Financial Accounting

3rd Edition

ISBN: 9780133791129

Author: Jane L. Reimers

Publisher: Pearson Higher Ed

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 68PB

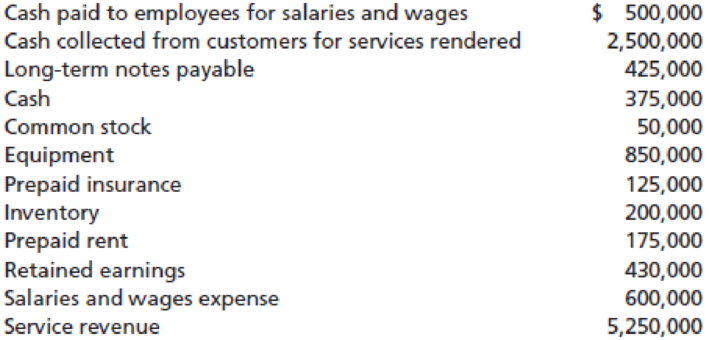

Record adjustments and prepare income statement. (LO 1, 2, 3, 4). Selected amounts (at December 31, 2012) from the accounting records of Dan’s Billiard Supply Company are shown here. No adjustments have been made.

Requirements

- 1. Five adjustments need to be made before the financial statements for the year ended December 31, 2012, can be prepared. Show each in an

accounting equation worksheet.- a. The equipment (purchased on January 1, 2012) has a useful life of 10 years with no salvage value (equal amount of

depreciation each year). - b. Interest on the notes payable needs to be accrued for the year in the amount of $60,000.

- c. Unexpired insurance at December 31, 2012, is $25,000.

- d. The rent payment of $175,000 was made on May 1. The rent payment is for 12 months beginning on the date of payment.

- e. Salaries of $65,000 were earned but unrecorded and unpaid at December 31, 2012.

- a. The equipment (purchased on January 1, 2012) has a useful life of 10 years with no salvage value (equal amount of

- 2. Prepare an income statement for the year ended December 31, 2012, for Dan’s Billiard Supply Company.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Badger Bagels had the following separate situations occur during 2016.The company’s accountant is preparing the annual financial statements at December 31, 2016 and has asked you to record the adjusting entries for each situation in the journal entry form.

a.

The Unearned Revenue account has an unadjusted balance of $8,000 consisting of gift cards sold to customers. Redeemed gift cards that have not yet been recorded total $4,800.

b.

At the beginning of the year, the company purchased supplies worth $5000 and paid cash. At December 31, 2016, the supplies available are $2000.

c.

At December 31, 2016, employee wages of $9,200 have been incurred but not paid or recorded.

d.

Nine months ago, the company paid one year's advance rent of $1200 in cash.

e.

The company purchased equipment on January 1 by paying $ 100,000 cash. Unrecorded depreciation on equipment is $11,200.

The income statement for the year 2018 of Stellar Co. contains the following information:

Revenues$70700Expenses: Salaries and Wages Expense$44800 Rent Expense12400 Advertising Expense9900 Supplies Expense5600 Utilities Expense2400 Insurance Expense2100 Total expenses77200Net income (loss)$ (6500)

After the revenue and expense accounts have been closed, the balance in Income Summary will be

a)a credit balance of $70700.

b)a credit balance of $6500.

c)a debit balance of $6500.

d)$0.

The following information was obtained from a review of the ledger and other records of

2Moons Company at the close of the current fiscal year ending December 31, 2017. Write the

adjusting entry and computation as description.

a. The office supplies expense account has a debit balance of P38,610. The inventory of

office supplies on hand as of December 31, totals P14,760.

b. The rent expense account has a debit balance of P74,400 composed of the following: (1)

January 1 balance of P16,800 representing rent for January through April 2017; and (2)

debit balance of P57,600 representing payment for a one-year beginning May 2017.

c. The prepaid insurance account has a debit balance of P62,640 at December 31. Details of

the policies acquired during the past year are as follows:

Type of Policy Premium Paid Date Started

Fire Insurance P 12,960 January 2

Accident Insurance 24,480 March 1

Car Insurance 9,360 June 1

Life Insurance 15,840 August 1

d. The balance of the commissions income account…

Chapter 3 Solutions

Financial Accounting

Ch. 3 - Prob. 1YTCh. 3 - Prob. 2YTCh. 3 - Prob. 3YTCh. 3 - Prob. 4YTCh. 3 - Prob. 5YTCh. 3 - Prob. 6YTCh. 3 - Prob. 7YTCh. 3 - How does accrual basis accounting differ from cash...Ch. 3 - Prob. 2QCh. 3 - Prob. 3Q

Ch. 3 - Prob. 4QCh. 3 - What are accrued expenses?Ch. 3 - Prob. 6QCh. 3 - Prob. 7QCh. 3 - Name two common deferred expenses.Ch. 3 - What does it mean to recognize revenue?Ch. 3 - How does matching relate to accruals and...Ch. 3 - What is depreciation?Ch. 3 - Why is depreciation necessary?Ch. 3 - Prob. 13QCh. 3 - Prob. 14QCh. 3 - Prob. 1MCQCh. 3 - Prob. 2MCQCh. 3 - Prob. 3MCQCh. 3 - Prob. 4MCQCh. 3 - Prob. 5MCQCh. 3 - Prob. 6MCQCh. 3 - Prob. 7MCQCh. 3 - Prob. 8MCQCh. 3 - When prepaid insurance has been used, the...Ch. 3 - Prob. 10MCQCh. 3 - Prob. 1SEACh. 3 - Prob. 2SEACh. 3 - Account for interest expense. (LO 1, 2). UMC...Ch. 3 - Prob. 4SEACh. 3 - Account for insurance expense. (LO 1, 3). Catrina...Ch. 3 - Prob. 6SEACh. 3 - Account for unearned revenue. (LO 1, 3). Able...Ch. 3 - Prob. 8SEACh. 3 - Prob. 9SEACh. 3 - Prob. 10SEACh. 3 - Calculate profit margin on sales ratio. (LO 5)....Ch. 3 - Prob. 12SEBCh. 3 - Prob. 13SEBCh. 3 - Prob. 14SEBCh. 3 - Prob. 15SEBCh. 3 - Prob. 16SEBCh. 3 - Prob. 17SEBCh. 3 - Prob. 18SEBCh. 3 - Prob. 19SEBCh. 3 - Calculate net income. (LO I, 4). Suppose a company...Ch. 3 - Prob. 21SEBCh. 3 - Prob. 22SEBCh. 3 - Prob. 23EACh. 3 - Prob. 24EACh. 3 - Prob. 25EACh. 3 - Prob. 26EACh. 3 - Prob. 27EACh. 3 - Prob. 28EACh. 3 - Account for insurance expense. (LO 1, 3). Yodel ...Ch. 3 - Prob. 30EACh. 3 - Prob. 31EACh. 3 - Prob. 32EACh. 3 - Prob. 33EACh. 3 - Prob. 34EACh. 3 - Southeast Pest Control, Inc., was started when its...Ch. 3 - Prob. 36EACh. 3 - Prob. 37EACh. 3 - Prob. 38EACh. 3 - Prob. 39EACh. 3 - Prob. 40EBCh. 3 - Prob. 41EBCh. 3 - Prob. 42EBCh. 3 - TJs Tavern paid 10,800 on February 1, 2010, for a...Ch. 3 - Prob. 44EBCh. 3 - Prob. 45EBCh. 3 - Account for insurance expense. (LO 1, 3). All...Ch. 3 - Prob. 47EBCh. 3 - Prob. 48EBCh. 3 - Prob. 49EBCh. 3 - Prob. 50EBCh. 3 - Prob. 51EBCh. 3 - Prob. 52EBCh. 3 - From the following list of accounts (1) identify...Ch. 3 - Prob. 54EBCh. 3 - Prob. 55EBCh. 3 - Prob. 56EBCh. 3 - Prob. 57PACh. 3 - Prob. 58PACh. 3 - Prob. 59PACh. 3 - Following is a partial list of financial statement...Ch. 3 - Prob. 61PACh. 3 - Record adjustments. (LO 1, 2, 3). The Gladiator...Ch. 3 - Prob. 63PACh. 3 - Transactions for Pops Company for 2011 were as...Ch. 3 - Record adjustments and prepare financial...Ch. 3 - Prob. 66PACh. 3 - Prob. 67PACh. 3 - Record adjustments and prepare income statement....Ch. 3 - Prob. 69PBCh. 3 - Prob. 70PBCh. 3 - Following is a partial list of financial statement...Ch. 3 - Prob. 72PBCh. 3 - Record adjustments. (LO 1, 2, 3). Summit Climbing...Ch. 3 - Prob. 74PBCh. 3 - Prob. 75PBCh. 3 - Record adjustments and prepare financial...Ch. 3 - Prob. 77PBCh. 3 - Prob. 78PBCh. 3 - Identify and explain accruals and deferrals. (LO...Ch. 3 - Prob. 2FSACh. 3 - Prob. 3FSACh. 3 - Prob. 1CTPCh. 3 - Prob. 1IECh. 3 - Prob. 3IECh. 3 - Prob. 4IE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The trial balance of Wikki Cleaners at December 31, 2012, the end of the current fiscal year, is as follows: Information for the adjusting entries is as follows: a. Cleaning supplies on hand on December 31, 2012, 18,750. b. Insurance premiums expired during the year, 1,800. c. Depreciation on equipment during the year, 21,600. d. Wages accrued but not paid at December 31, 2012, 1,830. As the accountant for Wikki Cleaners, you have been asked to prepare financial statements for the year. A file called F1WORK has been provided to assist you in this assignment. As you review this file, it should be noted that columns H and I will automatically change when you enter values in columns E or G.arrow_forwardReece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services Co.s accounting clerk prepared the following unadjusted trial balance at July 31, 2016: The data needed to determine year-end adjustments are as follows: a. Depreciation of building for the year, 6,400. b. Depreciation of equipment for the year, 2,800. c. Accrued salaries and wages at July 31, 900. d. Unexpired insurance at July 31, 1,500. e. Fees earned but unbilled on July 31, 10,200. f. Supplies on hand at July 31, 615. g. Rent unearned at July 31, 300. Instructions 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation ExpenseBuilding; Depreciation ExpenseEquipment; and Supplies Expense. 2. Determine the balances of the accounts affected by the adjusting entries and preparean adjusted trial balance.arrow_forwardThe account balances of Bryan Company as of June 30, the end of the current fiscal year, are as follows: Required 1. Data for the adjustments are as follows: a. Expired or used up insurance, 495 b. Depreciation expense on equipment, 670. c. Depreciation expense on the van, 1,190. d. Salary accrued (earned) since the last payday, 540 (owed and to be paid on the next payday). e. Supplies used during the period, 97. Your instructor may want you to use a work sheet for these adjustments. 2. Journalize the adjusting entries. 3. Prepare an income statement. 4. Prepare a statement of owners equity. Assume that there was an additional investment of 2,000 on June 10. 5. Prepare a balance sheet. 6. Journalize the closing entries using the four steps in the correct sequence. Check Figure Net Income, 13,627arrow_forward

- The balances of the ledger accounts of Pelango Furniture as of December 31, the end of its fiscal year, are as follows: Data for the adjustments are as follows: ab. Merchandise Inventory at December 31, 104,565. c. Wages accrued at December 31, 934. d. Supplies inventory (on hand) at December 31, 755. e. Depreciation of store equipment, 4,982. f. Depreciation of office equipment, 1,531. g. Insurance expired during the year, 935. h. Rent earned, 2,450. Required 1. Complete the work sheet after entering the account names and balances onto the work sheet. Ignore this step if using CLGL. 2. Journalize the adjusting entries. If using manual working papers, record adjusting entries on journal page 16.arrow_forwardWyoming Tours Co. is a travel agency. The nine transactions recorded by Wyoming Tours during June 2016, its first month of operations, are indicated in the following T accounts: Indicate for each debit and each credit: (a) whether an asset, liability, owners equity, drawing, revenue, or expense account was affected and (b) whether the account was increased (+) or decreased (). Present your answers in the following form, with transaction (1) given as an example:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License