Concept explainers

Calculate the missing amounts and prepare the T-accounts.

Explanation of Solution

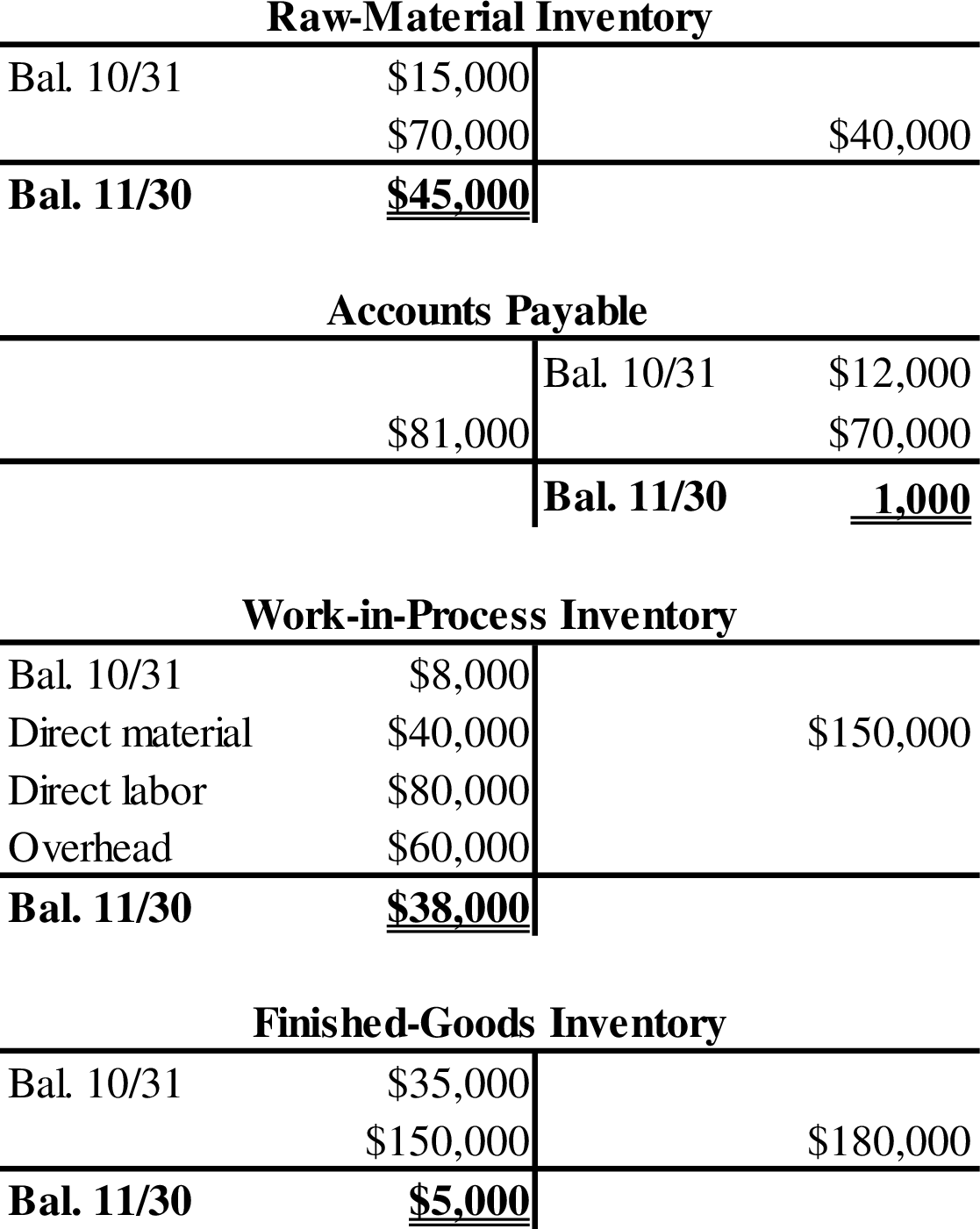

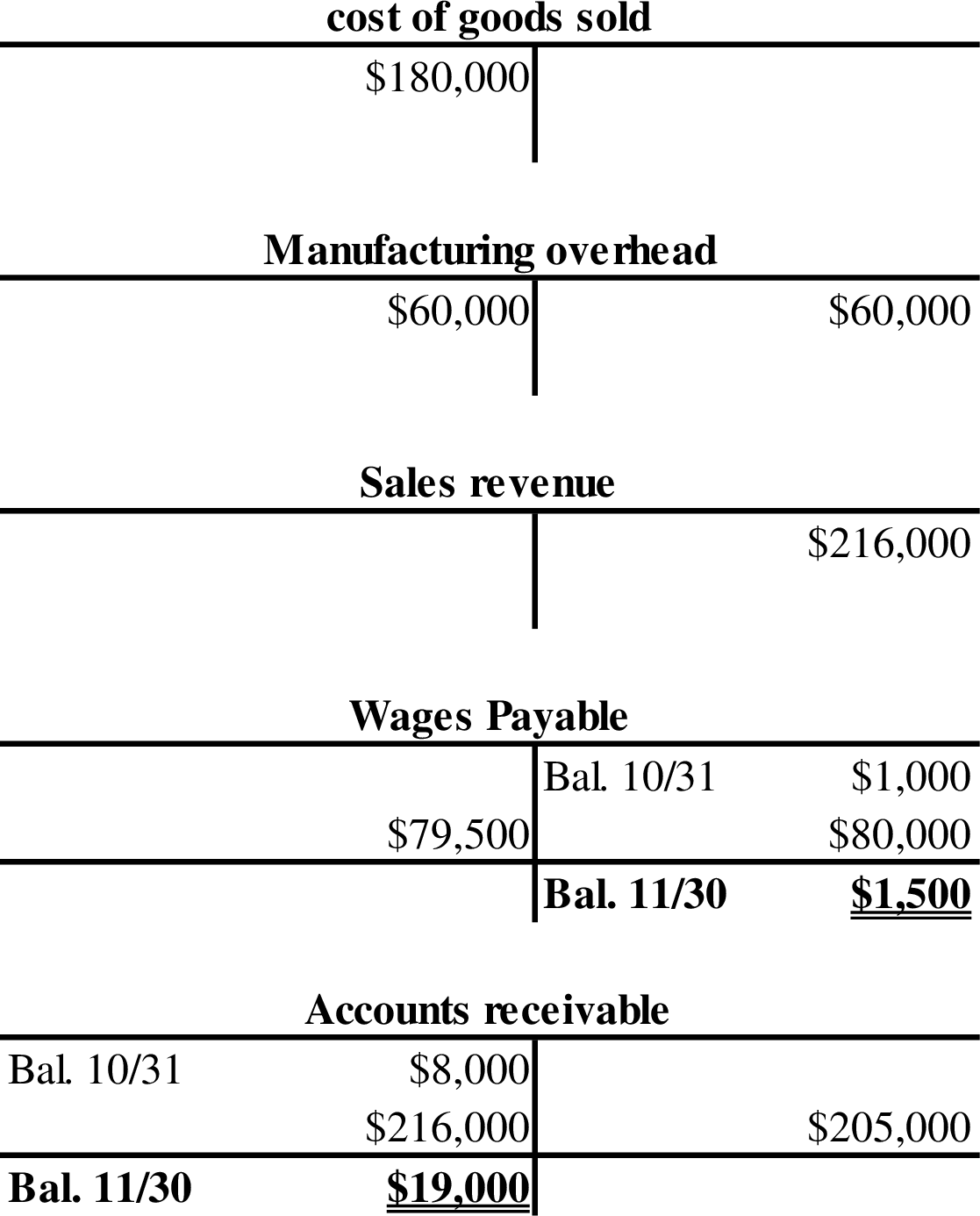

- 1. Calculate the sales revenue for November.

Thus, the sales revenue for November is $216,000.

- 2. Calculate the ending balance of

accounts receivable .

Thus, the ending balance in accounts receivable is $19,000.

- 3. Calculate the cost of raw materials purchased during November.

Thus, the cost of raw materials purchased during November is $70,000.

- 4. Calculate the ending balance in the work-in-process inventory.

Step 1: Calculate the budgeted direct-labor hours.

Step 2: Calculate the predetermined overhead rate.

Step 3: Calculate the ending balance in the work-in-process inventory.

Thus, the ending balance in the work-in-process inventory is $38,000.

- 5. Calculate the amount of direct labor added to work in process during November.

Thus, the amount of direct labor added to work in process during November is $80,000.

- 6. Calculate the amount of applied overhead for November.

Step 1: Calculate the direct-labor hours.

Step 2: Calculate the amount of applied overhead for November.

Thus, the applied overhead for November is $60,000.

- 7. Calculate the cost of goods completed during November.

Thus, the cost of goods completed during November is $150,000.

- 8. Calculate the amount of raw materials used during November.

Thus, the amount of raw materials used during November is $40,000.

- 9. Calculate the amount of October 31 balance in raw-material inventory.

Thus, the amount of October 31 balances in raw-material inventory is $15,000.

- 10. Calculate the amount of overapplied or underapplied for November.

Thus, there is no underapplied or overapplied overhead for the month November.

Prepare the T-accounts.

Want to see more full solutions like this?

Chapter 3 Solutions

Loose-Leaf for Managerial Accounting: Creating Value in a Dynamic Business Environment

- Taylor Industries had a fire and some of its accounting records were destroyed. Available information is presented below for the year ended December 31. Materials inventory, December 31 $ 15,000 Direct materials purchased 28,000 Direct materials used 22,900 Cost of goods manufactured 135,000 Additional information: Factory overhead is 150% of direct labor cost. Finished goods inventory decreased by $18,000 during the year. Work in process inventory increased by $12,000 during the year. a. Calculate Materials inventory, January 1.$ b. Calculate direct labor cost.$ c. Calculate factory overhead incurred.$ d. Calculate cost of goods sold.$arrow_forwardA series of computer and backup system failures caused the loss of most of the company records at Stotter, Incorporated. Information technology consultants for the company could recover only a few fragments of the company’s factory ledger for July as follows: Materials Inventory Debit Credit Beginning Balance (7/1) 136,000 228,000 Work-in-Process Inventory Debit Credit Beginning Balance (7/1) 23,000 Finished Goods Inventory Debit Credit Ending Balance (7/31) 93,900 2,190 Cost of Goods Sold Debit Credit Manufacturing Overhead Control Debit Credit 194,000 Accounts Payable (Materials) Debit Credit 184,900 39,200 Ending Balance (7/31) Further investigation and reconstruction from other sources yielded the following additional information: Based on records for January through June, overhead is applied at the rate of $24 per direct labor-hour. The production superintendent’s cost sheets showed only one job in Work-in-Process Inventory on July 31. Materials of $15,706 had been added to the…arrow_forwardGigaBite Company's computer system recently crashed, erasing much of the company's financial data. The following accounting information was discovered soon afterwards on the Chief Financial Officer's back-up computer data. Cost of Goods Sold $ 384,000 Work-in-Process Inventory, Beginning 31,000 Work-in-Process Inventory, Ending 41,200 Selling and Administrative Expense 51,800 Finished Goods Inventory, Ending 15,600 Finished Goods Inventory, Beginning ? Direct Materials Purchased 175,400 Factory Overhead Applied 118,000 Operating Income 24,200 Direct Materials Inventory, Beginning 19,200 Direct Materials Inventory, Ending 6,200 Cost of Goods Manufactured 344,000 Direct Labor 58,000 The Chief Financial Officer of GigaBite Company has asked you to recalculate the following accounts and report to him by week's end. What should be the amount of direct materials available for use? Multiple Choice $118,000. $188,400. $194,600.…arrow_forward

- GigaBite Company's computer system recently crashed, erasing much of the company's financial data. The following accounting information was discovered soon afterwards on the Chief Financial Officer's back-up computer data. Cost of Goods Sold $ 384,000 Work-in-Process Inventory, Beginning 31,000 Work-in-Process Inventory, Ending 41,200 Selling and Administrative Expense 51,800 Finished Goods Inventory, Ending 15,600 Finished Goods Inventory, Beginning ? Direct Materials Purchased 175,400 Factory Overhead Applied 118,000 Operating Income 24,200 Direct Materials Inventory, Beginning 19,200 Direct Materials Inventory, Ending 6,200 Cost of Goods Manufactured 344,000 Direct Labor 58,000 The Chief Financial Officer of GigaBite Company has asked you to recalculate the following accounts and report to him by week's end. What should be the amount of direct materials available for use?arrow_forwardConrad, Inc. recently lost a portion of its records in an office fire. The following information was salvaged from the accounting records. Cost of Goods Sold $ 65,000 Work-in-Process Inventory, Beginning 10,500 Work-in-Process Inventory, Ending 9,000 Selling and Administrative Expense 15,000 Finished Goods Inventory, Ending 15,000 Finished Goods Inventory, Beginning ? Direct Materials Used ? Factory Overhead Applied 12,000 Operating Income 14,000 Direct Materials Inventory, Beginning 11,000 Direct Materials Inventory, Ending 6,000 Cost of Goods Manufactured 60,000 Direct labor cost incurred during the period amounted to 1.5 times the factory overhead. The CFO of Conrad, Inc. has asked you to recalculate the following accounts and to report to him by the end of the day. What is the amount of direct materials purchased?arrow_forwardConrad, Inc. recently lost a portion of its records in an office fire. The following information was salvaged from the accounting records. Cost of Goods Sold $ 65,000 Work-in-Process Inventory, Beginning 10,500 Work-in-Process Inventory, Ending 9,000 Selling and Administrative Expense 15,000 Finished Goods Inventory, Ending 15,000 Finished Goods Inventory, Beginning ? Direct Materials Used ? Factory Overhead Applied 12,000 Operating Income 14,000 Direct Materials Inventory, Beginning 11,000 Direct Materials Inventory, Ending 6,000 Cost of Goods Manufactured 60,000 Direct labor cost incurred during the period amounted to 1.5 times the factory overhead. The CFO of Conrad, Inc. has asked you to recalculate the following accounts and to report to him by the end of the day. What is the amount of total manufacturing cost?arrow_forward

- Aelan Products Company, a small manufacturer, has submitted the items below concerning last year's operations. The president's secretary, trying to be helpful, has alphabetized the list. Administrative salaries $4,800 Advertising expense 2,400 Depreciation—factory building 1,600 Depreciation—factory equipment 3,200 Depreciation—office equipment 360 Direct labour cost 43,800 Raw materials inventory, beginning 4,200 Raw materials inventory, ending 6,400 Finished goods inventory, beginning 93,960 Finished goods inventory, ending 88,820 General liability insurance expense 480 Indirect labour cost 23,600 Insurance on factory 2,800 Purchases of raw materials 29,200 Repairs and maintenance of factory 1,800 Sales salaries 4,000 Taxes on factory 900 Travel and entertainment expense 2,820 Work in process inventory, beginning 3,340 Work in process inventory, ending 2,220…arrow_forwardWedge Company paid $8,000 for materials (all of which was used in production during the year), $7,000 to manufacturing workers, $4,000 to office workers, $5,000 for the factory utilities, and $1,000 for office utilities. During the year, the company manufactured 1,000 parts and sold 750 of them. There were no units in beginning inventory at the start of the period. 1. What was Wedge’s cost of goods sold for the year? [ Select ] ["$25,000", "$20,000", "$18,750", "$15,000"] 2. What was the value of Wedge’s inventory at the end of the year?arrow_forwardSmooth Sounds manufactures and sells a new line of MP3 players. Unfortunately, Smooth Sounds suffered serious fire damage at its home office. As a result, the accounting records for October were partially destroyed-and completely jumbled. Smooth Sounds has hired you to help figure out the missing pieces of the accounting puzzle. Assume that Smooth Sounds' raw materials inventory contains only direct materials. Work in process inventory, October 31 $1,500 Finished goods inventory, October 1 4,300 Direct labor in October 3,000 Purchases of direct materials in October 9,000 Work in process inventory, October 1 0 Revenues in October 27,000 Gross profit in October 12,000 Direct materials used in October 8,000 Raw materials inventory, October 31 3,000 Manufacturing overhead in October 6,300 Manufacturing costs Cost of goods manufactured in October Cost of goods sold in October Beginning direct materials inventory Ending…arrow_forward

- XYZ Ltd manufactures furniture. Due to a fire in the administrative offices, the accounting records for November of the current year were partially destroyed. You have been able to piece together the following information from the ledger. By examining various source documents and interviewing several employees, you are able to gather the following additional information: • The budgeted overhead for the current year is $492,000 • The accounts payable (A/P) balance on 30 November is 40 percent of A/P beginning balance. Only purchases of raw material are credited to accounts payable. A payment of $85 000 was made on 20 November. • The actual manufacturing overhead for November is $65 000. • November’s cost of goods sold (CGS) amounts to $165 000. • The 30 November balance in finished goods inventory is $7 000. • Budgeted direct labour cost for the current year is $820 000. The direct labour rate is $25 per hour. • Collection of accounts receivable during November 95% of credit sales. •…arrow_forwardThe following information was taken from the accounting records of Elliott Manufacturing Corporation. Unfortunately, some of the data were destroyed by a computer malfunction. Sales Revenue $ 58,000 Finished Goods Inventory, Beginning 9,000 Finished Goods Inventory, Ending 6,000 Cost of Goods Sold ? Gross Margin 25,000 Direct Materials Used 10,000 Selling and Administrative Expense ? Operating Income 14,000 Work-in-Process Inventory, Beginning ? Work-in-Process Inventory, Ending 5,000 Direct Labor Used 9,000 Factory Overhead 12,000 Total Manufacturing Cost ? Cost of Goods Manufactured ? Selling and administrative expenses are calculated to be: Multiple Choice $4,000. $9,000. $11,000. $12,000. $16,000.arrow_forwardOccasion Shop, Inc., keeps accounting and cost records on a personal computer. During the month of January, data were lost as a result of errors made by a new operator. Fortunately, some data were retrieved and are set forth as follows:a. The debit balance in the payroll account was P130,000. This balance included P20,000 in indirect labor that was charged to the factory overhead.b. The debit balance in the factory overhead account totaled P165,000 while the total credit totaled P166,000.c. Work in process account showed a January 1 balance of P 91,000. Materials requisitioned and charged to work in process during the period amounted to P 98,000. The balance in work in process on January 31, was P82,000.d. The finished goods balance at January 1 was P50,000.e. Cost of goods sold had a debit balance of P 389,000. This amount did not include under-applied factory overhead. The balance of Cost of Sales after closing the overhead variance (immaterial) is?arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub