College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 11SPB

CORRECTING ERRORS Assuming that all

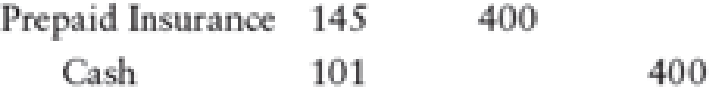

The following entry was made to record the purchase of $400 in equipment on account:

The following entry was made to record the payment of $200 for advertising:

The following entry was made to record a $600 payment to a supplier on account:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

College Accounting, Chapters 1-27

Ch. 4 - Source documents serve as historical evidence of...Ch. 4 - The chart of accounts lists capital accounts...Ch. 4 - No entries are made in the Posting Reference...Ch. 4 - When entering the credit item in a general...Ch. 4 - When an incorrect entry has been journalized and...Ch. 4 - Prob. 1MCCh. 4 - A revenue account will begin with the number...Ch. 4 - To purchase an asset such as office equipment on...Ch. 4 - When fees are earned and the customer promises to...Ch. 4 - When the correct numbers are used but are in the...

Ch. 4 - Prob. 1CECh. 4 - Prob. 2CECh. 4 - Prob. 3CECh. 4 - Prob. 4CECh. 4 - Trace the flow of accounting information through...Ch. 4 - Name a source document that provides information...Ch. 4 - Prob. 3RQCh. 4 - Prob. 4RQCh. 4 - Where is the first formal accounting record of a...Ch. 4 - Describe the four steps required to journalize a...Ch. 4 - In what order are the accounts customarily placed...Ch. 4 - Explain the primary advantage of a general ledger...Ch. 4 - Explain the five steps required when posting the...Ch. 4 - Prob. 10RQCh. 4 - Explain why the ledger can still contain errors...Ch. 4 - Prob. 12RQCh. 4 - What is a transposition error?Ch. 4 - What is a correcting entry?Ch. 4 - Prob. 1SEACh. 4 - GENERAL JOURNAL ENTRIES For each of the following...Ch. 4 - GENERAL LEDGER ACCOUNTS Set up T accounts for each...Ch. 4 - GENERAL JOURNAL ENTRIES Diane Bernick has opened...Ch. 4 - GENERAL LEDGER ACCOUNTS; TRIAL BALANCE Set up...Ch. 4 - FINANCIAL STATEMENTS From the information in...Ch. 4 - Prob. 7SEACh. 4 - FINDING AND CORRECTING ERRORS On May 25, after the...Ch. 4 - SERIES A PROBLEMS JOURNALIZING AND POSTING...Ch. 4 - JOURNALIZING AND POSTING TRANSACTIONS Jim Andrews...Ch. 4 - CORRECTING ERRORS Assuming that all entries have...Ch. 4 - Prob. 1SEBCh. 4 - GENERAL JOURNAL ENTRIES For each of the following...Ch. 4 - GENERAL LEDGER ACCOUNTS Set up T accounts for each...Ch. 4 - GENERAL JOURNAL ENTRIES Sengel Moon opened The...Ch. 4 - GENERAL LEDGER ACCOUNTS; TRIAL BALANCE Set up...Ch. 4 - FINANCIAL STATEMENTS From the information in...Ch. 4 - Prob. 7SEBCh. 4 - FINDING AND CORRECTING ERRORS On April 25, after...Ch. 4 - JOURNALIZING AND POSTING TRANSACTIONS Benito...Ch. 4 - Prob. 10SPBCh. 4 - CORRECTING ERRORS Assuming that all entries have...Ch. 4 - MANAGING YOUR WRITING You are a public accountant...Ch. 4 - MASTERY PROBLEM Barry Bird opened the Barry Bird...Ch. 4 - CHALLENGE PROBLEM Journal entries and a trial...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- CORRECTING ERRORS Assuming that all entries have been posted, prepare correcting entries for each of the following errors. 1. The following entry was made to record the purchase of 700 in supplies on account: 2. The following entry was made to record the payment of 450 in wages: 3. The following entry was made to record a 300 payment to a supplier on account:arrow_forwardJournalize correcting entries for each of the following errors and include a brief explanation. a. A cash purchase of office equipment for 680 was journalized as a cash purchase of store equipment for 680. (Use the ruling method; assume that the entry has not been posted.) b. An entry for a 180 payment for office supplies was journalized as 810. (Use the ruling method; assume that the entry has not been posted.) c. A 620 payment for repairs was journalized and posted as a debit to Equipment instead of a debit to Repair Expense. (Use the correcting entry method to journalize the correction.) d. A 750 bill for vehicle insurance was received and immediately paid. It was journalized and posted as 660. (Use the correcting entry method to journalize the correction.)arrow_forwardCORRECTING WORK SHEET WITH ERRORS A beginning accounting student tried to complete a work sheet for Dick Adys Bookkeeping Service. The following adjusting entries were to have been analyzed and entered in the work sheet: (a) Ending inventory of supplies on July 31, 130. (b) Unexpired insurance on July 31, 420. (c) Depreciation of office equipment, 325. (d) Wages earned, but not paid as of July 31, 95. REQUIRED Review the work sheet shown on page 174 for addition mistakes, transpositions, and other errors and make all necessary corrections.arrow_forward

- The trial balance of Hadden Company as of December 31, the end of its current fiscal year, is as follows: Here are the data for the adjustments. ab.Merchandise Inventory at December 31, 64,742.80. c.Store supplies inventory (on hand), 420.20. d.Insurance expired, 738. e.Salaries accrued, 684.50. f.Depreciation of store equipment, 3,620. Required Complete the work sheet after entering the account names and balances onto the work sheet.arrow_forwardThe trial balance of Jillson Company as of December 31, the end of its current fiscal year, is as follows: Here are the data for the adjustments. ab. Merchandise Inventory at December 31, 54,845.00. c. Store supplies inventory (on hand), 488.50. d. Insurance expired, 680. e. Salaries accrued, 692. f. Depreciation of store equipment, 3,760. Required Complete the work sheet after entering the account names and balances onto the work sheet.arrow_forwardFINDING AND CORRECTING ERRORS Joe Adams bought 500 worth of office supplies on account. The following entry was recorded on May 17. Find the error(s) and correct it (them) using the ruling method. On May 25, after the transactions had been posted, Adams discovered that the following entry contains an error. The cash received represents a collection on account, rather than new service fees. Correct the error in the general journal using the correcting entry method.arrow_forward

- FINDING AND CORRECTING ERRORS Mary Smith purchased 350 worth of office equipment on account. The following entry was recorded on April 6. Find the error(s) and correct it (them) using the ruling method. On April 25, after the transactions had been posted, Smith discovered the following entry contains an error. When her customer received services, Cash was debited, but no cash was received. Correct the error in the journal using the correcting entry method.arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. amount due for employee salaries, $4,800 B. actual count of supplies inventory, $ 2,300 C. depreciation on equipment, $3,000arrow_forwardAdjusting entries The Signage Company specializes in the maintenance and repair of signs, such as billboards. On March 31, 20Y6, the accountant for The Signage Company prepared the trial balances shown at the top of the following page. Instructions Journalize the seven entries that adjusted the accounts at March 31. None of the accounts were affected by more than one adjusting entry.arrow_forward

- A merchandising company shows 8,842 in the Supplies account on the preadjusted trial balance. After taking inventory of the actual supplies, the company still owns 3,638. a. How much was used or expired? b. Write the adjusting entry.arrow_forwardPost the following August transactions to T-accounts for Accounts Payable and Supplies, indicating the ending balance (assume no beginning balances in these accounts): A. purchased supplies on account, $600 B. paid vendors for supplies delivered earlier in month, $500 C. purchased supplies for cash, $450arrow_forwardThe following accounts appear in the ledger of Sheldon Company on January 31, the end of this fiscal year. The data needed for adjustments on January 31 are as follows: ab.Merchandise inventory, January 31, 55,750. c.Insurance expired for the year, 1,285. d.Depreciation for the year, 5,482. e.Accrued wages on January 31, 1,556. f.Supplies used during the year 1,503. Required 1. Prepare a work sheet for the fiscal year ended January 31. Ignore this step if using QuickBooks or general ledger. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. Ignore this step if using CLGL. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. Check Figure Net loss, 1,737arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License