | 12,100 | |

| Land | 110,800 | |

| Accounts payable | 16,100 | |

| Salaries payable | 1,500 | |

| Interest payable | 2,200 | |

| Notes payable | 30,000 | |

| Common stock | 130,000 | |

| Retained earnings | 32,700 | |

| Dividends | 2,900 | |

| Service revenue | 137,700 | |

| Salaries expense | 64,200 | |

| Advertising expense | 22,500 | |

| Interest expense | 2,500 | |

| Supplies expense | 9,800 | |

| Totals | $350,500 | $350,500 |

Table (6)

Therefore, the total of debit, and credit columns of adjusted trial balance is $350,500 and agree.

Requirement – 8

To prepare: An income statement for 2018 and classified balance sheet as on December 31, 2018.

Explanation of Solution

Income statement:

This is the financial statement of a company which shows all the revenues earned and expenses incurred by the company over a period of time.

Classified balance sheet:

This is the financial statement of a company which shows the grouping of similar assets and liabilities under subheadings.

Income statement:

Income statement of Company J is as follows:

| Company J | ||

| Income statement | ||

| For the year ended December 31, 2018 | ||

| $ | $ | |

| Service revenue (A) | 137,700 | |

| Expenses: | ||

| Salaries expense | 65,700 | |

| Utilities expense | 22,500 | |

| Depreciation expense | 2,500 | |

| Supplies expense | 9,800 | |

| Total expense (B) | 100,500 | |

| Net income

| 37,200 | |

Table (7)

Therefore, the net income of Company J is $37,200.

Classified balance sheet:

Classified balance sheet of Company J is as follows:

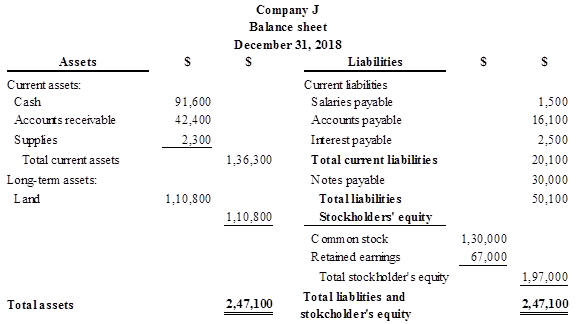

Figure (1)

Therefore, the total assets of Company P are $247,100, and the total liabilities and stockholders’ equity are $247,100.

Working note:

Calculation of ending balance retained earnings

Requirement – 9

To record: The necessary closing entries of Company J.

Explanation of Solution

Closing entries:

Closing entries are those journal entries, which are passed to transfer the final balances of temporary accounts, (all revenues account, all expenses account and dividend) to the retained earnings. Closing entries produce a zero balance in each temporary account.

Closing entries of Company J is as follows:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| 2018 | Service revenue | 137,700 | ||

| December 31 | Retained earnings | 137,700 | ||

| (To close all revenue account) | ||||

| 2018 | Retained earnings | 100,500 | ||

| December 31 | Salaries expense | 65,700 | ||

| Advertising expense | 22,500 | |||

| Interest expense | 2,500 | |||

| Supplies expense | 9,800 | |||

| (To close all the expenses account) | ||||

| 2018 | Retained earnings | 2,900 | ||

| December 31 | Dividends | 2,900 | ||

| (To close the dividends account) | ||||

Table (8)

Requirement – 10

To post: The closing entries to the T-accounts.

Explanation of Solution

| Cash | |||

| Jan.1 | $41,500 | July.7 | $11,300 |

| Feb.25 | $75,300 | Sep.30 | $64,200 |

| Mar.19 | $45,700 | Nov.22 | $22,500 |

| Apr.30 | $30,000 | Dec.30 | $2,900 |

| Total | $192,500 | Total | 100,900 |

| Bal. | $91,600 | ||

| Land | |||

| Jan.1 | $110,800 | ||

| Bal. | $110,800 | ||

| Interest payable | |||

| Jan.1 | $0 | ||

| Dec.31 | $2,500 | ||

| Retained earnings | |||

| Jan.1 | $32,700 | ||

| Bal. | $32,700 | ||

| Salaries Expense | |||

| Jan.1 | $0 | ||

| Sep.30 | $64,200 | ||

| Dec.30 | $1,500 | ||

| Bal. | $65,700 | ||

| Supplies Expense | |||

| Jan.1 | $0 | ||

| Dec.31 | $9,800 | ||

| Accounts receivable | |||

| Jan.1 | $25,700 | ||

| Jan.12 | $62,400 | Mar.19 | $45,700 |

| Accounts payable | |||

| Jan.1 | $15,300 | ||

| Bal. | $11,300 | Jun.16 | $12,100 |

| Total |

$16,100 | ||

|

Notes payable | |||

| Jan. 1 | $30,000 | ||

| Bal. | $30,000 | ||

| Dividends | |||

| Jan.1 | $0 | ||

| Dec.30 | $2,900 | Bal. | $2,900 |

| Advertising expense | |||

| Jan. 1 | $0 | ||

| Nov.22 | $22,500 | Bal. | $22,500 |

| Total | $0 | ||

| Supplies | |||

| Jan.1 | $0 | ||

| Jun.16 | $12,100 | ||

| Bal. | $9,800 | ||

| Total | $2,300 | ||

| Salaries payable | |||

| Jan. 1 | $0 | ||

| Dec.31 | $1,500 | ||

| Common stock | |||

| Jan. 1 | $100,000 | ||

| Apr.30 | $30,000 | ||

| Total | $130,000 | ||

|

Service revenue | |||

| Jan.1 | $0 | ||

| Jan.12 | $62,400 | ||

| Bal. | 137,700 | Feb.25 | $75,300 |

| Total. | $0 | ||

| Interest expense | |||

| Jan.1 | $0 | ||

| Dec.30 | $2,500 | Bal | $2,500 |

| Total | $0 | ||

Requirement – 11

To prepare: A post-closing trial balance of Company J.

Explanation of Solution

Post-closing trial balance:

The post-closing trial balance is a summary of all ledger accounts, and it shows the debit and the credit balances after the closing entries are journalized and posted. The post-closing trial balance contains only permanent (balance sheet) accounts, and the debit and the credit balances of permanent accounts should agree.

Post-closing trial balance of Company J is as follows:

| Company J | ||

| Adjusted Trial Balance | ||

| December 31, 2018 | ||

| Accounts | Debit Amount($) | Credit Amount($) |

| Cash | 91,600 | |

| Accounts Receivable | 42,400 | |

| Supplies | 2,300 | |

| Land | 110,800 | |

| Account payable | 16,000 | |

| Salaries payable | 1,500 | |

| Interest payable | 2,500 | |

| Notes payable | 30,000 | |

| Common stock | 130,000 | |

| Retained earnings | 67,000 | |

| Total | $247,100 | $247,100 |

Table (9)

Therefore, the total of debit, and credit columns of post-closing trial balance is $247,100 and agree.

Want to see more full solutions like this?

Chapter 3 Solutions

FINANCIAL ACCT LL W/ACCESS

- Prepare journal entries to record the following transactions: A. December 1, collected balance due from customer account, $5,500 B. December 12, paid creditors for supplies purchased last month, $4,200 C. December 31, paid cash dividend to stockholders, $1,000arrow_forwardThe transactions completed by AM Express Company during March 2016, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March 2016, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals, and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardThe following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2019: Instructions 1. Prepare a multiple-step income statement. 2. Prepare a statement of owners equity. 3. Prepare a balance sheet, assuming that the current portion of the note payable is 50,000. 4. Briefly explain how multiple-step and single-step income statements differ.arrow_forward

- On January 24, 20Y8, Niche Consulting collected $5,700 it had hilled its clients for services rendered on December 31, 20Y7. How would you record the January 24 transaction, using the accrual basis? A. Increase Cash, $5,700; decrease Fees Earned, $5,700 B. Increase Accounts Receivable, $5,700; increase Fees Earned, $5,700 C. Increase Cash, $5,700; decrease Accounts Receivable, $5,700 D. Increase Cash, $5,700; increase Fees Earned, $5,700arrow_forwardPrepare journal entries to record the following transactions. A. July 1, issued common stock for cash, $15,000 B. July 15, purchased supplies, on account, $1,800 C. July 25, billed customer for accounting services provided, $950arrow_forwardPost the following July transactions to T-accounts for Accounts Receivable, Sales Revenue, and Cash, indicating the ending balance. Assume no beginning balances in these accounts. A. on first day of the month, sold products to customers for cash, $13,660 B. on fifth day of month, sold products to customers on account, $22,100 C. on tenth day of month, collected cash from customer accounts, $18,500arrow_forward

- Analyzing the Accounts The controller for Summit Sales Inc. provides the following information on transactions that occurred during the year: a. Purchased supplies on credit, $18,600 b. Paid $14,800 cash toward the purchase in Transaction a c. Provided services to customers on credit1 $46,925 d. Collected $39,650 cash from accounts receivable e. Recorded depreciation expense, $8,175 f. Employee salaries accrued, $15,650 g. Paid $15,650 cash to employees for salaries earned h. Accrued interest expense on long-term debt, $1,950 i. Paid a total of $25,000 on long-term debt, which includes $1.950 interest from Transaction h j. Paid $2,220 cash for l years insurance coverage in advance k. Recognized insurance expense, $1,340, that was paid in a previous period l. Sold equipment with a book value of $7,500 for $7,500 cash m. Declared cash dividend, $12,000 n. Paid cash dividend declared in Transaction m o. Purchased new equipment for $28,300 cash. p. Issued common stock for $60,000 cash q. Used $10,700 of supplies to produce revenues Summit Sales uses the indirect method to prepare its statement of cash flows. Required: 1. Construct a table similar to the one shown at the top of the next page. Analyze each transaction and indicate its effect on the fundamental accounting equation. If the transaction increases a financial statement element, write the amount of the increase preceded by a plus sign (+) in the appropriate column. If the transaction decreases a financial statement element, write the amount of the decrease preceded by a minus sign (-) in the appropriate column. 2. Indicate whether each transaction results in a cash inflow or a cash outflow in the Effect on Cash Flows column. If the transaction has no effect on cash flow, then indicate this by placing none in the Effect on Cash Flows column. 3. For each transaction that affected cash flows, indicate whether the cash flow would be classified as a cash flow from operating activities, cash flow from investing activities, or cash flow from financing activities. If there is no effect on cash flows, indicate this as a non-cash activity.arrow_forwardPrepare journal entries to record the following transactions. Create a T-account for Accounts Payable, post any entries that affect the account, and tally ending balance for the account. Assume an Accounts Payable beginning balance of $5,000. A. February 2, purchased an asset, merchandise inventory, on account, $30,000 B. March 10, paid creditor for part of February purchase, $12,000arrow_forwardAccounts Used to Record Transactions A list of accounts, with an identifying number for each, is provided. Following the list of accounts is a series of transactions entered into by a company during its first year of operations. Required For each transaction, indicate the account or accounts that should be debited and credited. Cash Accounts Receivable Prepaid Insurance Office Supplies Automobiles Land Accounts Payable Income Taxes Payable Notes Payable Capital Stock Retained Earnings Service Revenue Wage and Salary Expense Utilities Expense Income Tax Expensearrow_forward

- Selected accounts and related amounts for Kanpur Co. for the fiscal year ended June 30, 2016, are presented in Problem 6-5B. Instructions 1. Prepare a single-step income statement in the format shown in Exhibit 11. 2. Prepare a statement of owners equity. 3. Prepare an account form of balance sheet, assuming that the current portion of the note payable is 7,000. 4. Prepare closing entries as of June 30, 2016.arrow_forwardSelected accounts and related amounts for Clairemont Co. for the fiscal year ended May 31, 2016, are presented in Problem 6-5A. Instructions 1. Prepare a single-step income statement in the format shown in Exhibit 11. 2. Prepare a statement of owners equity. 3. Prepare an account form of balance sheet, assuming that the current portion of the note payable is 50,000. 4. Prepare closing entries as of May 31, 2016.arrow_forwardSCHEDULE OF ACCOUNTS PAYABLE Ryans Express, a retail business, had the following beginning balances and purchases and payments activity in its accounts payable ledger during October. Prepare a schedule of accounts payable for Ryans Express as of October 31, 20--.arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning  Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning