RU-N PRINCIPLE OF CORPORATE FINANCE & C

13th Edition

ISBN: 9781264189229

Author: BREALEY

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Chapter 31, Problem 1PS

Summary Introduction

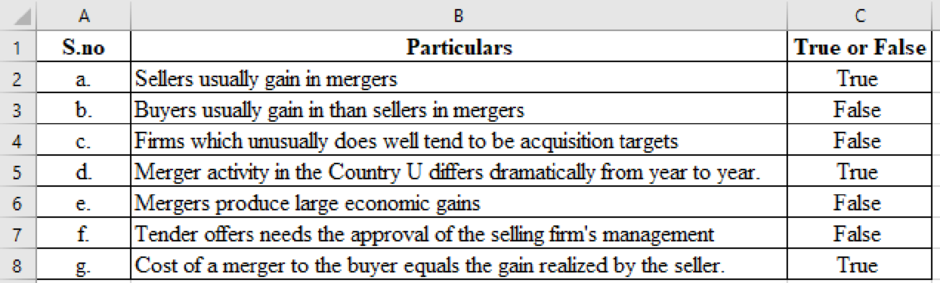

To indicate: Whether the transactions are true or false.

Expert Solution & Answer

Explanation of Solution

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

Why might one company have to complete more due diligence than another in a merger?

A. None of these answers

B. It is important for a company to know what it is buying

C. Acquisitions can be risky

D. If there is a large size discrepancy the merger seems more like an aquis

Which is not a valid, acceptable reason for companies to merge?

Synergistic benefits arising from mergers.

Reduction in competition resulting from mergers.

Acquisition of assets at below replacement value.

Attempts to minimize taxes by acquiring a firm with large accumulated losses that can be used immediately.

Using surplus cash to acquire another firm and prevent unfavorable tax consequences for shareholders.

q10. The hubris motive for M&As refers to which of the following?

Explains why mergers may happen even if the current market value of the target firm reflects its true economic value

The ratio of the market value of the acquiring firm’s stock exceeds the replacement cost of its assets

Agency problems

Market power

The Q ratio

Chapter 31 Solutions

RU-N PRINCIPLE OF CORPORATE FINANCE & C

Knowledge Booster

Similar questions

- Two large, publicly owned firms are contemplating a merger. No operating synergy isexpected. However, because returns on the two firms are not perfectly positively correlated,the standard deviation of earnings would be reduced for the combined corporation. Onegroup of consultants argues that this risk reduction is sufficient grounds for the merger.Another group thinks that this type of risk reduction is irrelevant because stockholders canhold the stock of both companies and thus gain the risk-reduction benefits without all thehassles and expenses of the merger. Whose position is correct? Explain.arrow_forwardWhich of the following LEAST accurately describes the advantages of specific types of mergers and acquisitions?a. The catch-all term for the benefits from M&As is synergy.b. A diversified group of business may further acquire other businesses in a conglomerate type of acquisition.c. The acquisition of an entity outside the industry and supporting services will result to decrease in cost of production of the acquirer.d. Financial advantages of M&A include decreased operating costs, increased financial capacity, and combined sales.arrow_forwardJoint ventures involve the merging of two or more companies. ( ) a) True () b) False A country experiences a trade surplus when the total value of exports is higher than the total value of imports. () a) True () b) Falsearrow_forward

- The following are sensible motives for mergers EXCEPT: a. Economies of scope b. Reducing firm risk through diversification c. Reducing competition d. Eliminating inefficiencies e. All of the abovearrow_forwardSuppose you are the CEO of a large firm in a service business and you think that by acquiring a certain competing firm, you can generate growth and profits at a greater rate for the combined firm. Youhave asked some financial analysts to study the proposed acquisition/merger. Do you think valuechain analysis would be useful to them? Why or why not?arrow_forward21. Which of the following are generally true about wealth gains or losses to stockholders following a merger? A. Stockholders of the target firm have zero or negative wealth gains B. Stockholders of the acquiring firm have zero or negative wealth gains C. Stockholders of competing firms have zero or negative wealth gains D. Stockholders of the target firm have positive wealth gains E. Both B and D 22. Empirical research about the method payment for mergers has shown that A. Returns for acquiring firm stockholders are much lower when cash is used for payment B. Returns for target firm stockholders are much lower when cash is used for payment C. Returns for competing firms are much lower when cash is used for payment D. Returns for acquiring firm stockholders are much higher when cash is used for payment E. None of the above 23. If a firm wishes to expand geographically, it is often preferable to do it by acquiring an existing firm rather than greenfield entry, because A. The…arrow_forward

- is this statement true or false and justify answer using logic and concepts Mergers inspired by vertical integration motives are very rare nowadays, as transaction costs have decreased substantially since the second merger wave.arrow_forwardCash or Stock In the business world, firms acquire other companies all the time. However, the question arises how is the merger paid for? In this Journal you will be looking at how outside ownership benefits from either accepting a cash buyout or stock in the parent company. Find a company that acquired a company for either cash or stock and answer the following questions: What is the name of the Parent and Subsidiary firm? What were the details of the acquisition? What was the immediate impact on each of the company’s stock price? What was the impact on each of the company’s stock price over the long run? Was the acquisition successful?arrow_forwardDo solve it as soon as possible Identify which statement is not correct. In a takeover bid to acquire a part or all shares in another company: Select one: a. Friendly merger reduces the chance of overpaying for target’s shares. b. Successful acquirer is likely to pay more for target’s shares in scenarios that include multiple rival bidders. c. Target company management would not accept an offer where the consideration for target’s shares exceeds the NPV of the merger. d. Hostile takeover may result in overpaying for target’s shares.arrow_forward

- Which of the following statements is CORRECT? a. A good goal for a rm's management is maximization of expected EPS. b. Most business in the U.S. is conducted by corporations, and corporations' popularity resultsprimarily from their favorable tax treatment. c. Because most stock ownership is concentrated in the hands of a relatively small segment ofsociety, rms' actions to maximize their stock prices have little benet to society. d. Corporations and partnerships have an advantage over proprietorships because a sole proprietoris exposed to unlimited liability, but the liability of all investors in the other types of businesses ismore limited. e. The potential exists for agency conicts between stockholders and managers. Please explain.arrow_forwardIt is quite often we observe some firms takeover target firms from a different industry. If diversifying harms firm value and it is more efficient to make diversification at the investor (shareholder) level than at the firm level, why do you think the managements still choose to make diversified acquisitions?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT