Concept explainers

The unadjusted

| PS Music Adjusted Trial Balance July 31, 2018 | |||

| Account No. | Debit Balances | Credit Balances | |

| Cash................................................. | 11 | 9,945 | |

| Accounts Receivable................................... | 12 | 4,150 | |

| Supplies.............................................. | 14 | 275 | |

| Prepaid Insurance..................................... | 15 | 2,475 | |

| Office Equipment..................................... | 17 | 7,500 | |

| Accumulated |

18 | 50 | |

| Accounts Payable..................................... | 21 | 8,350 | |

| Wages Payable........................................ | 22 | 140 | |

| Unearned Revenue.................................... | 23 | 3,600 | |

| Common Stock....................................... | 31 | 9,000 | |

| Dividends............................................ | 33 | 1,750 | |

| Fees Earned........................................... | 41 | 21,200 | |

| Music Expense........................................ | 54 | 3,610 | |

| Wages Expense....................................... | 50 | 2,940 | |

| Office Rent Expense................................... | 51 | 2,550 | |

| Advertising Expense................................... | 55 | 1,500 | |

| Equipment Rent Expense.............................. | 52 | 1,375 | |

| Utilities Expense...................................... | 53 | 1,215 | |

| Supplies Expense...................................... | 56 | 925 | |

| Insurance Expense.................................... | 57 | 225 | |

| Depreciation Expense................................. | 58 | 50 | |

| Miscellaneous Expense................................ | 59 | 1,855 | |

| 42,340 | 42,340 | ||

Instructions

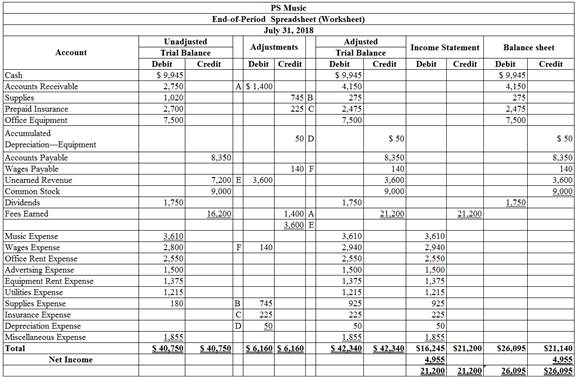

1. (Optional) Using the data from Chapter 3, prepare an end-of-period spreadsheet.

2. Prepare an income statement, a

3. Journalize and

4. Prepare a post-dosing trial balance.

(1)

Spreadsheet:

A spreadsheet is a worksheet. It is used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Income statement:

An income statement is one of the financial statements which shows the revenues, and expenses of the company. The income statement is prepared to ascertain the net income/loss of the company, by deducting the expenses from the revenues.

Statement of retained earnings: This statement reports the beginning retained earnings and all the changes which led to ending retained earnings. Net income from income statement is added to and dividends are deducted from beginning retained earnings to arrive at the end result, ending retained earnings.

Balance sheet:

A balance sheet is a financial statement consists of the assets, liabilities, and the stockholder’s equity of the company. The balance of the assets account must be equal to that of the liabilities and the stockholder’s equity account.

T-Accounts:

T-accounts are referred as T-account because its format represents the letter “T”. The T-accounts consists of the following:

- The title of accounts.

- The debit side (Dr) and,

- The credit side (Cr).

Closing entries:

Closing entries are recorded in order to close the temporary accounts such as incomes and expenses by transferring them to the permanent accounts. It is passed at the end of the accounting period, to transfer the final balance.

Post-Closing Trial Balance:

After passing all the journal entries and the closing entries of the permanent accounts and then further posting them to each of the respective accounts, a post-closing trial balance is prepared which consists of a list of all the permanent accounts. A post-closing trial balance serves as an evidence to prove that the balance of the permanent accounts is equal.

To prepare: An end-of-period spreadsheet.

Explanation of Solution

An end-of-period spreadsheet is prepared as follows:

Figure (1)

Hence, the end-of-period spreadsheet is prepared and completed.

(2)

To Prepare: An income statement for the year ended July 31, 2018.

Explanation of Solution

An income statement for the year ended July 31, 2018 is as follows:

| PS Music | ||

| Income Statement | ||

| For July 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues: | ||

| Fees Earned | 21,200 | |

| Expenses: | ||

| Music Expense | 3,610 | |

| Wages Expense | 2,940 | |

| Office Rent Expense | 2,550 | |

| Advertising Expense | 1,500 | |

| Equipment Rent Expense | 1,375 | |

| Utilities Expense | 1,215 | |

| Supplies Expense | 925 | |

| Insurance Expense | 225 | |

| Depreciation Expense | 50 | |

| Miscellaneous Expense | 1,855 | |

| Total Expenses | 16,245 | |

| Net Income | $4,955 | |

Table (1)

Hence, the net income of PS Music for the year ended July 31, 2018 is $4,955.

To Prepare: The statement of owners’ equity for the year ended July 31, 2018.

Explanation of Solution

The statement of retained earnings for the year ended July 31, 2018 is as follows:

| PS Music | ||

| Statement of Retained earnings | ||

| For the Year Ended July 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Retained earnings, June 1, 2018 | 0 | |

| Add: Net income | 4,955 | |

| Less: Dividends | (1,750) | |

| Change in retained earnings | 3,205 | |

| Retained earnings, July 31, 2018 | $3,205 | |

Table (2)

Hence, owners’ equity for the year ended July 31, 2018 is $3,205.

To Prepare: The balance sheet of PS Music at July 31, 2018.

Explanation of Solution

The balance sheet of PS Music at July 31, 2018 is prepared as follows:

| PS Music | ||

| Balance Sheet | ||

| At July 31, 2018 | ||

| Assets | ||

| Current Assets: | $ | $ |

| Cash | 9,945 | |

| Accounts Receivable | 4,150 | |

| Supplies | 275 | |

| Prepaid Insurance | 2,475 | |

| Total Current Assets | 16,845 | |

| Property, plant and equipment: | ||

| Office Equipment | 7,500 | |

| Less: Accumulated Depreciation | 50 | |

| Total Plant Assets | 7,450 | |

| Total Assets | $24,295 | |

| Liabilities | ||

| Current Liabilities: | ||

| Accounts Payable | 8,350 | |

| Salaries Payable | 140 | |

| Unearned Rent | 3,600 | 12,090 |

| Total Liabilities | ||

| Stock holders’ Equity | ||

| Common Stock | 9,000 | |

| Retained Earnings | 3,205 | |

| Total Stock holders’ Equity | 12,205 | |

| Total Liabilities and Stock holders’ Equity | $24,295 | |

Table (3)

It is one of the financial statements, which shows the assets, liabilities, and stockholders’ equity of a company at a particular point of time. It reveals the financial health of a company. Thus, this statement is also called as the Statement of Financial Position. It helps the users to know about the creditworthiness of a company as to whether the company has enough assets to pay off its liabilities.

Therefore, the total assets and total liabilities plus owners’ equity of PS Music at July 31, 2018 is $24,295.

(3)

To Journalize: The closing entries for PS Music.

Explanation of Solution

Closing entry for revenue and expense accounts:

| Date | Accounts title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| July 31, 2018 | Fees Earned | 41 | 21,200 | |

| Income Summary | 34 | 21,200 | ||

| (To record the closure of revenues account ) | ||||

| July 31 | Income Summary | 34 | 16,245 | |

| Wages Expense | 50 | 2,940 | ||

| Office Rent Expense | 51 | 2,550 | ||

| Equipment Rent Expense | 52 | 1,375 | ||

| Utilities Expense | 53 | 1,215 | ||

| Music Expense | 54 | 3,610 | ||

| Advertising Expense | 55 | 1,500 | ||

| Supplies Expense | 56 | 925 | ||

| Insurance Expense | 57 | 225 | ||

| Depreciation Expense | 58 | 50 | ||

| Miscellaneous Expense | 59 | 1,855 | ||

| (To close the revenues and expenses account. Then the balance amount are transferred to income summary account) | ||||

| July 31 | Income Summary | 34 | 4,955 | |

| Retained earnings | 32 | 4,955 | ||

| (To record the closure of net income from income summary to retained earnings) | ||||

| Retained earnings | 32 | 1,750 | ||

| Dividends | 33 | 1,750 | ||

| (To record the closure of dividend to retained earnings) | ||||

Table (4)

Fees earned account has a normal credit balance of $21,200 in total, now to close this account, the fees earned account must be debited with $21,200 and, income summary account must be credited with $21,200.

- In this closing entry, the fees earned account balance is being transferred to the income summary account, to bring the revenues account balance to zero.

- Thereby, the income summary account balance gets increased by $21,200 and, the revenue account balance gets decreased by $21,200.

All expenses accounts have a normal debit balance, the total of expenses are $16,245 have to be closed by transferring these account balances to the income summary account. All expenses account must be credited, and the income summary account must be debited with $ 16,245.

- In this closing entry, all the expenses account balances are transferred to the income summary account, to bring the expenses account balances to zero.

- Thereby, both the income summary account, and the expenses account balances get decreased by $16,245.

Determined amount balance of income summary is $4,955, which has to be closed by debiting the income summary account with $4,955, and crediting the retained earnings account with $4,955.

- In this closing entry, the income summary account balance is being transferred to the retained earnings account, to bring the income summary account balance to zero.

- Thereby, the income summary account gets decreased, and the retained earnings account balance gets increased by $4,955.

Dividends account has a normal debit balance of $1,750, now to close this account, retained earnings account must be debited with $1,750 and, dividend account must be credited with $1,750.

- In this closing entry, the dividend account balance is being transferred to the retained earnings account, to bring the dividend account balance to zero.

- Thereby, the retained earnings account balance gets increased by $1,750 and, the dividend account balance gets decreased by $1,750

To post: The closing entries of PS Music accounts in the appropriate balance column of a four-column account.

Explanation of Solution

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | Balance | ✓ | 3,920 | |||

| 1 | 1 | 5,000 | 8,920 | ||||

| 1 | 1 | 1,750 | 7,170 | ||||

| 1 | 1 | 2,700 | 4,470 | ||||

| 2 | 1 | 1,000 | 5,470 | ||||

| 3 | 1 | 7,200 | 12,670 | ||||

| 3 | 1 | 250 | 12,420 | ||||

| 4 | 1 | 900 | 11,520 | ||||

| 8 | 1 | 200 | 11,320 | ||||

| 11 | 1 | 1,000 | 12,320 | ||||

| 13 | 1 | 700 | 11,620 | ||||

| 14 | 1 | 1,200 | 10,420 | ||||

| 16 | 2 | 2,000 | 12,420 | ||||

| 21 | 2 | 620 | 11,800 | ||||

| 22 | 2 | 800 | 11,000 | ||||

| 23 | 2 | 750 | 11,750 | ||||

| 27 | 2 | 915 | 10,835 | ||||

| 28 | 2 | 1,200 | 9,635 | ||||

| 29 | 2 | 540 | 9,095 | ||||

| 30 | 2 | 500 | 9,595 | ||||

| 31 | 2 | 3,000 | 12,595 | ||||

| 31 | 2 | 1,400 | 11,195 | ||||

| 31 | 2 | 1,250 | 9,945 | ||||

Table (5)

| Account: Accounts Receivable Account no. 12 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | Balance | ✓ | 1,000 | |||

| 2 | 1 | 1,000 | |||||

| 23 | 2 | 1,750 | 1,750 | ||||

| 30 | 2 | 1,000 | 2,750 | ||||

| 31 | Adjusting | 3 | 1,400 | 4,150 | |||

Table (6)

| Account: Supplies Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | Balance | ✓ | 170 | |||

| 18 | 2 | 850 | 1,020 | ||||

| 31 | Adjusting | 3 | 745 | 275 | |||

Table (7)

| Account: Prepaid Insurance Account no. 15 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | 1 | 2,700 | 2,700 | |||

| 31 | Adjusting | 3 | 225 | 2,475 | |||

Table (8)

| Account: Office equipment Account no. 17 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 5 | 1 | 7,500 | 7,500 | |||

Table (9)

| Account: Accumulated Depreciation-Office equipment Account no. 18 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 31 | Adjusting | 3 | 50 | 50 | ||

Table (10)

| Account: Accounts Payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | Balance | ✓ | 250 | |||

| 3 | 1 | 250 | |||||

| 5 | 1 | 7,500 | 7,500 | ||||

| 18 | 2 | 850 | 8,350 | ||||

Table (11)

| Account: Wages Payable Account no. 22 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 31 | Adjusting | 3 | 140 | 140 | ||

Table (12)

| Account: Unearned Revenue Account no. 23 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 3 | 1 | 7,200 | 7,200 | |||

| 31 | Adjusting | 3 | 3,600 | 3,600 | |||

Table (13)

| Account: Common Stock Account no. 31 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | ✓ 1 | 5,000 | ||||

| 1 | Balance | 1 | 4,000 | 9,000 | |||

Table (14)

| Account: Retained earnings Account no. 32 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | Balance | |||||

| 31 | Closing | 4 | 4,955 | 4,955 | |||

| 31 | Closing | 4 | 1,750 | 3,205 | |||

Table (15)

| Account: Dividends Account no. 33 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | Balance | ✓ | 500 | |||

| 31 | 2 | 1,250 | 1,750 | ||||

| 31 | Closing | 4 | 1,750 | ||||

Table (16)

| Account: Income Summary Account no. 34 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 31 | Closing | 4 | 21,200 | 21,200 | ||

| 31 | Closing | 4 | 16,245 | 4,955 | |||

| 31 | Closing | 4 | 4,955 | ||||

Table (17)

| Account: Fees earned Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | Balance | ✓ | 6,200 | |||

| 11 | 1 | 1,000 | 7,200 | ||||

| 16 | 2 | 2,000 | 9,200 | ||||

| 23 | 2 | 2,500 | 11,700 | ||||

| 30 | 2 | 1,500 | 13,200 | ||||

| 31 | 2 | 3,000 | 16,200 | ||||

| 31 | Adjusting | 3 | 1,400 | 17,600 | |||

| 31 | Adjusting | 3 | 3,600 | 21,200 | |||

| 31 | Closing | 4 | 21,200 | ||||

Table (18)

| Account: Wages expense Account no. 50 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | Balance | ✓ | 400 | |||

| 14 | 1 | 1,200 | 1,600 | ||||

| 27 | 2 | 1,200 | 2,800 | ||||

| 31 | Adjusting | 3 | 140 | 2,940 | |||

| 31 | Closing | 4 | 2,940 | ||||

Table (19)

| Account: Office Rent expense Account no. 51 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | Balance | ✓ | 800 | |||

| 1 | 1 | 1,750 | 2,550 | ||||

| 31 | Closing | 4 | 2,550 | ||||

Table (20)

| Account: Equipment rent expense Account no. 52 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | Balance | ✓ | 675 | |||

| 31 | 1 | 700 | 1,375 | ||||

| 31 | Closing | 4 | 1,375 | ||||

Table (21)

| Account: Utilities expense Account no. 53 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | Balance | ✓ | 300 | |||

| 27 | 2 | 915 | 1,215 | ||||

| 31 | Closing | 4 | 1,215 | ||||

Table (22)

| Account: Music expense Account no. 54 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | Balance | ✓ | 1,590 | |||

| 21 | 2 | 620 | 2,210 | ||||

| 31 | 2 | 1,400 | 3,610 | ||||

| 31 | Closing | 4 | 3,610 | ||||

Table (23)

| Account: Advertising expense Account no. 55 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | Balance | ✓ | 500 | |||

| 8 | 1 | 200 | 700 | ||||

| 22 | 2 | 800 | 1,500 | ||||

| 31 | Closing | 4 | 1,500 | ||||

Table (24)

| Account: Supplies expense Account no. 56 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | Balance | ✓ | 180 | |||

| 22 | Adjusting | 2 | 745 | 925 | |||

| 31 | Closing | 4 | 925 | ||||

Table (25)

| Account: Insurance expense Account no. 57 | ||||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | |||

| Debit ($) | Credit ($) | |||||||

| 2018 | ||||||||

| July | 31 | Adjusting | 3 | 225 | 225 | |||

| 31 | Closing | 4 | 225 | |||||

Table (26)

| Account: Depreciation expense Account no. 58 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 31 | Adjusting | 3 | 50 | 50 | ||

| 31 | Closing | 4 | 50 | ||||

Table (27)

| Account: Miscellaneous expense Account no. 59 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| July | 1 | Balance | ✓ | 415 | |||

| 4 | 1 | 900 | 1,315 | ||||

| 29 | 2 | 540 | 1,855 | ||||

| 31 | Closing | 4 | 1,855 | ||||

Table (28)

(4)

To prepare: A post–closing trial balance of PS Music for July 31, 2018.

Explanation of Solution

Prepare a post–closing trial balance of PS Music for July 31, 2018 as follows:

|

PS Music Post-closing Trial Balance July, 31, 2018 |

|||

| Particulars | Account No | Debit $ | Credit $ |

| Cash | 11 | 9,945 | |

| Accounts receivable | 12 | 4,150 | |

| Supplies | 14 | 275 | |

| Prepaid insurance | 15 | 2,475 | |

| Office Equipment | 17 | 7,500 | |

| Accumulated depreciation – Office Equipment | 18 | 50 | |

| Accounts payable | 21 | 8,350 | |

| Wages payable | 22 | 140 | |

| Unearned revenue | 23 | 3,600 | |

| Common Stock | 31 | 9,000 | |

| Retained earnings | 32 | 3,205 | |

| Total | 24,345 | 24,345 | |

Table (29)

The debit column and credit column of the post–closing trial balance are agreed, both having balance of $24,345.

Want to see more full solutions like this?

Chapter 4 Solutions

Working Papers for Warren/Reeve/Duchac's Corporate Financial Accounting, 14th

- Balance Sheet without Amounts The following is an alphabetical list of all of While Limnology Companys adjusted trial balance accounts as of December 31, 2019: Required: Prepare White Limnologys balance sheet (without amounts) in proper format.arrow_forwardPrepare an adjusted trial balance from the following account information, considering the adjustment data provided (assume accounts have normal balances). Adjustments needed: Physical count of supplies inventory remaining at end of period, $2,150 Taxes payable at end of period, $3,850arrow_forwardPrepare an adjusted trial balance from the following account information, and also considering the adjustment data provided (assume accounts have normal balances). Adjustments needed: Accrued interest revenue on investments at period end, $2,200 Insurance still unexpired at end of the period, $12,000arrow_forward

- Identify whether each of the following transactions, which are related to expense recognition, are accrual, deferral, or neither. A. paid an expense for the current month B. prepaid an expense for future months C. made a payment to reduce accounts payable D. incurred a current-month expense, to be paid next montharrow_forwardUse the following account T-balances (assume normal balances) and correct balance information to make the December 31 adjusting journal entries.arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. depreciation on fixed assets, $ 8,500 B. unexpired prepaid rent, $12,500 C. remaining balance of unearned revenue, $555arrow_forward

- What two accounts are affected by each of these adjustments? A. recorded accrued interest on note payable B. adjusted unearned rent to correct C. recorded depreciation for the year D. adjusted salaries payable to correct E. sold merchandise to customers on accountarrow_forwardAdjusting Entries The following partial list of accounts and account balances has been taken from the trial balance and the adjusted trial balance of Baye Company: Required: Next Level Prepare the adjusting entry that caused the change in each account balance.arrow_forwardThe following is the adjusted trial balance data for Emma's Alterations as of December 31, 2019. Emma's AlterationsAdjusted Trial BalanceYear Ended December 31, 2019 Debit Credit Cash $603,538 Accounts Receivable 51,689 Equipment 199,430 Merchandise Inventory 169,744 Accounts Payable $234,893 Common Stock 502,200 Sales 400,593 Interest Revenue 100,976 Rent Revenue 65,200 Sales Salaries Expense 28,750 Office Supplies Expense 4,903 Sales Discounts 61,347 Interest Expense 3,570 Sales Returns and Allowances 55,632 Cost of Goods Sold 90,800 Rent Expense 10,600 Depreciation Expense-Office Equipment 8,560 Insurance Expense 3,421 Advertising Expense 11,878 Totals $1,303,862 $1,303,862 Question Content Area A. Use the data provided to compute net sales for 2019. $fill in the blank 5505dbf53068011_1 B. Compute the gross margin for 2019. $fill in the blank 5505dbf53068011_2 C. Compute the gross profit…arrow_forward

- The adjusted trial balance columns in the worksheet of Elliot Painting Services are as follows.ELLIOT PAINTING SERVICESWorksheet (Partial)for the year ended 30 June 2019Adjusted trial balance Income statement Balance sheetAccount Debit Credit Debit Credit Debit CreditCash at Bank 1 230Accounts Receivable 75 600Prepaid Rent 1 800Office Supplies 8 320Equipment 160 000Accum. Depr. Equip’t 25 000Accounts Payable 54 000Salaries Payable 8 760Unearned Revenue 3 430F. Elliot, Capital 101 500F. Elliot, Drawings 22 000Painting Revenue 219 650Salaries Expense 106 000Rent Expense 6 050Depreciation Expense 8 040Telephone Expense 4 020Office Supplies Used 10 080Sundry Expenses 9 200$412 340 $412 340Profit for the periodRequired:a) Complete the worksheet. (6 marks)b) Prepare the closing entries necessary at 30 June 2019, assuming that this date is the end of theentity’s accounting period. (4 marks)arrow_forwardThe adjusted trial balance columns in the worksheet of Elliot Painting Services are as follows.ELLIOT PAINTING SERVICESWorksheet (Partial)for the year ended 30 June 2019Adjusted trial balance Income statement Balance sheetAccount Debit Credit Debit Credit Debit CreditCash at Bank 1 230Accounts Receivable 75 600Prepaid Rent 1 800Office Supplies 8 320Equipment 160 000Accum. Depr. Equip’t 25 000Accounts Payable 54 000Salaries Payable 8 760Unearned Revenue 3 430F. Elliot, Capital 101 500F. Elliot, Drawings 22 000Painting Revenue 219 650Salaries Expense 106 000Rent Expense 6 050Depreciation Expense 8 040Telephone Expense 4 020Office Supplies Used 10 080Sundry Expenses 9 200Profit for the period_ debit is $412340 and credit is $412340Required:a) Complete the worksheet. b) Prepare the closing entries necessary at 30 June 2019, assuming that this date is the end of the entity’s accounting period.arrow_forwardThe adjusted trial balance columns in the worksheet of Elliot Painting Services are as follows.ELLIOT PAINTING SERVICESWorksheet (Partial)for the year ended 30 June 2019Adjusted trial balance Income statement Balance sheetAccount Debit Credit Debit Credit Debit CreditCash at Bank 1 230Accounts Receivable 75 600Prepaid Rent 1 800Office Supplies 8 320Equipment 160 000Accum. Depr. Equip’t 25 000Accounts Payable 54 000Salaries Payable 8 760Unearned Revenue 3 430F. Elliot, Capital 101 500F. Elliot, Drawings 22 000Painting Revenue 219 650Salaries Expense 106 000Rent Expense 6 050Depreciation Expense 8 040Telephone Expense 4 020Office Supplies Used 10 080Sundry Expenses 9 200$412 340 $412 340Profit for the periodRequired:a) Complete the worksheet.b) Prepare the closing entries necessary at 30 June 2019, assuming that this date is the end of theentity’s accounting period.arrow_forward

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning