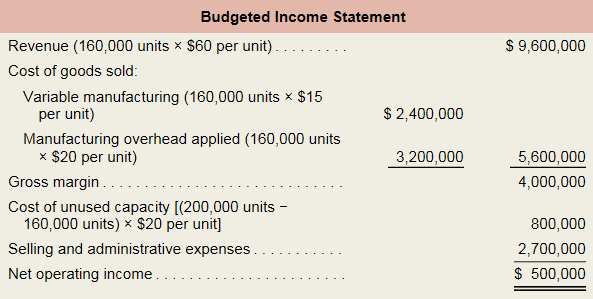

Ethics; Predetermined Overhead Rate and Capacity LO3—2, LO3—6

Pat Miranda the new controller of Vault Hard Drives, Inc., has just returned from a seminar on the choice of the activity level in the predetermined overhead rate. Even though the subject did not sound exciting at first, she found that there were some important ideas presented that should get a hearing at her company. After returning from the seminar, she arranged a meeting with the production manager, J. Stevens, and the assistant production manager, Marvin Washington.

Pat: I ran across an idea that I wanted to check out with both of you. It’s about the way we compute predetermined overhead rates.

J.: We’re all ears.

Pat: We compute the predetermined overhead rate by dividing the estimated total factory overhead for the coming year, which is all a fixed cost, by the estimated total units produced for the coming year.

Marvin: We’ve been doing that as long as I’ve been with the company.

J.: And it has been done that way at every other company I’ve worked at, except at most places they divide by direct labor-hours.

Pat: We use units because it is simpler and we basically make one product with minor variations. But, there’s another way to do it. Instead of basing the overhead rate on the estimated total units produced for the coming year, we could base it on the total units produced at capacity.

Marvin: Oh, the Marketing Department will love that. It will drop the costs on all of our products. They’ll go wild over there cutting prices.

Pat: That is a worry, but I wanted to talk to both of you first before going over to Marketing.

J.: Aren’t you always going to have a lot of unused capacity costs?

Pat: That’s correct, but let me show you how we would handle it. Here’s an example based on our budget for next year.

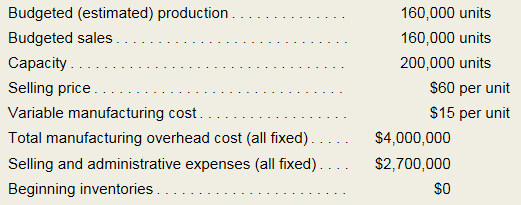

TraditionaI Approach to Computation of the Predetermined Overhead Rate

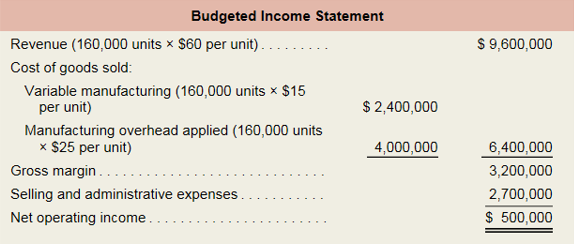

New Approach to Computation of the Predetermined Overhead Rate Using Capacity in the

Denominator

J.: Whoa!! I don’t think I like the looks of that “Cost of unused capacity.” If that thing shows up on the income statement: someone from headquarters is likely to come down here looking for some people to lay off.

Martin: I’m worried about something else too. What happens when sales are not up to expectations? Can we pull the “hat trick”?

Pat: I’m sorry, I don’t understand.

J.: Marvin’s talking about something that happens fairly regularly. When sales are down and profits look like they are going to be lower than the president told the owners they were going to be, the president comes down here and asks us to deliver some more profits.

Marvin: And we pull them out of our hat

J.: Yeah, we just increase production until we get the profits we want.

Pat: I still don’t understand. You mean you increase sales?

J.: Nope, we increase production. We’re the production managers, not the sales managers.

Pat: I get it. Because you have produced more, the sales force has more units it can sell.

J.: Nope, the marketing people don’t do a thing- We just build inventories and that does the trick.

Required:

In all of the questions below, assume that the predetermined overhead rate under the traditional method is $25 per unit, and under the new capacity-based method it is $20 per unit.

- Assume actual sales is 150,000 units and the actual production in units, actual selling price, actual variable

manufacturing cost per unit, and actual fixed costs all equal their respective budgeted amounts. Given these assumptions: - Compute net operating income using the traditional income statement format.

- Compute net operating income using the new income statement format.

- Assume that actual sales is 150,000 units and the actual selling price, actual variable manufacturing cost per unit, and actual fixed costs all equal their respective budgeted amounts. Under the traditional approach, how many units would have to be produced to realize net operating income of $500,000?

- Assume that actual sales is 150,000 units and the actual selling price, actual variable manufacturing cost per unit, and actual fixed costs all equal their respective budgeted amounts. Under the new capacity-based approach, how many units would have to be produced to realize net operating income of $500,000?

- What effect does the new capacity-based approach have on the volatility of net operating income?

- Will the “hat trick” be easier or harder to perform if the new capacity-based method is used?

- Do you think the “hat trick” is ethical?

Want to see the full answer?

Check out a sample textbook solution

Chapter 3B Solutions

MANAGERIAL ACCOUNTING F/MGRS.

- Exercise 6-45 (Algo) Predetermined Overhead Rates and Product Profitability (LO 6-3, 4) Social Media, Inc. (SMI) has two services for users. Toot!, which connects tutors with students who are looking for tutoring services, and TiX, which can be used to buy, sell, or exchange event tickets. For the following year, SMI expects the following results. Toot! TiX Total Users 14,900 21,600 36,500 Revenues $ 1,950,000 $ 2,000,000 $ 3,950,000 Engineering hours 10,125 8,125 18,250 Engineering cost $ 830,625 $ 948,750 $ 1,779,375 Administrative costs $ 1,423,500 Required: a. Compute the predetermined overhead rate used to apply administrative costs to the two services assuming SMI uses the engineering hours to allocate administrative costs. b. Based on the rates computed in requirement (a), what is the profit for each service? Required A Compute the predetermined overhead rate used to apply administrative costs to the two services assuming…arrow_forwardQ.1 (a) Compare / contrast. Why are these two different? Inventoriable costs and period costs. Direct costs and indirect costs. Manufacturing costs and non-manufacturing costs. Period costs and product costs. Operating costs and non-operating costs. Q.1 (b) A client approached to Incredible Fabricating and Manufacturing for a one-time special order for Steel doors. These Steel doors are fabricated and manufactured to local clients regularly. The cost per unit information apply for deals to regular clients: Direct materials $1,982 Direct labor 810 Variable manufacturing overhead 1,296 Fixed manufacturing overhead 2,808 Total manufacturing costs 6,896 Markup (50%)…arrow_forwardQ6) Manufacturing overhead costs are easy to trace and can be ignored while calculating total costs. Select one: True Falsearrow_forward

- The answer has incorrect solutions. There is the right soloution on Bartleby: PROBLEM 4B-6 Step-Down Method versus Direct Method; Predetermined Overhead Rates LO4-10, LO4-11. I just need to get the calculations from that answer elaborated. Thank youarrow_forwardActivity-based costing for a service company Wells Fargo insurance Services (WFIS) is an insurance brokerage company that classified insurance products as either easy or difficult. Easy and difficult products were defined as follows: Easy: Electronic claims, few inquiries, mature product Difficult: Paper claims, complex claims to process, many inquiries, a new product with complex options The company originally allocated processing and service expenses on the basis of revenue. Under this traditional allocation approach, the product profitability report revealed the following: Easy Product Difficult Product Total Revenue 600 400 1,000 Processing and service expenses 420 280 700 Income from operations 180 120 300 Operating income margin 30% 30% 30% WFIS decided to use activity-based costing to allocate the processing and service expenses. The following activity-based costing analysis of the same data illustrates a much different profit picture for the two types of products: Easy Product Difficult Product Total Revenue 600 400 1,000 Processing and service expenses 183 517 700 Income from operations 417 (117) 300 Operating income margin 70% (29%) 30% Explain why the activity-based profitability report reveals different information from the traditional sales allocation report. Source: Dan Patras and Kevin Clancy, ABC in the Service Industry: Product Line Profitability at Acordia, Inc. As Easy as ABC Newsletter, issue 12. Spring 1993arrow_forwardRefer to Exercise 12.14. Suppose that for 20x2, Sanford, Inc., has chosen suppliers that provide higher-quality parts and redesigned its plant layout to reduce material movement. Additionally, Sanford implemented a new setup procedure and provided training for its purchasing agents. As a consequence, less setup time is required and fewer purchasing mistakes are made. At the end of 20x2, the information shown on page 680 is provided. Required: 1. Prepare a report that compares the non-value-added costs for 20x2 with those of 20x1. 2. What is the role of activity reduction for non-value-added activities? For value-added activities? 3. Comment on the value of a trend report.arrow_forward

- AIP 2.8 Cost-benefit Analysis of Information LO 4A Blu-ray disk manufacturer feels that he needs better information on the quality of disks that the plant is producing. He is considering purchasing a scanning machine that would identify defects in the Blu-ray disks as they are being produced. The scanner would have to be operated full time by an employee. Question 1. What factors should the manufacturer consider in determining the costs and benefits of the scanning machine?arrow_forwardQUESTION 3 (17)Mvete Limited is an established company in the manufacturing industry. The company is manufacturing a very successful product, namely Vete12. The following cost structure is given to you, the newly appointed Trainee Cost Accountant, to advise management on the different levels of production: At the current level of 15 000 units produced and sold:Direct material R20 per unit Direct labour R375 000Indirect material R5 per unit Indirect labour (includes the production supervisors’ salary of R240 000. The remainder is R5.50 per unit R352 500 Other manufacturing overheads (all variable) R12.50 per unit Depreciation charge PPE (production plant and machinery) R375 000Selling and administrative expenses: • Variable selling expenses R10.25 per unit• Fixed selling expenses R5 per unit • Administrative expenses (all fixed) R7 per unit Required a) Calculate at the three (3) different production levels of: • 15 000 units (current level of production)• 20 000 units,• 12 000 units i.…arrow_forwardAIP 8.5 Effect of Allocation Bases on Behavior LO 4 Portable Phones, plc. manufactures and sells mobile telephones for residential and commercial use. Portable Phones' plant is organized by product line, with five telephone assembly departments in total. Each of these five telephone assembly departments is responsible for the complete production of a particular telephone line, including manufacturing some parts, purchasing other parts, and assembling the unit. Each of the five assembly department managers reports to a product-line manager, who has profit responsibility for his or her product. These five product-line managers have authority over pricing, marketing, distribution, and production of their product. Each of the five assembly departments is a cost center within its respective product-line profit centers. A key component of each telephone is the circuit board(s) containing the integrated circuit chips. Each assembly department purchases the basic boards and chips to be…arrow_forward

- Q.1A client approached to Incredible Fabricating and Manufacturing for a one-time special order for Steel doors. These Steel doors are fabricated and manufactured to local clients regularly. The cost per unit information apply for deals to regular clients: Direct materials $1,982 Direct labor 810 Variable manufacturing overhead 1.296 Fixed manufacturing overhead 2.808 Total manufacturing costs 6,896 Markup (50%) 3,348 Targeted selling price $10.244 Incredible Fabricating and Manufacturing has ample idle capacity. Required: a. What is the full cost of the product per unit if the marketing costs is $2,000? b. What is the contribution margin per unit? c. Which costs are relevant for making the decision regarding this one-time-only special order? Why? d. For Incredible Fabricating and Manufacturing, what is the minimum acceptable price of this one-time-only special order? e. For this one-time-only special order, should Incredible Fabricating and Manufacturing consider a price of 55,400 per…arrow_forwardQ. 2 Índigo manufacturing has five activity cost pools and two products ( a budget tape vacuum and a deluxe tape vacuum). Information is presented below:arrow_forward(Ch 8) Which departments in an organization produce services for external customers? Question 1 options: Support departments. Dual-rate departments. Operating departments. Sales departments. (Ch 8) When allocating support department costs, managers must identify cost pools. The choice of cost pools is: Question 2 options: not influenced by the allocation base. not important, because all support department costs will eventually be allocated anyway. influenced by the design of the accounting information system. determined by whether a company uses IFRS or ASPE.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning

Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning