Ethics; Predetermined Overhead Rate and Capacity LO3—2, LO3—6

Pat Miranda the new controller of Vault Hard Drives, Inc., has just returned from a seminar on the choice of the activity level in the predetermined overhead rate. Even though the subject did not sound exciting at first, she found that there were some important ideas presented that should get a hearing at her company. After returning from the seminar, she arranged a meeting with the production manager, J. Stevens, and the assistant production manager, Marvin Washington.

Pat: I ran across an idea that I wanted to check out with both of you. It’s about the way we compute predetermined overhead rates.

J.: We’re all ears.

Pat: We compute the predetermined overhead rate by dividing the estimated total factory overhead for the coming year, which is all a fixed cost, by the estimated total units produced for the coming year.

Marvin: We’ve been doing that as long as I’ve been with the company.

J.: And it has been done that way at every other company I’ve worked at, except at most places they divide by direct labor-hours.

Pat: We use units because it is simpler and we basically make one product with minor variations. But, there’s another way to do it. Instead of basing the overhead rate on the estimated total units produced for the coming year, we could base it on the total units produced at capacity.

Marvin: Oh, the Marketing Department will love that. It will drop the costs on all of our products. They’ll go wild over there cutting prices.

Pat: That is a worry, but I wanted to talk to both of you first before going over to Marketing.

J.: Aren’t you always going to have a lot of unused capacity costs?

Pat: That’s correct, but let me show you how we would handle it. Here’s an example based on our budget for next year.

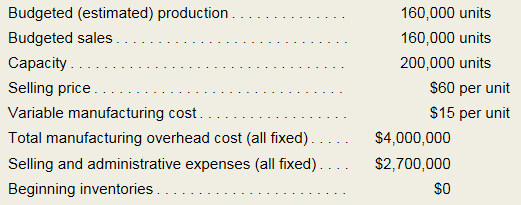

TraditionaI Approach to Computation of the Predetermined Overhead Rate

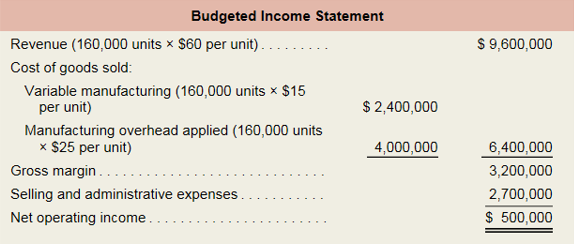

New Approach to Computation of the Predetermined Overhead Rate Using Capacity in the

Denominator

J.: Whoa!! I don’t think I like the looks of that “Cost of unused capacity.” If that thing shows up on the income statement: someone from headquarters is likely to come down here looking for some people to lay off.

Martin: I’m worried about something else too. What happens when sales are not up to expectations? Can we pull the “hat trick”?

Pat: I’m sorry, I don’t understand.

J.: Marvin’s talking about something that happens fairly regularly. When sales are down and profits look like they are going to be lower than the president told the owners they were going to be, the president comes down here and asks us to deliver some more profits.

Marvin: And we pull them out of our hat

J.: Yeah, we just increase production until we get the profits we want.

Pat: I still don’t understand. You mean you increase sales?

J.: Nope, we increase production. We’re the production managers, not the sales managers.

Pat: I get it. Because you have produced more, the sales force has more units it can sell.

J.: Nope, the marketing people don’t do a thing- We just build inventories and that does the trick.

Required:

In all of the questions below, assume that the predetermined overhead rate under the traditional method is $25 per unit, and under the new capacity-based method it is $20 per unit.

- Assume actual sales is 150,000 units and the actual production in units, actual selling price, actual variable

manufacturing cost per unit, and actual fixed costs all equal their respective budgeted amounts. Given these assumptions: - Compute net operating income using the traditional income statement format.

- Compute net operating income using the new income statement format.

- Assume that actual sales is 150,000 units and the actual selling price, actual variable manufacturing cost per unit, and actual fixed costs all equal their respective budgeted amounts. Under the traditional approach, how many units would have to be produced to realize net operating income of $500,000?

- Assume that actual sales is 150,000 units and the actual selling price, actual variable manufacturing cost per unit, and actual fixed costs all equal their respective budgeted amounts. Under the new capacity-based approach, how many units would have to be produced to realize net operating income of $500,000?

- What effect does the new capacity-based approach have on the volatility of net operating income?

- Will the “hat trick” be easier or harder to perform if the new capacity-based method is used?

- Do you think the “hat trick” is ethical?

Want to see the full answer?

Check out a sample textbook solution

Chapter 3B Solutions

CONNECT ONLINE ACCESS F/MANAGERIAL ACC.

- ctoring Enabled: Chapter 3 Linear Programming.. 6 Saved Help Save & 1 A plumbing repair company has 9 employees and must choose which of 9 jobs to assign each to (each employee is assigned to exactly one job and each job must have someone assigned). a. How many decision variables will the linear programming model include? Number of decision variables b. How many fixed requirement constraint will the linear programming model include? Number of fixed requirement constraintsarrow_forwardok sk int rences C raw 124,010 :8: F1 Exercise 6-8A (Static) Which of the following is true about the cost of employees within a business context? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) @ 2 W ?Hiring employees involves a significant overhead cost. ? Costs associated with employees include only salary and limited hiring expenses. ?Employees constitute a high cost of conducting business. ?The cost of providing employee benefits is minimal and of little importance. F2 # 3 E S D AL 15 80 F3 $ с 4 R Q F4 % 5 * 8 F G H J DII F8 I XCVBNM ( 9 K A DD F9 0 < ) 0 F10 L P 4 F11 M + [ F12 = ? 11 I Warrow_forwardInstructions for Excel Spreadsheet Assignment #2Preliminary Setup InformationYour company manufactures and sells computer memory chips. You are part of the department whose job it is to figure out how many chips you should produce and sell. Let x represent the number (in millions) of chips that you plan to produce and sell. Your marketing department has figured out that if you produce x million chips then the selling price (in dollars) you must charge for each chip is given by the functionp(x) = 150-2x. Your production department has figured out that if you produce x million chips then the cost of production (in millions of dollars) will be given by the function C(x) = 50 + 40xYour tax department has figured out that you should expect to pay 10% tax on any profits. The tax (in millions of dollars) on a profit of y millions of dollars will be given by the functionT( y) = 0.1yExplanation of what you are to do on the Excel spreadsheetNOTE: You will not get credit for your work if you just…arrow_forward

- Question #6 Describe the difference between direct and step-down methods to allocate service department costs to user departments. Respond Responses for this topic are hidden from you until you make a response. Pearson Copyright © 2021 Pearson Education Inc. All rights reserved.I Terms of Use l Privacy Policy I Permissions I Contact UsI 9:20 ENG 4/22/20 hp prt sc delete home backspace Vock Parrow_forwardChapter 4 Pg. 318 Facility, Product, Batch and Unit Levels.Would you please explain in great detail the different levels and the role they play, and provide examples for each, good examples please. Also, there is a question below about utilities that I need answered. Please give GREAT examples for each level. Also what would utitilies for the facility fall under? Which of the 4 categoriesarrow_forwardENOWV2 | Online teach x SOFTWARE UPDATE KeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false macOS Big Sur 11.3.1 is available and will be later tonight. eBook Show Me How E Print Item Activity-Based Costing for a Service Business Sterling Hotel uses activity-based costing to determine the cost of servicing customers. There are three activity pools: guest check-in, room cleaning, and meal service. The activity rates associated with each activity pool are $8.90 per quest check-in, $19.00 per room cleaning, and $2.00 per served meal (not including food). Janelle Washington visited the hotel for a 5-night stay. Janelle had 6 meals in the hotel during the visit. Determine the total activity-based cost for Washington's visit during the month. Round your answer to the nearest cent. Feedback Check My Work Calculate: Number of activities x Activity rate = Cost of activity Sum all activity costs to determine the total. Check My Work Previous Next Email…arrow_forward

- YPLUS Kimmel, Accounting, 7e Help | System Announcements CALCULATOR PRINTER VERSION 1 BACK NEXT National Corporation needs to set a target price for its newly designed product M14-M16. The following data relate to this new product. RESOURCES OMEWORK --05 -07 -09 -11 a-b Per Unit Total Direct materials $21 -16 Direct labor $41 --01A -02A -03A Variable manufacturing overhead Fixed manufacturing overhead $14 $1,264,000 Variable selling and administrative expenses $ 4 Fixed selling and administrative expenses $ 1,106,000 Its by Study These costs are based on a budgeted volume of 79,000 units produced and sold each year. National uses cost-plus pricing methods to set its target selling price. The markup percentage on total unit cost is 40%. Compute the total variable cost per unit, otal fixed cost per unit, and total cost per unit for M14-M16. Variable cost per unit 2$ Fixed cost per unit Total cost per unit 24 MacBookarrow_forwardReduce setup time Vernon Inc. has analyzed the setup time on its computer-controlled lathe. The setup requires changing the type of fixture that holds a part. The average setup time has been 140 minutes, consisting of the following steps: a. Why should management be concerned about improving setup time? b. What do you recommend to Vernon Inc. for improving setup time? c. How much time would be required for a setup, using your suggestion in (b)?arrow_forwardX MindTap - Ceng: X M Mathway | Alget XU Microsoft 365 (F X UD Microsoft 365 (F X Sign out akeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false eBook Salaries Materials Insurance Utilities Cost of inspection of materials for quality control Promotion expenses Advertising Equipment depreciation Cost of market survey Problem 7-39 (LO. 5) Blue Corporation, a manufacturing company, decided to develop a new line of merchandise. The project began in 2022. Blue had the following expenditures in connection with the project, all incurred in the U.S.: Amount of the deduction Check My Work 49 2023 $500,000 $600,000 90,000 70,000 8,000 11,000 6,000 8,000 7,000 6,000 11,000 18,000 20,000 14,000 144 2022 $ f The new product will be introduced for sale beginning in April 2024. If an amount is zero, enter "0". Calculate the monthly expense to the nearest dollar and use in subsequent computations. a. Determine Blue Corporation's research and experimental…arrow_forward

- A 12 Compute the ROI 13 Margin 14 Turnover 15 ROI 16 1 Chapter 10: Applying Excel 2 3 Data 4 Sales 5 6 Average operating assets 7 Minimum required rate of return 8 9 Enter a formula into each of the cells marked with a ? below 10 Review Problem: Return on Investment (ROI) and Residual Income 11 Net operating income 17 Compute the residual income 18 Average operating assets 22 23 24 25 26 27 28 29 30 31 32 33 34 19 Net operating income 20 Minimum required return 21 Residual income Chapter 10 Form B + $25,000,000 $3,000,000 $10,000,000 25% ? ? ? C ? ? ? ? D E F G H | J K Larrow_forward* CengageNOWv2 | Online te x My Questions | bartleby keAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false * 司 Upd Print Item Rene is working with the operations manager to determine what the standard labor cost is for a spice chest. He has watched the process from start to finish and taken detailed notes on what each employee does. The first employee selects and mills the wood, so it is smooth on all four sides. This takes the employee 1 hour for each chest. The next employee takes the wood and cuts it to the proper size. This takes 30 minutes. The next employee assembles and sands the chest. Assembly takes 2 hours. The chest then goes to the finishing department. It takes 1.5 hours to finish the chest. All employees are cross-trained so they are all paid the same amount per hour, $19.60. A. What are the standard hours per chest? Standard hour per chest hours B. What is the standard cost per chest for labor? Round your answer to two decimal places.…arrow_forwardb My Questions | bartleby PoF ACCT3039-Unit 4.pdf O Unit 4 -Discussion Question 303 x + PDF A marl File | C:/Users/Ronnick%20Douglas/OneDrive/Desktop/Advanced%20Manage. ... Activity-Based Costing, Traditional Costing 1. The controller for Mitchell Supply Company has established the following overhead cost pools and cost drivers: Overhead Cost Pool Machine setups Material handling Quality control inspection Other overhead costs Total Budgeted Overhead Cost $150,000 52,500 37,500 90.000 $330.000 Cost Driver Number of setups Units of raw material Number of inspections Machine hours Overhead Cost Pool Machine setups Material handling Quality control Other overhead Budgeted Level for Cost Driver 100'setups 50,000 units 1,000 inspections 15,000 machine hours Overhead Rate $1,500 per setup $1.05 per unit $37.50 per inspection $6 per machine hour Order no. 610 has the following production requirements: Machine setups Raw material Inspections Machine hours 5 setups 10,000 units 12 inspections…arrow_forward

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning

Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning