MyAccountingLab Access Code

3rd Edition

ISBN: 9780132952644

Author: Pearson

Publisher: Pearson College Div

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 62PA

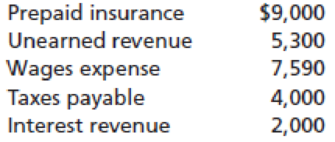

Record adjustments. (LO 1, 2, 3). The Gladiator Sports Company has the following account balances at the end of the year before any adjustments have been made:

The company also has the following information available at the end of the year:

- Of the prepaid insurance shown, $1,000 has now expired.

- Of the unearned revenue shown, $3,000 has been earned.

- The company must accrue an additional $2,250 of wages expense.

- The company has earned an additional $750 of interest revenue, not yet recorded or received.

Requirements

- 1. Use the

accounting equation to show the adjustments needed at year end. - 2. Calculate the balances in each account after the adjustments.

- 3. Indicate whether each adjustment is related to an accrual or a deferral.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Packer Wings Company received an advance payment of $144,000 for a consulting contract during the year. The balance in the Unearned Consulting Fees account at the beginning of the year was $12,000. At the end of the year, $8,000 was still unearned. Create T-accounts for the accounts involved in the adjusting entry needed at year end, and post all amounts to them, including the adjusting entry necessary, and calculate the account balances. How much will Packer Wings report as Consulting Revenue on its income statement for the year?

I need quick answer

At the end of the year, Tesla owes employees of $16,000. These salaries will be paid in the following year. What adjusting entry, if any, does the company need to record at the end of the year?

A. Debit Salaries Expense and credit Salaries Payable for $16,000

B. Debit Salaries Expense and credit cash for $16,000

C. No adjusting entry is necessary.

D. Debit Salaries Payable and credit Salaries Expense for $16,000

Service Pro Corp (SPC) is preparing adjustments for its September 30 year-end. For the followingtransactions and events, show the September 30 adjusting entries that SPC would make.a. Prepaid Insurance shows a balance of zero at September 30, but Insurance Expense shows adebit balance of $2,340, representing the cost of a three-year fire insurance policy that waspurchased on September 1 of the current year.b. On August 31 of this year, Cash was debited and Service Revenue was credited for $1,500.The $1,500 related to fees for a three-month period beginning September 1 of the current year.c. The company’s income tax rate is 20%. After making the above adjustments, SPC’s netincome before tax is $10,000. No income tax has been paid or recorded.

Chapter 3 Solutions

MyAccountingLab Access Code

Ch. 3 - Prob. 1YTCh. 3 - Prob. 2YTCh. 3 - Prob. 3YTCh. 3 - Prob. 4YTCh. 3 - Prob. 5YTCh. 3 - Prob. 6YTCh. 3 - Prob. 7YTCh. 3 - How does accrual basis accounting differ from cash...Ch. 3 - Prob. 2QCh. 3 - Prob. 3Q

Ch. 3 - Prob. 4QCh. 3 - What are accrued expenses?Ch. 3 - Prob. 6QCh. 3 - Prob. 7QCh. 3 - Name two common deferred expenses.Ch. 3 - What does it mean to recognize revenue?Ch. 3 - How does matching relate to accruals and...Ch. 3 - What is depreciation?Ch. 3 - Why is depreciation necessary?Ch. 3 - Prob. 13QCh. 3 - Prob. 14QCh. 3 - Prob. 1MCQCh. 3 - Prob. 2MCQCh. 3 - Prob. 3MCQCh. 3 - Prob. 4MCQCh. 3 - Prob. 5MCQCh. 3 - Prob. 6MCQCh. 3 - Prob. 7MCQCh. 3 - Prob. 8MCQCh. 3 - When prepaid insurance has been used, the...Ch. 3 - Prob. 10MCQCh. 3 - Prob. 1SEACh. 3 - Prob. 2SEACh. 3 - Account for interest expense. (LO 1, 2). UMC...Ch. 3 - Prob. 4SEACh. 3 - Account for insurance expense. (LO 1, 3). Catrina...Ch. 3 - Prob. 6SEACh. 3 - Account for unearned revenue. (LO 1, 3). Able...Ch. 3 - Prob. 8SEACh. 3 - Prob. 9SEACh. 3 - Prob. 10SEACh. 3 - Calculate profit margin on sales ratio. (LO 5)....Ch. 3 - Prob. 12SEBCh. 3 - Prob. 13SEBCh. 3 - Prob. 14SEBCh. 3 - Prob. 15SEBCh. 3 - Prob. 16SEBCh. 3 - Prob. 17SEBCh. 3 - Prob. 18SEBCh. 3 - Prob. 19SEBCh. 3 - Calculate net income. (LO I, 4). Suppose a company...Ch. 3 - Prob. 21SEBCh. 3 - Prob. 22SEBCh. 3 - Prob. 23EACh. 3 - Prob. 24EACh. 3 - Prob. 25EACh. 3 - Prob. 26EACh. 3 - Prob. 27EACh. 3 - Prob. 28EACh. 3 - Account for insurance expense. (LO 1, 3). Yodel ...Ch. 3 - Prob. 30EACh. 3 - Prob. 31EACh. 3 - Prob. 32EACh. 3 - Prob. 33EACh. 3 - Prob. 34EACh. 3 - Southeast Pest Control, Inc., was started when its...Ch. 3 - Prob. 36EACh. 3 - Prob. 37EACh. 3 - Prob. 38EACh. 3 - Prob. 39EACh. 3 - Prob. 40EBCh. 3 - Prob. 41EBCh. 3 - Prob. 42EBCh. 3 - TJs Tavern paid 10,800 on February 1, 2010, for a...Ch. 3 - Prob. 44EBCh. 3 - Prob. 45EBCh. 3 - Account for insurance expense. (LO 1, 3). All...Ch. 3 - Prob. 47EBCh. 3 - Prob. 48EBCh. 3 - Prob. 49EBCh. 3 - Prob. 50EBCh. 3 - Prob. 51EBCh. 3 - Prob. 52EBCh. 3 - From the following list of accounts (1) identify...Ch. 3 - Prob. 54EBCh. 3 - Prob. 55EBCh. 3 - Prob. 56EBCh. 3 - Prob. 57PACh. 3 - Prob. 58PACh. 3 - Prob. 59PACh. 3 - Following is a partial list of financial statement...Ch. 3 - Prob. 61PACh. 3 - Record adjustments. (LO 1, 2, 3). The Gladiator...Ch. 3 - Prob. 63PACh. 3 - Transactions for Pops Company for 2011 were as...Ch. 3 - Record adjustments and prepare financial...Ch. 3 - Prob. 66PACh. 3 - Prob. 67PACh. 3 - Record adjustments and prepare income statement....Ch. 3 - Prob. 69PBCh. 3 - Prob. 70PBCh. 3 - Following is a partial list of financial statement...Ch. 3 - Prob. 72PBCh. 3 - Record adjustments. (LO 1, 2, 3). Summit Climbing...Ch. 3 - Prob. 74PBCh. 3 - Prob. 75PBCh. 3 - Record adjustments and prepare financial...Ch. 3 - Prob. 77PBCh. 3 - Prob. 78PBCh. 3 - Identify and explain accruals and deferrals. (LO...Ch. 3 - Prob. 2FSACh. 3 - Prob. 3FSACh. 3 - Prob. 1CTPCh. 3 - Prob. 1IECh. 3 - Prob. 3IECh. 3 - Prob. 4IE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On October 31, the Vermillion Igloos Hockey Club received 800,000 in cash in advance for season tickets for eight home games. The transaction was recorded as a debit to Cash and a credit to Unearned Admissions. By December 31, the end of the fiscal year, the team had played three home games and received an additional 450,000 cash admissions income at the gate. a. Journalize the adjusting entry as of December 31. b. List the title of the account and the related balance that will appear on the income statement. c. List the title of the account and the related balance that will appear on the balance sheet.arrow_forwardReece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services accounting clerk prepared the following unadjusted trial balance at July 31, 2019: The data needed to determine year-end adjustments are as follows: Depreciation of building for the year, 6,400. Depreciation of equipment for the year, 2,800. Accrued salaries and wages at July 31, 900. Unexpired insurance at July 31, 1,500. Fees earned but unbilled on July 31, 10,200. Supplies on hand at July 31, 615. Rent unearned at July 31, 300. Instructions 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable, Rent Revenue, Insurance Expense, Depreciation ExpenseBuilding, Depreciation ExpenseEquipment, and Supplies Expense. 2. Determine the balances of the accounts affected by the adjusting entries and prepare an adjusted trial balance.arrow_forwardIn August, JemCo, which has an October 31 year end, pays $1,200 for office supplies and records it in Supplies Expense. On October 31, a physical count reveals $440 of supplies unused. What adjusting entry must JemCo record on October 31? If this entry is not recorded, how will it affect JemCo’s financial statements?arrow_forward

- For each item, determine the accounts to be adjusted on December 31, 2024, the amount of the adjustment, and the ending balance. Assume no adjustments were previously made during the year. On December 1, 2024, Wolverine received $4,000 cash from a company renting office space from Wolverine. The payment, representants rent for December and January was recorded to Deferred Revenue on December Revenue for other rentals totaled $125,000. My question is this: does the "revenue for other rentals totaled $125,000" have any relevance on answering the question. Or is jut "filler"? Thank you!arrow_forwardOn December 31, Frank Voris Company correctly made an adjusting entry to recognize $2,000 of accrued salaries and wages payable. On January 8 of the next year, total salaries and wages of $3,400 were paid. Assuming the correct reversing entry was made on January 1, the entry on January 8 will result in a credit to Cash $3,400 and the following debit(s):Salaries and Wages Payable $2,000 and Salaries and Wages Expense $1,400.Salaries and Wages Payable $3,400.Salaries and Wages Payable $1,400, and Salaries and Wages Expense $2,000.Salaries and Wages Expense $3,400.arrow_forwardThe Piper Ventura Illustrators presented the following information pertaining to accounts that willneed adjustments for its Nov. 30, 2021 year-end financial statements. a) On Oct. 1, 2021, Piper paid P10,800 for 6-months’ insurance premiums.b) The balance in the ledger account Office Supplies amounted to P32,000. A count of theoffice supplies on Nov. 30, 2021 totaled P12,800.c) The company received P22,800 on Nov. 1, 2021 from a customer for services to berendered during the months of November, December, January, and February.d) Piper Ventura acquired Office Equipment costing P352,800 on April 1, 2020. Theequipment is expected to last 5 years after which it will be worthless.e) Assume that Nov. 30, 2021 is a Friday and the Piper pays its employees a total of P87,500on Saturday.f) On September 1, the entity completed the negotiations with a client and accepted anadvance of P168,000 for services to be performed on November. The P168,000 wascredited to Unearned Service Revenues on the…arrow_forward

- Mac Ltd. provides legal advice to customers for fees. On 30 June 2020, Mac Ltd. completed its first year of operations. Some of the ledger account balances of the business, before any financial year end (30 June) adjustments, are provided below: $ Fees Revenue 295,000 Rent Expense 14,640 Electricity Expense 5,640 Wages Expense 108,800 Advertising Prepaid 1,800 No adjusting entries have been made to these accounts at any time during the year. An analysis of the business records reveals the following. The total Fees Revenue recorded includes $1,500 that was prepaid by a client as a deposit for legal advice to be provided in July 2020. The balance in Advertising Prepaid represents the amount paid for an advertising on a legal magazine for 6 months. The agreement with the publisher of the magazine covers the period 1 May 2020 to 31 October 2020. The Electricity Expense ledger balance does not include the amount for June 2020. The account…arrow_forwardBest Company had the following items that require adjustment at year end. Cash for equipment rental in the amount of $3,800 was paid in advance. The $3,800 was debited to prepaid rent when paid. At year end, $2,950 of the prepaid rent had expired. Cash for insurance in the amount of $8,200 was paid in advance. The $8,200 was debited to prepaid insurance when paid. At year end, $1,850 of the prepaid insurance was still unused. Supplies at the beginning of the year showed a balance of $2,000. Best purchased supplies of $16,200 during the year. At the end of the year, a physical count of supplies showed $4,125 of supplies on hand. Required: 1. Prepare the adjusting journal entries needed at December 31. If an amount box does not require an entry, leave it blank. Dec. 31 Rent Expense fill in the blank 27781a0e1020040_2 fill in the blank 27781a0e1020040_3 Prepaid Rent fill in the blank 27781a0e1020040_5 fill in the blank 27781a0e1020040_6 Dec. 31 Insurance Expense…arrow_forwardAt the beginning of the year, it had a balance in its prepaid insurance account of $48,400. During the year, $86,000 was paid for insurance. At the end of the year, after adjusting entries were recorded, the balance in prepaid insurance account was $42,000. Indurancr expense for the year would be: A. $92,400 B. $6,400 C. $134,400 D. $86,000arrow_forward

- For each of the following, indicate by how much the assets, liabilities, and stockholders' equity in the balance sheet for December 31, 2024 is higher or lower if the adjusting entry is not recorded. 1. On November 28, 2024, a company received a $1,950 payment from a customer for services to be rendered evenly over the next three months. Deferred Revenue was credited on November 28. 2. On December 1, 2024, the company paid a local radio station $2,190 for 30 radio ads that were to be aired, 10 per month, throughout December, January, and February. Prepaid Advertising was debited on December 1. 3. Employee salaries for the month of December totaling $6,300 will be paid on January 7, 2025. 4. On August 31, 2024, the company borrowed $53,000 from a local bank. A note was signed with principal and 6% interest to be paid on August 31, 2025.arrow_forwardA company owes employee salaries of $5,000 on December 31 for work completed in the current year, but the company doesn’t plan to pay those salaries until the following year. What adjusting entry, if any, is needed on December 31? a. Debit Salaries Payable for $5,000; Credit Salaries Expense for $5,000.b. Debit Salaries Payable for $5,000; Credit Cash for $5,000.c. Debit Salaries Expense for $5,000; Credit Salaries Payable for $5,000.d. No adjusting entry is needed.arrow_forwardWhen the accounts of Daniel Barenboim Inc. are examined, the adjusting data listed below are uncovered on December 31, the end of an annual fiscal period. 1. The prepaid insurance account shows a debit of $5,280, representing the cost of a 2-year fire insurance policy dated August 1 of the current year. 2. On November 1, Rent Revenue was credited for $1,800, representing revenue from a subrental for a 3-month period beginning on that date. 3. Purchase of advertising materials for $800 during the year was recorded in the Advertising Expense account. On December 31, advertising materials of $290 are on hand. 4. Interest of $770 has accrued on notes payable. Instructions Prepare the following in general journal form. a. The adjusting entry for each item. b. The reversing entry for each item where appropriate.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY