Concept explainers

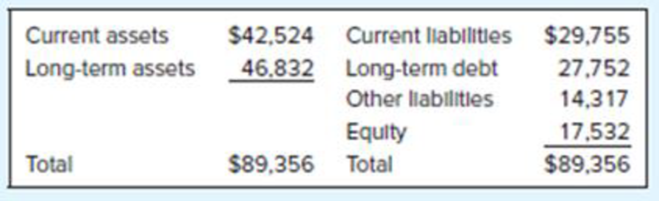

Market Value Added. Here is a simplified balance sheet for Locust Farming:

Locust has 657 million shares outstanding with a market price of $83 a share.

- a. Calculate the company’s market value added.

- b. Calculate the market-to-book ratio.

- c. How much value has the company created for its shareholders?

a.

To calculate: The added market value.

Explanation of Solution

Computation of the market value added:

Hence, the market value added is $36.999.

b.

To compute: The market to book ratio.

Explanation of Solution

Computation of the market to book ratio:

Hence, the market to book ratio is 3.11.

c.

To discuss: The value created by the company to their shareholders.

Explanation of Solution

The company has maximized the value of the investment in equity by 311%.

Want to see more full solutions like this?

Chapter 4 Solutions

FUND OF CORPORATE FINANCE LL W/ CONNECT

- Analyze and compare Bank of America and Wells Fargo Bank of America Corporation (BAC) and Wells Fargo Company (WFC) are two large financial services companies. The following data (in millions) were taken from a recent years financial statements for both companies: a. Compute the earnings per share for both companies. Round to the nearest cent. a. Which company appears to be more profitable on an earnings-per-share basis? b. Which company would you expect to have the larger quoted market price?arrow_forwardRebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the market price per share for Rebert is 51.50. Required: 1. Compute the dollar amount of preferred dividends. 2. Compute the number of common shares. 3. Compute earnings per share. (Note: Round to two decimals.) 4. Compute the price-earnings ratio. (Note: Round to the nearest whole number.)arrow_forwardRebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the dividends paid to common stockholders for last year were 2,600,000 and that the market price per share of common stock is 51.50. Required: 1. Compute the dividends per share. 2. Compute the dividend yield. (Note: Round to two decimal places.) 3. Compute the dividend payout ratio. (Note: Round to two decimal places.)arrow_forward

- Albion Inc. provided the following information for its most recent year of operations. The tax rate is 40%. Required: 1. Compute the following: (a) return on sales, (b) return on assets, (c) return on stockholders equity, (d) earnings per share, (e) price-earnings ratio, (f) dividend yield, and (g) dividend payout ratio. 2. CONCEPTUAL CONNECTION If you were considering purchasing stock in Albion, which of the above ratios would be of most interest to you? Explain.arrow_forwardMike Sanders is considering the purchase of Kepler Company, a firm specializing in the manufacture of office supplies. To be able to assess the financial capabilities of the company, Mike has been given the companys financial statements for the 2 most recent years. Required: Note: Round all answers to two decimal places. 1. Compute the following for each year: (a) return on assets, (b) return on stockholders equity, (c) earnings per share, (d) price-earnings ratio, (e) dividend yield, and (f ) dividend payout ratio. 2. CONCEPTUAL CONNECTION Based on the analysis in Requirement 1, would you invest in the common stock of Kepler?arrow_forwardRatio Analysis MJO Inc. has the following stockholders equity section of the balance sheet: On the balance sheet date, MJOs stock was selling for S25 per share. Required: Assuming MJOs dividend yield is 1%, what are the dividends per common share? Assuming MJOs dividend yield is 1% and its dividend payout is 20%, what is MJOs net income?arrow_forward

- Macon Mills is a division of Bolin Products. Inc. During the most recent year, Macon had a net income of $40 million. Included in the income was interest expense of $2,800,000. The companys tax rate was 40%. Total assets were $470 million, current liabilities were $104,000,000, and $72,000,000 of the current liabilities are noninterest bearing. What are the invested capital and ROI for Macon?arrow_forwardTriangular Chemicals has total assets of $95 million, a return on equity of 44%, a net profit margin of 5.1%, and an equity multiplier of 2.73. How much are the firm's sales?arrow_forwardA Vegetable Company has the following results: Net sales sh6,000,000 Net total assets sh4,000,000 Depreciation sh160,000 Net income sh400,000 Long-term debt sh2,000,000 Equity sh1,160,000 Dividends sh160,000 Required: a. Compute the Company’s ROE directly. % b. Using the ROE computed in Part (a) above, what is the expected sustainable growth rate for the Company? % c. Assuming the firm’s net profit margin went to 0.04, what would happen to the Company’s ROE? % d. Using the ROE in Part c, what is the expected sustainable growth rate? % e. Using the ROE in Part c, what is the expected sustainable growth rate if dividends were only sh40,000?arrow_forward

- . The Anderson Company has net profits of $20 million, sales of $250 million, and 4.5 million shares of common stock outstanding. The company has total assets of $175 million and total stockholders’ equity of $95 million. It pays $1.50 per share in common dividends, and the stock trades at $35 per share. Given this information, determine the following: The company’s net profit margin The stock’s dividend payout ratio and its dividend yield The stock’s PEG ratio, given that the company’s earnings have been growing at an average annual rate of 7.5%arrow_forwardUsing the DuPont method, evaluate the effects of the following relationships for the Butters Corporation. A.Butters Corporation has a profit margin of 5.5 percent and its return on assets (investment) is 8.75 percent. What is its assets turnover? Round your answer to 2 decimal places. ______ times B.If the Butters Corporation has a debt-to-total-assets ratio of 65.00 percent, what would the firm’s return on equity be? Note: Input your answer as a percent rounded to 2 decimal places. C.What would happen to return on equity if the debt-to-total-assets ratio decreased to 60.00 percent? Input your answer as a percent rounded to 2 decimal places.arrow_forwardEaster Egg and Poultry Company has $1,760,000 in assets and $608,000 of debt. It reports net income of $100,000. a. What is the firm’s return on assets? (Enter your answer as a percent rounded to 2 decimal places.) b. What is its return on stockholders’ equity? (Enter your answer as a percent rounded to 2 decimal places.) c. If the firm has an asset turnover ratio of 3.5 times, what is the profit margin (return on sales)? (Enter your answer as a percent rounded to 2 decimal places.)arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning