Concept explainers

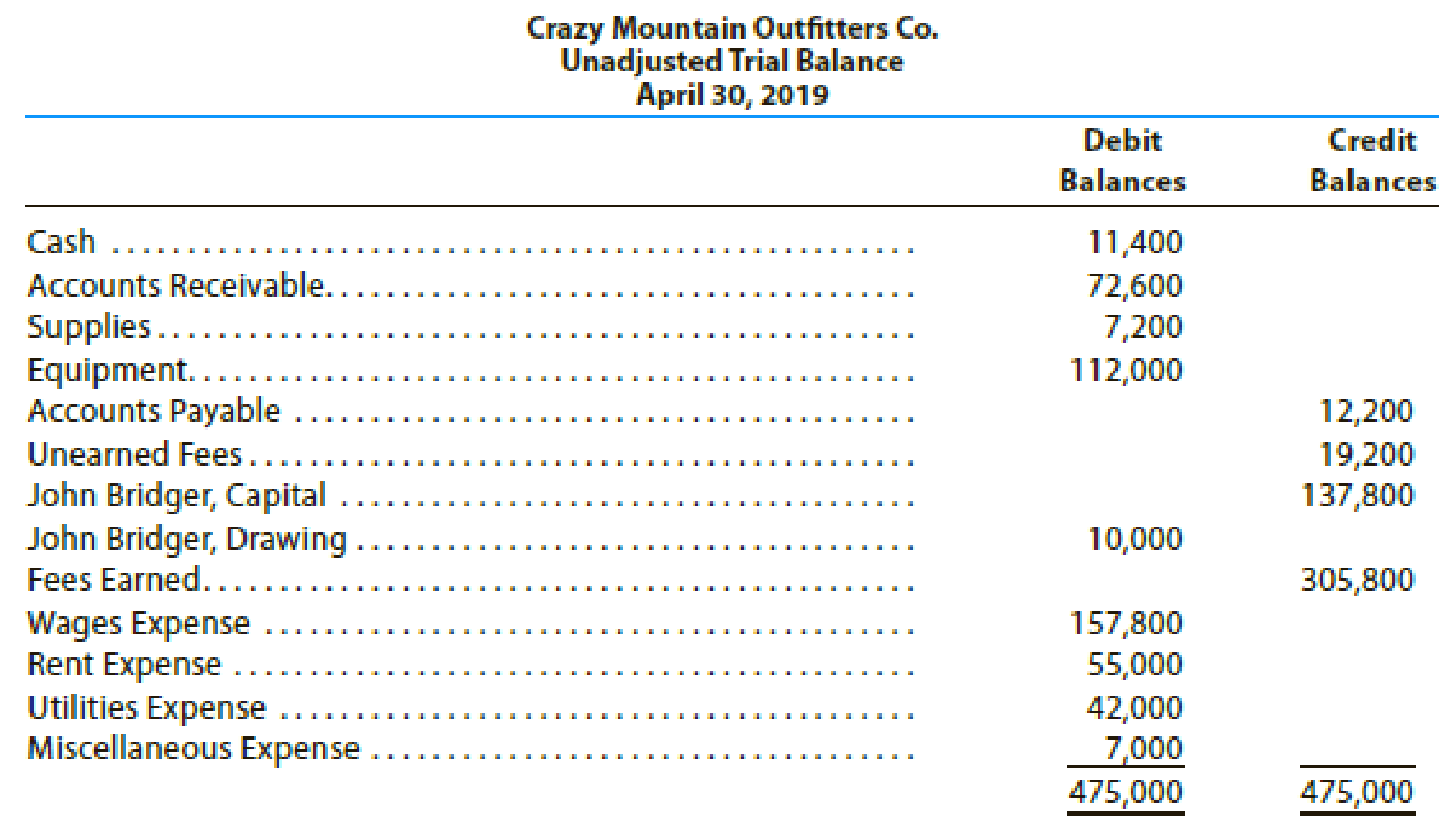

Crazy Mountain Outfitters Co., an outfitter store for fishing treks, prepared the following unadjusted

For preparing the

- • Supplies on hand on April 30 were $1,380.

- • Fees earned but unbilled on April 30 were $3,900.

- •

Depreciation of equipment was estimated to be $3,000 for the year. - • Unpaid wages accrued on April 30 were $2,475.

- • The balance in unearned fees represented the April 1 receipt in advance for services to be provided. Only $14,140 of the services was provided between April 1 and April 30.

Instructions

- 1. Journalize the adjusting entries necessary on April 30, 2019.

- 2. Determine the revenues, expenses, and net income of Crazy Mountain Outfitters Co. before the adjusting entries.

- 3. Determine the revenues, expenses, and net income of Crazy Mountain Outfitters Co. after the adjusting entries.

- 4. Determine the effect of the adjusting entries on John Bridger, Capital.

(1)

Record the adjusting entries on April 30, 2019 of CMO Company.

Answer to Problem 3PB

Adjusting Entries: Adjusting entries indicates those entries, which are passed in the books of accounts at the end of one accounting period. These entries are passed in the books of accounts as per the revenue recognition principle and the expenses recognition principle to adjust the revenue, and the expenses of a business in the period of their occurrence.

Adjusted Trial Balance: Adjusted trial balance is a trial balance prepared at the end of a financial period, after all the adjusting entries are journalized and posted. It is prepared to prove the equality of the total debit and credit balances.

Rule of Debit and Credit:

Debit - Increase in all assets, expenses & dividends, and decrease in all liabilities and stockholders’ equity.

Credit - Increase in all liabilities and stockholders’ equity, and decrease in all assets & expenses.

The following entry shows the adjusting entry for supplies on April 30.

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| April 30 | Supplies Expense (1) | 5,820 | |

| Supplies | 5,820 | ||

| (To record the supplies expense at the end of the accounting period) |

Table (1)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Explanation of Solution

Justification for journal entry

- Supplies expense is a component of stockholders’ equity, and it decreased the stockholders’ equity by $5,820. So debit supplies expense by $5,820.

- Supplies are an asset for the business, and it is decreased by $5,820. So credit supplies by $5,820.

Working Note 1:

Calculation of fees earned for the accounting period

The following entry shows the adjusting entry for accrued fees unearned on April 30.

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| April 30 | Accounts Receivable | 3,900 | |

| Fees earned | 3,900 | ||

| (To record the accounts receivable at the end of the year.) |

Table (2)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Justification for journal entry

- Accounts Receivable is an asset, and it is increased by $3,900. So debit Accounts receivable by $3,900.

- Fees earned are component of stockholders’ equity and increased it by $3,900. So credit fees earned by $3,900.

The adjusting entry for recording depreciation is as follows:

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| April 30 | Depreciation expense | 3,000 | |

| Accumulated Depreciation | 3,000 | ||

| (To record the depreciation on office equipment for the current year.) |

Table (3)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Justification for journal entry

- Depreciation expense is component of stockholders’ equity and decreased it, so debit depreciation expense by $3,000.

- Accumulated depreciation is a contra asset account, and it decreases the asset value by $3,000. So credit accumulated depreciation by $3,000.

The following entry shows the adjusting entry for wages expense on April 30.

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| April 30 | Wages expenses | 2,475 | |

| Wages Payable | 2,475 | ||

| (To record the wages accrued but not paid at the end of the accounting period.) |

Table (4)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Justification for journal entry

- Wages expense is a component of Stockholders ‘equity, and it decreased it by $2,475. So debit wage expense by $2,475.

- Wages Payable is a liability, and it is increased by $2,475. So credit wages payable by $2,475.

The following entry shows the adjusting entry for unearned fees on June 30.

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| June 30 | Unearned Fees | 14,140 | |

| Fees earned | 14,140 | ||

| (To record the fees earned from services at the end of the accounting period.) |

Table (5)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Justification for journal entry

- Unearned fees are a liability, and it is decreased by $14,140. So debit unearned rent by $14,140.

- Fees earned are a component of Stockholders’ equity, and it is increased by $14,140. So credit rent revenue by $14,140.

(2)

Determine the revenues, expenses and net income of CMO Company before adjusting entries.

Answer to Problem 3PB

The revenues, expenses and net income before adjusting entries of CMO Company are stated below:

- Revenue = $305,800 (given)

- Expenses = $261,800 (W.N-1)

- Net income = $44,000 (W.N-2)

Explanation of Solution

Working Note 1: Calculation of expenses before adjusting entries:

Working Note 2: Calculation of net income before adjusting entries

Hence, the revenues, expenses and net income of CMO Company are $305,800, $261,800 and $44,000 respectively.

(3)

Determine the revenues, expenses and net income of CMO Company after adjusting entries

Answer to Problem 3PB

The revenues, expenses and net income after adjusting entries of CMO Company are stated below:

- Revenue = $323,840 (W.N-4)

- Expenses = $273,095 (W.N-3)

- Net income = $50,745 (W.N-5)

Explanation of Solution

Working Note 3: Calculation of expenses after adjusting entries:

Working Note 4: Calculation of revenue after adjusting entries:

Working Note 5: Calculation of net income after adjusting entries

Hence, the revenues, expenses and net income of CMO Company are $323,840, $273,095 and $50,745 respectively.

(4)

Determine the effect of the adjusting entries on the capital of CMO Company.

Answer to Problem 3PB

The capital of CMO Company will be increased by $10,745 after the adjusting entry.

Explanation of Solution

Due to the adjusting entry there is an increase in the net income of $10,745

Want to see more full solutions like this?

Chapter 3 Solutions

Bundle: Financial Accounting, Loose-Leaf Version, 15th + LMS Integrated CengageNOWv2, 1 term Printed Access Card

- Reece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services Co.s accounting clerk prepared the following unadjusted trial balance at July 31, 2016: The data needed to determine year-end adjustments are as follows: a. Depreciation of building for the year, 6,400. b. Depreciation of equipment for the year, 2,800. c. Accrued salaries and wages at July 31, 900. d. Unexpired insurance at July 31, 1,500. e. Fees earned but unbilled on July 31, 10,200. f. Supplies on hand at July 31, 615. g. Rent unearned at July 31, 300. Instructions 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation ExpenseBuilding; Depreciation ExpenseEquipment; and Supplies Expense. 2. Determine the balances of the accounts affected by the adjusting entries and preparean adjusted trial balance.arrow_forwardReece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services accounting clerk prepared the following unadjusted trial balance at July 31, 2019: The data needed to determine year-end adjustments are as follows: Depreciation of building for the year, 6,400. Depreciation of equipment for the year, 2,800. Accrued salaries and wages at July 31, 900. Unexpired insurance at July 31, 1,500. Fees earned but unbilled on July 31, 10,200. Supplies on hand at July 31, 615. Rent unearned at July 31, 300. Instructions 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable, Rent Revenue, Insurance Expense, Depreciation ExpenseBuilding, Depreciation ExpenseEquipment, and Supplies Expense. 2. Determine the balances of the accounts affected by the adjusting entries and prepare an adjusted trial balance.arrow_forwardAt the end of August, the first month of operations, the following selected data were taken from the financial statements of Tucker Jacobs, an attorney: In preparing the financial statements, adjustments for the following data were overlooked: Unbilled fees earned at August 31, 31,900. Depreciation of equipment for August, 7,500. Accrued wages at August 31, 5,200. Supplies used during August, 3,000. Instructions 1. Journalize the entries to record the omitted adjustments. 2. Determine the correct amount of net income for August and the total assets, liabilities, and owners equity at August 31. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The first adjustment is presented as an example.arrow_forward

- At the end of April, the first month of operations, the following selected data were taken from the financial statements of Shelby Crawford, an attorney: In preparing the financial statements, adjustments for the following data were overlooked: Supplies used during April, 2,750. Unbilled fees earned at April 30, 23,700. Depreciation of equipment for April, 1,800. Accrued wages at April 30, 1,400. Instructions 1. Journalize the entries to record the omitted adjustments. 2. Determine the correct amount of net income for April and the total assets, liabilities, and owners equity at April 30. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The adjustment for supplies used is presented as an example.arrow_forwardThe trial balance of Wikki Cleaners at December 31, 2012, the end of the current fiscal year, is as follows: Information for the adjusting entries is as follows: a. Cleaning supplies on hand on December 31, 2012, 18,750. b. Insurance premiums expired during the year, 1,800. c. Depreciation on equipment during the year, 21,600. d. Wages accrued but not paid at December 31, 2012, 1,830. Suppose you discover that an assistant in your department had misunderstood your instructions and had provided you with the wrong information on two of the adjusting entries. Cleaning supplies consumed during the year should have been 18,750, and insurance premiums unexpired at year-end were 1,800. Make the corrections on your worksheet and save the corrected file as F1WORK4. Reprint the worksheet.arrow_forwardThe unadjusted trial balance of La Mesa Laundry at August 31, 2016, the end of the fiscal year, follows: The data needed to determine year-end adjustments are as follows: a. Wages accrued but not paid at August 31 are 2,200. b. Depreciation of equipment during the year is 8,150. c. Laundry supplies on hand at August 31 are 2,000. d. Insurance premiums expired during the year are 5,300. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as Aug. 31 Bal. In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, Insurance Expense, and Income Summary. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed. 3. Journalize and post the adjusting entries. Identify the adjustments by Adj. and the new balances as Adj. Bal. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of owners equity (no additional investments were made during the year), and a balance sheet. 6. Journalize and post the closing entries. Identify the closing entries by Clos. 7. Prepare a post-closing trial balance.arrow_forward

- Adjusting entries Trident Repairs Service, an electronics repair store, prepared the following unadjusted trial balance at the end of its first year of operations: For preparing the adjusting entries, the following data were assembled: Fees earned but unbilled on November 30 were 7,000. Supplies on hand on November 30 were 1,300. Depreciation of equipment was estimated to be 7,200 for the year. The balance in unearned fees represented the November 1 receipt in advance for services to be provided. During November, 13,500 of the services were provided. Unpaid wages accrued on November 30 were 4,800. Instructions 1. Journalize the adjusting entries necessary on November 30, 20Y3. 2. Determine the revenues, expenses, and net income of Trident Repairs Service before the adjusting entries. 3. Determine the revenues, expense, and net income of Trident Repairs Service after the adjusting entries. 4. Determine the effect of the adjusting entries on Retained Earnings.arrow_forwardThe trial balance of Wikki Cleaners at December 31, 2012, the end of the current fiscal year, is as follows: Information for the adjusting entries is as follows: a. Cleaning supplies on hand on December 31, 2012, 18,750. b. Insurance premiums expired during the year, 1,800. c. Depreciation on equipment during the year, 21,600. d. Wages accrued but not paid at December 31, 2012, 1,830. As the accountant for Wikki Cleaners, you have been asked to prepare financial statements for the year. A file called F1WORK has been provided to assist you in this assignment. As you review this file, it should be noted that columns H and I will automatically change when you enter values in columns E or G.arrow_forwardCOMPLETION OF A WORK SHEET SHOWING A NET LOSS The trial balance for Cascade Bicycle Shop, a business owned by David Lamond, is shown below. Year-end adjustment information is as follows: (a and b) Merchandise inventory costing 22,000 is on hand as of December 31, 20--. (The periodic inventory system is used.) (c)Supplies remaining at the end of the year, 2,400. (d)Unexpired insurance on December 31, 1,750. (e)Depreciation expense on the building for 20--, 4,000. (f)Depreciation expense on the store equipment for 20--, 3,600. (g)Unearned storage revenue as of December 31, 1,950. (h)Wages earned but not paid as of December 31, 750. REQUIRED 1. Complete the Adjustments columns, identifying each adjustment with its corresponding letter. 2. Complete the work sheet. 3. Enter the adjustments in the general journal.arrow_forward

- Reece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services’ accounting clerk prepared the following unadjustedtrial balance at July 31, 2018: The data needed to determine year-end adjustments are as follows:• Depreciation of building for the year, $6,400.• Depreciation of equipment for the year, $2,800.• Accrued salaries and wages at July 31, $900.• Unexpired insurance at July 31, $1,500.• Fees earned but unbilled on July 31, $10,200.• Supplies on hand at July 31, $615.• Rent unearned at July 31, $300.Instructions1. Journalize the adjusting entries using the following additional accounts: Salaries and WagesPayable; Rent Revenue; Insurance Expense; Depreciation Expense—Building; DepreciationExpense—Equipment; and Supplies Expense.2. Determine the balances of the accounts affected by the adjusting entries, and prepare anadjusted trial balance.arrow_forwardThe following unadjusted trial balance contains the accounts and balances of Dylan Delivery Company as of December 31. 1. Use the following information about the company’s adjustments to complete a 10-column work sheet. a. Unrecorded depreciation on the trucks at the end of the year is $40,000. b. The total amount of accrued interest expense at year-end is $6,000. c. The cost of unused office supplies still available at year-end is $2,000. 2. Prepare the year-end closing entries for this company and determine the capital amount to be reported on its year-end balance sheet. Note: The S. Dylan, Capital account balance was $307,000 on December 31 of the prior year.arrow_forwardJohnson’s Boat Yard, Inc., repairs, stores, and cleans boats for customers. It is completing the accounting process for the year just ended on November 30. The transactions for the past year have been journalized and posted. The following data with respect to adjusting entries at year-end are available: a. Johnson’s winterized (cleaned and covered) three boats for customers at the end of November but did not record the service for $4,100. b. On October 1, Johnson’s paid $1,560 to the local newspaper for an advertisement to run every Thursday for 12 weeks. All ads have been run except for three Thursdays in December to complete the 12-week contract. c. Johnson’s borrowed $282,000 at a(n) 8 percent annual interest rate on April 1 of the current year to expand its boat storage facility. The loan requires Johnson’s to pay the interest quarterly until the note is repaid in three years. Johnson’s paid quarterly interest on July 1 and October 1. d. The Sanjeev family paid Johnson’s $4,020…arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning