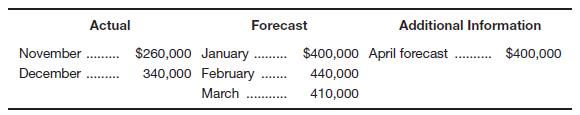

Harry’s Carryout Stores has eight locations. The firm wishes to expand by two more stores and needs a bank loan to do this. Mr. Wilson, the banker, will finance construction if the firm can present an acceptable three-month financial plan for January through March. The following are actual and

Of the firm’s sales, 60 percent are for cash and the remaining 40 percent are on credit. Of credit sales, 20 percent are paid in the month after sale and 80 percent are paid in the second month after the sale. Materials cost 20 percent of sales and are purchased and received each month in an amount sufficient to cover the following month’s expected sales. Materials are paid for in the month after they are received. Labor expense is 50 percent of sales and is paid for in the month of sales. Selling and administrative expense is 15 percent of sales and is also paid in the month of sales. Overhead expense is

For January, February, and March, prepare a schedule of monthly cash receipts, monthly cash payments, and a complete monthly cash budget with borrowings and repayments.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

FOUND.OF FINANCIAL MANAGEMENT-ACCESS

- Earthies Shoes has 55% of its sales in cash and the remainder on credit. Of the credit sales, 70% is collected in the month of sale, 15% is collected the month after the sale, and 10% is collected the second month after the sale. How much cash will be collected in June if sales are estimated as $75,000 in April, $65,000 in May, and $90,000 in June?arrow_forwardNegus Enterprises has an inventory conversion period of 50 days, an average collection period of 35 days, and a payables deferral period of 25 days. Assume that cost of goods sold is 80% of sales. What is the length of the firm’s cash conversion cycle? If annual sales are $4,380,000 and all sales are on credit, what is the firm’s investment in accounts receivable? How many times per year does Negus Enterprises turn over its inventory?arrow_forwardJim Daniels Health Products has eight stores. The firm wants to expand by two more stores and needs a bank loan to do this. Mr. Hewitt, the banker, will finance construction if the firm can present an acceptable three-month financial plan for January through March. Following are actual and forecasted sales figures: Actual November December Sales Credit sales Cash sales Forecast $480,000 January 500,000 February March Of the firm's sales, 40 percent are for cash and the remaining 60 percent are on credit. Of credit sales, 30 percent are paid in the month after sale and 70 percent are paid in the second month after the sale. Materials cost 30 percent of sales and are purchased and received each month in an amount sufficient to cover the current month's expected sales. Materials are paid for in the month they are received. Labour expense is 50 percent of sales and is paid in the month of sales. Selling and administrative expense is 5 percent of sales and is also paid in the month of…arrow_forward

- Jayden's Carryout Stores has eight locations. The firm wishes to expand by two more stores and needs a bank loan to do this. Mrs. Wilson, the banker, will finance construction if the firm can present an acceptable three-month financial plan for January through March. The following are actual and forecast sales figures: Actual November December $ 260,000 340,000 Sales Credit sales Forecast January February March Cash sales One month after sale Two months after sale $ 400,000 440,000 410,000 Of the firm's sales, 60 percent are for cash and the remaining 40 percent are on credit. Of credit sales, 20 percent are paid in the month after sale and 80 percent are paid in the second month after the sale. Materials cost 20 percent of sales and are purchased and received each month in an amount sufficient to cover the following month's expected sales. Materials are paid for in the month after they are received. Labor expense is 50 percent of sales and is paid for in the month of sales. Selling…arrow_forwardHarry's Carryout Stores has eight locations. The firm wishes to expand by two more stores and needs a bank loan to do this. Mr. Wilson, the banker, will finance construction if the firm can present an acceptable three-month financial plan for January through March. The following are actual and forecast sales figures: Actual Additional Information $400,000 Forecast November December $260,000 January 340,000 February March $400,000 April forecast 440,000 410,000 Of the firm's sales, 60 percent are for cash and the remaining 40 percent are on credit. Of credit sales, 20 percent are paid in the month after sale and 80 percent are paid in the second month after the sale. Materials cost 20 percent of sales and are purchased and received each month in an amount sufficient to cover the following month's expected sales. Materials are paid for in the month after they are received. Labor expense is 50 percent of sales and is paid for in the month of sales. Selling and administrative expense is 15…arrow_forwardJayden's Carryout Stores has eight locations. The firm wishes to expand by two more stores and needs a bank loan to do this. Mrs. Wilson, the banker, will finance construction if the firm can present an acceptable three-month financial plan for January through March. The following are actual and forecast sales figures: November December Actual $ 240,000 January 260,000 February March Forecast Additional Information $ 320,000 April forecast $360,000 360,000 370,000 Of the firm's sales, 60 percent are for cash and the remaining 40 percent are on credit. Of credit sales, 30 percent are paid in the month after sale and 70 percent are paid in the second month after the sale. Materials cost 30 percent of sales and are purchased and received each month in an amount sufficient to cover the following month's expected sales. Materials are paid for in the month after they are received. Labor expense is 40 percent of sales and is paid for in the month of sales. Selling and administrative expense…arrow_forward

- A firm collects 25% of its credit sale in the month of sale and the remainder in the following month. The credit sale for the month of June is GHC 150,000. It expert to pay bills of GHC 22,000 in July. The depreciation for the month is GHC 1000. If the company maintains an end month cash balance of GHC 100,000, what is the external finance required?arrow_forwardHarry’s Carryout Stores has eight locations. The firm wishes to expand by two more stores and needs a bank loan to do this. Mr. Wilson, the banker, will finance construction if the firm can present an acceptable three-month financial plan for January through March. The following are actual and forecast sales figures: Actual Forecast Additional Information November $340,000 January $420,000 April forecast $410,000 December 360,000 February 460,000 March 420,000 Of the firm’s sales, 30 percent are for cash and the remaining 70 percent are on credit. Of credit sales, 40 percent are paid in the month after sale and 60 percent are paid in the second month after the sale. Materials cost 40 percent of sales and are purchased and received each month in an amount sufficient to cover the following month’s expected sales. Materials are paid for in the month after they are received. Labor expense is 25 percent of sales and is paid for in the month of…arrow_forwardWilson, the banker, will finance construction if the firm can present an acceptable three-month financial plan for January through March. The following are actual and forecast sales figures: Actual November December Sales Credit sales $ 600,000 January 620,000 February March Cash sales One month after sale Two months after sale Total cash receipts Of the firm's sales, 50 percent are for cash and the remaining 50 percent are on credit. Of credit sales, 50 percent are paid in the month after sale and 50 percent are paid in the second month after the sale. Materials cost 30 percent of sales and are purchased and received each month in an amount sufficient to cover the following month's expected sales. Materials are paid for in the month after they are received. Labor expense is 40 percent of sales and is paid for in the month of sales. Selling and administrative expense is 20 percent of sales and is paid in the month of sales. Overhead expense is $38,000 in cash per month. Forecast…arrow_forward

- Harry’s Carryout Stores has eight locations. The firm wishes to expand by two more stores and needs a bank loan to do this. Mr. Wilson, the banker, will finance construction if the firm can present an acceptable three-month financial plan for January through March. The following are actual and forecast sales figures: Actual Forecast Additional Information November $320,000 January $400,000 April forecast $400,000 December 340,000 February 440,000 March 410,000 Of the firm’s sales, 60 percent are for cash and the remaining 40 percent are on credit. Of credit sales, 20 percent are paid in the month after sale and 80 percent are paid in the second month after the sale. Materials cost 20 percent of sales and are purchased and received each month in an amount sufficient to cover the following month’s expected sales. Materials are paid for in the month after they are received. Labor expense is 50 percent of sales and is paid for in the month of…arrow_forwardA company is launching a new sales initiative and expects sales of $446,838 during the first year, and the gross profit margin to be 25%. To prepare for this, they plan to acquire 49 days worth of inventory. Their vendor will allow 48 days to pay its invoices. The company plans to sell only on account to its customers, so sales will be entirely credit based, and the average invoice is expected to take 44 days to collect. What amount of net working capital should be included in the initial investment? Enter your answer as a monetary amount rounded to four decimal places, but without the currency symbol. For example, if your answer is $90.1234, enter 90.1234 Type your answer...arrow_forwardHoliday Tree Farm has a cash balance of $34 and a short-term loan balance of $180 at the beginning of Qt. The net cash inflow for the first quarter is $36 and for the second quarter there is a net cash outflow of $48. All cash shortfalls are funded with short-term debt. The firm pays 2 percent of its prior quarter's ending loan balance as interest each quarter. The minimum cash balance is $20. What is the short-term loan balance at the end of Q2? Multiple Choice $184.3 $179.2 $138.6 $128.4 $1931arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College