The effect of tax on economic efficiency.

Explanation of Solution

The tax is a unilateral payment made to the government from the public for various purposes. There are many types of taxes, such as the income tax, wealth tax and so forth which constitutes the major portion of the revenue of the government that can be used for making the public expenditures. Economic efficiency is a situation where no one can be in a better position without hurting the other.

In the case, the economic efficiency is the situation where the marginal benefit of the consumer from the last unit produced is equal to the marginal cost of the production of the unit. This means that both of them will be the same and neither the consumer nor the producer can be in a better position. The sum of the

Here, the tax imposed on the vacation rental homes is 12% which is equal to $120. This is because the equilibrium rent was $1000 before the tax and the

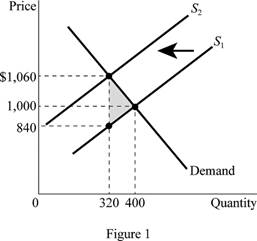

Thus, the supply vertically shifts by the tax amount of $120 and as a result, the quantity demanded decreases to 320 rental houses. The owner of the house receives only $940 which is the reason for the decrease in the supply of the rental houses in the market. Thus, the consumer has to pay $60 more than the

Thus, the tax is equally shared among the consumer and the owner by $60 each. The economic efficiency is reduced by the tax because there will be

The new quantity demanded after the introduction of the tax is 320 houses and the new price after the introduction of the tax is $1,060. The price actually received by the owner of the house also reduces to $940 which means that both the owner and the consumer is paying $60 each as tax. This shows that the tax burden is evenly distributed among the seller and the buyer. There is deadweight loss in the economy because of the tax and it can be denoted by the area shaded in grey color on the graph.

Concept introduction:

Tax: It is the unilateral payment made by the public towards the government. There are many different types of taxes in the economy which includes the income tax, property tax and professional tax and so forth.

Economic efficiency: It is the situation where the economy is efficient. Which means that the marginal benefit from the last unit produced is equal to the marginal cost of production and the economic surplus will be at is maximum.

Want to see more full solutions like this?

Chapter 4 Solutions

Microeconomics Plus Myeconlab With Pearson Etext (1-Semester Access)

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education